As the cryptocurrency sector matures, crypto regulatory compliance has become a defining challenge for innovators and institutions alike. The decentralized nature of blockchain networks offers transparency and resilience, but it also complicates the enforcement of anti-money laundering (AML) and know-your-customer (KYC) regulations. In response, onchain attestations are emerging as a transformative solution, providing verifiable, privacy-preserving proofs that align digital assets with global compliance standards.

Onchain Attestations: The Foundation of Trust in Decentralized Finance

Onchain attestations are cryptographic proofs recorded immutably on blockchains. They verify claims such as user identity, asset backing for stablecoins, or eligibility for token sales. This mechanism not only streamlines compliance processes but also builds trust between users, platforms, and regulators by making these proofs transparent and easily auditable.

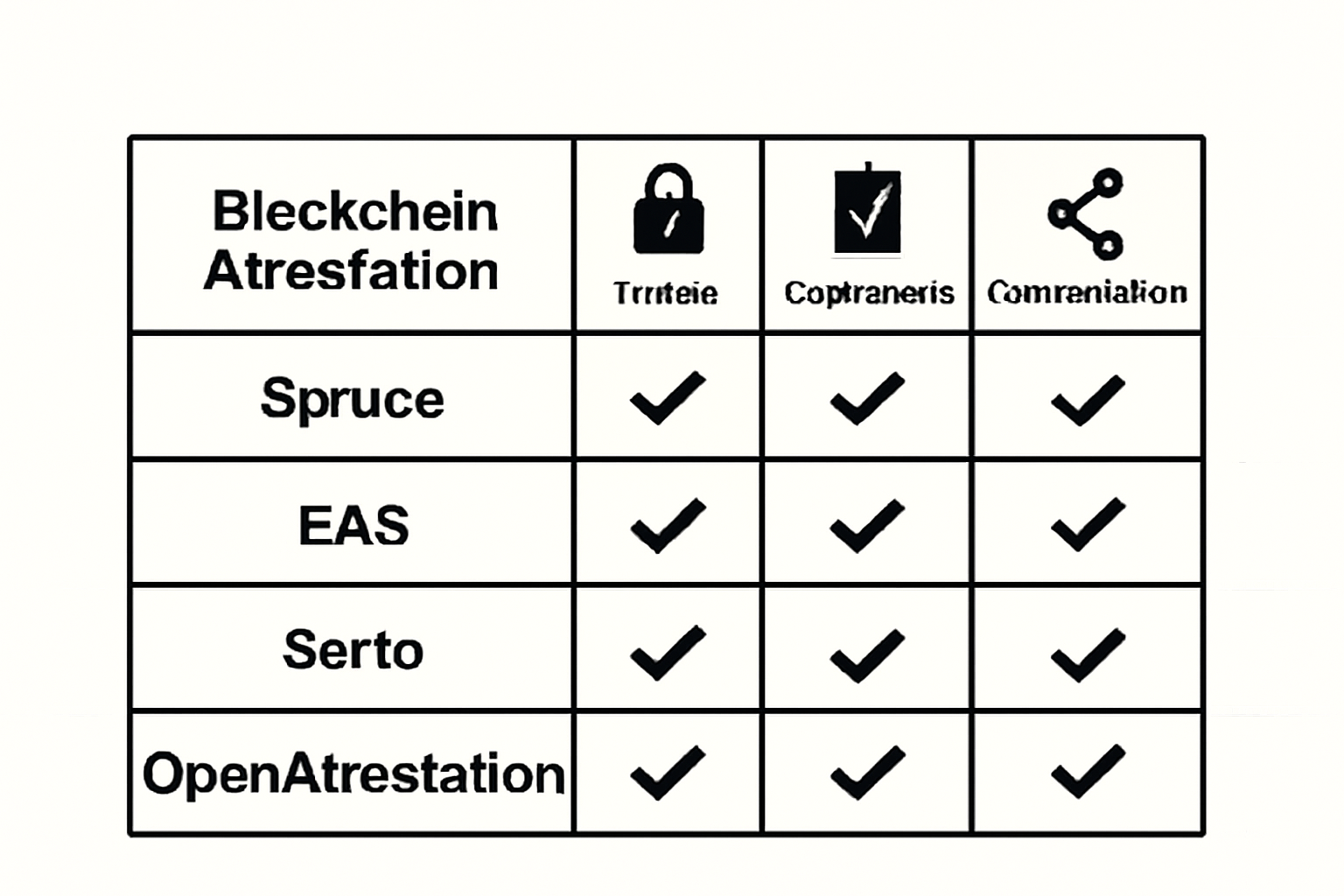

The rise of attestation services tailored for crypto companies underscores their growing importance. These services empower organizations to verify financial integrity, build stakeholder trust, and meet evolving regulatory standards without compromising the core principles of decentralization. According to Chainlink’s Automated Compliance Engine (ACE), integrating attestations into smart contracts enables real-time enforcement of compliance policies, ensuring that only authorized users can interact with sensitive functions or assets.

KYC and AML: Reinvented for the Blockchain Era

Traditional KYC/AML procedures often require intrusive data collection and siloed recordkeeping. Onchain attestations disrupt this paradigm by allowing users to prove compliance status using verifiable credentials stored directly on-chain. For example, platforms such as Altme enable individuals to manage digital identities as NFTs, granting access to decentralized applications without exposing sensitive personal data (altme.io). This approach not only reduces friction but also preserves user privacy while meeting regulatory mandates.

Smart contracts can further automate these checks at the protocol level. When combined with standardized protocols like ERC-3643, token transfers can be permissioned so that only verified entities participate, enabling seamless integration across DeFi platforms and ensuring consistent adherence to compliance requirements.

Transparency Without Compromise: Stablecoin Reserves and Beyond

The need for transparency extends beyond user identity into the realm of asset backing, particularly for stablecoins pegged to fiat currencies or commodities. Onchain attestations provided by independent third parties offer irrefutable proof that circulating tokens are fully backed by appropriate reserves. This practice is increasingly demanded by both users and regulators seeking assurance against insolvency risks (cointelegraph.com).

This model is now being extended throughout DeFi and Web3 ecosystems, from allowlist management in token sales to gated community membership, all while maintaining the balance between transparency and privacy.

One of the most compelling aspects of KYC on blockchain is its ability to balance regulatory oversight with user autonomy. Privacy-preserving protocols like Hinkal have introduced mechanisms for confidential transactions that still satisfy regulatory scrutiny. By leveraging attestations from trusted KYC providers, users can participate in DeFi or private transfers without revealing their entire identity graph, yet remain accountable if required by law enforcement or compliance officers. This dual mandate, protecting privacy while enabling oversight, marks a step-change in how compliance is achieved in digital finance.

Standardization is another critical driver. As industry-wide standards such as ERC-3643 gain adoption, interoperability between platforms increases and friction decreases for both users and developers. The protocol’s ability to embed regulatory requirements directly into token logic means that compliant transfers become the default, not the exception. This shift reduces manual intervention, minimizes human error, and enhances auditability, qualities highly valued by institutional participants considering entry into DeFi markets.

Decentralized Compliance Tools: Unlocking Institutional Adoption

The evolution of decentralized compliance tools is unlocking new opportunities for institutional capital to flow into crypto markets. Automated attestation engines and composable smart contract modules allow funds, exchanges, and custodians to implement robust controls without relying on legacy infrastructure. As a result, regulated token offerings, permissioned liquidity pools, and cross-jurisdictional asset flows are becoming feasible at scale.

This momentum is evidenced by the proliferation of attestation services tailored for Web3 projects, from allowlist management solutions for NFT drops to real-time monitoring of stablecoin reserves. The transparency and immutability provided by blockchain-based attestations are increasingly seen as prerequisites for market integrity and sustainable growth.

Looking Forward: Onchain Attestations as Industry Standard

The convergence of regulatory pressure and technical innovation has set the stage for onchain attestations AML solutions to become industry standard. As protocols mature and adoption widens, expect to see further integration between traditional financial institutions and decentralized ecosystems. The ability to issue, manage, and verify credentials directly on-chain will not only streamline compliance but also enable new forms of programmable finance, where rules are enforced transparently at the protocol level.

Ultimately, the rise of onchain attestations signals a paradigm shift in how trust is established online. By embedding verifiable credentials into the very fabric of blockchain networks, we move closer to a world where digital assets can be regulated responsibly, without sacrificing privacy or decentralization. Those who embrace these tools today will be best positioned to thrive in tomorrow’s compliant crypto economy.