Compliance has always been the linchpin for institutional participation in decentralized finance (DeFi). As regulators sharpen their focus on digital assets, DeFi platforms face mounting pressure to automate compliance without sacrificing privacy or user autonomy. The answer? Onchain attestations: verifiable credentials that live directly on the blockchain, enabling real-time, privacy-preserving compliance checks.

Why DeFi Needs Automated Compliance Now

The explosive growth of DeFi has outpaced traditional compliance models. Manual KYC processes and off-chain identity checks are not only slow but fundamentally at odds with the ethos of decentralization. The result is a fragmented landscape, where regulatory uncertainty hampers innovation and keeps institutional capital at bay.

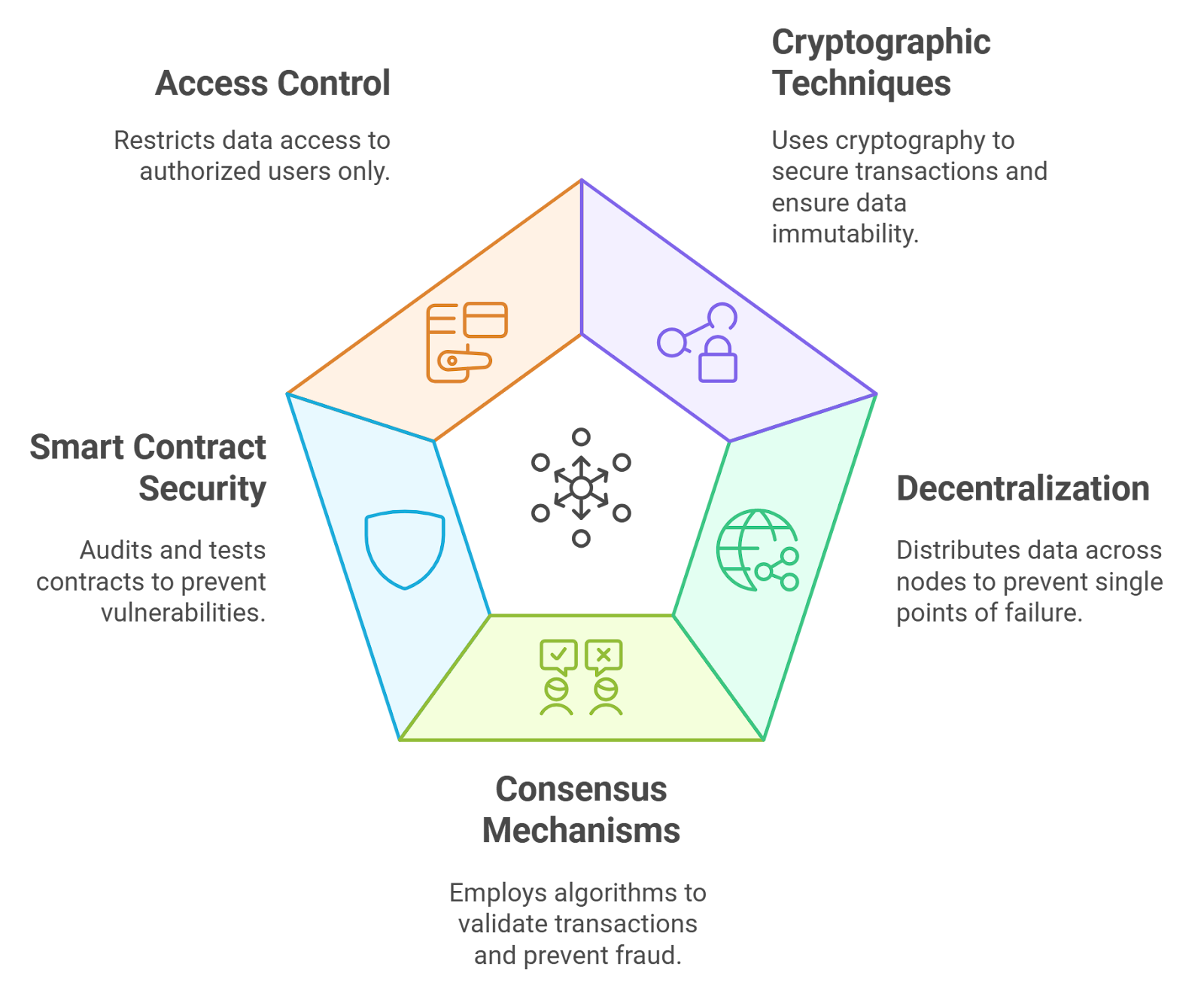

Automated compliance solutions are changing this narrative. By embedding KYC/AML checks directly into smart contracts and leveraging onchain attestations, platforms can automate user eligibility, transaction monitoring, and regulatory reporting, without ever exposing sensitive data.

The Rise of Onchain Attestations in DeFi

Onchain attestations represent a paradigm shift. Instead of relying on centralized databases or third-party verifiers, credentials such as KYC status or jurisdictional eligibility are cryptographically signed and stored on public blockchains. This enables dApps to verify users instantly while preserving anonymity, a win-win for both compliance teams and privacy-conscious users.

ComplyDeFi, developed by ONCHAINID, exemplifies this approach. Their SDK lets Web3 developers build permissioned protocols that tap into ONCHAINID’s self-sovereign identity system. Users receive anonymous credentials after completing verification, which protocols can check for eligibility criteria like residency or accreditation, no personal data ever leaves the user’s control. For more details, see ComplyDeFi by ONCHAINID.

Key Benefits of Automating DeFi Compliance with Onchain Attestations

-

Streamlined Regulatory Adherence: Onchain attestations enable DeFi platforms to automate Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, ensuring real-time compliance with evolving regulations across jurisdictions. This reduces manual overhead and helps platforms like Chainlink ACE and ComplyDeFi maintain up-to-date compliance standards.

-

Enhanced Privacy for Users: Solutions such as Hinkal and Altme leverage zero-knowledge proofs and decentralized identity (DID) to verify user eligibility without exposing sensitive personal information, preserving privacy while meeting compliance requirements.

-

Frictionless User Onboarding: By issuing verifiable credentials and compliance NFTs, platforms like Altme enable one-time KYC processes, allowing users to seamlessly interact with multiple DeFi protocols without repeated verification, improving the overall user experience.

-

Institutional-Grade Security and Trust: Automated compliance engines, such as Chainlink ACE, integrate with established identity systems, creating a secure environment that attracts institutional capital and broadens access to DeFi markets.

-

Cross-Chain and Modular Flexibility: Modern compliance frameworks like Chainlink ACE are designed to support both public and private blockchains, enabling interoperability and modular integration with existing financial infrastructure.

Modular Compliance Engines: Setting New Standards

The launch of Chainlink’s Automated Compliance Engine (ACE) marks a watershed moment for the industry. ACE is a modular framework that connects existing identity infrastructure with blockchain-native services across both public and private chains. It enables financial institutions to issue compliance-focused digital assets while meeting global regulatory requirements, all without compromising composability or interoperability.

This modularity is crucial: as regulations evolve across jurisdictions, ACE allows protocols to update rulesets dynamically via smart contracts or governance votes. For example, AML checks can be embedded directly into protocol logic, letting token holders participate in ongoing compliance updates, a model already being explored by leading projects (source).

Privacy-Preserving Compliance: Zero-Knowledge Protocols

Hinkal’s ZK protocol demonstrates how privacy and regulation can coexist in DeFi. By utilizing zero-knowledge proofs and KYC(B) attestations, Hinkal enables confidential transactions that remain fully compliant, only verified users can interact with private pools, yet their wallet addresses and transaction histories stay hidden from prying eyes (learn more here). This approach is pivotal as privacy becomes a non-negotiable feature for both retail users and institutions.

Altme’s decentralized compliance model on Tezos and BNB Chain further cements this new paradigm. By combining decentralized identity (DID) with non-transferable NFTs, Altme empowers users to mint a proof-of-compliance NFT after a one-time KYC check within their wallet. This NFT acts as an onchain passport, granting access to permissioned dApps while ensuring the user’s personal information remains private and under their control. For DeFi platforms, integrating such solutions means frictionless onboarding and automated eligibility checks at scale, no more bottlenecks, no more manual reviews.

Crucially, these advances aren’t just technical upgrades, they’re strategic levers for unlocking institutional capital. As highlighted in recent industry commentary, compliance automation is rapidly becoming table stakes for DeFi protocols seeking to tap into regulated markets. The ability to prove KYC status or AML clearance onchain, without ever exposing sensitive data, addresses both regulatory mandates and the privacy demands of Web3 natives.

Real-World Impact: Streamlining Access and Reducing Risk

Automated compliance transforms the user journey in DeFi. Instead of repetitive KYC submissions across multiple platforms, users can leverage a single verifiable credential, instantly recognized by any dApp that supports the relevant attestation standard. This not only reduces onboarding friction but also dramatically lowers operational costs for platforms by eliminating manual reviews and redundant data collection.

For allowlist managers and token sale organizers, onchain attestations offer a scalable solution for whitelisting eligible participants. Smart contracts can enforce compliance gates programmatically: only wallets with valid credentials can interact with gated pools or participate in launches. This minimizes legal exposure while maximizing inclusivity for global users who meet regulatory criteria.

Key Use Cases of Onchain Attestations in DeFi Compliance

-

Permissioned DeFi Protocols via ComplyDeFi and ONCHAINID: By integrating ONCHAINID’s self-sovereign identity system, DeFi protocols can verify user eligibility through anonymous onchain credentials. This enables permissioned access, ensuring only compliant users participate—crucial for attracting institutional capital and meeting regulatory standards.

-

Decentralized Identity & Compliance NFTs with Altme: Altme leverages decentralized identity (DID) and non-transferable NFTs to verify user compliance directly onchain. After a one-time KYC in the Altme wallet, users mint compliance NFTs, which serve as verifiable proof of regulatory adherence for dApps—streamlining access while safeguarding privacy.

-

Automated Compliance Infrastructure with Chainlink ACE: Chainlink’s Automated Compliance Engine (ACE) provides a modular framework that connects existing identity systems to onchain infrastructure. This enables the creation of compliance-focused digital assets and services across blockchains, supporting both traditional and decentralized finance use cases.

-

Privacy-Preserving, Compliant Transactions via Hinkal: Hinkal’s zero-knowledge protocol allows users to conduct confidential DeFi transactions while maintaining compliance. By using KYC(B) attestations, Hinkal ensures only legitimate parties benefit from privacy features, balancing regulatory requirements with user confidentiality.

Of course, automation does not mean abdication of responsibility. Protocols must still ensure that their attestation sources are reputable and that smart contract logic is robust against manipulation or circumvention attempts. However, as frameworks like Chainlink ACE mature, and as more projects adopt interoperable standards, the risk profile for DeFi compliance continues to improve.

What’s Next? The Road Ahead for DeFi Compliance Automation

The future is clear: compliance will be programmable. As regulatory clarity increases worldwide, expect to see further convergence between traditional finance (TradFi) standards and blockchain-native innovations like self-sovereign identity and zero-knowledge proofs. Onchain attestations will become the connective tissue linking user credentials, protocol logic, and external regulators, enabling real-time audits without sacrificing decentralization.

For developers and project leads evaluating their next steps: now is the time to integrate modular compliance engines and verifiable credential systems into your stack. The tools are here, and so is the demand from both users and institutions.