The rapid evolution of decentralized finance and Web3 platforms has brought the question of interoperable KYC attestations to the forefront. As users and organizations increasingly interact across multiple blockchain ecosystems, the need for a universal, privacy-preserving, and compliant identity solution is undeniable. Yet, achieving seamless cross-chain KYC remains a technical and regulatory challenge.

Why Interoperability Matters for Onchain KYC

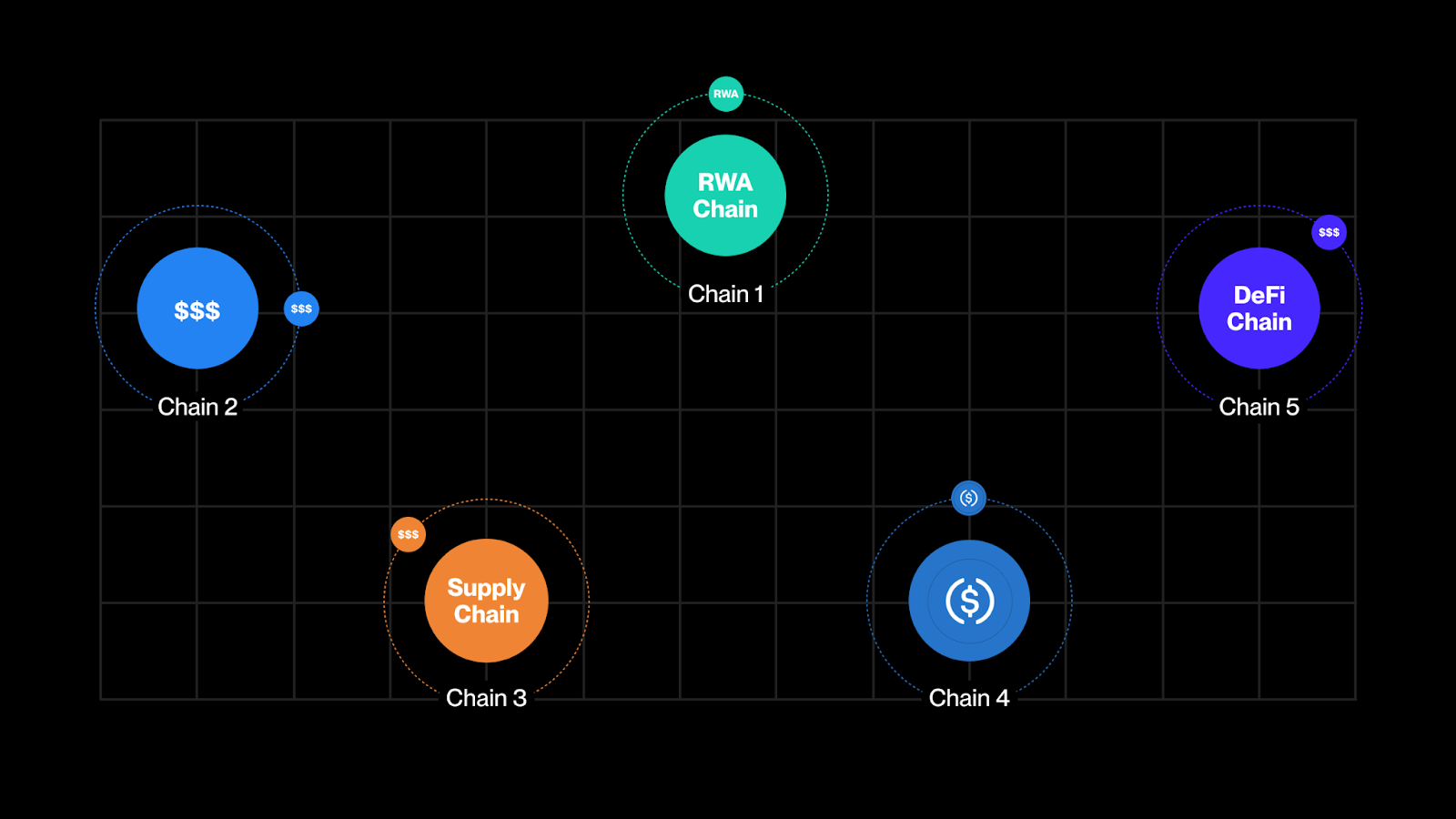

Imagine a world where your verified identity on one blockchain can be instantly recognized on another – without repetitive onboarding or data exposure. This vision is at the core of blockchain interoperability for KYC: making it possible for users to participate in token sales, DeFi lending, or gated communities across different networks using a single verifiable credential.

The stakes are high. Without standardized cross-chain identity solutions, users face friction, while projects grapple with fragmented compliance processes. As highlighted in research from Blockpass and recent collaborations like Hypersign with Chainlink (source), the industry is moving toward solutions that enable secure, privacy-respecting transfer of KYC attestations between chains.

The Current Landscape: Key Players and Protocols

Key Solutions Advancing Onchain KYC Interoperability

-

Blockpass–Chainlink Integration: Blockpass operates a Chainlink node to deliver secure, on-chain KYC data across multiple blockchains. This enables decentralized applications to verify user identities without exposing personal information, automating compliance and enhancing privacy.

-

Hypersign DIDs and ZKPs: Hypersign, in partnership with Chainlink, leverages Decentralized Identifiers (DIDs), Verifiable Credentials, and Zero-Knowledge Proofs to enable cross-chain KYC verification. This ensures privacy-preserving, interoperable identity checks across blockchain networks.

-

Polymesh’s Built-In Identities: Polymesh embeds identity verification at the protocol level. Users complete an Initial Identification Process (IDI) with authorized providers, resulting in unique on-chain identities that can receive attestations for compliance across platforms.

-

ONCHAINID System: ONCHAINID assigns unique on-chain identities to participants, linking wallets with verifiable credentials issued by trusted entities. These claims are stored and checked on-chain, streamlining regulatory compliance across different platforms.

-

zkVerify–Hyperbridge Alliance: zkVerify and Hyperbridge collaborate to enable efficient, cost-effective zero-knowledge proof verification across multiple blockchains. This alliance reduces gas costs and enhances scalability for cross-chain KYC attestations.

Several innovative protocols have emerged to address the interoperability puzzle:

- Blockpass and Chainlink: By operating a Chainlink node that delivers secure KYC data onchain, Blockpass enables dApps across multiple blockchains to perform identity checks without exposing personal information. This means smoother user onboarding and automated compliance – all while maintaining privacy.

- Hypersign and Chainlink: Their joint use of Decentralized Identifiers (DIDs), Verifiable Credentials (VCs), and Zero-Knowledge Proofs (ZKPs) allows for cross-chain validation of credentials. With Chainlink Functions acting as an interoperability layer, credentials issued on one chain can be efficiently verified elsewhere – a critical leap forward for universal KYC solutions.

- Polymesh: Unlike general-purpose blockchains, Polymesh bakes identity verification into its core infrastructure. Users complete an Initial Identification Process (IDI) through authorized providers and receive unique onchain identities that can be attested to by third parties for attributes like residency or accreditation (learn more). This streamlines compliance across platforms.

- ONCHAINID: This system issues unique onchain identities tied to wallets; trusted entities then issue claims (verifiable credentials) directly onto these identities. The result? Instantaneous verification during transactions without repeated manual checks (details here).

- zkVerify and Hyperbridge: Their September 2024 alliance enables cost-effective zero-knowledge proof verification across multiple chains – reducing gas costs while preserving privacy and scalability for mass adoption of onchain KYC (see announcement).

Main Challenges in Achieving Universal Blockchain Interoperability

No discussion about interoperable KYC attestations would be complete without acknowledging the hurdles still ahead:

- Diverse Consensus Mechanisms: Different blockchains use varied consensus models (PoW vs PoS vs permissioned), complicating direct data exchange.

- Lack of Standardization: The absence of universally accepted formats for digital credentials makes it hard to ensure compatibility between platforms (KYC Interoperability: Standardisation Boosts Onboarding, Togggle).

- User Privacy vs Regulatory Demands: Balancing GDPR-style privacy requirements with global AML/KYC rules is non-trivial; zero-knowledge proofs are emerging as a promising solution but require further adoption.

- User Experience Friction: Complex wallet management and fragmented onboarding processes deter mainstream adoption unless streamlined by universal standards.

The convergence of technical innovation (like ZKPs), regulatory clarity, and industry-wide standards will determine how quickly we reach true blockchain interoperability for digital identity.

Despite these obstacles, the momentum toward universal KYC solutions is unmistakable. The market is shifting from siloed compliance checks to a future where one identity, many chains becomes the norm. This transition is not just about technical wizardry; it’s about reshaping how trust and access are managed in the digital economy.

Real-World Impact: What Interoperable KYC Unlocks

The practical benefits of interoperable KYC attestations ripple across every layer of the blockchain ecosystem. For users, it eliminates repetitive onboarding and reduces exposure of sensitive data. For projects, it means faster user acquisition and simplified compliance, especially vital for DeFi protocols, NFT platforms, and DAOs operating in multiple jurisdictions.

- Token Sales and Airdrops: Seamless allowlist management across chains means broader participation without jeopardizing regulatory standing.

- Gated Communities: Access to exclusive groups or services can be controlled by onchain credentials recognized everywhere, not just on a single network.

- DeFi Lending and Borrowing: Lenders can verify a borrower’s eligibility instantly, regardless of which chain their credentials originated on.

The Road Ahead: Standardization and Collaboration

The next phase for interoperable KYC will hinge on industry-wide collaboration. Initiatives like the W3C’s Verifiable Credentials standard and open-source protocols such as ERC-3643 are paving the way for shared formats that any blockchain can understand. Meanwhile, alliances between infrastructure providers (as seen with Blockpass-Chainlink or zkVerify-Hyperbridge) are demonstrating that interoperability isn’t just theoretical, it’s happening now.

This progress is also attracting attention from regulators seeking frameworks that preserve both privacy and auditability. As more jurisdictions recognize onchain attestations as valid forms of identity verification, expect to see even greater adoption across financial services and beyond.

Top Use Cases Enabled by Interoperable On-Chain KYC

-

Token Launches with Global Compliance: Interoperable KYC allows projects to verify user identities across multiple blockchains, enabling compliant token launches that meet regulatory standards worldwide. This streamlines participation for users and issuers alike.

-

Cross-Chain DeFi Access: Users can seamlessly access DeFi protocols on different blockchains using a single, reusable KYC attestation. This unlocks broader liquidity pools and reduces onboarding friction for decentralized finance platforms.

-

Global Allowlists for Permissioned Applications: On-chain KYC interoperability enables the creation of universal allowlists, letting verified users participate in permissioned dApps and platforms across multiple networks without repeated verification.

-

Secure and Compliant NFT Drops: Projects can restrict NFT mints to verified participants across chains, ensuring regulatory compliance (such as age or residency restrictions) and preventing bot abuse during high-profile drops.

-

Regulated Web3 Gaming: Interoperable KYC supports age verification, anti-money laundering (AML) compliance, and fair access in blockchain-based games, especially those involving real-world value or regulated assets.

Building Trust Without Borders

The vision of borderless digital identity is closer than ever. Thanks to breakthroughs in zero-knowledge proof technology and cross-chain messaging standards, users can finally control their credentials while sharing only what’s necessary for each transaction or community they join.

For developers and project leads evaluating their options today, platforms like OnchainKYCe. me offer a robust foundation for issuing verifiable credentials that travel with users, no matter which chain they’re on. By embracing interoperability now, you’re not just future-proofing your project; you’re contributing to an open ecosystem where trust moves at internet speed.