In the rapidly evolving landscape of decentralized finance (DeFi), regulatory compliance is no longer a peripheral concern. As institutional capital and mainstream users flow into DeFi, the demand for robust Know Your Customer (KYC) mechanisms grows. Yet, traditional KYC processes are at odds with decentralization and privacy. Enter onchain attestations: cryptographic proofs recorded directly on blockchain networks, confirming that an address has met specific requirements, such as passing KYC checks, without exposing sensitive personal data.

Onchain Attestations: The Backbone of Modern DeFi Allowlists

An allowlist is simply a list of addresses pre-approved to interact with specific smart contracts or participate in protocol events, such as token sales or governance votes. Historically, allowlists have been managed off-chain via spreadsheets or centralized databases, a process rife with inefficiency, opacity, and risk. Onchain attestations transform this paradigm by embedding eligibility directly into the blockchain layer.

When users complete KYC through a trusted provider, their wallet address receives an onchain attestation, an immutable proof that can be referenced by any DeFi protocol supporting this standard. This enables seamless interoperability across platforms and eliminates redundant verification steps for both users and project teams.

Streamlining Compliance Without Sacrificing Privacy

The tension between regulatory compliance and user privacy is one of the defining challenges for Web3. Onchain attestations offer a compelling solution: instead of storing personal data on public ledgers, only the attestation itself, a cryptographic proof, is recorded onchain. Personal details remain securely off-chain with the original verifier.

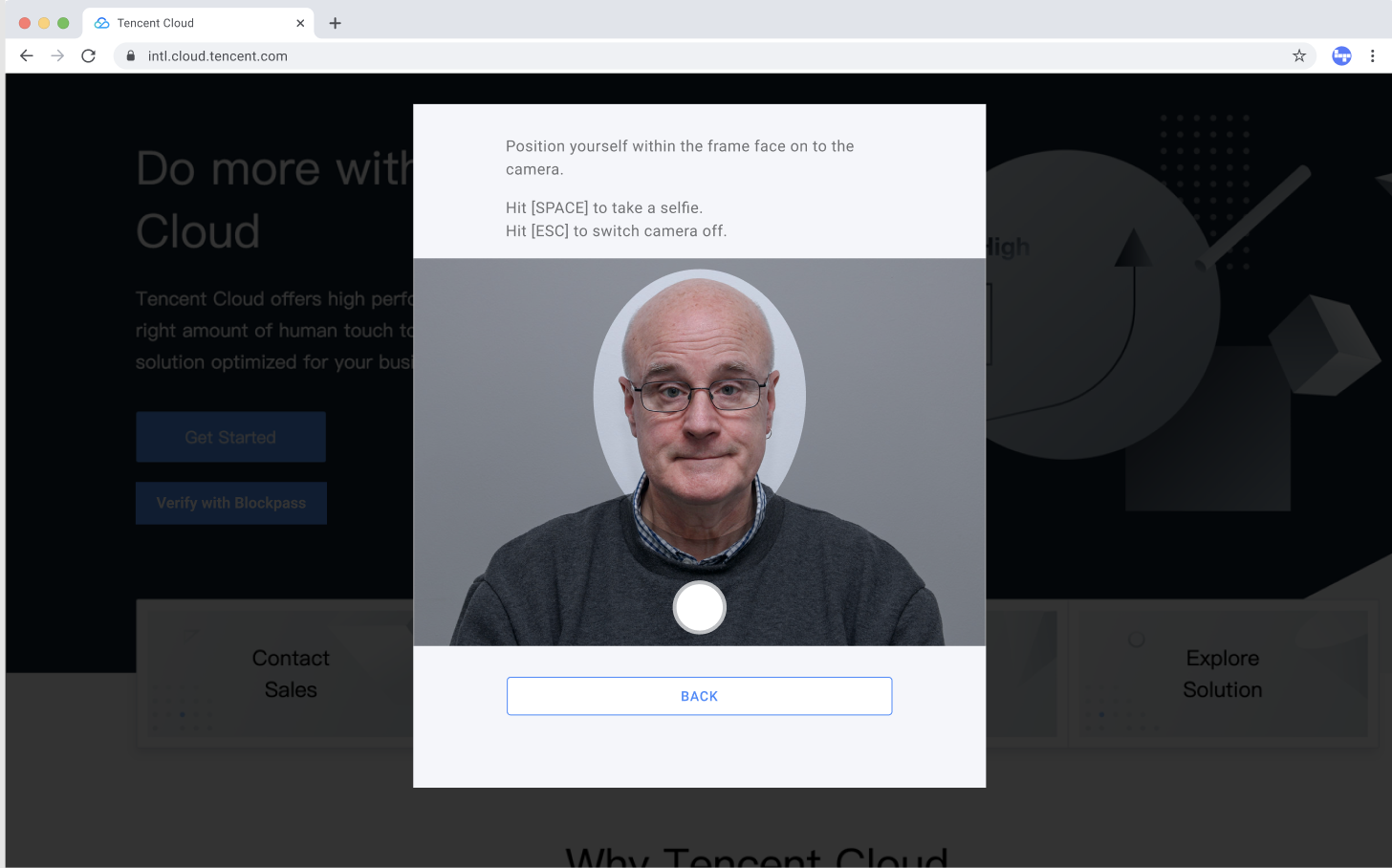

This model aligns with global privacy regulations while providing DeFi protocols with an auditable trail of compliance. For example, solutions like Blockpass’s On-Chain KYC® 2.0 empower users to prove their eligibility across multiple venues without revealing who they are at every step.

Key Benefits of Onchain Attestations for KYCed DeFi Addresses

-

Streamlined KYC Verification Across Platforms: Onchain attestations allow users to complete KYC verification once and reuse the resulting proof on multiple DeFi platforms, reducing redundancy and accelerating onboarding. Learn more at Blockpass

-

Enhanced Privacy Preservation: By storing only cryptographic attestations onchain and keeping personal data offchain, users maintain control over their sensitive information, aligning with privacy regulations and building trust. See Blockpass privacy approach

-

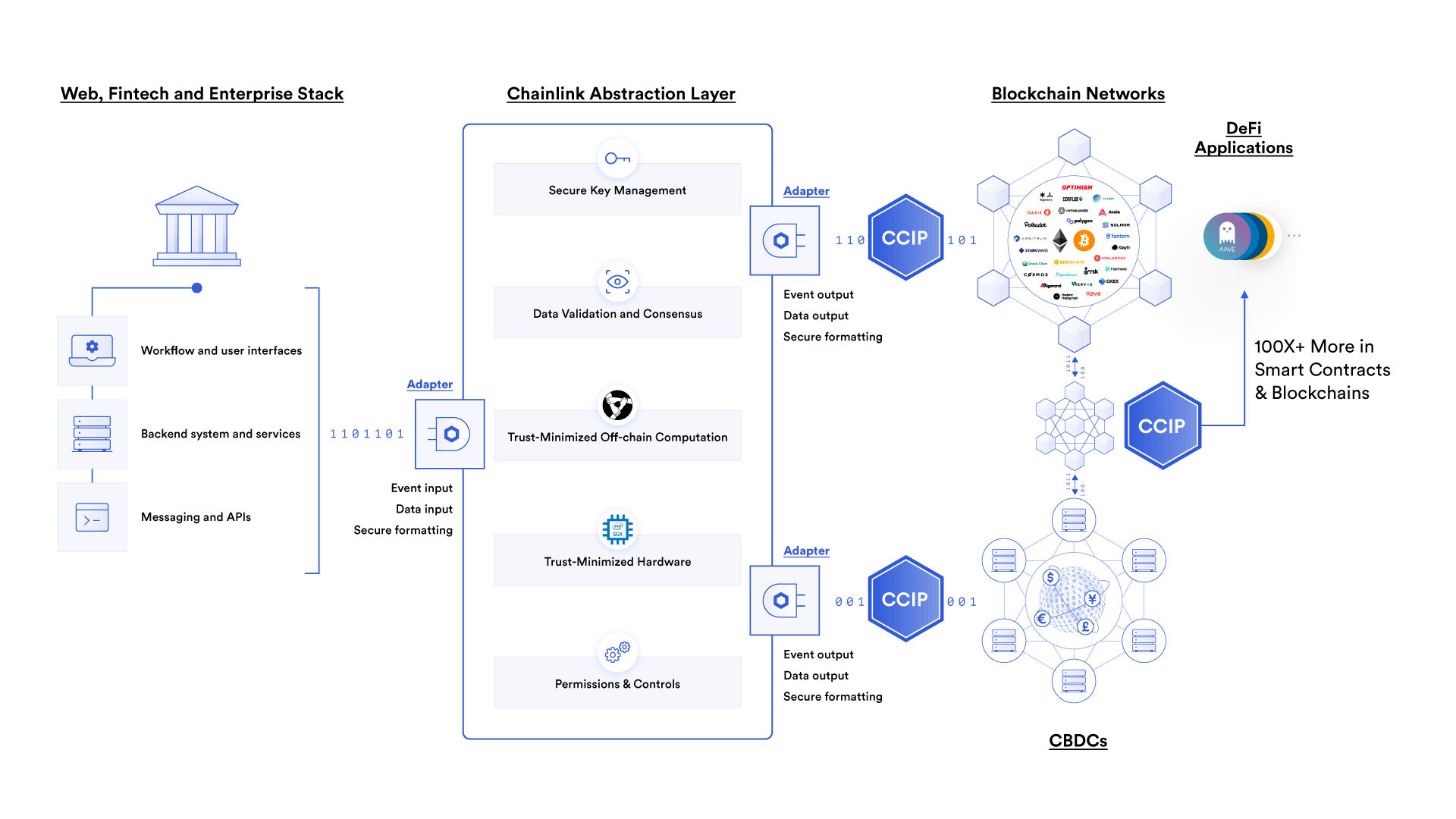

Automated Regulatory Compliance: DeFi protocols can enforce KYC and AML compliance by permitting only users with valid onchain attestations to interact with allowlisted services, ensuring adherence to regulations without sacrificing decentralization. Explore Chainlink ACE

-

Interoperability and Scalability: Onchain attestations support a standardized, interoperable approach to compliance, making it easier for DeFi protocols to scale and for users to access services across different platforms. Read about Attest Protocol

-

Real-World Adoption by Leading Platforms: Solutions like Coinbase’s Verified Pools, PureFi’s integration with Uniswap, and the Altme–TezID partnership demonstrate how onchain attestations are enabling compliant, privacy-preserving DeFi participation at scale. See Coinbase Verified Pools PureFi & Uniswap Altme and TezID

By leveraging these privacy-preserving standards, projects can confidently build gated communities or run compliant token sales, without alienating privacy-conscious users or exposing themselves to regulatory risk.

Real-World Adoption: From Coinbase Verified Pools to PureFi’s Zero-Knowledge Integrations

The practical impact of onchain attestations is already visible in several high-profile deployments:

- Coinbase’s Verified Pools: By linking KYC-verified identities to smart contracts via onchain attestations, Coinbase enables transparent yet compliant asset pools accessible only to eligible participants.

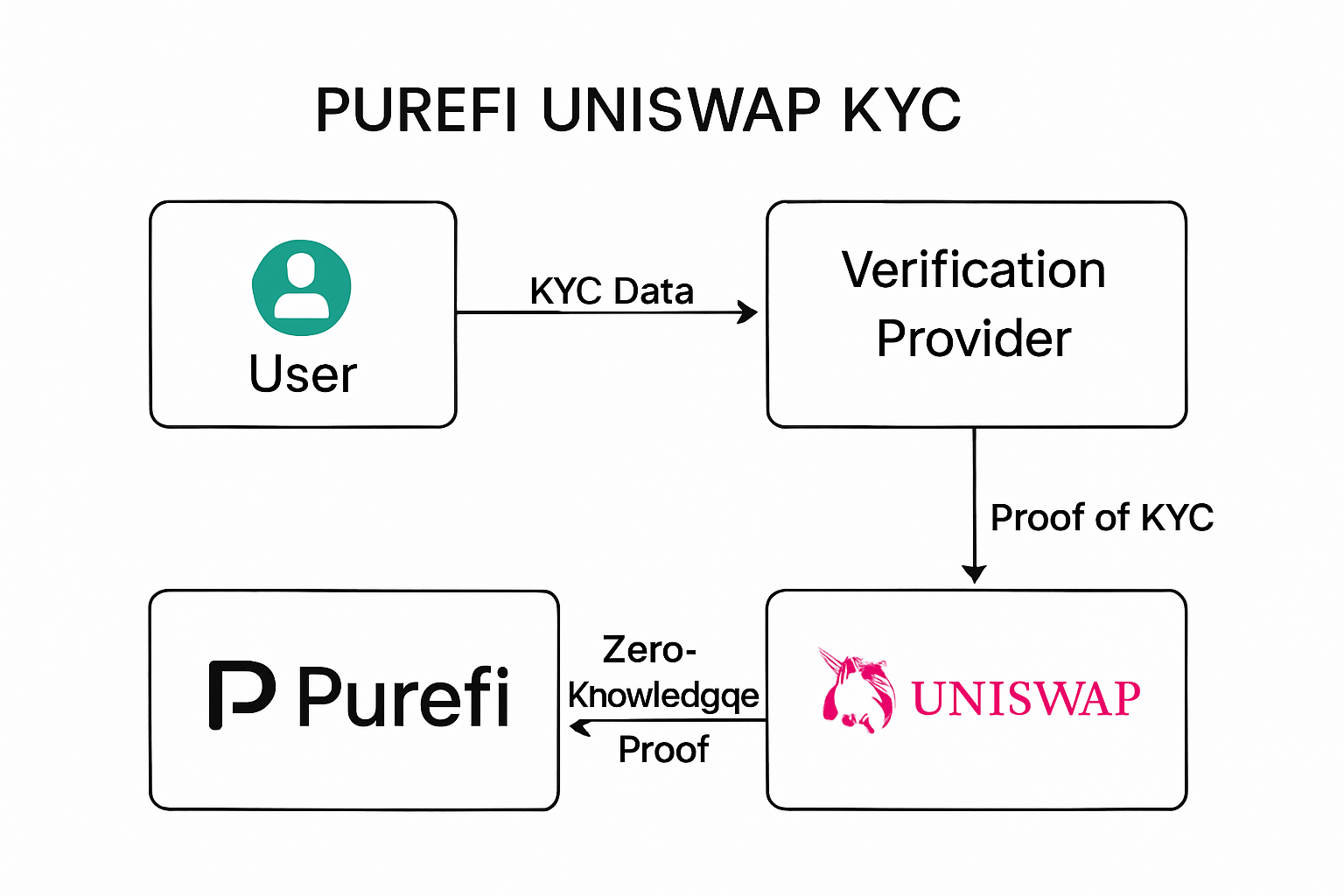

- PureFi x Uniswap: PureFi’s integration brings zero-knowledge-based KYC/AML checks directly into Uniswap’s workflow, scaling verification based on transaction volume while safeguarding user anonymity.

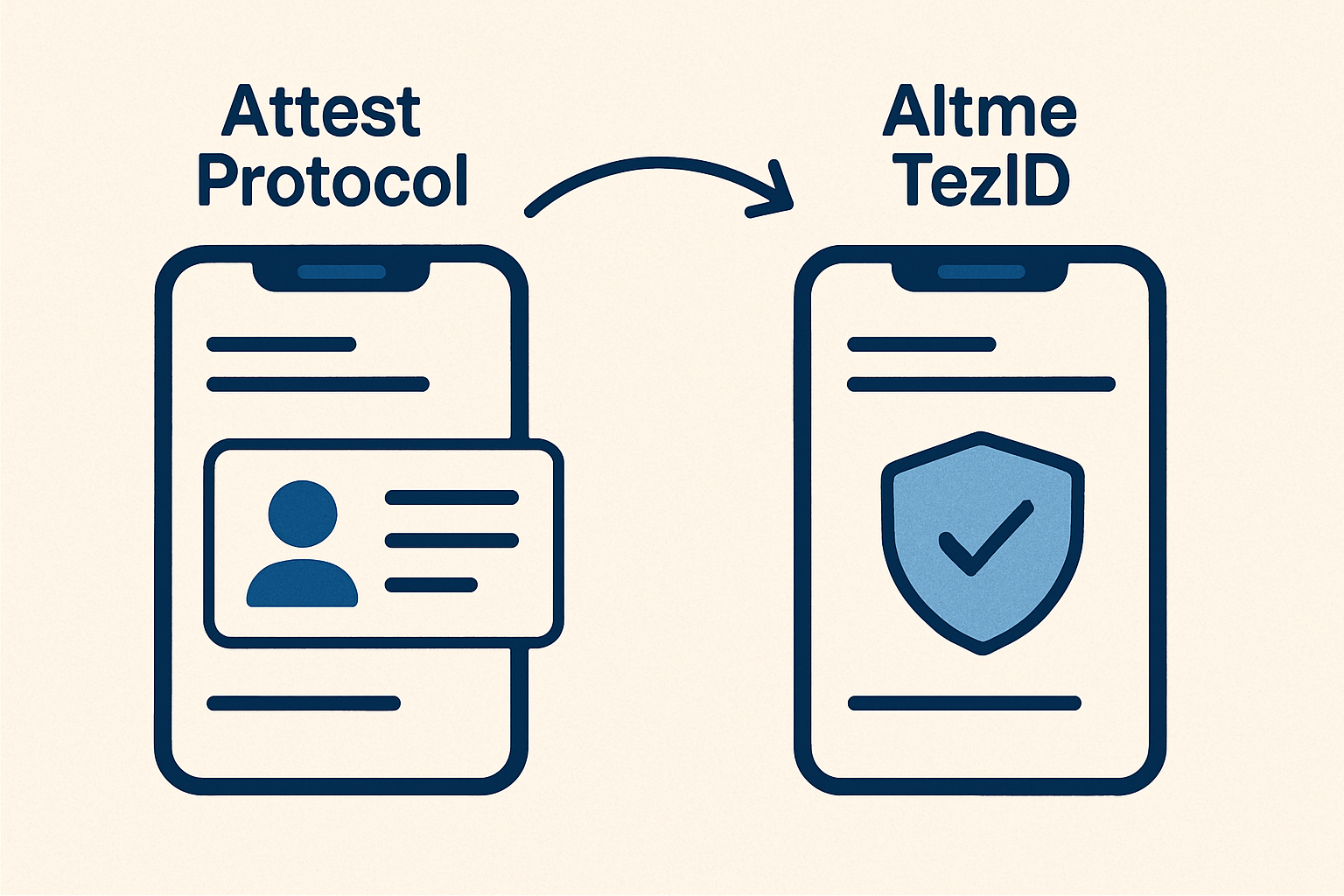

- Altme and amp; TezID Partnership: In the Tezos ecosystem, Altme and TezID deliver seamless compliance for dApps through interoperable onchain credentials.

This wave of adoption signals that standardized attestation protocols are becoming foundational infrastructure, not just for compliance but for trust itself in Web3 interactions. For more technical guidance on building secure allowlists powered by verified addresses, see this resource.

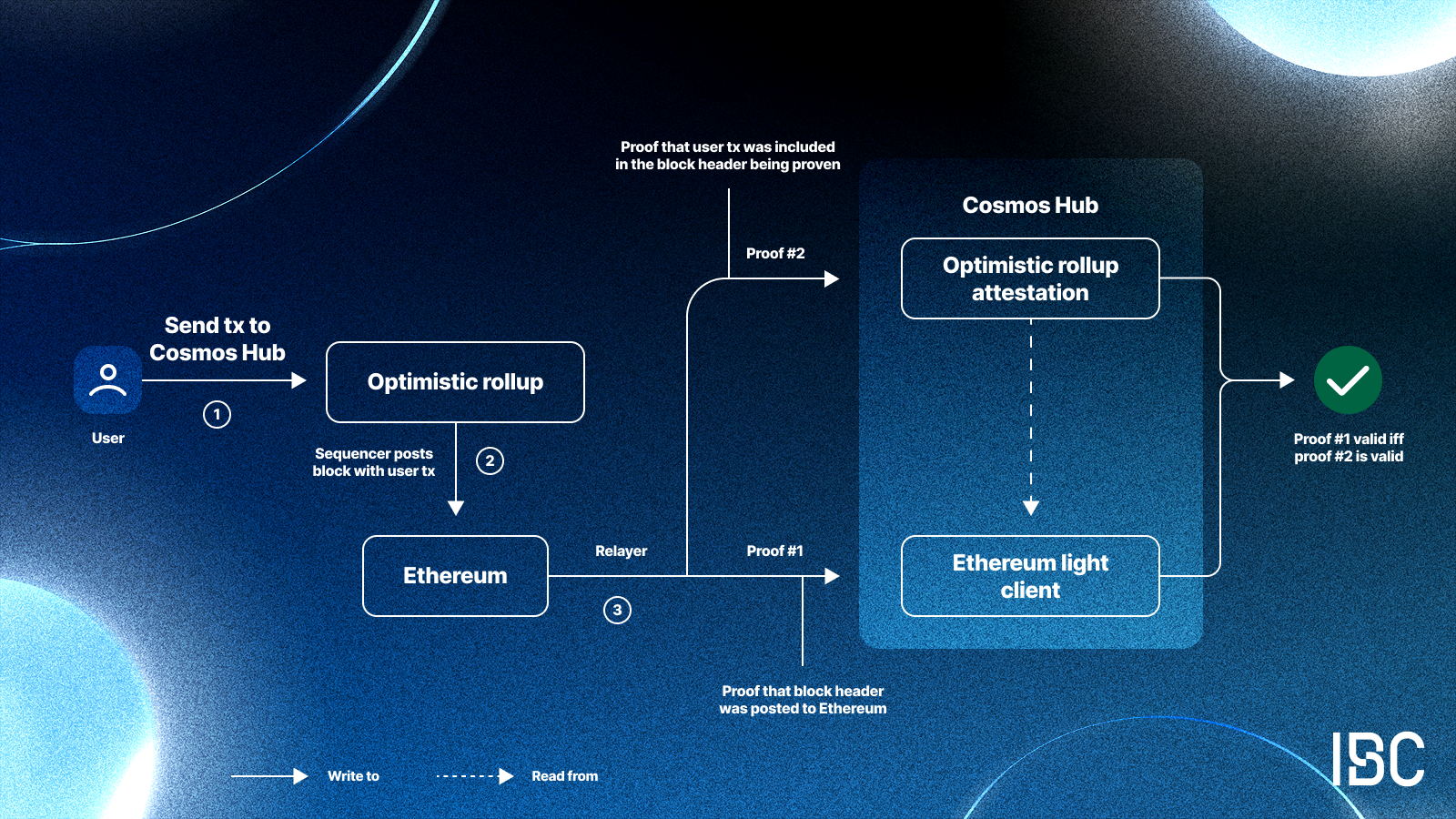

As DeFi matures, the importance of interoperability and scalability in compliance frameworks cannot be overstated. Onchain attestations excel here, enabling KYCed addresses to participate in multiple ecosystems without friction. Attestation standards, such as those pioneered by Chainlink ACE and Sign Protocol, are rapidly gaining traction for their ability to unify compliance workflows across disparate blockchains and jurisdictions. This modularity is critical for protocols looking to attract institutional liquidity while preserving the permissionless ethos of Web3.

Regulators are also taking notice. With the rise of compliance-focused digital assets and the introduction of automated engines like Chainlink ACE, there is growing recognition that onchain verification can meet both global KYC/AML requirements and user expectations for privacy. The ability to issue, manage, and revoke credentials onchain provides a level of transparency and auditability that is simply not feasible with legacy systems.

Key Features Driving Adoption in Web3 Compliance Solutions

Key Features of Onchain Attestations for DeFi KYC & Allowlists

-

Reusable KYC Proofs Across Platforms: Onchain attestations let users complete KYC verification once and reuse the cryptographic proof across multiple DeFi protocols, streamlining onboarding and reducing friction. (Example: Blockpass On-Chain KYC® 2.0)

-

Privacy-Preserving Compliance: Personal data remains offchain, while only the attestation is stored onchain, ensuring sensitive user information is protected and regulatory privacy standards are met. (Example: Blockpass, PureFi x Uniswap)

-

Automated & Enforceable Regulatory Compliance: DeFi protocols can automatically restrict participation to wallets with valid onchain attestations, ensuring KYC/AML adherence while maintaining decentralization. (Example: Chainlink Automated Compliance Engine (ACE))

-

Interoperability & Standardization: Attestations can be recognized across different DeFi protocols and blockchains, supporting a unified and scalable approach to compliance. (Example: Attest Protocol, Altme & TezID on Tezos)

-

Real-World Adoption by Major Platforms: Leading projects like Coinbase (Verified Pools), PureFi (Uniswap integration), and Altme/TezID (Tezos compliance) have implemented onchain attestation solutions, demonstrating practicality and industry momentum. (See: Coinbase Verified Pools)

The flexibility of onchain attestations means they are not limited to token sales or DeFi allowlists. They are increasingly used for governance participation, gated community access, NFT drops, and any scenario where eligibility must be proven without revealing sensitive data. As more protocols adopt these standards, users gain a portable digital identity, one that is reusable yet privacy-preserving.

Critically, this approach also supports risk-based compliance. For instance, protocols can require higher levels of attestation (such as enhanced due diligence) for larger transactions or sensitive operations. This dynamic model aligns with evolving regulatory expectations while minimizing user friction.

What’s Next? The Road Ahead for Blockchain KYC Compliance

The next phase will see further convergence between attestation protocols and emerging compliance engines. As standards mature, driven by collaboration between infrastructure providers like Chainlink, Blockpass, Altme/TezID, and others, the cost and complexity of integrating robust KYC checks will continue to fall.

For Web3 projects designing new products or migrating existing communities onchain, the message is clear: leveraging onchain attestations is no longer optional if you seek mainstream adoption or institutional participation. The combination of privacy preservation, auditability, interoperability and regulatory alignment positions this technology as an essential building block for the future of decentralized finance.

If you’re ready to implement secure allowlists with verifiable credentials or want a deeper dive into technical best practices around attested KYCed addresses in DeFi environments, refer to this comprehensive guide.