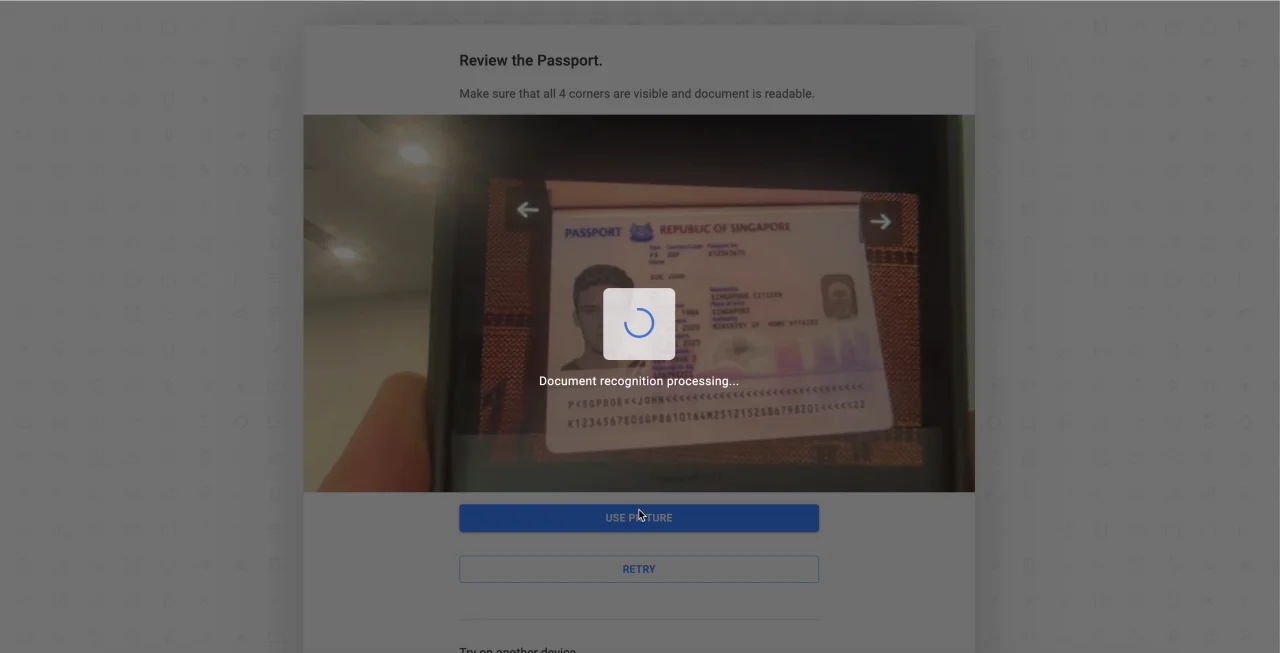

Decentralized finance (DeFi) has always promised open, permissionless access to financial services. But as real-world assets and regulatory scrutiny enter the space, compliance with Know Your Customer (KYC) rules is no longer optional for many protocols. The challenge? How to verify users without undermining privacy or decentralization. Enter onchain attestations for KYCed addresses – a breakthrough that lets DeFi projects create permissionless allowlists while keeping user data secure and protocols compliant.

Onchain Attestations: The Building Blocks of Trust

At their core, onchain KYC attestations are digital credentials issued by trusted entities after verifying a user’s identity. These credentials are cryptographically signed and recorded on the blockchain, linked to a wallet address but not revealing any underlying personal information. In practice, this means that DeFi protocols can check if an address holds a valid attestation – confirming compliance – without ever seeing who the user is.

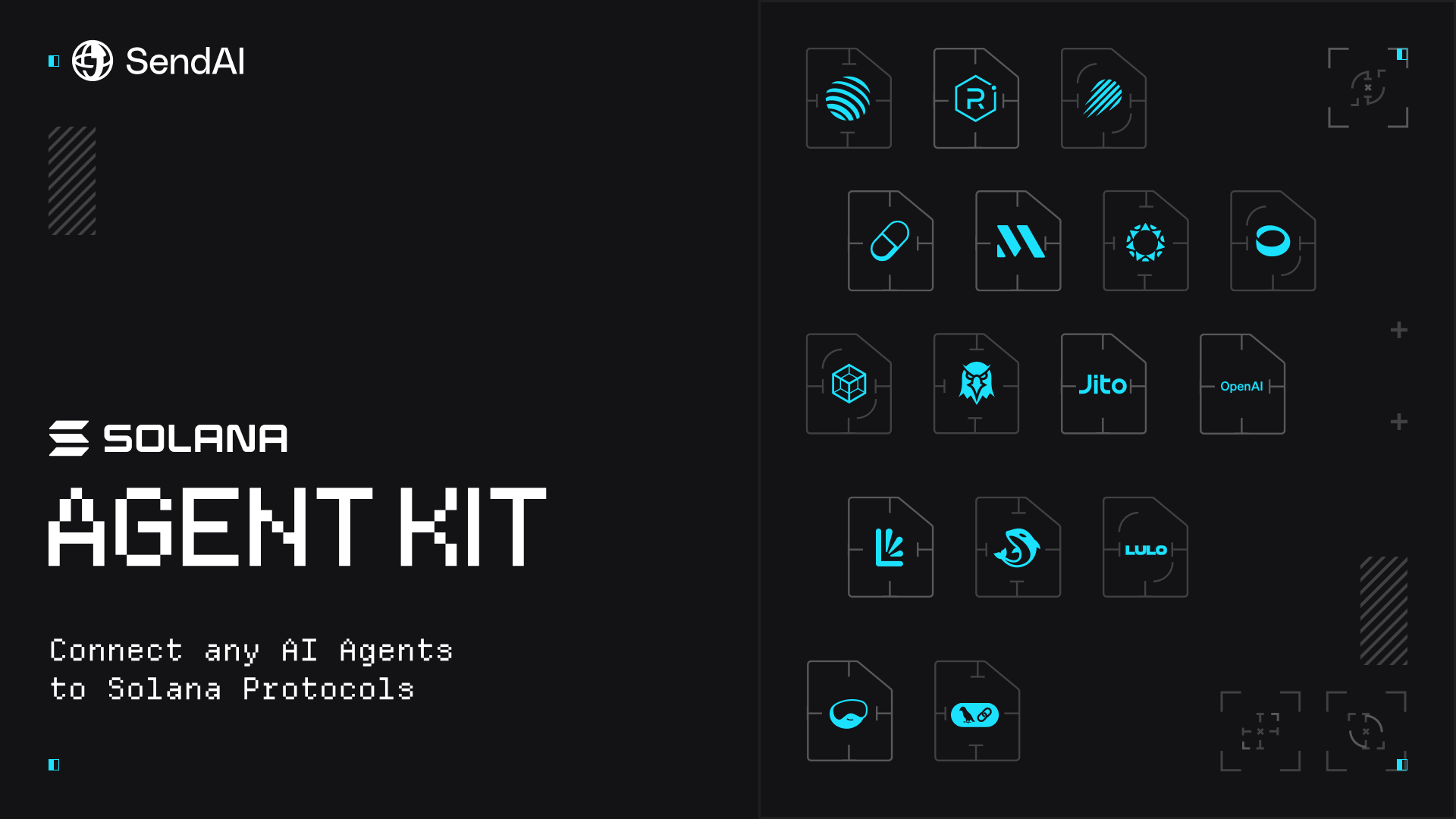

This model is already gaining traction across major networks. For example, the Solana Attestation Service (SAS) acts like a passport for wallets: once verified, users can prove eligibility across multiple platforms without repeating the KYC process or exposing their identity every time. Similarly, Blockpass On-Chain KYC® enables businesses to issue reusable, privacy-preserving attestations that travel with the user from app to app.

“Permissionless allowlists powered by onchain attestations are changing the game for DeFi projects navigating compliance. “

Permissionless Allowlists: Compliance Without Compromise

The traditional approach to allowlists in DeFi involves maintaining off-chain lists of approved addresses or using Merkle trees for compact verification. While effective at gating access, these methods often require centralized management and don’t solve the problem of repeated identity checks across different platforms.

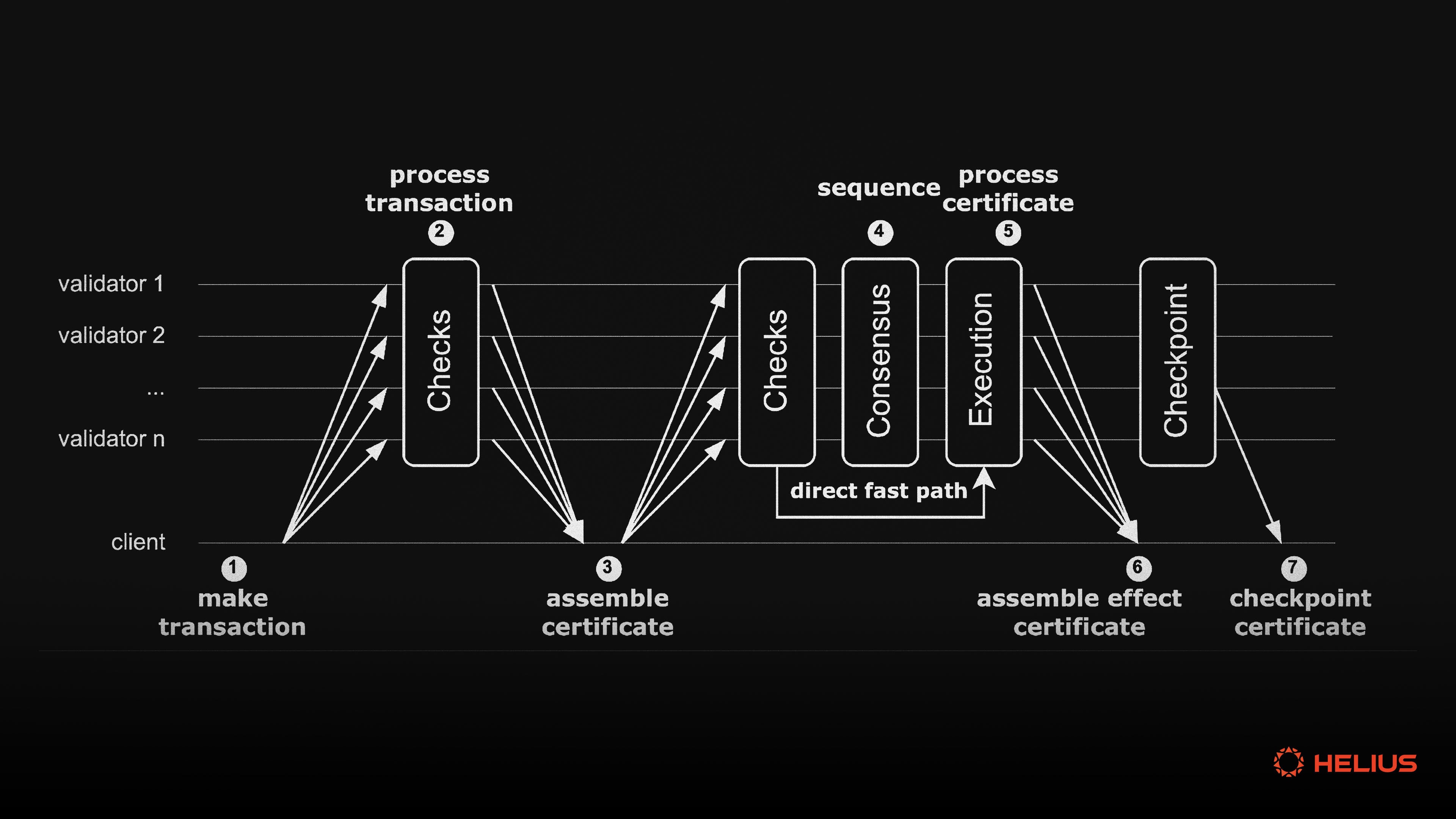

Onchain attestations flip this paradigm. Now, anyone with a verifiable attestation can interact with smart contracts that enforce compliance rules automatically – no manual list updates required. This enables truly permissionless allowlists: platforms set criteria (e. g. , holding an attested KYC credential), and smart contracts do the rest in real time.

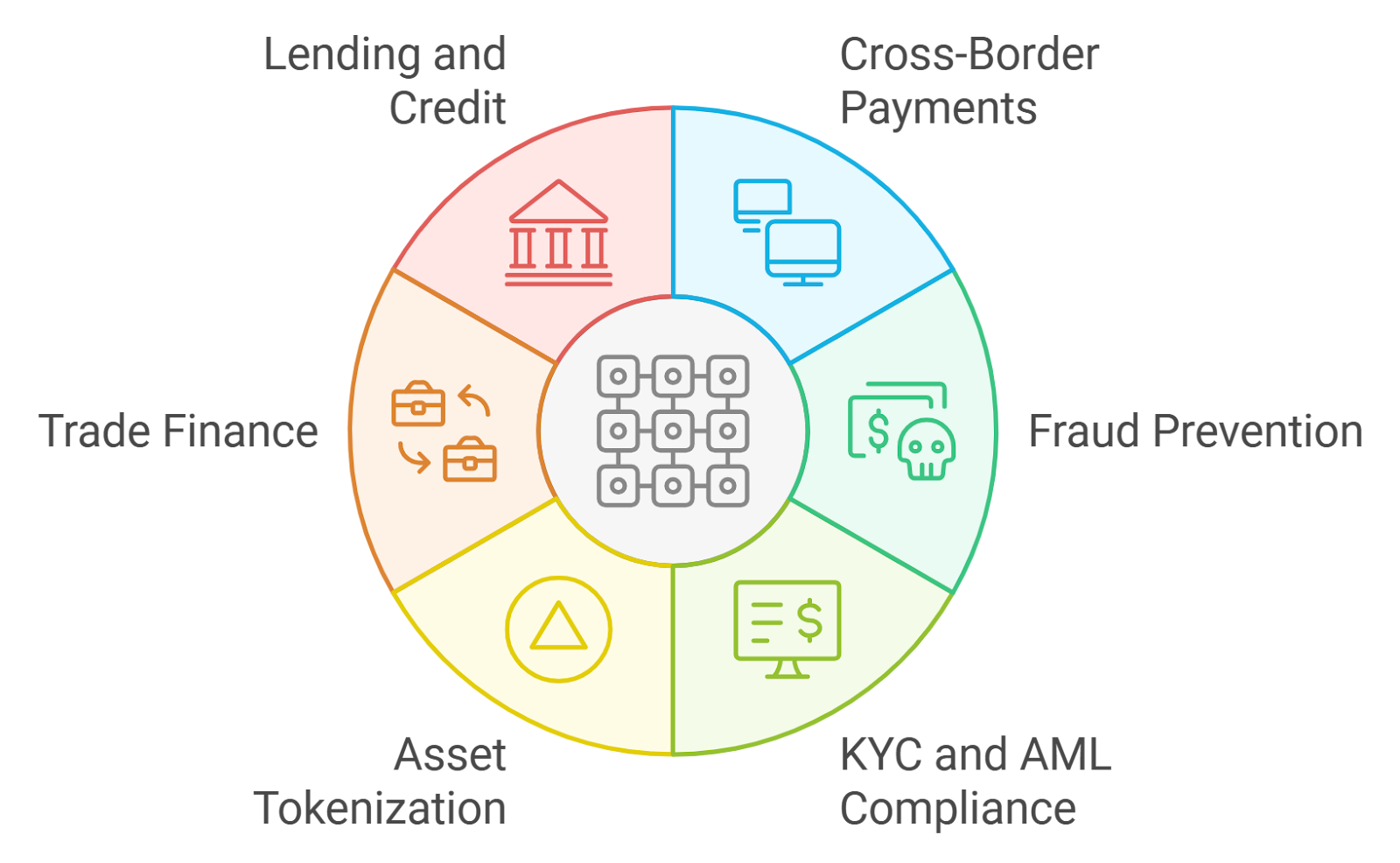

Key Benefits of Onchain KYCed Address Allowlists

-

Enhanced Regulatory Compliance: Onchain attestations allow DeFi platforms to verify user identities and compliance status, meeting KYC/AML requirements without directly handling sensitive personal data.

-

Improved User Privacy: Users share only the necessary verification results, not their full identity details, preserving privacy while accessing DeFi services.

-

Reusable and Interoperable Credentials: Attestations like those from Solana Attestation Service and Blockpass On-Chain KYC® can be used across multiple DeFi platforms, eliminating repeated KYC checks.

-

Streamlined Access and User Experience: Permissionless allowlists powered by onchain attestations enable instant, automated access to DeFi protocols for verified users, reducing onboarding friction.

-

Reduced Fraud and Security Risks: Only verified users can interact with permissioned DeFi features, helping to prevent fraudulent activity and unauthorized access.

This new infrastructure is particularly powerful for:

- Token sales: Only verified users can participate, reducing legal risk while preserving privacy

- Gated communities and DAOs: Membership can be restricted to those meeting compliance requirements without doxxing members

- Lending and borrowing platforms: Automated risk controls based on verified user status rather than static lists

The Privacy-Compliance Balancing Act in DeFi

The most common concern about integrating KYC into DeFi is loss of privacy or increased centralization. However, modern solutions like those offered by SAS and Blockpass are designed specifically to avoid these pitfalls:

- No PII on-chain: Only the attestation result is visible; personal data stays off-chain with the verifier.

- User-controlled credentials: Users decide when and where to present their proof of verification.

- Interoperability: The same credential works across multiple dApps and chains thanks to emerging standards like ERC-725/735 and omni-chain protocols such as Sign Protocol (read more here).

A Glimpse at Real-World Implementations

The theory is compelling – but how does this play out in production? Several leading protocols have already adopted onchain attestations as their foundation for compliant access control:

Live DeFi Projects Using Onchain KYC Attestations

-

Solana Attestation Service (SAS): An open protocol on the Solana blockchain that lets trusted issuers attach KYC checks to wallets. Users can prove compliance across apps without exposing personal data or repeating verification steps.

-

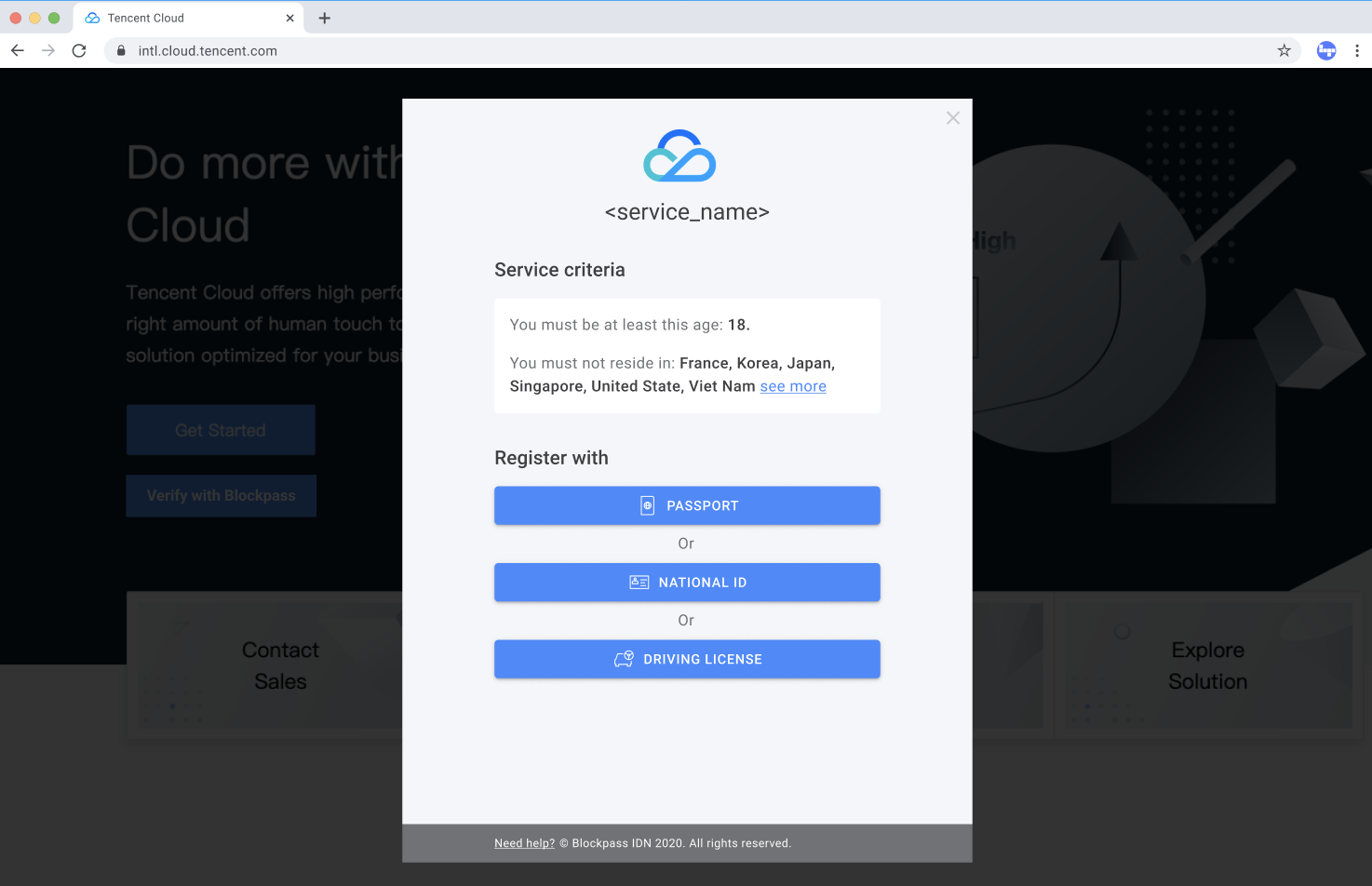

Blockpass On-Chain KYC®: Blockpass enables businesses to issue onchain attestations for user identities, creating reusable digital IDs. Only the verification result is shared onchain, preserving user privacy while meeting compliance.

-

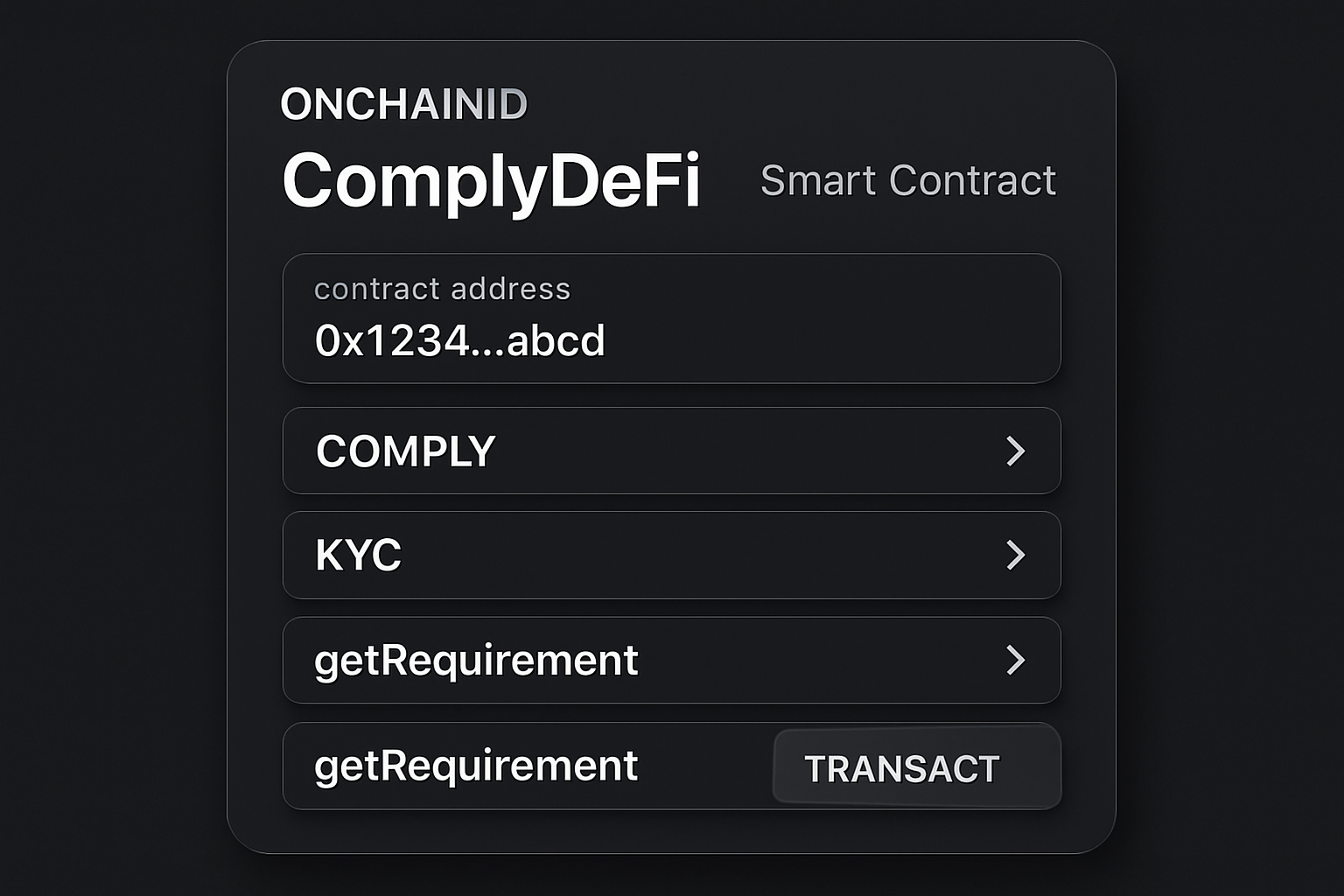

ComplyDeFi by ONCHAINID: This solution uses identity smart contracts and onchain attestations to restrict DeFi protocol access to users with valid claims from trusted third parties, combining compliance with decentralization.

This evolution isn’t just about ticking regulatory boxes; it’s about building ecosystems where users retain sovereignty over their identities while enjoying seamless access to financial products. As these standards mature and adoption spreads, expect more DeFi teams to embrace solutions like OnchainKYCe. me for streamlined integration of blockchain KYC verification into their workflows.

For developers and project leads, integrating onchain KYC attestations is becoming less of a technical hurdle and more of a strategic advantage. By leveraging platforms like OnchainKYCe. me, teams can embed compliance checks directly into their smart contracts, automating the allowlist process for everything from token launches to lending pools. This not only reduces operational overhead but also sets a new bar for user experience, no more endless forms or third-party verifications for each new platform.

What’s especially exciting is how these permissionless allowlists are already unlocking new use cases in DeFi. Imagine a world where:

Real-World Use Cases for Onchain KYCed Address Allowlists

-

Cross-Platform DeFi Access with Solana Attestation Service (SAS): SAS enables users to complete KYC once and use the resulting onchain attestation across multiple DeFi apps on Solana—without revealing personal data to each platform. This streamlines onboarding and preserves privacy.

-

Reusable Digital Identities via Blockpass On-Chain KYC®: Blockpass lets users create a verifiable, reusable digital identity through onchain attestations. These can be used to access permissioned DeFi protocols and token sales, ensuring compliance while keeping user data off-chain.

-

Permissioned DeFi Pools with ComplyDeFi by ONCHAINID: ComplyDeFi leverages onchain identity contracts, allowing only KYC-verified addresses to interact with specific DeFi pools or smart contracts. This is crucial for institutional DeFi and compliant real-world asset tokenization.

-

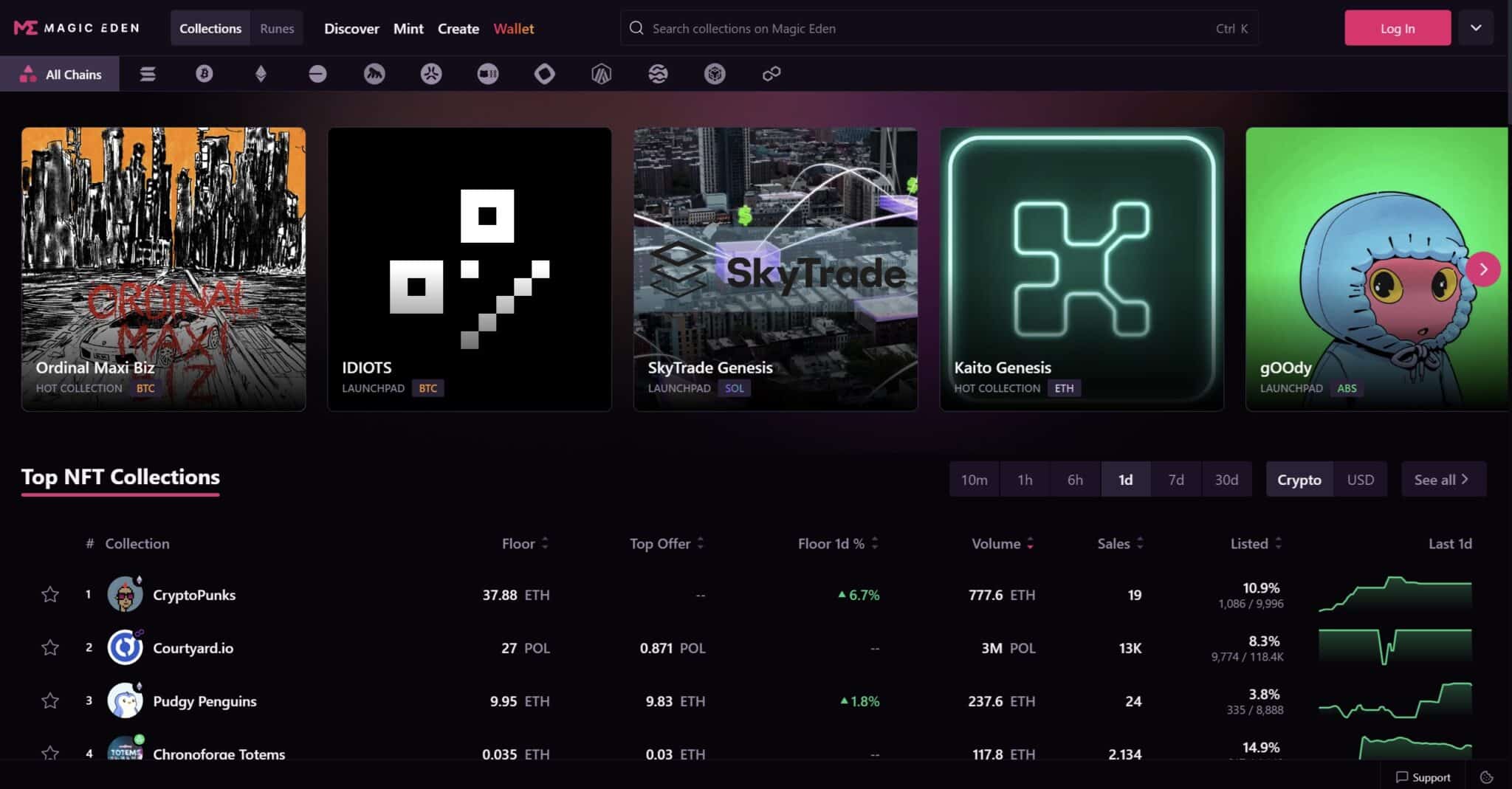

Permissionless NFT Marketplaces with Attestation-Based Access: Some NFT platforms use onchain KYC attestations to allow only verified users to mint or trade certain collections, enabling regulatory compliance for high-value or real-world asset-backed NFTs.

-

Decentralized Launchpads and Token Sales: Launchpads can use onchain allowlists based on KYC attestations to automatically grant access to eligible participants, preventing sybil attacks and ensuring regulatory compliance without manual whitelisting.

Instead of siloed compliance, users and protocols benefit from a network effect: once verified, wallets can participate across ecosystems, from NFT drops to real-world asset tokenization projects. As highlighted in discussions around ComplyDeFi by ONCHAINID, this approach transforms DeFi protocols from isolated islands into interoperable hubs where trust is portable and privacy is respected.

Challenges and the Road Ahead

No innovation comes without challenges. The biggest hurdles for onchain KYC attestations are:

- Issuer trust: The legitimacy of an attestation depends on the reputation of its issuer. Ecosystem-wide standards and transparent governance will be crucial.

- User adoption: Educating users about privacy-preserving KYC, and dispelling fears about surveillance, is essential for mass uptake.

- Regulatory clarity: As global rules evolve, DeFi teams must stay agile to ensure that onchain attestations remain compliant without sacrificing decentralization.

The upside? Solutions are emerging rapidly. Projects like Sign Protocol are pioneering omni-chain attestation standards (details here) that make it easier than ever to issue, manage, and verify credentials across networks. Meanwhile, new tools like the Solana Attestation Service continue to demonstrate how permissionless allowlists can scale without bottlenecks or data leaks.

Why OnchainKYCe. me Stands Out

If you’re building or managing an allowlist today, or planning a token sale tomorrow, platforms like OnchainKYCe. me offer an out-of-the-box solution designed for Web3 scale. With seamless integration, robust privacy protections, and interoperability across chains, OnchainKYCe. me empowers projects to meet compliance needs without sacrificing the permissionless ethos that makes DeFi unique.

The next wave of decentralized finance won’t be defined by who gets excluded, it’ll be shaped by how we include more participants safely, transparently, and privately. Onchain attestations for KYCed addresses are the key to this future: enabling permissionless allowlists that work for everyone, everywhere.