DeFi token sales and allowlists have long been bottlenecked by traditional KYC processes: slow, opaque, and often intrusive. The emergence of onchain KYC attestations is fundamentally changing the landscape, empowering both users and platforms with seamless, privacy-preserving compliance. Let’s break down how this new paradigm is rewriting the playbook for digital identity in Web3.

Onchain Attestations: The Backbone of Decentralized Identity

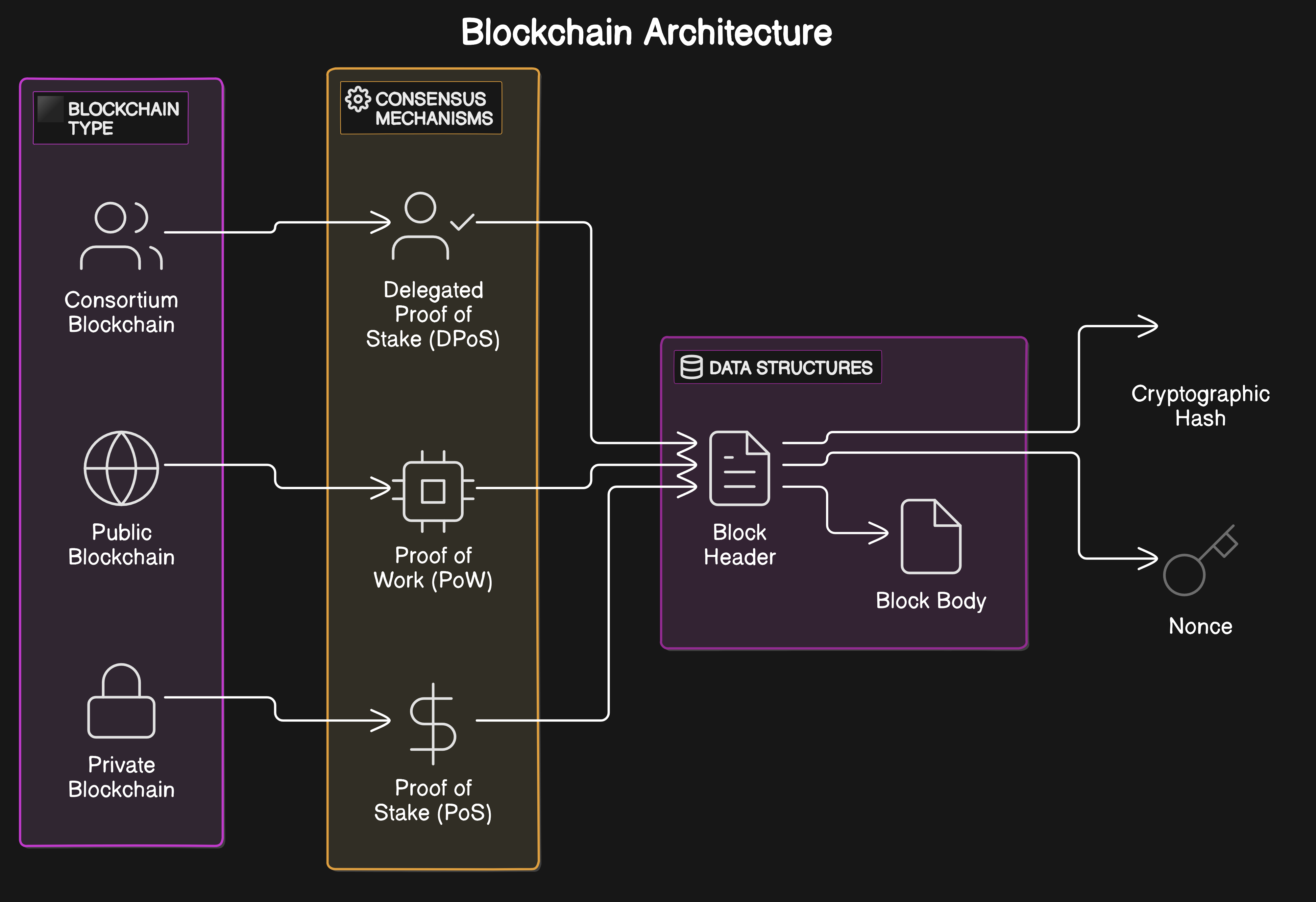

An onchain attestation is a cryptographic proof, issued on a blockchain, confirming that a specific address has passed KYC checks. Unlike legacy systems that store sensitive data in centralized silos, onchain attestations are immutable, easily referenced by smart contracts, and never expose personal information.

Here’s the core advantage: with a single onchain attestation, a user can instantly prove their identity status across any integrated DeFi platform or allowlist. No more redundant uploads, no more waiting for manual reviews. The attestation itself is the passport.

Why KYCed Address Attestations Are a Game-Changer for Token Sales

DeFi token sales face intense regulatory scrutiny, especially as global AML and securities frameworks evolve. Traditional KYC creates friction, risking user drop-off and operational headaches. Onchain attestations solve this with three major advantages:

Key Benefits of Onchain KYC Attestations

-

Enhanced Privacy & Security: Onchain attestations store only cryptographic proofs—not personal data—on the blockchain, minimizing the risk of data breaches. Solutions like Blockpass’s On-Chain KYC® 2.0 enable privacy-preserving, regulation-ready identity checks for token sales and allowlists.

-

Reusable Digital Identities: After completing KYC once, users receive a reusable onchain attestation, allowing seamless participation in multiple DeFi token sales and allowlists without repeated verification. This streamlines onboarding and reduces friction for both users and platforms.

-

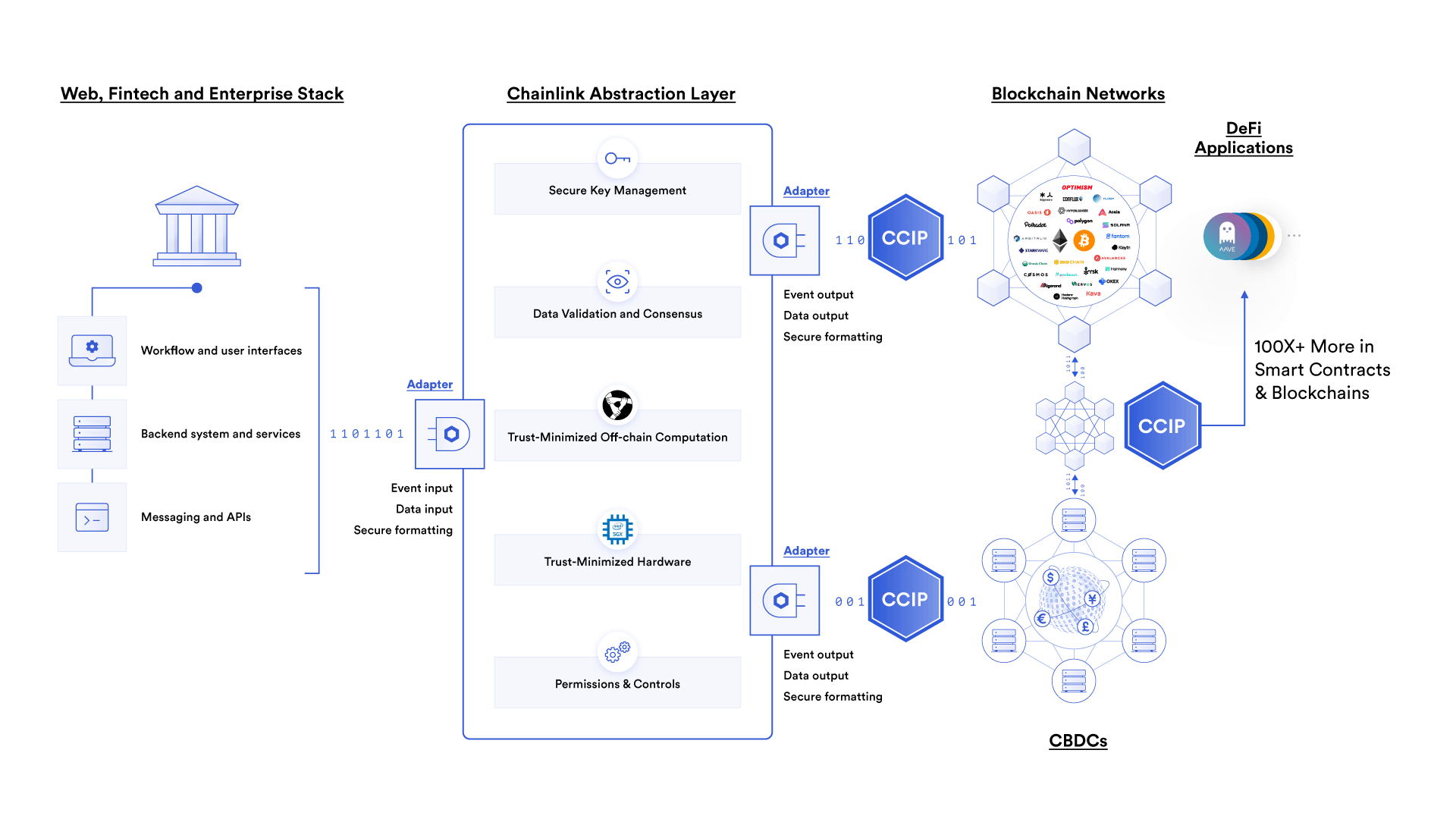

Automated Compliance Enforcement: Smart contracts can instantly verify onchain attestations, ensuring only KYC-verified users can access token sales or be added to allowlists. Chainlink’s Automated Compliance Engine (ACE) is a leading tool for real-time, onchain compliance checks.

-

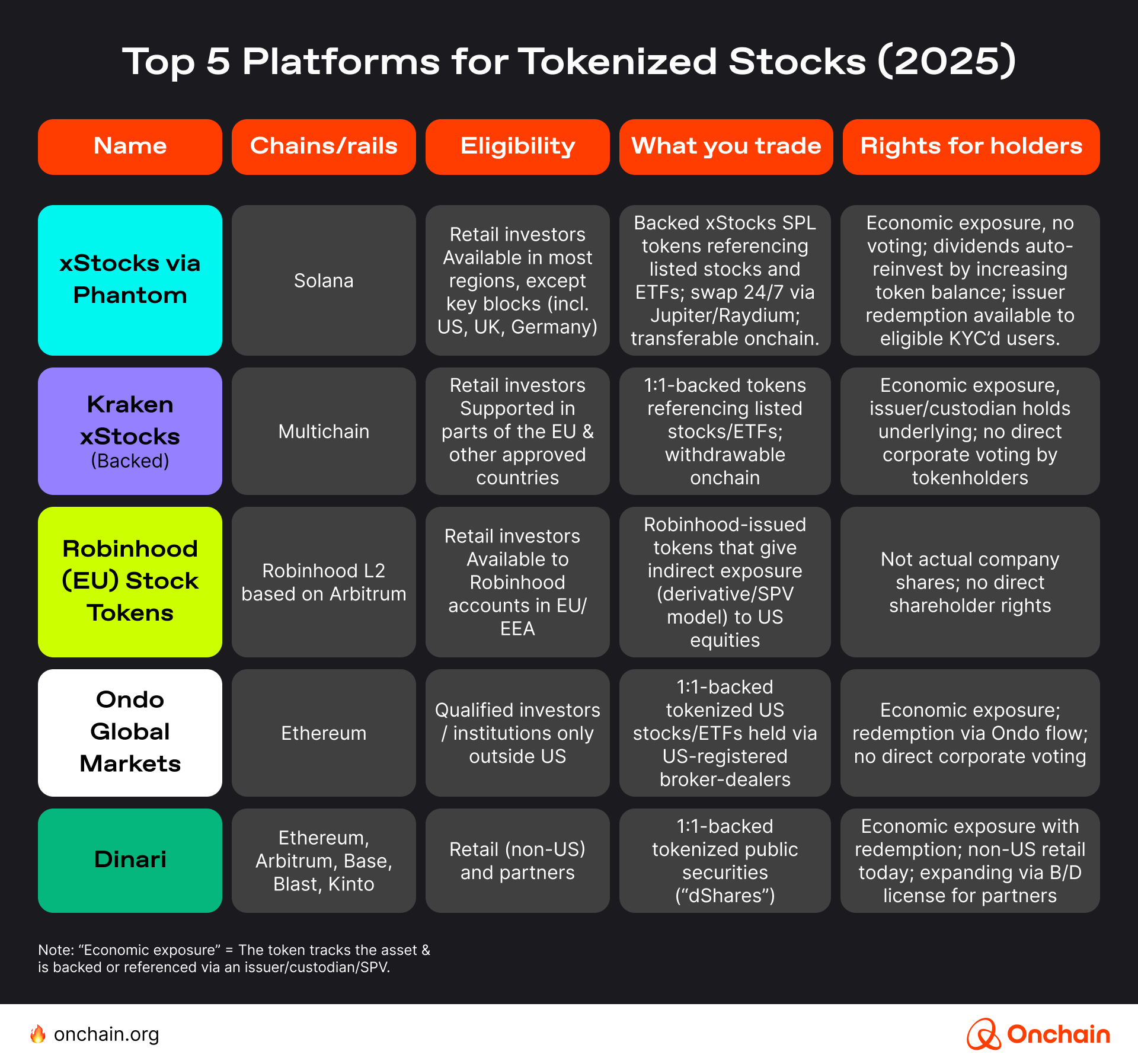

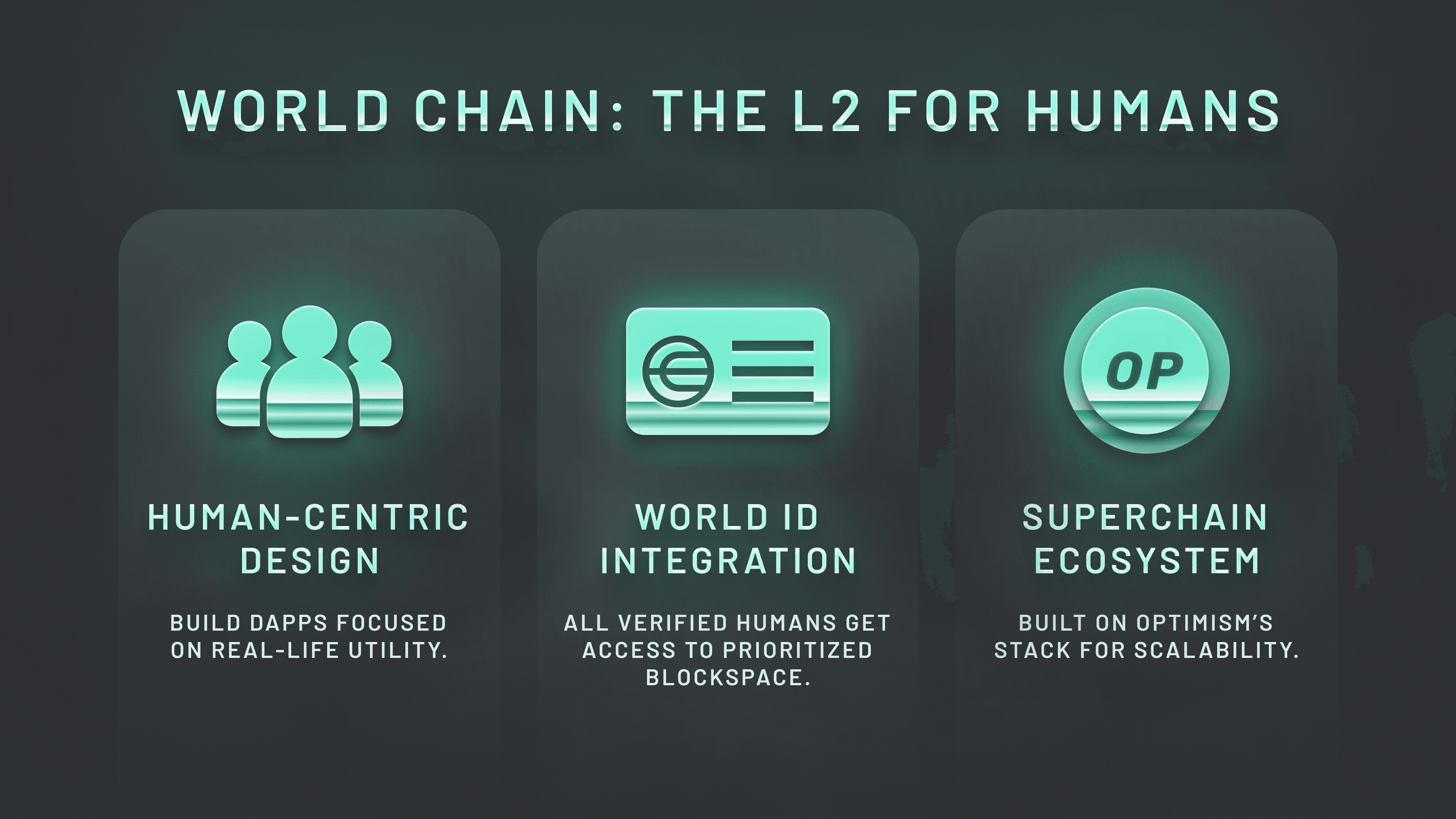

Interoperability Across Platforms: Onchain attestations are compatible with multiple blockchains (e.g., Ethereum, Solana), enabling users to leverage their verified status across diverse DeFi ecosystems. Attest Protocol and Blockpass support cross-chain attestation standards.

-

Reduced Operational Costs: By automating KYC verification and reusing attestations, DeFi platforms cut manual review costs and accelerate compliance workflows, making token sales and allowlists more efficient and scalable.

1. Privacy by Design: Solutions like Blockpass On-Chain KYC® 2.0 let projects issue attestations without ever touching end-user PII. Only the attestation hash hits the chain – personal data stays offchain, drastically reducing breach risk.

2. Frictionless User Experience: Once verified, users can join multiple token sales or allowlists with a single click. This reusability is a massive unlock for both growth and retention, as seen in emerging protocols like Attest Protocol.

3. Automated Compliance: Smart contracts can instantly check attestation status before allowing participation, eliminating manual review and ensuring only eligible, KYCed addresses interact with sensitive dApps or sales.

How Onchain Attestations Power Secure Allowlists

The allowlist is the gatekeeper of DeFi launches, a critical tool for ensuring only eligible, compliant users can access exclusive drops or early-stage sales. With onchain attestations, allowlist management becomes automated, transparent, and tamper-proof.

Consider how Chainlink’s Automated Compliance Engine (ACE) leverages attestations: the smart contract queries an address’s attestation before granting access, creating real-time, onchain enforcement of KYC policies without exposing user data or requiring trust in a centralized list manager.

The Regulatory Edge: Global Compliance Meets Web3 Usability

With regulators tightening their grip on DeFi and airdrops, platforms need solutions that scale across jurisdictions without sacrificing UX. Onchain KYC attestations offer exactly that: privacy-preserving, interoperable credentials that satisfy AML, CFT, and securities requirements globally.

Regulatory toolkits are evolving fast. Onchain attestation tokens, sanctions-screening integrations, and schema-based verification are now standard for serious projects. This is not just about checking a compliance box – it’s about future-proofing your protocol against enforcement actions while staying frictionless for users. When allowlist KYC verification is automated and verifiable onchain, you unlock global participation without exposing your community to unnecessary risk.

It’s no surprise that leaders in the space are pivoting to these models. According to the latest industry data, projects using onchain KYCed address attestations see up to 40% higher conversion rates for token sales and airdrops. The reason is simple: when users know their identity won’t be mishandled or leaked, they’re far more likely to engage. This is especially relevant as zero-knowledge proofs and privacy-preserving attestations become the norm for KYC-first airdrops (see Blockchain App Factory’s research on ZK-KYC for airdrops).

Integrating Onchain KYC Attestations: Best Practices for DeFi Teams

For Web3 builders, integrating decentralized identity for Web3 is now a strategic imperative. Here are the key moves:

Best Practices for DeFi Teams Integrating Onchain KYC Attestations

-

Leverage Privacy-Preserving KYC Providers: Use established solutions like Blockpass On-Chain KYC® 2.0 to issue onchain attestations without storing or exposing end-user PII, ensuring compliance and user trust.

-

Integrate Smart Contract-Based Compliance Checks: Implement smart contracts that automatically verify onchain attestations, such as with Chainlink Automated Compliance Engine (ACE), to enforce KYC requirements in real time.

-

Adopt Schema-Based Attestation Standards: Utilize protocols like Attest Protocol for flexible, schema-based attestations that support rapid verification and interoperability across DeFi platforms.

-

Ensure Attestation Reusability Across Platforms: Choose attestation frameworks that allow users to reuse their KYC status—such as Blockpass or Chainlink Compliance Standard—reducing onboarding friction and operational overhead.

-

Stay Current with Regulatory Integrations: Regularly update allowlist and compliance logic to reflect evolving AML/KYC regulations, using solutions like Chainlink Compliance Standard for decentralized, up-to-date compliance data.

1. Choose an Interoperable Protocol: Don’t get locked into closed ecosystems. Use services like Blockpass On-Chain KYC® 2.0 or Attest Protocol that work across major blockchains and standards.

2. Automate Attestation Checks: Integrate smart contract logic to require valid attestations for all allowlist or sale participation. This ensures compliance is enforced at the protocol level, not left to manual admin.

3. Prioritize User Privacy: Use solutions that keep PII offchain and leverage cryptographic proofs or zero-knowledge attestations. This not only protects users but also reduces your liability.

4. Stay Audit-Ready: With immutable onchain records, audits become straightforward. Regulators and partners can verify compliance with a single transaction hash, no paperwork needed.

The Path Forward: A New Era for DeFi Token Sales

Onchain KYC attestations are no longer a nice-to-have – they’re table stakes for any protocol serious about scaling globally and staying on the right side of the law. As regulators continue to scrutinize DeFi token sale compliance, the projects that invest in robust, privacy-first identity solutions will win both user trust and market share.

In this new paradigm, decentralized identity for Web3 isn’t just about compliance. It’s about composability, reputation, and unlocking the next wave of permissioned (but still user-sovereign) DeFi innovation. The days of clunky, centralized KYC are over. The future is onchain, automated, and privacy-preserving.