For DeFi allowlist managers, the days of repeatedly collecting sensitive user documents and relying on centralized KYC databases are numbered. The rise of onchain attestations for KYC is transforming how decentralized finance projects verify user identities, automate compliance, and build trust – all while preserving privacy and minimizing operational risk.

Why Traditional KYC Fails DeFi Allowlist Managers

DeFi platforms have long struggled to balance regulatory requirements with the ethos of decentralization. Traditional KYC methods force users to repeatedly submit personal information to every new protocol or token sale, creating friction and exposing both users and projects to data breaches. Centralized storage of identity data is a honeypot for attackers and a liability for allowlist managers who must comply with evolving global regulations.

This fragmented approach also undermines the composability that makes DeFi so powerful. Users are forced through redundant verification loops, while allowlist managers juggle compliance checks across disparate systems. The result? Frustration, inefficiency, and missed opportunities for both sides.

The Case for Onchain Attestations in DeFi Compliance

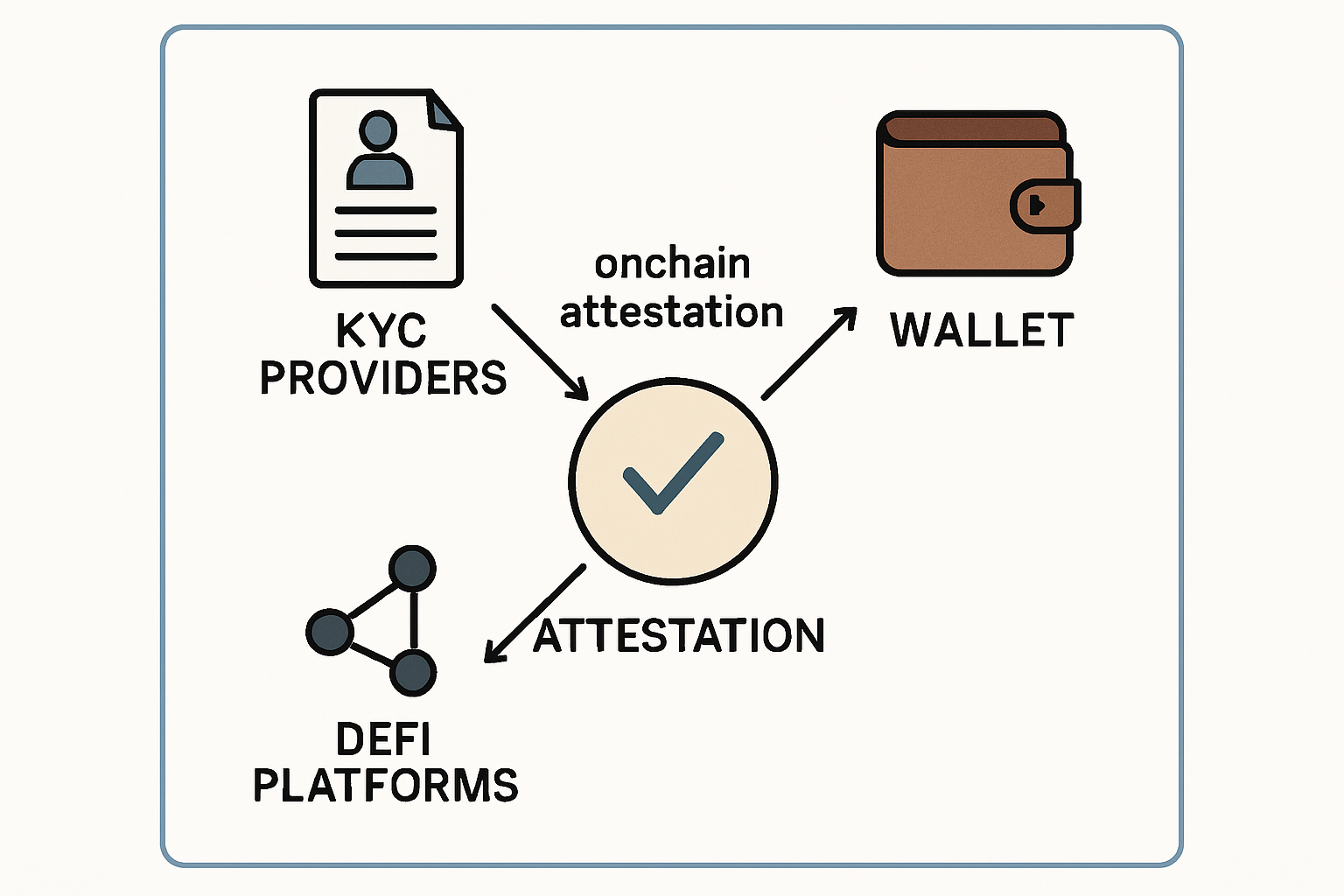

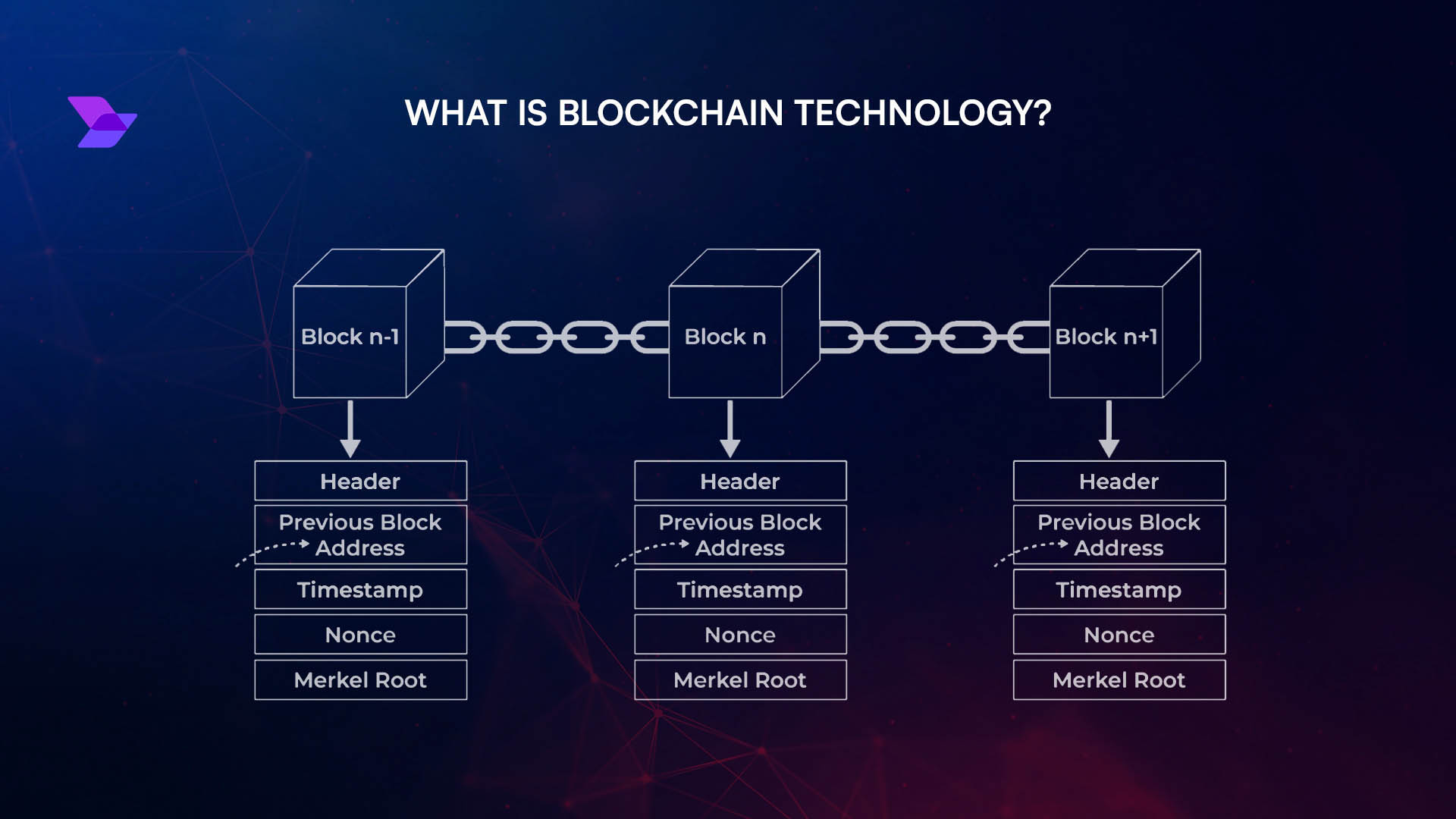

Onchain attestations offer a pragmatic solution: cryptographic proofs issued by trusted KYC providers that are stored directly on the blockchain. Instead of sharing raw personal data, users receive a verifiable credential tied to their wallet address. Allowlist managers can then check these credentials instantly using smart contracts or lightweight APIs, no emails or off-chain lookups required.

This model delivers several key advantages:

Key Benefits of Onchain Attestations for DeFi Allowlist Management

-

Decentralized Identity Verification: Onchain attestations allow users to complete KYC with trusted issuers (like exchanges or KYC providers), who then issue verifiable credentials to their wallets. This enables DeFi platforms to confirm user identity without directly handling sensitive personal data, greatly enhancing privacy and reducing centralized data risks.

-

Efficient Compliance Checks: Allowlist managers can instantly verify users’ compliance with KYC and AML regulations using onchain attestations. Solutions like the Solana Attestation Service (SAS) streamline regulatory checks, speeding up onboarding and access control.

-

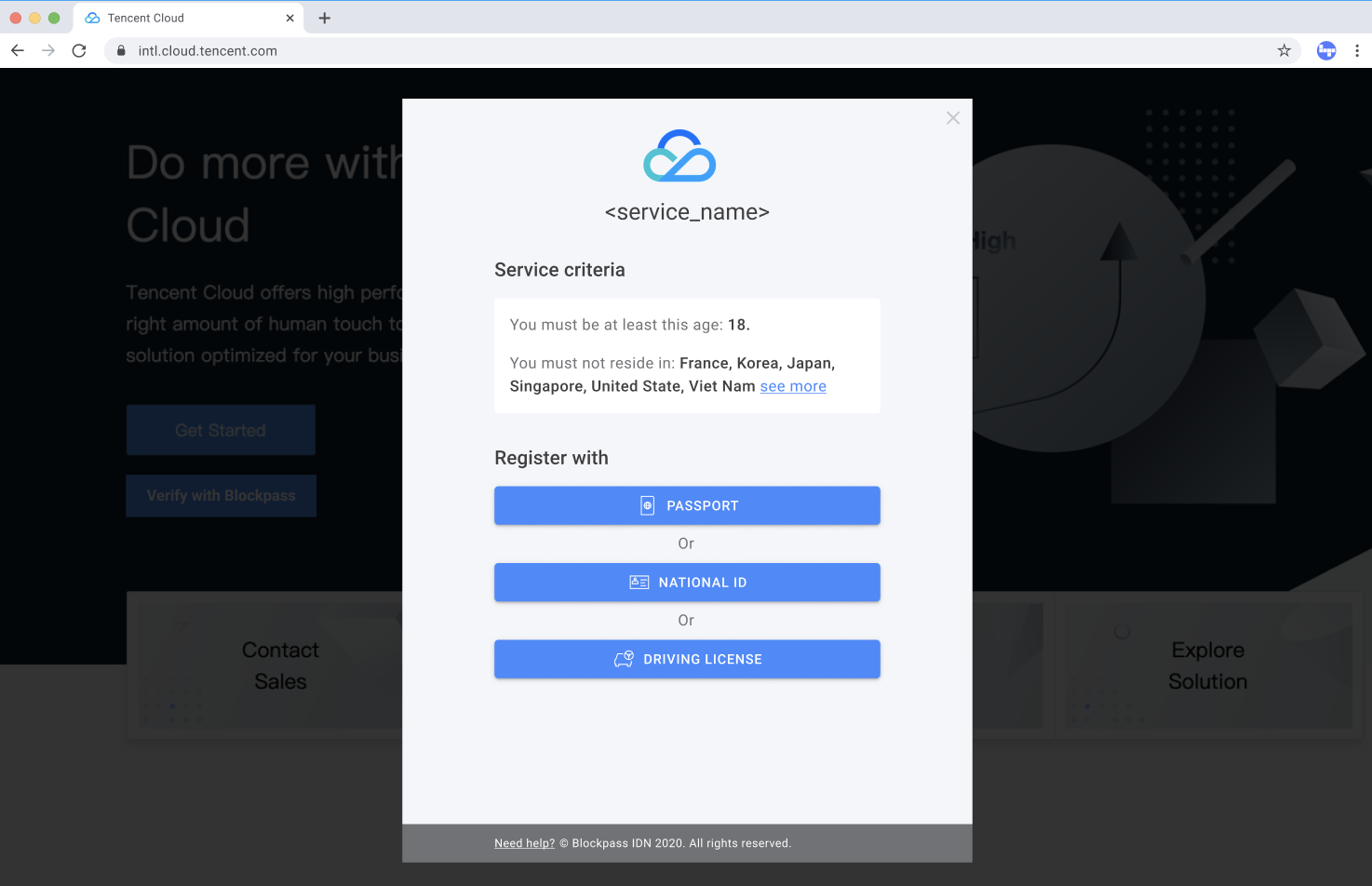

Interoperability Across Platforms: Onchain attestations are reusable and recognized across multiple DeFi platforms. Once verified, users can access a variety of services without repeating KYC processes, reducing friction and simplifying management for allowlist administrators. Blockpass On-Chain KYC® is a leading example of this approach.

-

Enhanced Security and Trust: Blockchain’s immutability ensures attestations cannot be altered or forged, providing strong guarantees of authenticity. Since personal data isn’t repeatedly shared, the risk of data breaches is minimized, increasing trust for both users and platforms.

-

Streamlined Integration for Developers: Protocols like Attest Protocol offer lightweight tools for integrating KYC verification, making it easier for DeFi projects to adopt secure, onchain allowlist management with minimal development overhead.

- Privacy-first onboarding: Personal details remain with the user; only proof of verification is shared.

- No more repeated KYC: Once verified by a trusted issuer, users can access multiple platforms without re-submitting documents.

- Automation at scale: Smart contracts can enforce allowlists based on attestation status in real time, no manual review queues.

- Regulatory agility: Attestations can encode nuanced compliance checks (jurisdictional blocks, sanctions screening) without exposing unnecessary data.

- Ecosystem interoperability: Standards like Sign Protocol and Blockpass On-Chain KYC® make credentials portable across chains and dApps.

A Closer Look at Real-World Implementations

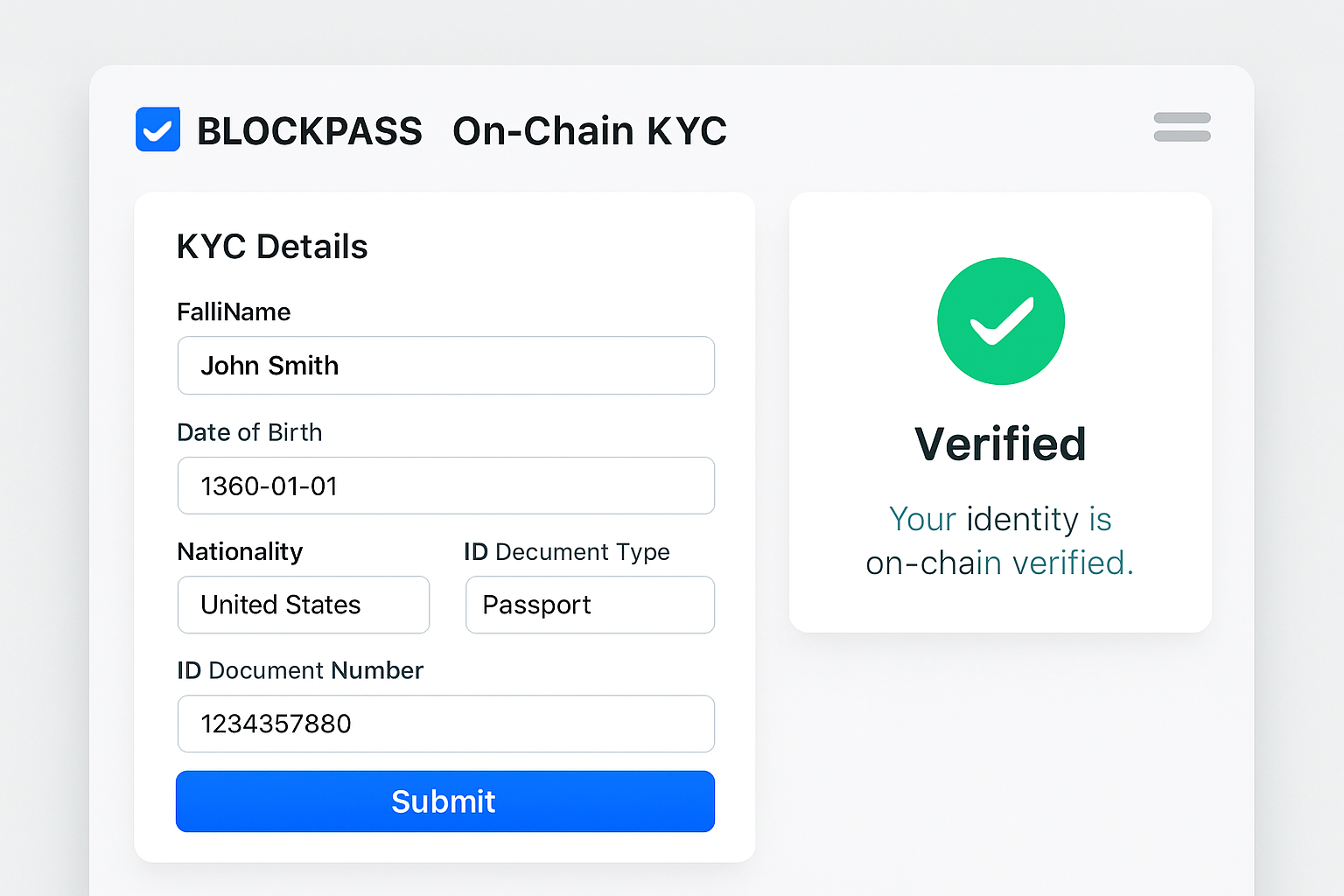

The shift toward decentralized KYC credentials isn’t just theoretical, it’s already reshaping major ecosystems. The Solana Attestation Service (SAS), for example, lets issuers create immutable proofs about wallet compliance status that any dApp can verify permissionlessly. Similarly, Blockpass On-Chain KYC® 2.0 empowers users with reusable digital identities that streamline onboarding across token sales, NFT launches, and gated communities, all without compromising privacy.

This interoperability reduces friction dramatically: once a user’s wallet receives an attestation from a recognized provider, that credential can unlock access across dozens of protocols without further paperwork or delay.

The Mechanics: How Onchain Attestations Work Behind the Scenes

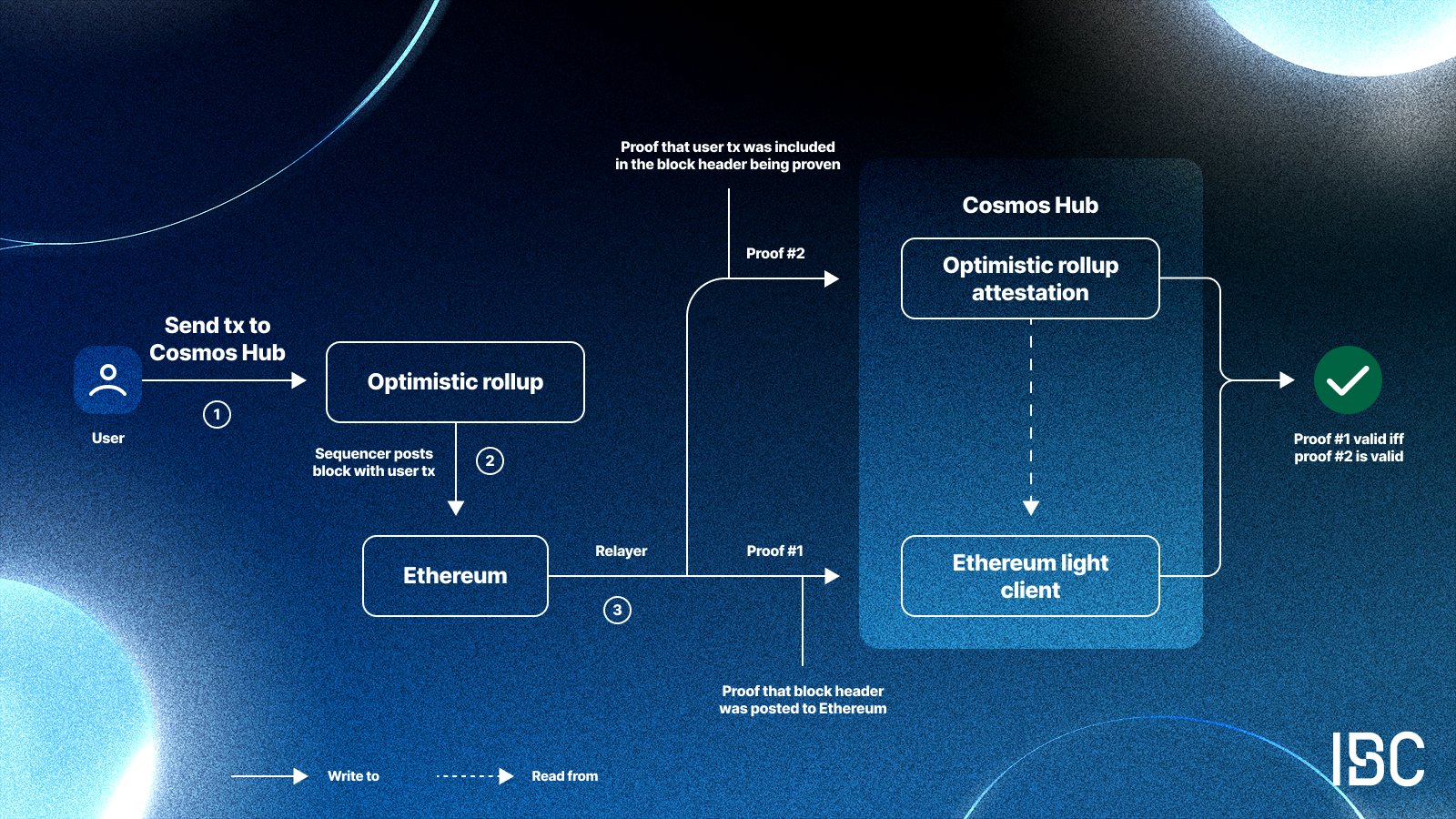

The process begins when a user completes identity verification with an approved off-chain provider (such as Sumsub or Blockpass). This provider then issues an attestation, a digitally signed statement using predefined schemas, that is written to the blockchain alongside the user’s wallet address. When a user attempts to join an allowlist or participate in a token sale, the smart contract queries this public record to confirm their compliance status instantly.

Step-by-Step: Issuing & Verifying Onchain KYC Attestations

-

1. User Completes KYC Verification with a Trusted IssuerThe user submits identity documents and completes KYC checks with a trusted provider, such as Blockpass or a regulated exchange. The issuer verifies the user’s identity according to regulatory standards.

-

2. Issuer Creates an Onchain AttestationOnce verified, the issuer generates a cryptographic attestation—using protocols like Solana Attestation Service (SAS) or Attest Protocol—that confirms the wallet address has passed KYC. This attestation is published directly to the blockchain.

-

3. Attestation Is Linked to the User’s WalletThe attestation is cryptographically linked to the user’s self-hosted wallet address, creating a reusable, privacy-preserving digital identity that can be referenced by DeFi platforms.

-

4. DeFi Allowlist Manager Queries the BlockchainWhen a user attempts to join an allowlist or access a service, the DeFi platform’s smart contract or backend queries the blockchain for a valid KYC attestation associated with the user’s wallet.

-

5. Smart Contract Verifies Attestation ValidityThe smart contract checks the attestation’s issuer, schema, and cryptographic signature to confirm authenticity and compliance. If valid, the user is automatically added to the allowlist without exposing personal data.

-

6. User Gains Access Across Multiple PlatformsThanks to interoperability, users can reuse the same onchain KYC attestation to access other DeFi platforms or services that recognize attestations from the same issuer, streamlining onboarding and compliance.

This architecture eliminates implicit trust assumptions found in many permissioned DeFi solutions (see arXiv’s recent analysis on privacy-preserving permissioning). Rather than trusting each project with sensitive data storage or manual review processes, trust shifts to cryptographic proofs anchored in transparent blockchain infrastructure.

This paradigm shift doesn’t just make life easier for allowlist managers, it fundamentally changes the game for DeFi users. With decentralized KYC credentials, users gain control over their identity proofs, reducing their exposure to centralized honeypots and repetitive document uploads. In turn, projects can focus on growth and innovation instead of wrangling compliance paperwork or building brittle KYC integrations from scratch.

For platforms managing high-stakes events, like token launches, airdrops, or gated governance, the advantages compound. Onchain attestations make it trivial to enforce nuanced compliance logic: block sanctioned jurisdictions, limit participation to accredited investors, or even set tiered access rules based on verified attributes. All of this happens at the speed and transparency of smart contracts.

Privacy Without Compromise: The Core Value Proposition

One of the most compelling features of privacy-first KYC for DeFi is that it decouples identity verification from personal data exposure. Users never have to reveal more than a cryptographic proof that they meet requirements, a breakthrough for both privacy advocates and risk-conscious institutions.

This model is already gaining traction across ecosystems that prioritize composability and user sovereignty. As highlighted by Chainlink’s integration guides, compliance policies can now be embedded directly into smart contracts or token standards, no need for leaky off-chain databases or trust in opaque third parties.

The upshot? Allowlist managers can automate access with confidence while still meeting regulatory obligations. And users finally get a seamless experience that respects their privacy by design.

What’s Next: Interoperability and the Future of DeFi Compliance

The next frontier is interoperability, making sure these decentralized credentials work not just within one ecosystem but across chains, wallets, and dApps. Protocols like Sign Protocol are leading the charge here, enabling omni-chain attestations that travel with the user wherever they go in Web3.

As standards mature and adoption spreads, expect to see:

Top Trends in Blockchain KYC Allowlist Management

-

Privacy-Preserving Onchain Attestations: Solutions like Blockpass On-Chain KYC® and Solana Attestation Service (SAS) enable users to verify their identity without exposing sensitive personal data, leveraging cryptographic proofs recorded directly on the blockchain.

-

Interoperable Digital Identities: Platforms such as Blockpass and Attest Protocol are driving the creation of reusable, cross-platform digital identities, allowing users to access multiple DeFi services with a single KYC verification.

-

Embedded Compliance in Smart Contracts: Technologies like Chainlink are enabling compliance policies to be directly embedded within smart contracts, automating allowlist management and reducing manual intervention for KYC checks.

-

Decentralized and Automated KYC Verification: The adoption of protocols such as Attest Protocol allows DeFi platforms to automate KYC verification through onchain attestations, streamlining onboarding while maintaining regulatory standards.

-

Enhanced Security and Trust via Immutable Records: By storing attestations on blockchain, services like Solana Attestation Service ensure that KYC verifications are tamper-proof, boosting trust for both users and allowlist managers.

- Universal wallet-based identity: Users control reusable credentials tied to their wallets, not siloed accounts.

- Automated cross-platform compliance: Smart contracts query attestations in real time across multiple blockchains.

- Evolving regulatory support: New schemas encode complex compliance checks (age gating, regional blocks) without sacrificing privacy or efficiency.

This isn’t science fiction, it’s already happening as projects like Blockpass On-Chain KYC® 2.0 and Solana’s SAS demonstrate real-world traction. For a deeper dive into how these systems eliminate repeated KYC headaches while boosting trust in token sales and allowlists, check out our guide here.

Final Thoughts: Building Trust at Scale

Onchain attestations represent more than just another compliance checkbox, they’re a foundation for scalable trust in permissionless finance. By shifting verification from closed silos to open protocols anchored by cryptography, DeFi allowlist managers unlock new efficiencies while raising the bar for user protection and regulatory alignment.

The best part? This is only the beginning. As standards converge and more platforms embrace decentralized KYC workflows, expect onboarding barriers to fall, and new forms of open collaboration between users, issuers, and builders across the blockchain economy.