Decentralized Finance (DeFi) is rewriting the rules of global finance, yet regulatory compliance remains a persistent challenge. Know Your Customer (KYC) regulations are non-negotiable for platforms looking to scale, attract institutional capital, or launch compliant token sales. Traditional KYC processes, however, are slow, siloed, and at odds with DeFi’s ethos of privacy and permissionless access. This is where onchain attestations for KYCed addresses are transforming the landscape, offering a data-driven, privacy-preserving solution for DeFi allowlists.

How Onchain Attestations Work for DeFi Allowlists

Onchain attestations are cryptographic proofs anchored on a blockchain. They verify that a user’s wallet address meets specific compliance requirements, such as passing KYC, without exposing sensitive personal details. When users complete KYC with a trusted provider, they receive an attestation linked to their wallet. DeFi platforms can then check for these attestations using smart contracts to gate access to allowlists for token sales, airdrops, and gated communities.

This approach flips the script: instead of uploading documents to every new platform, users prove their compliance with a single onchain credential. Learn more about streamlining compliance for DeFi token sales and allowlists.

Key Benefits: Privacy, Automation, and Reusability

Top Benefits of Onchain KYC Attestations for DeFi Allowlists

-

Enhanced Privacy: Users can prove KYC compliance without exposing sensitive personal data directly to DeFi platforms, preserving privacy while meeting regulatory demands. Learn more at Altme

-

Interoperability & Reusability: Onchain attestations are reusable across multiple DeFi platforms, eliminating repetitive KYC checks and streamlining onboarding. See Blockpass On-Chain KYC

-

Automated Compliance Verification: Smart contracts instantly verify attestations in user wallets, reducing manual KYC processes and boosting operational efficiency. Explore Singularity Finance Docs

-

Granular Access Control: Attestations can specify user attributes (like investor status or residency), enabling nuanced, policy-based access controls for DeFi allowlists. Discover granular KYC with Blockpass

-

Real-Time, Cross-Chain Compliance: Solutions like Chainlink ACE enable dynamic, policy-enforced compliance across multiple blockchains, supporting evolving regulatory needs. Read about Chainlink ACE

-

Privacy-Preserving Digital Identities: Platforms such as Altme and TezID empower users to manage digital identity and share compliance proofs while keeping personal information confidential. Altme & TezID partnership

The advantages of onchain attestations are clear and quantifiable:

- Enhanced Privacy: Attestations confirm compliance without revealing identity details to every protocol.

- Interoperability: Once issued, onchain KYC credentials are reusable across multiple DeFi platforms, no more repeated onboarding.

- Automated Compliance: Smart contracts instantly verify attestations, eliminating manual review and reducing operational overhead.

- Granular Access Control: Attestations can encode attributes like jurisdiction or investor status for precise allowlist management.

This model not only satisfies regulators but also keeps user experience frictionless, a win for both sides of the table.

Leading Implementations: From Blockpass to Chainlink ACE

The market is already seeing robust deployments:

- Blockpass’s On-Chain KYC® 2.0 issues reusable digital identities across multiple blockchains.

- Chainlink’s Automated Compliance Engine (ACE) links onchain identities to offchain credentials for real-time compliance enforcement.

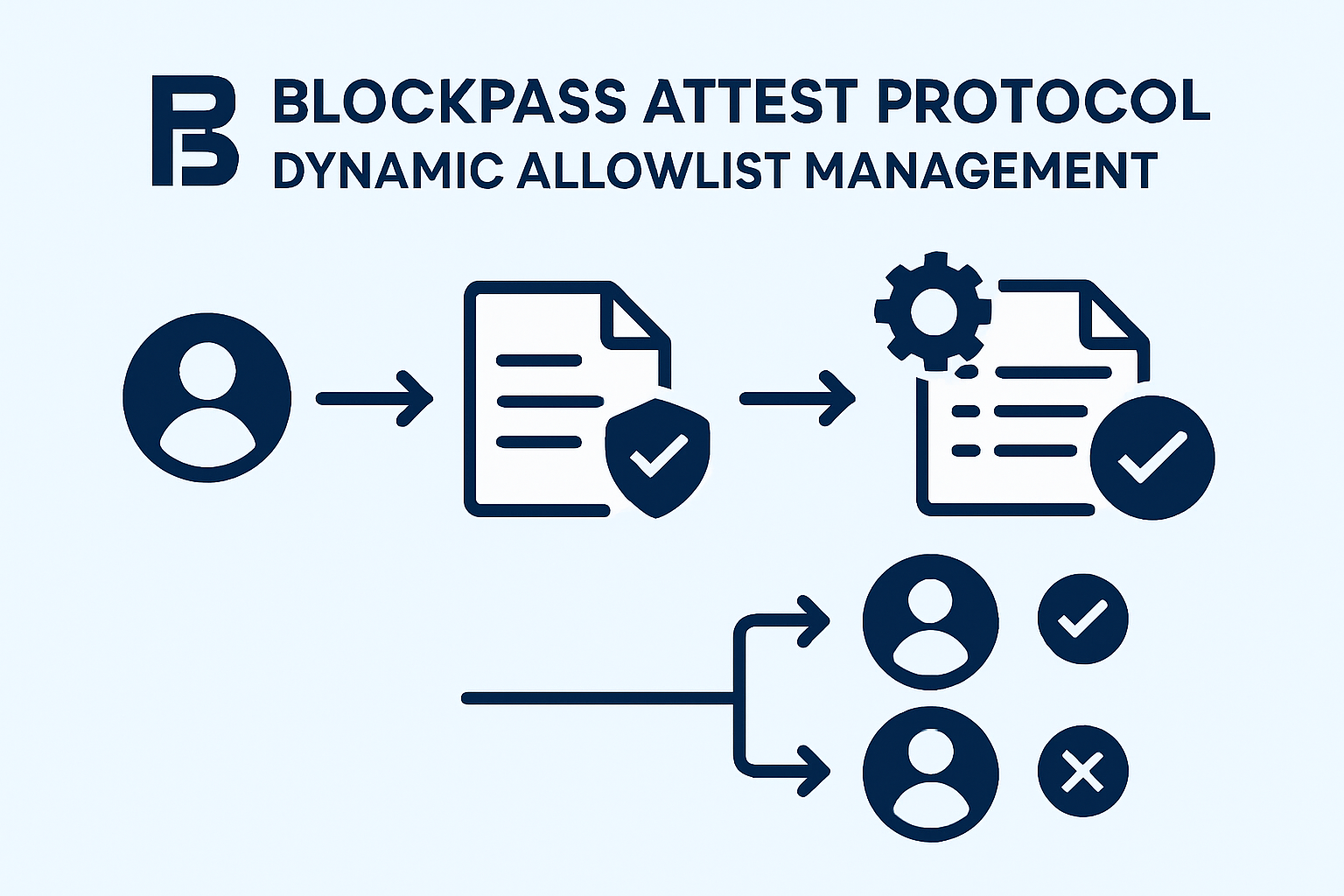

- Attest Protocol and Altme/TezID deliver schema-based attestations and privacy-first solutions for Tezos and beyond.

The convergence of these tools is driving a new standard for decentralized identity compliance. For a deep dive on how onchain attestations solve repeated KYC headaches for allowlist managers, check out this guide.

Why It Matters Now: Regulatory Pressure and User Demand

With regulatory scrutiny ramping up worldwide, DeFi projects can’t afford to overlook compliance. Yet users increasingly demand privacy, faster onboarding, and control over their data. Onchain KYC verification bridges this gap by making compliance seamless, secure, and interoperable. In today’s market, the projects that master this balance will be best positioned to capture both institutional trust and grassroots adoption.

DeFi protocols leveraging onchain attestations are already reaping measurable rewards: lower onboarding costs, faster time-to-market for token launches, and dramatically reduced legal risk. Instead of siloed, duplicative KYC checks that frustrate users and expose sensitive data, onchain attestations empower users to carry a single, portable proof of compliance. This not only satisfies evolving regulatory frameworks but also aligns with the ethos of Web3, self-sovereign identity and permissionless participation.

For allowlist managers and DeFi builders, the operational upside is huge. Smart contracts can instantly check for valid KYCed attestations at the point of user interaction, no manual review queues, no back-office bottlenecks. This automation is especially impactful during high-demand events like airdrops or token launches, where speed and security are paramount. The compliance logic is transparent, auditable, and enforced onchain, reducing the risk of human error or malicious actors slipping through the cracks.

Real-World Impact: From Frictionless Onboarding to Global Access

What does this look like in practice? Imagine a user who completes KYC once with a trusted provider and receives an onchain attestation tied to their wallet. That same credential unlocks access to dozens of DeFi protocols, token sales, and gated DAOs, no more repetitive document uploads or waiting days for approval. For projects, this means higher conversion rates and a broader pool of compliant users worldwide.

Onchain attestation standards are also paving the way for cross-chain interoperability. Solutions like Attest Protocol and Chainlink ACE are making it possible for KYCed addresses to move seamlessly between Ethereum, Solana, Tezos, and beyond. This fluidity is critical as DeFi becomes more multi-chain and composable.

Key takeaway: Onchain attestations are the connective tissue enabling decentralized identity compliance at scale, without sacrificing privacy or user experience.

Top Use Cases for Onchain Attestations in DeFi

-

Streamlined KYC for Token Sales: Onchain attestations allow users to prove KYC compliance instantly, enabling seamless participation in token sales and IDOs without repetitive document submissions. Blockpass On-Chain KYC® 2.0 is a leading solution powering this use case.

-

Efficient Airdrop Eligibility Verification: Projects use onchain attestations to ensure only verified, eligible wallets receive airdrops, reducing the risk of Sybil attacks and regulatory non-compliance. Attest Protocol offers schema-based attestation for airdrop allowlists.

-

Cross-Chain Compliance Enforcement: Onchain attestations enable compliance checks across multiple blockchains, letting users access DeFi protocols on any supported chain with a single verified identity. Chainlink Automated Compliance Engine (ACE) is a prominent example.

-

Dynamic Policy-Based Allowlist Management: Smart contracts leverage onchain attestations to enforce real-time, policy-driven allowlists that automatically adapt to regulatory changes or user status updates. Blockpass and Attest Protocol are actively enabling this functionality.

If you’re building or managing allowlists for DeFi projects, integrating onchain attestation infrastructure is no longer optional, it’s table stakes for regulatory resilience and user trust. The next wave of DeFi growth will be driven by protocols that make compliance invisible and onboarding effortless.

For more tactical insights on deploying onchain KYC verification for your next token sale or allowlist campaign, read this practical guide.