Decentralized finance (DeFi) and token sale ecosystems are evolving at a breakneck pace, but user onboarding remains a persistent friction point. Traditional Know Your Customer (KYC) processes are notorious for their inefficiency, privacy risks, and redundancy. Users are forced to submit sensitive documents repeatedly across multiple platforms, while project teams shoulder the burden of compliance and data security. Enter onchain KYC attestations: cryptographic proofs that transform how identity is managed, verified, and reused across the Web3 landscape.

How Onchain Attestations Reshape KYC for DeFi and Token Sales

Onchain attestations are not just another compliance tool. They are the foundation for reusable KYC credentials that empower users and platforms alike. Here’s how the process unfolds:

- User Verification: The user completes KYC with a trusted verifier, providing identity documents and, if needed, proof of residency or accredited investor status.

- Issuance of Attestation: Upon approval, the verifier issues an onchain attestation, a cryptographic record on the blockchain confirming the user’s verified status, but without exposing private data.

- Cross-Platform Reuse: The user can now present this attestation to any DeFi protocol, token sale, or Web3 gated community that recognizes the standard, eliminating the need for repeated KYC submissions.

This approach directly addresses two of the most acute pain points in the industry: data privacy and user experience. Personal information stays off-chain, dramatically reducing data breach risks, while users enjoy seamless access across platforms.

Industry Leaders Driving Onchain KYC 2.0

Several pioneering projects are setting new standards for decentralized identity verification:

Top Onchain KYC Attestation Providers and Their Unique Approaches

-

Blockpass On-Chain KYC® 2.0: Blockpass offers a privacy-preserving solution for issuing onchain KYC attestations that enable users to create verifiable, reusable digital identities across multiple blockchains, including Ethereum and Solana. Its configurable attestations cover identity documents, residency, and more, with flexible expiration for ongoing compliance.

-

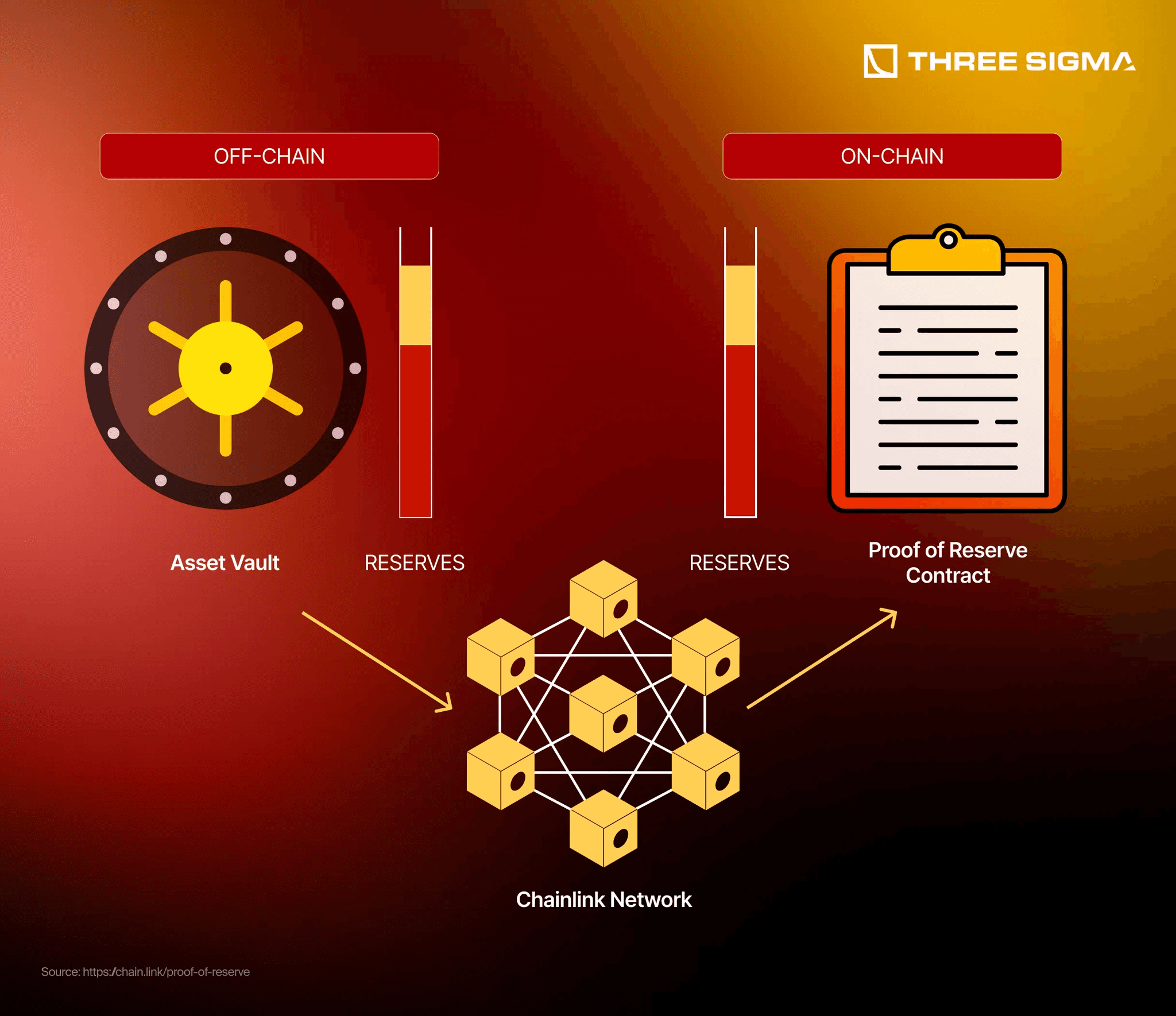

Chainlink Automated Compliance Engine (ACE): Chainlink’s ACE provides a modular compliance framework that connects traditional identity systems with onchain infrastructure. It supports reusable digital identities and automated policy enforcement, allowing DeFi platforms to verify users via attestations without handling personal data directly.

-

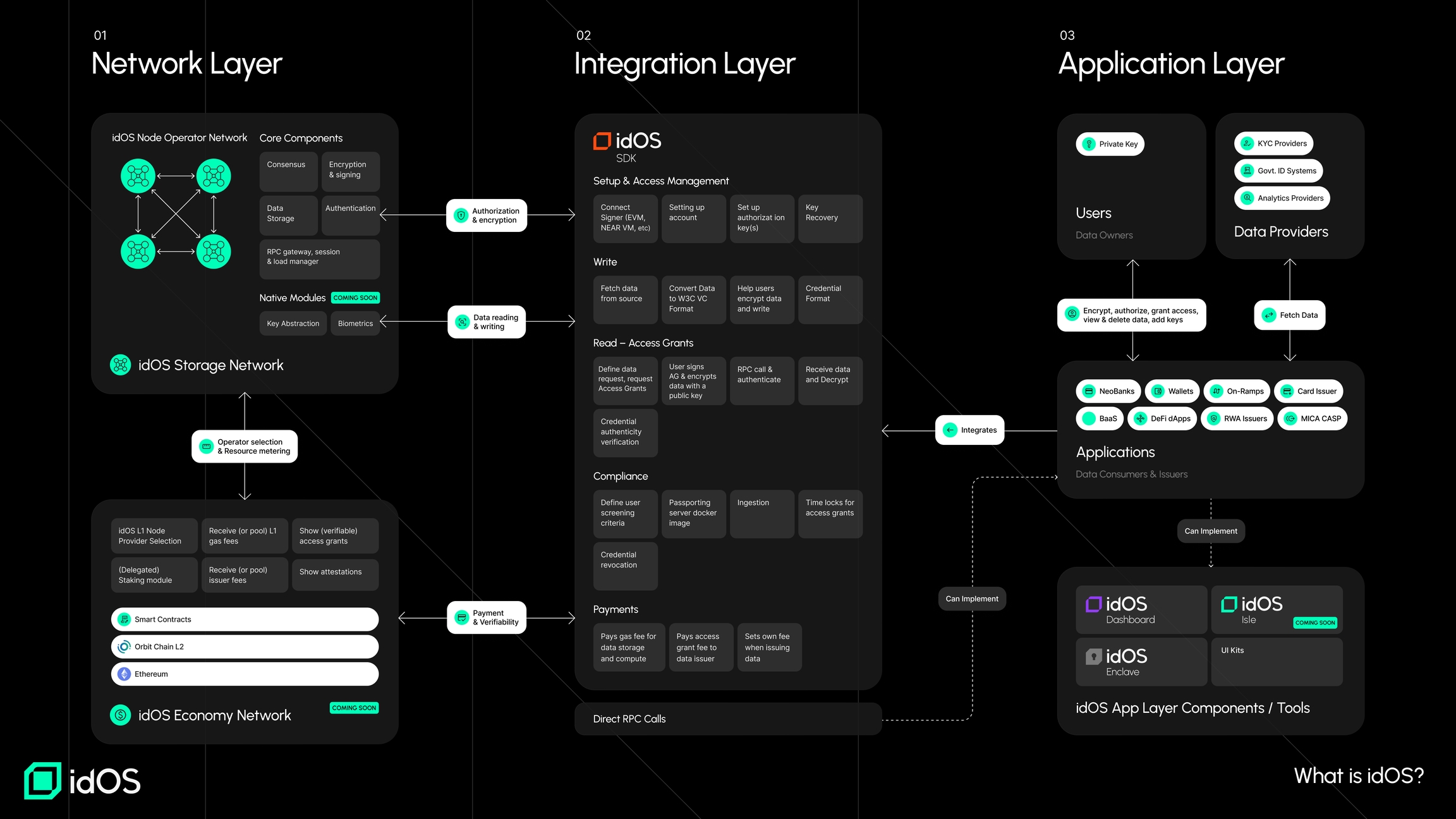

idOS Network: idOS enables users to complete KYC verification once and reuse their credentials across supported dApps and services. Leveraging multi-party computation (MPC), idOS ensures that private keys and sensitive data remain secure while facilitating seamless interoperability for verified digital identities.

Blockpass’s On-Chain KYC® 2.0 is a standout solution, enabling businesses to issue granular attestations for various identity attributes, such as document verification or residency, across multiple blockchains. These attestations are configurable with expiration dates, supporting ongoing monitoring and compliance needs. Blockpass’s system is already seeing adoption among DeFi allowlist managers and token sale organizers who require robust yet privacy-preserving verification.

Chainlink’s Automated Compliance Engine (ACE) takes a modular approach, integrating both onchain and offchain policy enforcement. ACE’s Cross-Chain Identity (CCID) framework lets users prove their investor status or compliance credentials across diverse networks, streamlining onboarding for multi-chain DeFi applications and token launches. This interoperability is crucial as Web3 projects increasingly span multiple blockchains.

The Mechanics of Privacy-Preserving, Reusable Credentials

The technical backbone of onchain attestations is both elegant and robust. By leveraging cryptographic proofs and decentralized infrastructure, these systems achieve a delicate balance: platforms can verify that a user is compliant without ever seeing their raw personal data. This is achieved through:

- Zero-Knowledge Proofs (ZKPs): Allow users to prove statements about their identity (e. g. , over 18, not a resident of a restricted country) without revealing specifics.

- Multi-Party Computation (MPC): As used by networks like idOS, this technique ensures that private keys and sensitive data never reside in a single location, further mitigating risk.

- Revocable and Expiring Attestations: Credentials can be revoked or set to expire, enabling ongoing compliance monitoring and reducing exposure to outdated or compromised verifications.

This architecture not only satisfies regulatory requirements but also aligns with the ethos of decentralization and user sovereignty that defines Web3. For a deeper dive into how these systems streamline allowlist management and compliance, see our guide on how onchain attestations simplify KYC for DeFi token sales and allowlist management.

As DeFi and tokenized ecosystems mature, the demand for scalable, interoperable, and privacy-preserving KYC solutions will only intensify. Onchain attestations are positioned as the linchpin for this new paradigm, enabling not just compliance but also a more user-centric Web3 experience. The ability to reuse a single KYC credential across multiple platforms dramatically reduces onboarding friction, making DeFi and token sales more accessible while maintaining rigorous regulatory standards.

Unlocking New Use Cases and Ecosystem Synergies

Reusable onchain KYC credentials open the door to a range of innovative applications beyond simple allowlist management. For instance, Web3 gated communities can verify members’ eligibility without ever collecting or storing sensitive data. Decentralized autonomous organizations (DAOs) can enforce one-person-one-vote governance or jurisdictional restrictions with minimal administrative overhead. Even real-world asset tokenization projects can leverage these attestations for seamless investor onboarding and secondary market compliance.

Emerging Use Cases for Onchain KYC Attestations

-

DeFi Platform Access: Onchain KYC attestations enable users to seamlessly access multiple decentralized finance (DeFi) platforms after a single verification, eliminating redundant KYC checks while maintaining compliance.

-

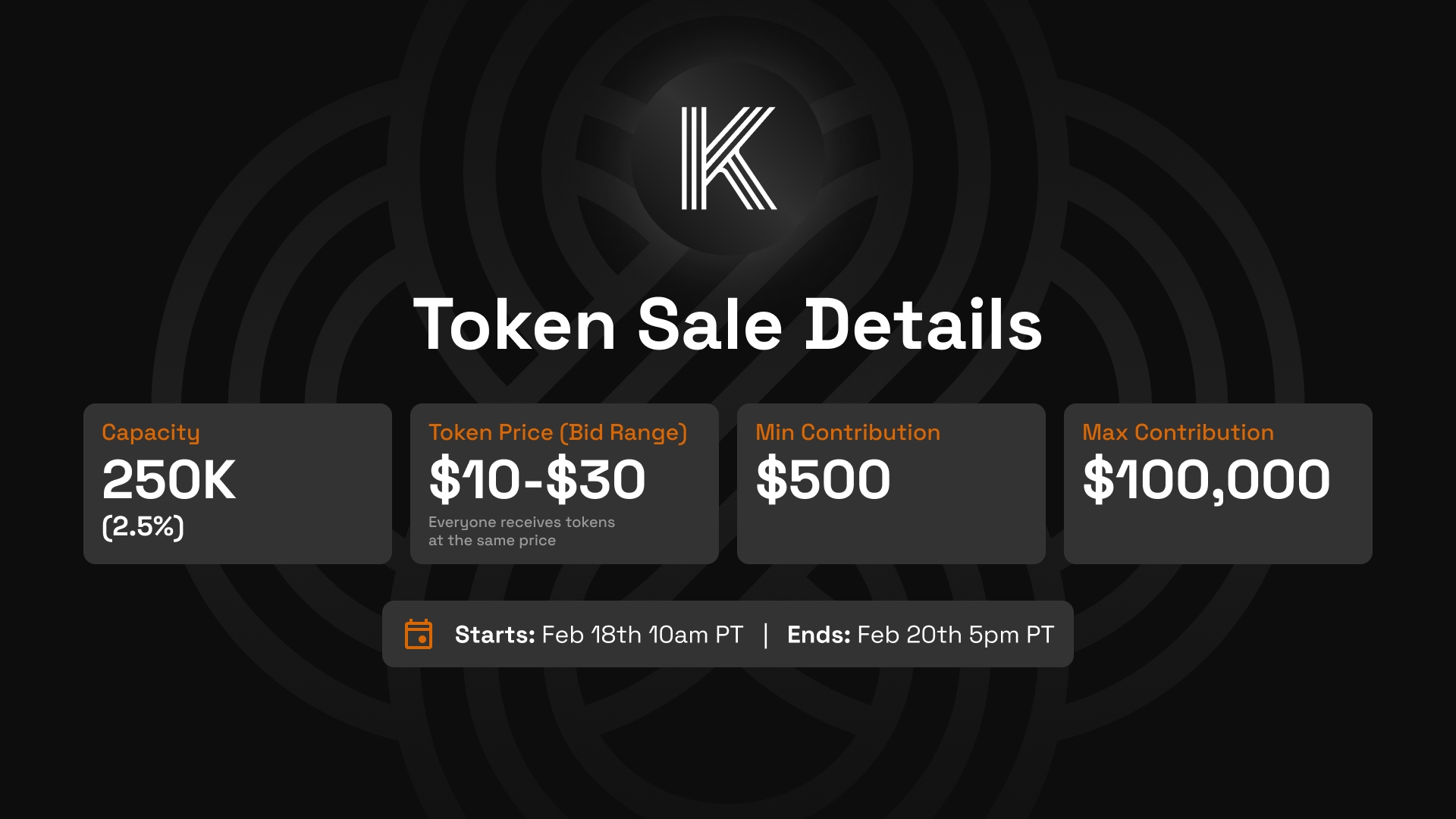

Token Sale Allowlists: Projects conducting token sales can use onchain attestations to automate allowlist eligibility, ensuring only verified participants can join while preserving user privacy.

-

DAO Membership Verification: Decentralized Autonomous Organizations (DAOs) can leverage onchain KYC attestations to verify member eligibility for governance or participation, supporting regulatory compliance without exposing sensitive data.

-

Cross-Chain Identity Portability: Solutions like Chainlink’s Automated Compliance Engine (ACE) and idOS Network allow users to reuse their verified credentials across multiple blockchains and dApps, enhancing interoperability and user experience.

-

Real-World Asset (RWA) Tokenization: Platforms tokenizing real-world assets can require onchain KYC attestations to ensure that only verified investors participate, streamlining compliance for offerings involving securities or regulated assets.

-

Web3 Community Access Control: Web3 communities and gated platforms can use onchain attestations to restrict access to verified users, enabling private forums, exclusive airdrops, or reputation-based privileges.

These synergies are already being realized in projects that combine zero-knowledge proofs with onchain attestations, allowing for selective disclosure and granular access control. As frameworks like Chainlink’s ACE and Blockpass’s On-Chain KYC® 2.0 become more widely adopted, expect to see a proliferation of standards that further enhance interoperability and composability across the ecosystem.

Challenges and the Road Ahead

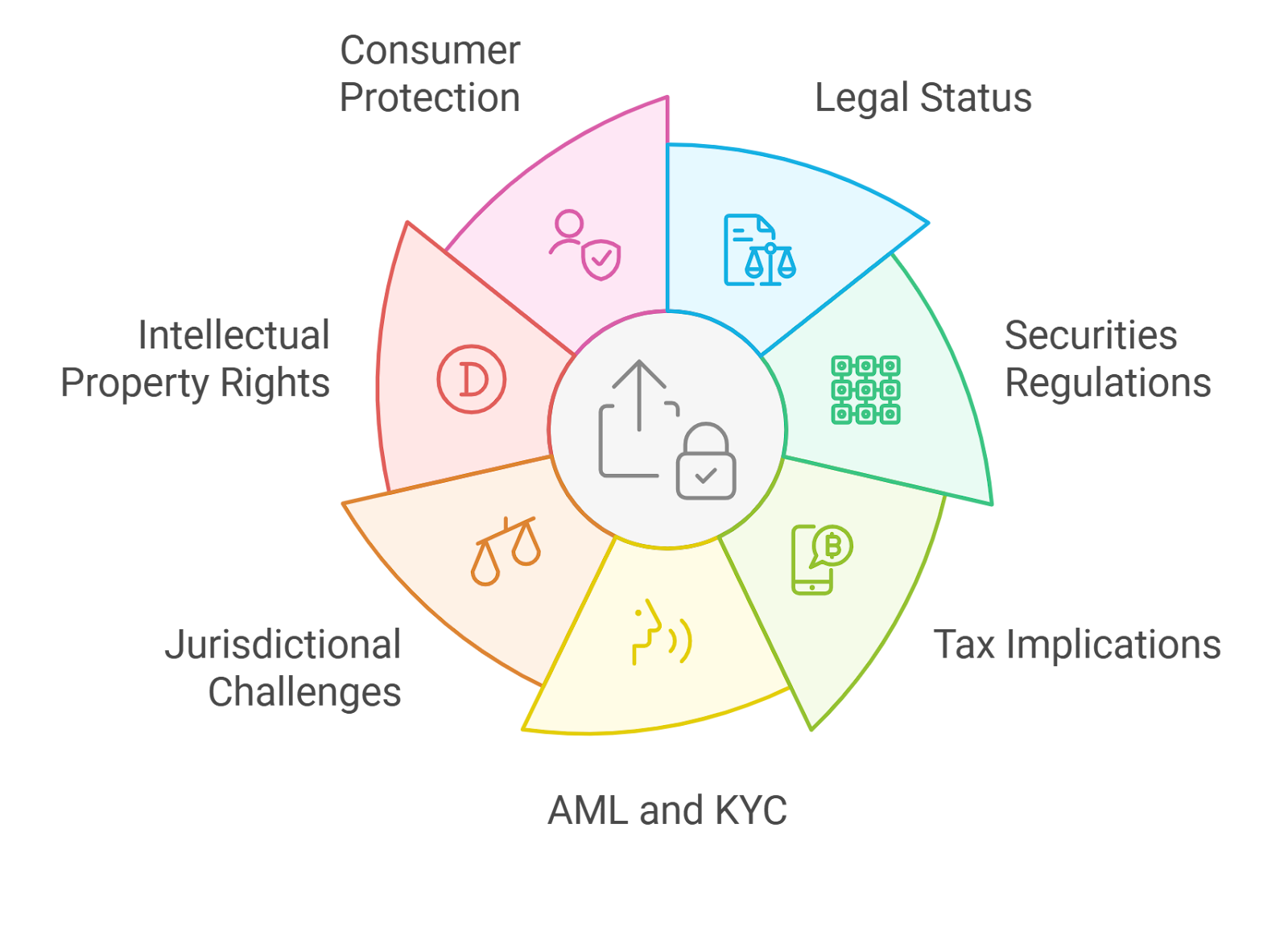

Despite the clear advantages, implementing reusable onchain KYC is not without hurdles. Interoperability remains a work in progress, as standards for attestations and identity proofs continue to evolve. There is also the ongoing challenge of ensuring that verifiers remain compliant with global regulatory regimes, especially as rules for digital assets shift. Additionally, educating users and platforms about the nuances of privacy-preserving KYC is critical for widespread adoption.

Nevertheless, the trajectory is clear: as more DeFi protocols and token sale organizers embrace onchain attestations, the days of repetitive, siloed KYC checks are numbered. For allowlist managers and compliance teams, this shift promises significant operational efficiencies and a vastly improved user experience. For users, it means greater privacy, faster onboarding, and a truly portable digital identity.

“Onchain attestations are more than a compliance shortcut, they’re the foundation for a user-owned, borderless digital identity layer that will power the next wave of Web3 innovation. “

For practical guidance on deploying these tools in your project, see our resource on how onchain attestations solve repeated KYC in Web3.