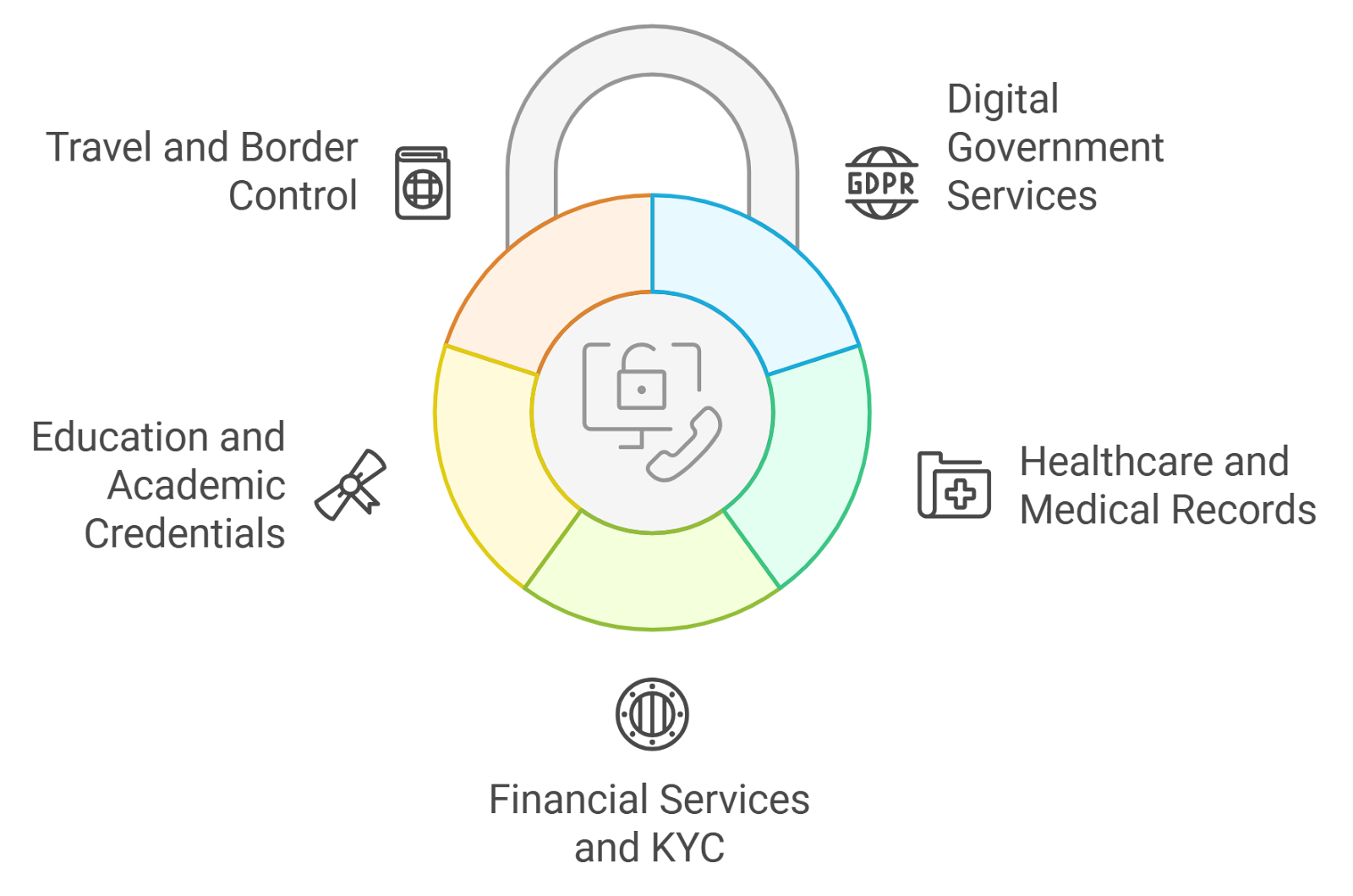

Reusable onchain KYC attestations are rapidly redefining the landscape of decentralized finance (DeFi) onboarding, offering a much-needed solution to the persistent friction of repeated identity verification. As DeFi grows increasingly cross-chain and interconnected, the demand for seamless, privacy-preserving, and interoperable KYC solutions has never been higher. Recent advancements such as On-Chain KYC® 2.0 and decentralized identity protocols are at the forefront of this transformation, enabling users to verify once and participate everywhere.

From Fragmented Identity Checks to Unified Digital Credentials

Traditional DeFi onboarding is marred by inefficiency. Users must repeatedly submit personal documents and undergo manual reviews for each new platform or protocol they wish to access. This not only introduces friction but also exposes users’ sensitive data to unnecessary risk and increases compliance overhead for projects.

Reusable onchain KYC attestations eliminate these bottlenecks. Once a user completes a robust KYC process with a trusted provider, an onchain attestation is issued to their wallet address. This cryptographic proof can then be used across multiple dApps, DEXs, token sales, and allowlist-enabled communities without resubmitting documentation or revealing private information again.

Key Benefits of Reusable Onchain KYCed Addresses for DeFi

-

Streamlined Onboarding Across Platforms: Users complete KYC verification once and reuse their onchain attestation across multiple DeFi platforms, eliminating repetitive checks and accelerating access.

-

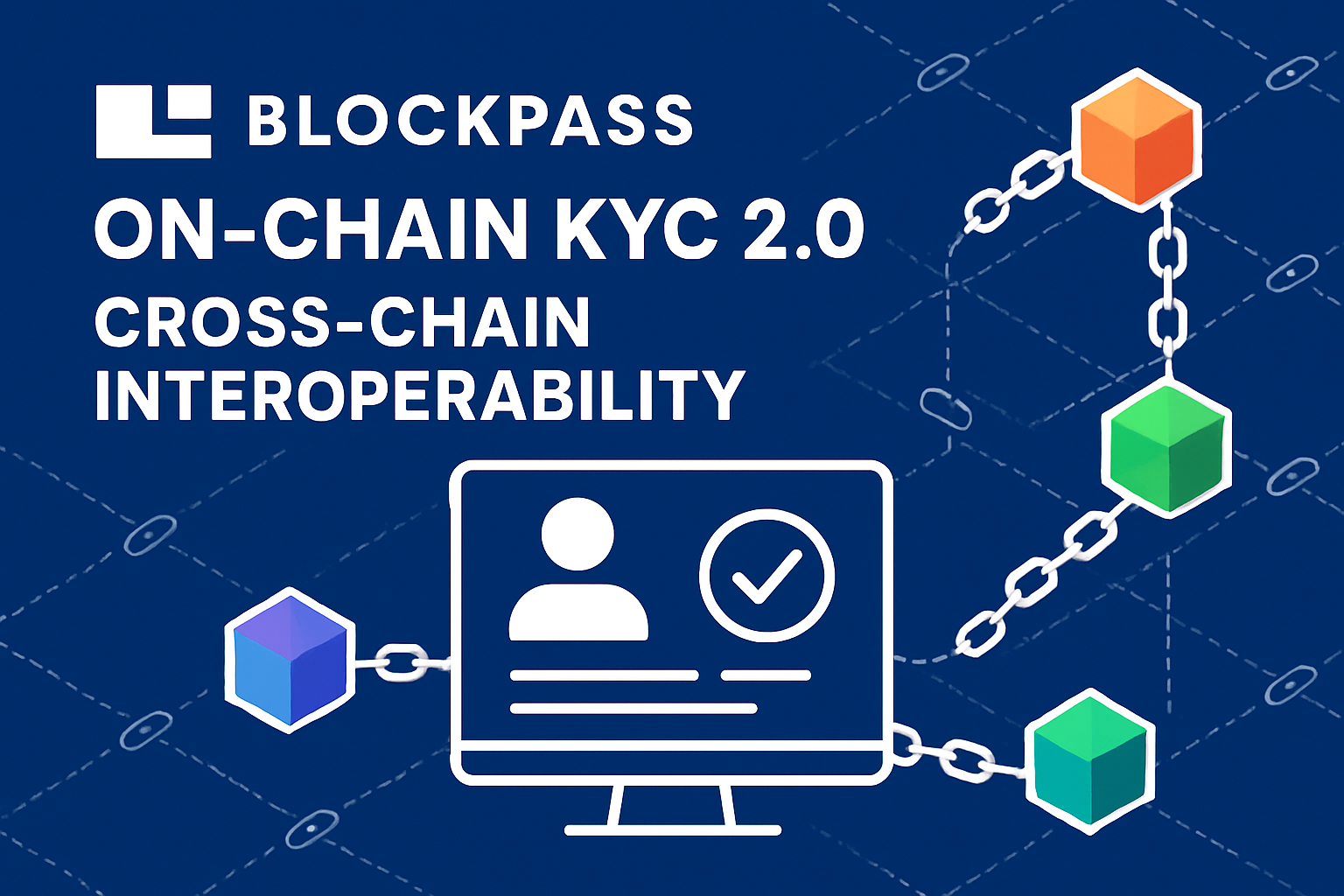

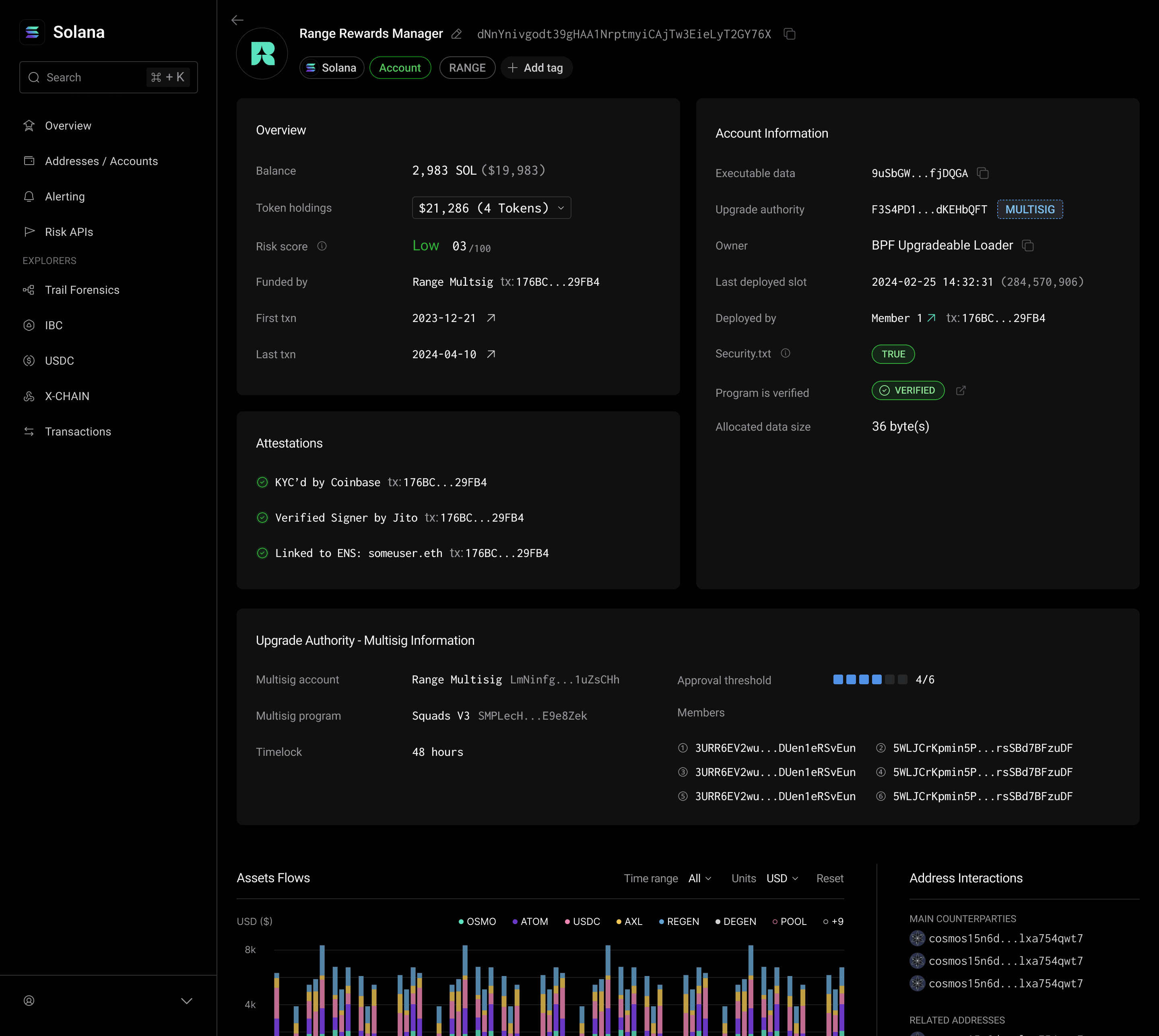

Interoperability Across Multiple Blockchains: Solutions like Blockpass On-Chain KYC® 2.0 issue attestations compatible with major blockchains such as Ethereum and Solana, enabling seamless cross-chain identity verification.

-

Enhanced Privacy and Data Security: Onchain KYC attestations allow platforms to verify users without storing or exposing sensitive personal data, reducing the risk of data breaches and ensuring regulatory compliance.

-

Reduced Compliance and Integration Costs: By leveraging reusable attestations and established services like Blockpass, DeFi projects avoid the expense and complexity of building custom KYC infrastructure.

-

Accelerated Cross-Chain DeFi Adoption: Standardized, reusable KYC credentials empower users to access a broader range of DeFi protocols across different chains, fostering a more interconnected and scalable ecosystem.

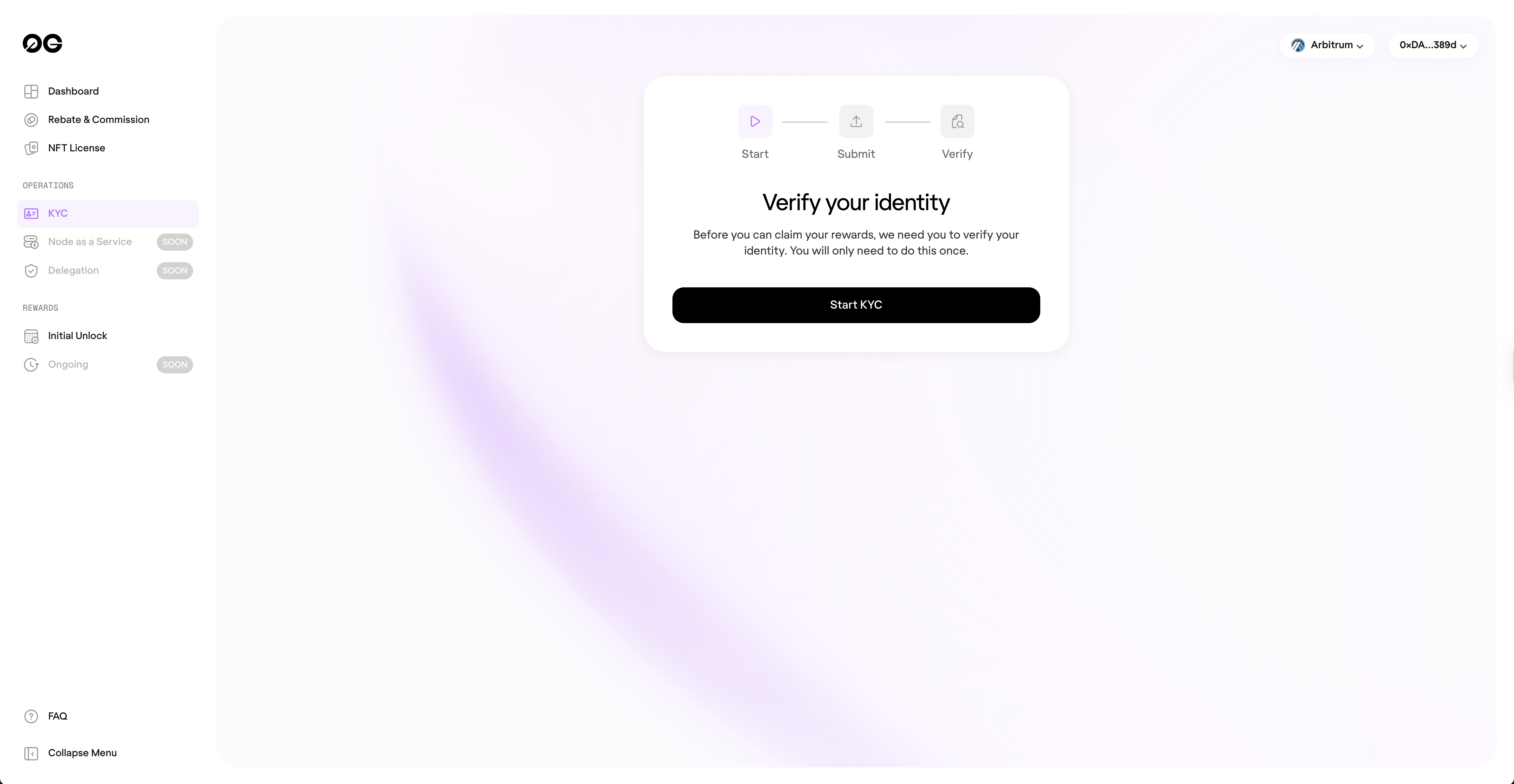

The Mechanics: How Reusable Onchain Attestations Work

The core innovation lies in leveraging blockchain’s transparency and immutability to anchor identity credentials while preserving privacy. A typical flow involves:

- A user completes KYC with an approved service (e. g. , Blockpass, Civic).

- The service issues an attestation – a signed statement that the address is verified – directly onto the blockchain.

- This attestation is readable by smart contracts across supported chains (Ethereum, Solana), enabling instant allowlisting or access control without exposing underlying PII.

This approach not only streamlines user experience but also reduces operational costs for DeFi platforms by eliminating redundant verification infrastructure. For a detailed breakdown of how these attestations simplify compliance workflows in token sales and allowlists, see this guide.

Interoperability: Enabling Cross-Chain Access Without Compromise

One of the most significant breakthroughs in recent months has been the emergence of interoperable attestation standards that function across multiple blockchains. Providers like Blockpass have engineered their On-Chain KYC 2.0 system to issue attestations that are recognized by both EVM-compatible chains and high-performance networks like Solana.

This interoperability means users can seamlessly access DeFi protocols regardless of network – no more silos or repeated verifications. Smart contracts simply check for the presence (and validity) of an attestation tied to a given wallet address before granting access or participation rights.

The result? A more composable DeFi ecosystem where compliance does not come at the cost of user privacy or developer agility.

With reusable onchain KYC attestations, the paradigm of onboarding shifts from fragmented, duplicative checks to a unified, portable digital credential. This unlocks a new layer of efficiency for both users and DeFi projects. Instead of being bottlenecked by manual compliance reviews, platforms can automate allowlisting and access control with a single smart contract call to verify the attestation. The result is an onboarding experience that is not only faster but also inherently more secure and privacy-preserving.

For developers, this means lower maintenance costs and fewer legal liabilities. Rather than storing or transmitting sensitive user data, projects simply reference the cryptographic attestation onchain. This dramatically reduces the attack surface for data breaches and aligns with emerging global standards for privacy-preserving KYC.

Privacy by Design: Zero-Knowledge Proofs and Selective Disclosure

The latest generation of onchain KYC frameworks are increasingly leveraging zero-knowledge proofs (ZKPs) and selective disclosure mechanisms. These innovations allow users to prove they have passed KYC without revealing underlying personal information to DeFi protocols or third parties. For instance, Blockpass’ On-Chain KYC® 2.0 enables platforms to verify that an address is compliant, without ever accessing the user’s PII.

This architecture is not just about regulatory compliance; it’s about empowering users with true digital sovereignty over their identity in Web3 environments. As privacy regulations evolve globally, such as GDPR in Europe or CCPA in California, these privacy-first models are rapidly becoming table stakes for any platform seeking institutional adoption.

Key Technical Features of Privacy-Preserving Reusable KYC Attestations

-

Zero-Knowledge Proofs (ZKPs): Leading solutions like Blockpass On-Chain KYC® 2.0 utilize ZKPs to verify user identity without exposing underlying personal data, ensuring compliance and privacy.

-

Cross-Chain Compatibility: Attestation frameworks such as Solana Attestation Service and Blockpass On-Chain KYC® 2.0 issue reusable attestations that function across multiple blockchains, including Ethereum and Solana, enabling seamless DeFi onboarding.

-

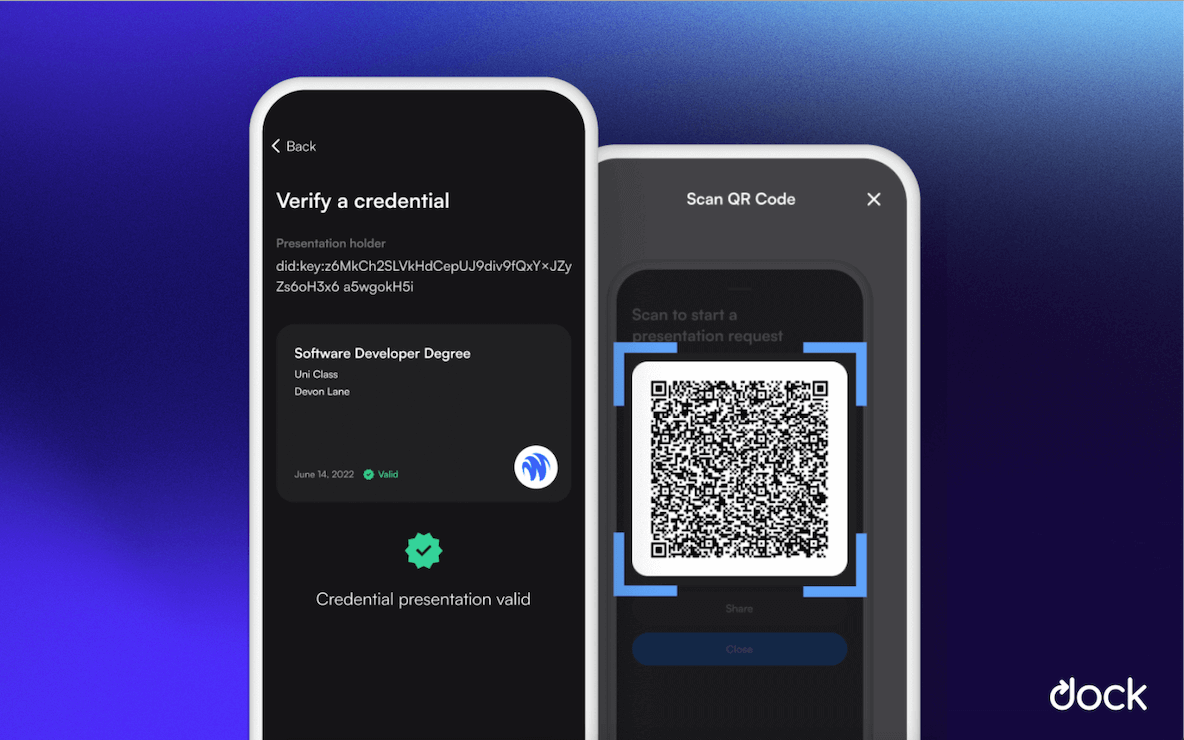

Decentralized Identity Standards: Platforms like Dock and Civic implement decentralized identity (DID) protocols, allowing users to control and reuse their verified credentials securely across DeFi applications.

-

Selective Disclosure: Solutions such as Civic and Blockpass enable users to share only necessary verification results (e.g., age, residency) with DeFi platforms, minimizing data exposure and enhancing privacy.

-

Automated Compliance and Fraud Prevention: On-chain KYC providers like Blockpass leverage AI and blockchain to automate compliance checks, reduce onboarding costs, and protect against identity fraud without storing sensitive user data.

Enabling Seamless Compliance for Token Sales and Allowlists

Token sales and allowlist-driven launches remain core pillars of DeFi growth, but they are also frequent flashpoints for regulatory scrutiny. By integrating interoperable onchain KYCed addresses, projects can automate compliance at scale while supporting global user bases across multiple networks.

The attestation model allows for composable allowlists that can be referenced by any smart contract-enabled sale or gated community event. This not only streamlines participation but also provides transparent auditability for regulators, without exposing sensitive user data on public ledgers.

If you’re interested in how this workflow operates in practice, see our deep dive on how reusable attestations simplify KYC for token sales.

Looking Ahead: The Future of Decentralized Identity Verification

The momentum behind decentralized identity verification is unmistakable. As more protocols adopt reusable attestations as their default compliance layer, we’ll see exponential improvements in onboarding speed, regulatory alignment, and overall ecosystem security.

What’s next? Expect further convergence between AI-driven verification agents and standardized attestation formats, making cross-chain onboarding even more seamless while minimizing human error and fraud risk. The ultimate vision is a Web3 landscape where users control portable credentials that unlock access anywhere across the decentralized internet.

Reusable onchain KYC isn’t just about meeting today’s compliance needs, it’s laying the groundwork for a truly open financial system where trustless verification becomes the norm rather than the exception.