Decentralized finance (DeFi) has exploded in both scale and regulatory scrutiny, putting immense pressure on projects to balance open access with robust compliance. As token sales and allowlists become more complex, the demand for seamless, privacy-preserving KYC (Know Your Customer) solutions is at an all-time high. Enter onchain attestations: cryptographic proofs of identity or compliance status, issued by trusted entities and stored directly on blockchain networks. This innovation is rapidly redefining how DeFi projects onboard users, enforce regulatory requirements, and manage access control.

What Are Onchain Attestations? The Core Mechanism Explained

An onchain attestation is a digital credential that proves a wallet address has completed KYC verification, without ever exposing sensitive personal data on-chain. Think of it as a reusable stamp of approval: once issued by an authorized provider (like Blockpass or OnchainKYCe. me), the attestation lives on the blockchain as an immutable record. Smart contracts for token sales or allowlists can instantly check this proof before granting access or allocating tokens.

This approach replaces siloed, repetitive KYC checks with a single, verifiable credential that any compliant dApp can recognize. Instead of uploading documents to every new platform, users complete verification once and leverage their onchain attestation wherever required. The result? Lower friction for users and dramatically reduced operational overhead for platforms.

KYC Pain Points in DeFi: Why Status Quo Isn’t Enough

Traditional KYC processes are poorly suited to the speed and composability of Web3:

- Redundant Verification: Users must repeatedly submit documents across multiple platforms, slowing onboarding and increasing drop-off rates.

- Poor Privacy: Centralized KYC providers store sensitive data off-chain, creating honeypots for hackers and regulatory headaches for projects.

- Lack of Interoperability: Each project’s allowlist or token sale contract must implement its own eligibility logic, leading to inconsistent compliance enforcement and wasted dev resources.

The inefficiency isn’t just annoying, it’s costly. Missed opportunities due to onboarding friction directly impact participation in token launches, DeFi protocols, and gated NFT communities.

The Competitive Edge: How Onchain Attestations Streamline Allowlists and Token Sales

The emergence of onchain attestations is already transforming industry best practices:

- Instant Verification: Smart contracts query the blockchain for attestations before adding addresses to allowlists or approving token purchases, no manual review needed.

- Compliance by Design: Only addresses with valid attestations can interact with restricted functions (such as claiming tokens or joining liquidity pools), ensuring alignment with evolving global regulations.

- User-Centric Privacy: Since only the fact of verification, not underlying personal details, is stored on-chain, privacy is preserved without sacrificing trust.

- Ecosystem Interoperability: Standardized attestation formats mean credentials issued by one provider are recognized across multiple DeFi platforms, from launchpads to DAOs.

This model eliminates bottlenecks during high-demand launches while dramatically reducing compliance risks, a win-win for both builders and participants. For deeper technical details on implementation strategies, see our guide: How Onchain Attestations Simplify KYC Compliance for DeFi Allowlists.

Adoption of onchain attestations KYC is accelerating as regulatory clarity converges with the need for scalable, user-friendly compliance. Projects that leverage these verifiable credentials are not just ticking a legal box, they’re optimizing for growth, security, and future-proof interoperability.

DeFi Projects Using Onchain Attestations for KYC

-

Blockpass – On-Chain KYC® 2.0 lets DeFi platforms issue verifiable, reusable digital identities as onchain attestations, streamlining KYC for allowlists and token sales. Integrates with major blockchains and dApps for seamless compliance.

-

Attest Protocol – Provides a lightweight trust layer for blockchains, enabling developers to verify KYC status onchain with minimal code. Used by DeFi projects to automate allowlist management and regulatory compliance.

-

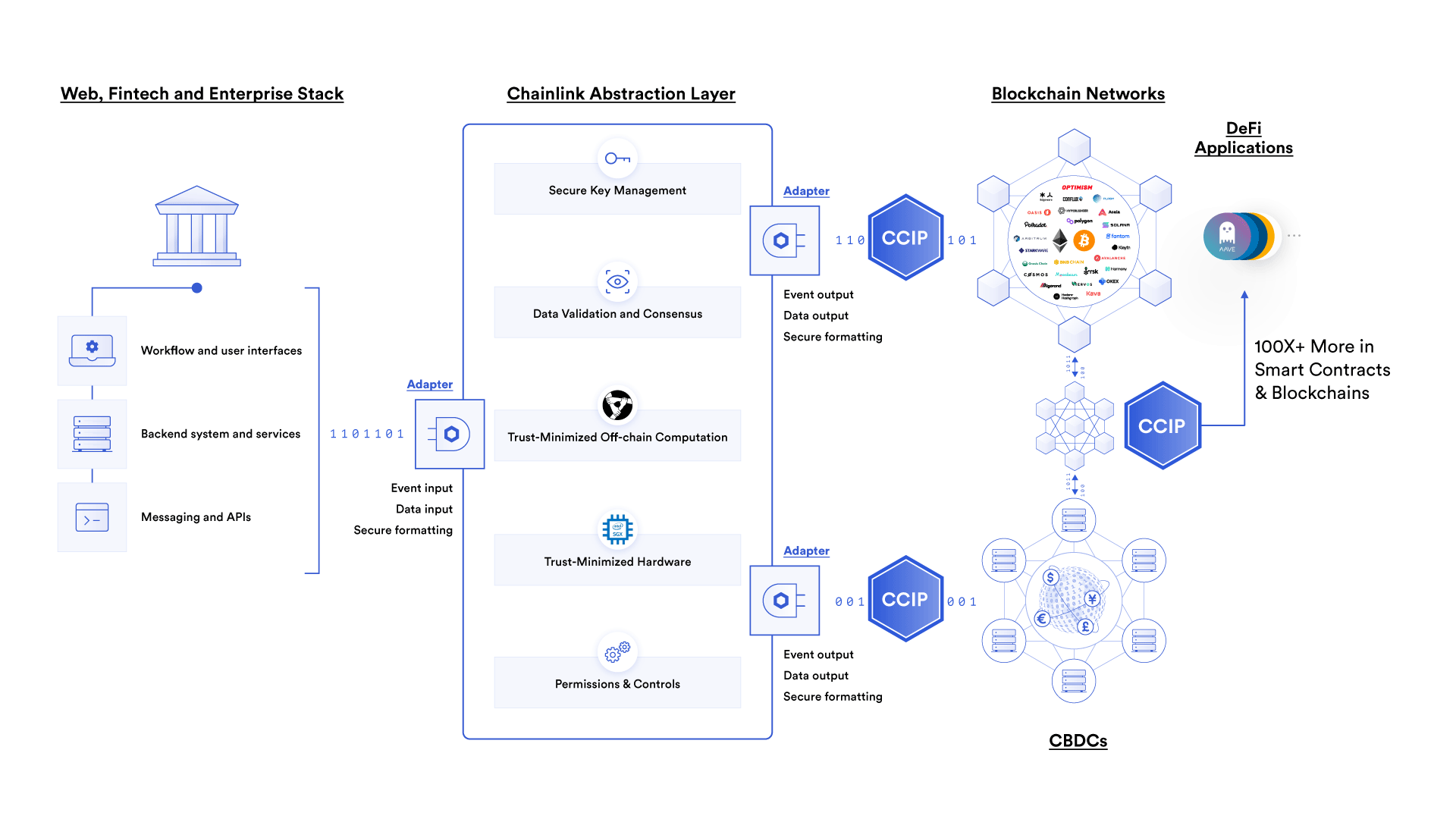

Chainlink Compliance Standard – Utilizes the Onchain Compliance Protocol (OCP) to embed KYC and AML policies directly into smart contracts, ensuring only verified users can access tokenized assets or participate in sales.

-

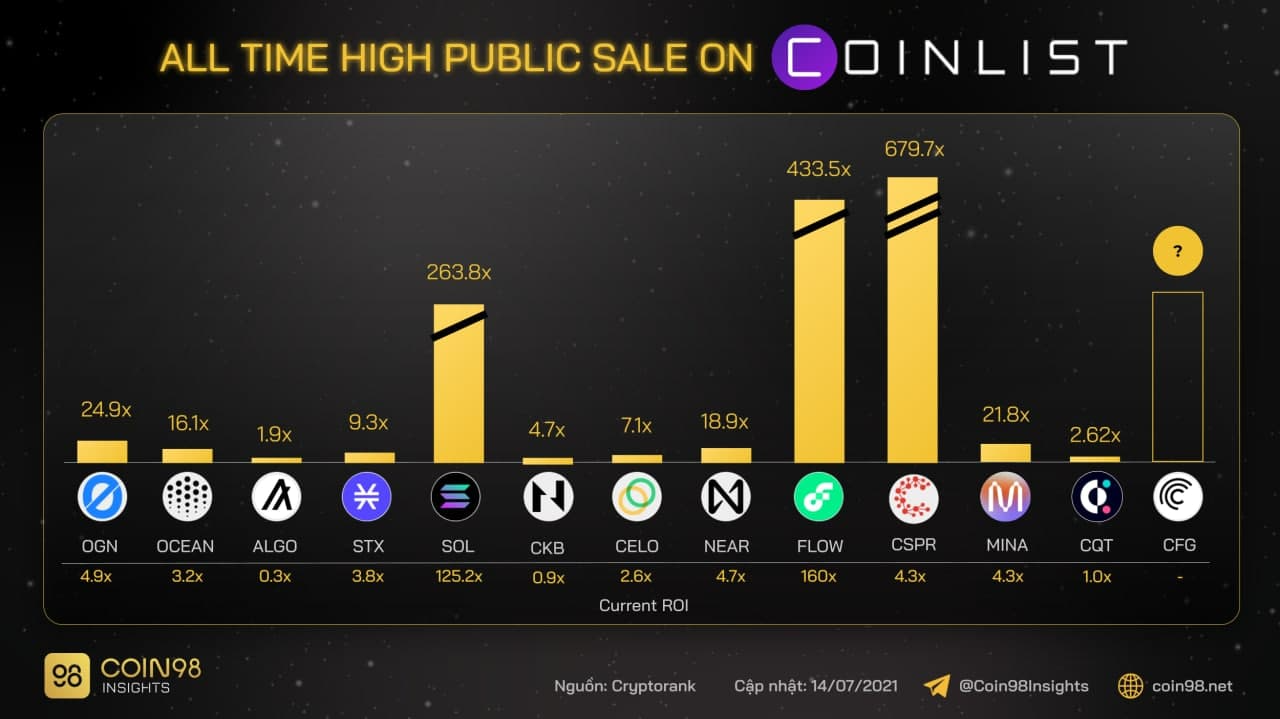

CoinList – A leading platform for token sales and DeFi launches, CoinList requires onchain KYC attestations for all participants, ensuring regulatory compliance and secure user onboarding.

-

SettleMint – Offers onchain allowlist management for fund tokenization and DeFi, using verified wallet attestations to enforce jurisdictional and eligibility rules.

Unlocking New Use Cases: Beyond Token Sales

The utility of onchain attestations extends far beyond initial token launches. We’re seeing rapid adoption in:

- DAO Memberships: Gated governance participation, where only KYCed addresses can vote or propose changes.

- Private NFT Drops: Creators can restrict access to verified collectors, eliminating bots and sybil attacks.

- Cross-Chain Compliance: As multi-chain ecosystems mature, standardized attestations ensure seamless eligibility checks across Ethereum, Solana, and L2s.

- Regulated DeFi Products: Lending protocols and asset managers can enforce jurisdictional restrictions or investor caps at the smart contract level, no more manual audits.

This flexibility is catalyzing a new wave of compliant innovation in Web3. For a deep dive into how attested identities are powering secure allowlists and gated communities, check out our feature: Building a Secure Allowlist with Onchain Attested KYCed Addresses.

Implementation: What Projects Need to Know

The technical lift to integrate onchain attestations is lighter than many expect. Platforms like Blockpass and OnchainKYCe. me provide developer kits and API endpoints that abstract away most of the complexity. Smart contracts simply check for the presence (and validity) of an attestation before executing restricted functions, no need to handle personal data directly.

This modular approach means projects can stay agile as standards evolve. Whether you’re running a token sale, managing a DAO, or launching an NFT collection, integrating attestation checks is now as simple as plugging in an oracle or adding an access modifier to your contract logic.

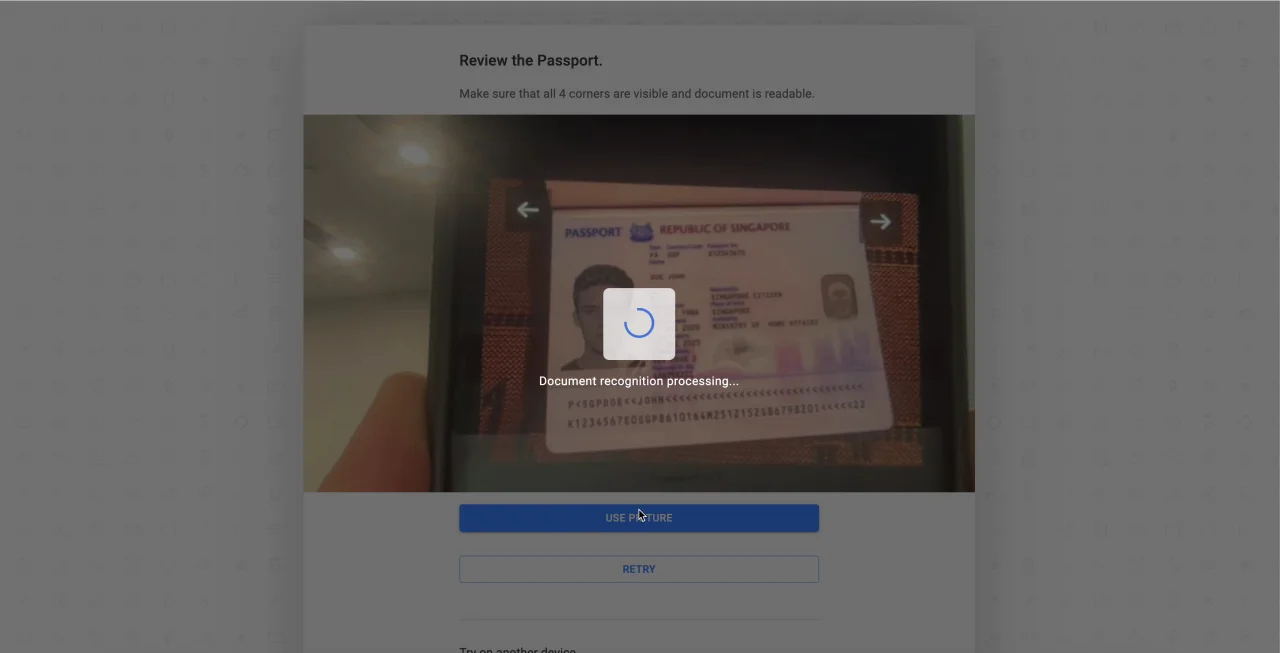

User Experience: Frictionless Compliance Is Here

The real breakthrough isn’t just backend efficiency, it’s the improved user journey. Participants complete KYC once through a trusted provider; from there, their wallet address becomes their reusable passport across compliant DeFi ecosystems. No more endless document uploads or waiting periods during high-demand launches. This not only increases conversion rates but also builds trust with users who demand both privacy and transparency from next-gen financial platforms.

The bottom line? As regulators sharpen their focus on digital assets, projects that embrace privacy-preserving onchain compliance will have the agility to scale globally without sacrificing user experience or security. For more actionable strategies on deploying these systems in your own protocol, see our latest analysis: How Onchain Attestations Streamline KYC for Web3 Allowlists and Token Sales.