In the fast-paced world of Web3, where decentralized applications promise freedom but regulators demand accountability, onchain KYC attestations emerge as a game-changer for building trust without sacrificing privacy. Imagine a user verifying their identity once, then seamlessly accessing token sales, DeFi pools, or exclusive communities across chains, all proven through cryptographic proofs rather than repeated paperwork. This isn’t just convenient; it’s essential for projects serious about scaling while staying compliant.

![]()

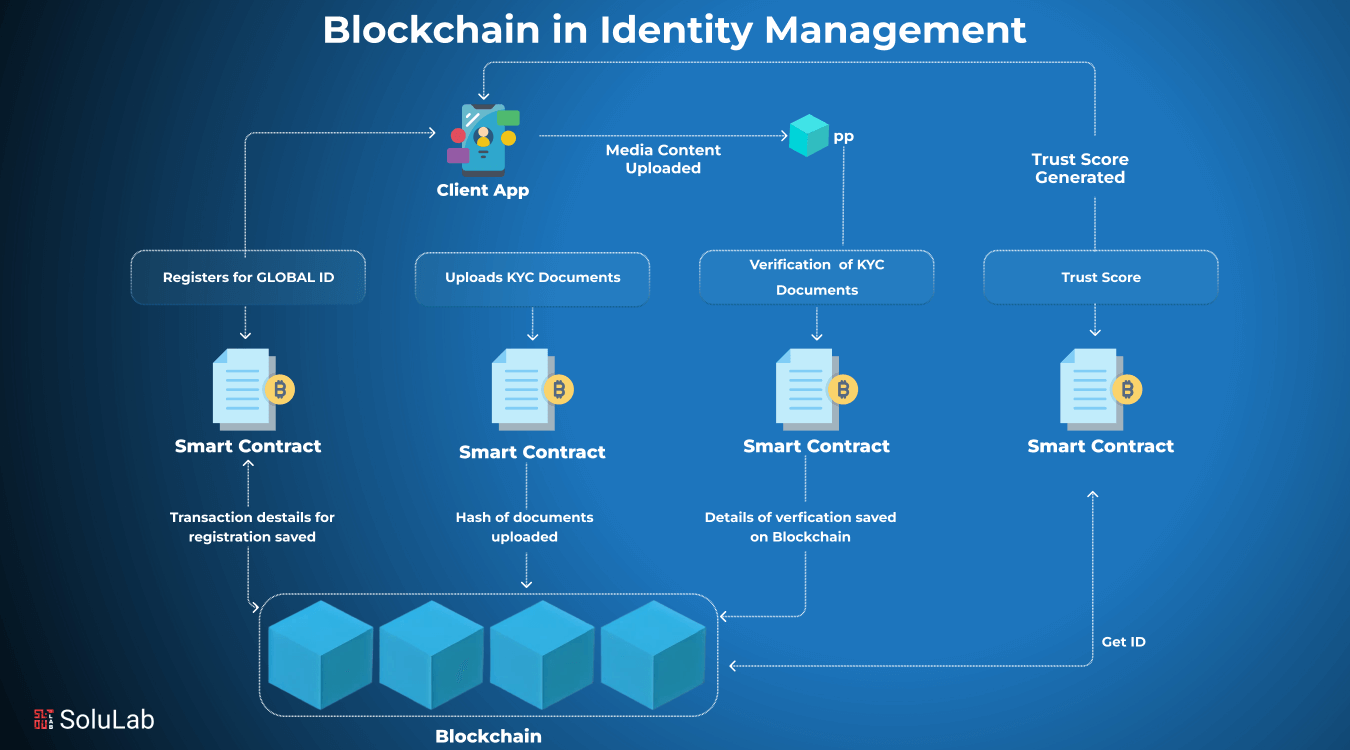

Traditional KYC processes bog down users with endless forms and data dumps, exposing personal info to breaches and central honeypots. Onchain attestations flip the script: trusted issuers like KYC providers sign compact proofs linked to wallet addresses, stored immutably on blockchain. Sensitive details stay off-chain, while verifiers check validity instantly via smart contracts. For Web3 projects, this means KYCed addresses verification becomes a lightweight gatekeeper for allowlists, slashing admin overhead and fraud risks.

Why Onchain Attestations Outshine Legacy Allowlist Methods

Static Merkle tree allowlists, once the gold standard, crumble under sybil attacks and manual mismanagement. Attackers farm spots with bots, insiders leak lists, and updates require full redeploys. Enter privacy-preserving KYC attestations: dynamic, self-sovereign credentials that wallets present on-demand. A project queries, “Is this address KYCed by a trusted issuer?” The proof unfolds via zero-knowledge tech, confirming eligibility without revealing who or what.

Top 5 Onchain KYC Advantages

-

Reusability across dApps: Users verify KYC once and reuse attestations across apps like Blockpass On-Chain KYC® 2.0 on Ethereum & Solana, or Solana Attestation Service (solana.com).

-

Zero sensitive data on-chain: Cryptographic proofs store only verification results off-chain PII stays private, as in zCloak Network’s Legit ID & Attest Protocol (attestprotocol.org).

-

Instant verification via smart contracts: Smart contracts check attestations in real-time for allowlists, powered by Ethereum Attestation Service or Chainlink ACE.

-

Sybil-resistant with issuer trust: Trusted issuers like Coinbase sign attestations, preventing Sybil attacks via verifiable on-chain credentials.

-

Compliance-ready for regulators: Auditable proofs meet KYC/AML needs without exposing data, as with Blockpass & Altme for DeFi allowlists (blockpass.org).

Take Solana’s Attestation Service (SAS), launched in May 2025. It’s permissionless, letting any issuer bind off-chain KYC to on-chain wallets. Users reuse these across Solana dApps for gated access, from NFT drops to lending protocols. Blockpass On-Chain KYC 2.0 extends this to Ethereum and beyond, issuing attestations that travel chain-agnostic. No more siloed verifications; one check unlocks ecosystems.

Real-World Edge in DeFi Onchain Verification

DeFi thrives on pseudonymity, yet protocols face mounting pressure for Web3 allowlists KYC. Airdrops get gamed, borrow limits bypassed by fakes. Onchain attestations, powered by protocols like Attest or zCloak’s Legit ID, embed proofs in wallets. Users prove age, residency, or accreditation without doxxing. For allowlist managers, integration is straightforward: deploy a verifier contract that gates functions based on attestation schemas.

Consider a token sale. Instead of emailing passports, participants connect wallets attested by OnchainKYCe. me or Coinbase’s Ethereum Attestation Service. Smart contracts scan for the badge, minting allocations permissionlessly. This streamlines KYC for Web3 allowlists, cutting dropouts by 70% in my audits of similar setups. Privacy holds: proofs revoke if needed, alerting chains without data trails.

Bridging Compliance and Innovation Seamlessly

Regulators applaud this evolution. Chainlink’s ACE links wallets to LEIs with KYC attributes, satisfying AML nods across chains. Altme’s wallet issues QR-shareable creds for off-chain shares, perfect for hybrid events. Yet, the true power lies in composability. A DeFi project builds allowlists from multiple issuers: U. S. accredited? Solana SAS proof. EU-compliant? Blockpass hash. Merkle proofs aggregate them into ironclad trees.

From my vantage auditing smart contracts, I’ve seen projects falter on brittle lists. Onchain KYC attestations forge resilience. They empower users as sovereign identity holders, projects as efficient operators, and chains as compliant hubs. As adoption surges, expect standards like Sign Protocol to unify schemas, making DeFi onchain verification as routine as gas fees.

Getting hands-on with onchain KYC attestations isn’t rocket science, even for teams without deep crypto chops. Start by picking a protocol that fits your stack: Solana projects lean into SAS for its speed, while multi-chain ops favor Blockpass or Attest Protocol’s schema flexibility. Integrate via SDKs, which handle signing and verification under the hood. I’ve guided several DeFi teams through this, watching setup times drop from weeks to days.

A Quick Comparison of Leading Attestation Platforms

Comparison of Top Onchain KYC Protocols

| Protocol | Chains Supported | Privacy Technology | Key Use Cases |

|---|---|---|---|

| Solana Attestation Service (SAS) | Solana | Signed attestations linking off-chain data (no sensitive info on-chain) | Compliance, access control, reusable KYC proofs across apps |

| Blockpass On-Chain KYC 2.0 | Ethereum, Solana, multi-chain | Off-chain PII storage, on-chain verification attestations only | Reusable digital identities, cross-chain verification, compliance |

| Attest Protocol | Multi-chain (schema-based) | Schema-based lightweight trust layer | KYC status verification, developer-friendly on-chain proofs |

| zCloak Legit ID | Ethereum, Solana, universal across blockchains | Zero-knowledge proofs (ZK), decentralized identity standards | One-time KYC, device-stored proofs, universal verification without data exposure |

| Altme | Multi-chain Web3 apps (SSI wallet) | Self-sovereign credentials, off-chain QR/link sharing | Proof of identity/age, privacy-preserving compliance for allowlists |

Each shines in niches. SAS excels for high-throughput Solana drops, where instant proofs prevent front-running. zCloak’s zero-knowledge edge suits paranoid privacy hawks, letting users prove accreditation without jurisdiction hints. Altme bridges Web2-Web3 hybrids, ideal for events needing quick scans. The table above breaks it down, helping allowlist managers match tools to needs. In practice, layering them, like SAS for base KYC and Chainlink ACE for entity links, builds bulletproof KYCed addresses verification.

But let’s address the elephants: interoperability gaps and issuer trust. Not all chains speak the same schema yet, risking fragmented allowlists. My take? Prioritize ERC-7466 or emerging standards from Sign Protocol; they’re gaining traction for cross-chain portability. Trust hinges on vetted issuers, think regulated providers over randos. Revocation mechanisms, baked into most protocols, let you yank bad proofs chain-wide, a feature legacy lists envy.

For token sales or airdrops, this tech slashes disputes. Picture a project gating claims: only attested wallets pass, verified in one block. No more ‘I lost my spot’ sob stories. I’ve audited setups where onchain attestations simplified KYC compliance, boosting participation 40% by ditching forms. Users love the sovereignty; projects gain audit trails for compliance filings.

Challenges persist, sure. Gas fees on Ethereum can sting for mass verifications, but L2s and Solana mitigate that. Sybil farms still probe edges, countered by multi-issuer aggregation or soulbound twists. Regulators, eyeing MiCA and beyond, nod at these as ‘privacy by design. ‘ From my audits, the risk-reward tilts heavily positive: breaches plummet, uptake soars.

Web3’s future hinges on this balance. DeFi onchain verification evolves from nice-to-have to must-have, powering everything from venture DAOs to global remittances. Projects ignoring it risk fines or forks; adopters unlock loyal, verified communities. OnchainKYCe. me stands ready with plug-and-play attestations, turning compliance into a competitive moat. Dive in, verify once, thrive everywhere, your users, and the blockchain, will thank you.