In the fast-evolving world of decentralized finance, reusable onchain KYC attestations stand out as a game-changer, allowing users to complete identity verification once and deploy that proof across countless platforms. This “verify once, use everywhere” model slashes onboarding friction, fortifies privacy through cryptographic safeguards, and aligns DeFi with mounting regulatory pressures without sacrificing decentralization’s core tenets.

The Persistent Drag of Fragmented Identity Verification

DeFi platforms have long grappled with Know Your Customer (KYC) mandates, yet traditional approaches falter under blockchain’s borderless ethos. Users routinely face redundant document uploads, biometric scans, and manual reviews for each protocol, breeding inefficiency and dropout rates as high as 40% during onboarding. Worse, centralized providers hoard sensitive data, inviting breaches that erode trust. From my vantage in risk management, this setup mirrors unhedged volatility positions: exposed, unpredictable, and costly when breached.

Regulatory clarity, like the EU’s MiCA or U. S. clarity on stablecoins, amplifies the need for compliant yet agile solutions. Onchain identity verification emerges here, encoding KYC outcomes as tamper-proof attestations on blockchains like Ethereum, Solana, or Tezos. These aren’t mere snapshots; they’re portable credentials, reusable indefinitely until revocation, all while concealing personal details via zero-knowledge proofs or selective disclosure.

Technical Foundations of Verifiable KYC Credentials

At their core, KYC attestations for DeFi leverage standards like Ethereum Attestation Service (EAS) or Solana Attestation Service (SAS). An issuer, say, a trusted verifier, validates a user’s identity offchain, then mints an onchain attestation: a signed schema attesting traits like “KYC complete, ” “jurisdiction verified, ” or “AML cleared. ” Smart contracts query these via oracles or direct chain reads, gating access without exposing PII.

Privacy-preserving KYC on blockchain shines through mechanisms like zk-SNARKs, where proofs confirm compliance (e. g. , “age >18”) sans revealing birthdates. Revocation registries ensure dynamism; if a user’s status changes, the attestation nullifies across ecosystems. This interoperability, powered by cross-chain bridges or universal schemas, realizes true portability.

Leading Reusable Onchain KYC Projects

-

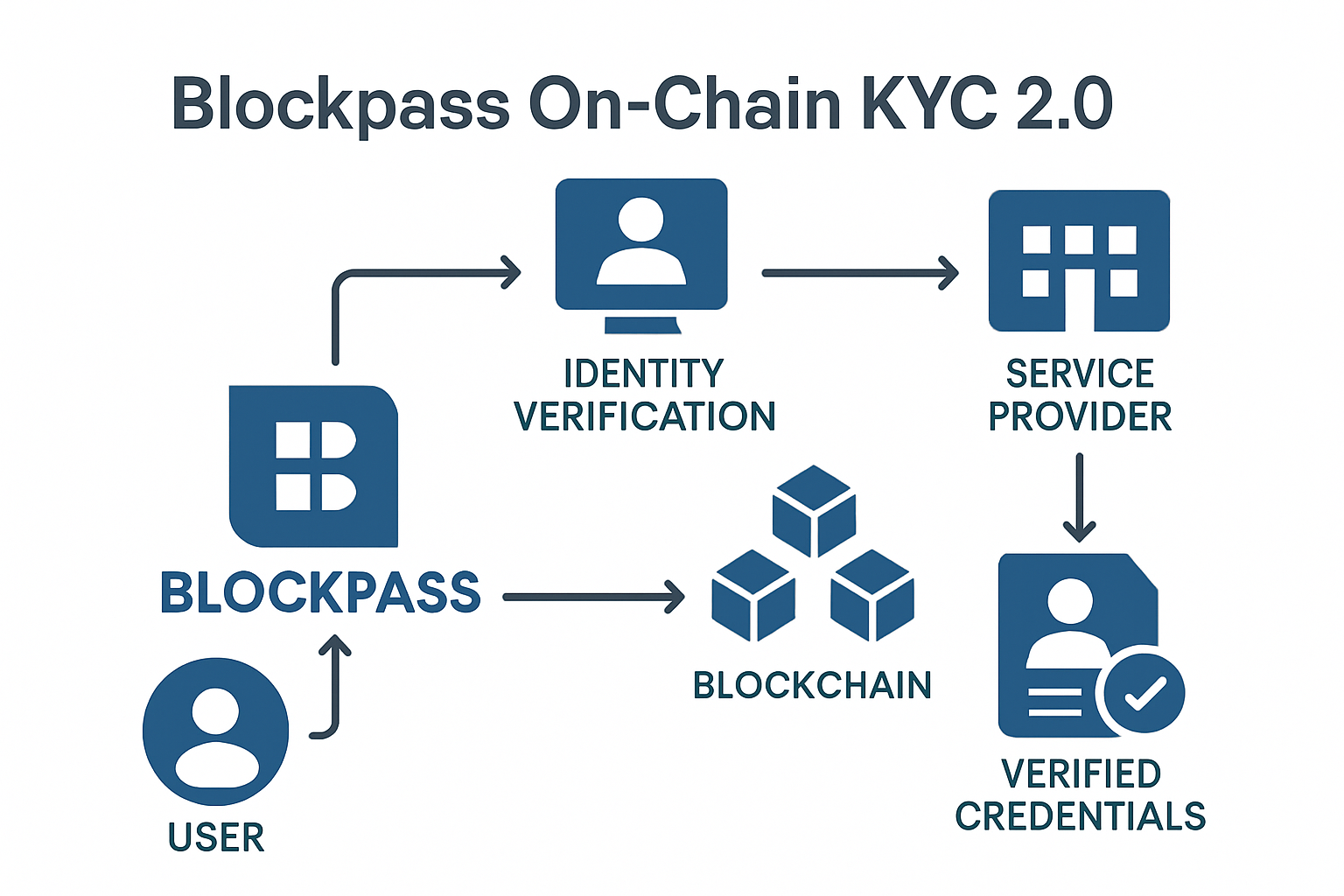

Blockpass On-Chain KYC® 2.0: Issues onchain attestations to create verified, reusable digital identities across multiple blockchains, enhancing security and compliance for DeFi platforms. Details

-

Solana Attestation Service (SAS): Provides signed, verifiable attestations reusable across applications, confirming identity and compliance without exposing sensitive data onchain. Solana SAS

-

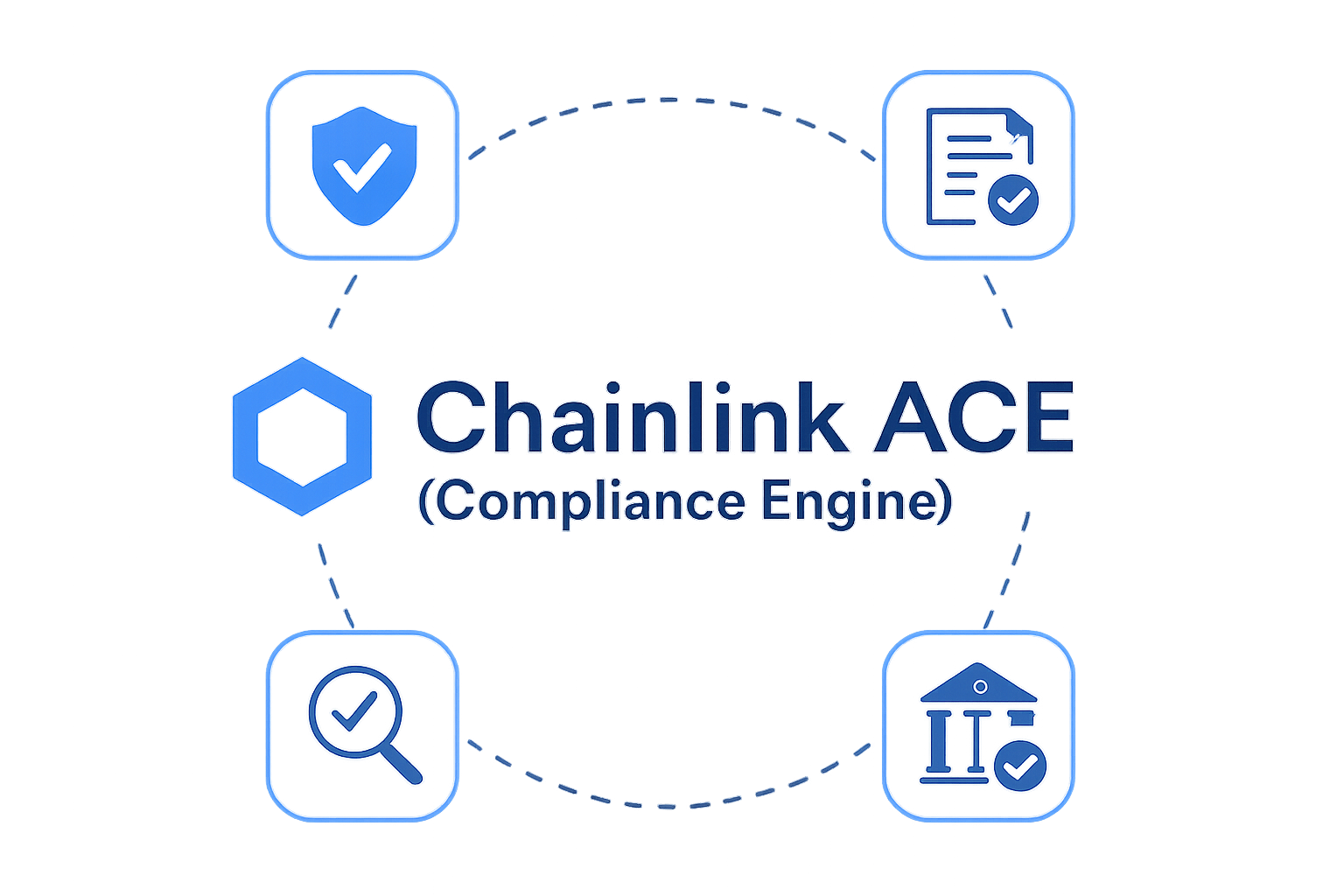

Chainlink Automated Compliance Engine (ACE): Enables reusable proofs of KYC via identity credentials accepted across platforms, supporting automated compliance in DeFi. Chainlink ACE

-

Solid Universal Digital Identity: Empowers users to own and share KYC data with consent, offering privacy-preserving verification for seamless Web2/Web3 onboarding. Explore Solid

-

Coinbase Verified Pools: Simplifies verification for DeFi liquidity pools, allowing retail and institutional access to assets with reusable attestations (launched March 2025). Read more

Trailblazers Reshaping DeFi Onboarding

Recent innovations underscore momentum. Blockpass’s On-Chain KYC 2.0 crafts reusable digital identities via attestations, spanning blockchains for seamless Web3 access. Their tie-up with Binance Attestation Service exemplifies ecosystem synergy, converting Web2 creds to onchain proofs.

Solana Attestation Service delivers lightweight, signed verifications for identity, sanctions screening, and jurisdiction checks, ideal for high-throughput DeFi. Chainlink’s Automated Compliance Engine (ACE) weaves these into oracle-fed policies, enabling reusable KYC as reliable cross-platform proof.

Coinbase’s March 2025 Verified Pools initiative brings institutional-grade liquidity onchain, streamlining verification for retail and pros alike. Meanwhile, idOS Network’s portable KYC empowers self-sovereign control, mitigating data misuse fears. 0xKYC’s zero-knowledge liveness checks prevent sybil attacks, issuing attestations that DeFi gates trust implicitly.

Newton Protocol’s Veriff Data Oracle enforces residency rules pre-transaction, blending Proof of Address with programmable compliance. Altme and TezID’s Tezos partnership delivers instant, decentralized AML/KYC, proving onchain compliance scales ecosystem-wide.

These tools, including offerings like those at OnchainKYCe. me, equip Web3 KYC compliance with verifiable, reusable attestations tailored for allowlists and token sales. For deeper dives, explore how onchain attestations empower KYCed addresses.

Such advancements don’t just check regulatory boxes; they catalyze DeFi’s maturation, blending user sovereignty with institutional rigor.

Quantifying the impact reveals why reusable onchain KYC merits immediate adoption. Platforms integrating these attestations report onboarding times plummeting from days to minutes, slashing customer acquisition costs by up to 70%. Dropout rates dip below 10%, unlocking billions in trapped liquidity. For risk managers like myself, this equates to tighter spreads on volatility hedges; protocols gain predictable compliance layers atop unpredictable markets.

Balancing Privacy and Compliance in Practice

Privacy-preserving KYC blockchain techniques form the backbone. Zero-knowledge proofs let users prove attributes without disclosure: a DeFi lender verifies “sanctions-free” status via an attestation from Chainlink ACE, blind to underlying docs. Selective disclosure adds granularity; share only jurisdiction for geo-fencing, not full identity. Revocation mechanisms, often via merkle trees or nullifier sets, propagate changes instantly across chains, mitigating risks from stale data.

This framework sidesteps Web2 pitfalls. No honeypots of PII; data stays offchain or encrypted. Yet regulators see verifiable trails: auditors query attestation schemas for compliance audits. DeFi’s pseudonymous ethos endures, now fortified against sybil floods and illicit flows.

Comparison of Reusable Onchain KYC Solutions

| Project | Key Features | Supported Chains | Privacy Tech |

|---|---|---|---|

| Blockpass 2.0 | Multi-chain attestations, Reusable digital identities, Flexible verification | Multi-chain | ZK-proofs, On-chain attestations |

| Solana SAS | High TPS, Sanctions screening, Signed verifiable attestations | Solana | Privacy-preserving (no sensitive data onchain) |

| Chainlink ACE | Oracle-integrated, Automated compliance, Reusable KYC proofs | Multi-chain (via oracles) | Privacy-preserving credentials |

| idOS | Self-sovereign identity, Portable KYC, Seamless onboarding | Multi-chain/Web3 | Self-sovereign identity (SSI) |

| 0xKYC | Liveness verification, Anti-duplicate accounts, Identity checks | EVM-compatible | Zero-knowledge proofs (ZK) |

Streamlining Operations: A Practical Checklist

DeFi builders shouldn’t theorize; they deploy. Start by auditing current KYC flows for bottlenecks. Select an attestation standard like EAS, then integrate verifiers via APIs. Test cross-protocol reuse with mock attestations. Monitor via dashboards tracking verification rates and revocations.

Real-world wins abound. Sumsub’s Binance integration turns passports into attestations, gating BNB Chain apps fluidly. J. P. Morgan’s Project EPIC prototypes reusable AML/KYC for tokenized funds, easing institutional ramps. Dock Labs’ decentralized identity guide forecasts 2025 ubiquity, as platforms like OnchainKYCe. me issue credentials primed for allowlists and sales. Check how onchain attestations streamline KYC for DeFi allowlists for tactical edges.

Challenges persist: interoperability lags between chains demand unified schemas, while verifier trust hinges on offchain rigor. Sybil resistance evolves with liveness proofs from 0xKYC. Still, momentum builds; Solana’s SAS and Tezos’ Altme-TezID duo prove scalability.

Forward-thinking protocols grasp this: verifiable KYC credentials aren’t regulatory shackles but competitive moats. They draw regulated capital, from stablecoin issuers to hedge funds, fueling TVL surges. Users reclaim agency, verifying once to roam freely. Platforms like those leveraging OnchainKYCe. me attestations position at DeFi’s vanguard, where compliance meets composability. The verify-once paradigm isn’t future hype; it’s deployable now, reshaping KYC attestations DeFi relies on for sustainable growth.