In the pulsating heart of DeFi, where billions flow through permissionless protocols, a quiet revolution brews around reusable onchain KYC attestations. Imagine verifying your identity once, then carrying that proof like a digital passport across token sales, allowlists, and platforms-without exposing the details that make you, you. This isn’t just tech wizardry; it’s a thoughtful recalibration of trust in Web3, balancing regulatory demands with the sacred right to privacy. As platforms grapple with AML scrutiny, these attestations emerge as a holistic salve, fostering inclusion while safeguarding autonomy.

![]()

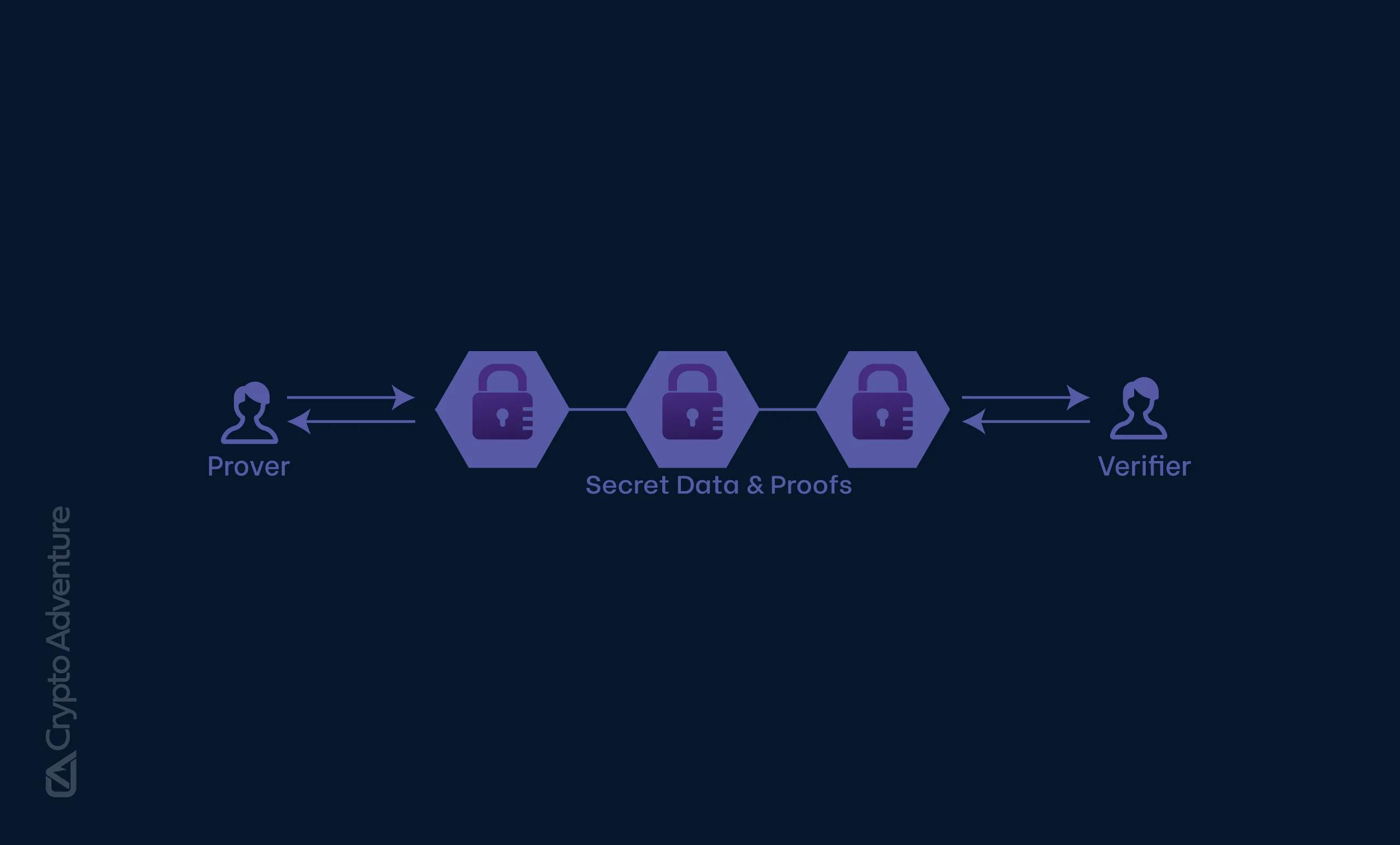

Traditional KYC feels like a relic in decentralized ecosystems-clunky forms, repeated submissions, and data silos that breed inefficiency and risk. Reusable KYC blockchain solutions flip this script. Users complete verification off-chain with trusted providers, then mint cryptographic attestations on-chain. These proofs, often powered by zero-knowledge proofs (ZKPs), let smart contracts confirm compliance attributes-like age, residency, or accreditation-without revealing underlying data. The result? Frictionless DeFi KYC verification that scales across chains.

Navigating Compliance Without Sacrificing Sovereignty

DeFi’s growth has invited regulators to the party, mandating KYC/AML for allowlists and token sales to curb illicit flows. Yet, mandating full data disclosure clashes with Web3’s ethos of pseudonymity. Enter privacy preserving KYC onchain: attestations that prove ‘yes, I’m compliant’ without the ‘how’ or ‘who. ‘ This preserves user sovereignty, reduces breach risks, and cuts onboarding costs by up to 80%, per industry estimates.

Benefits of Reusable Onchain KYC

-

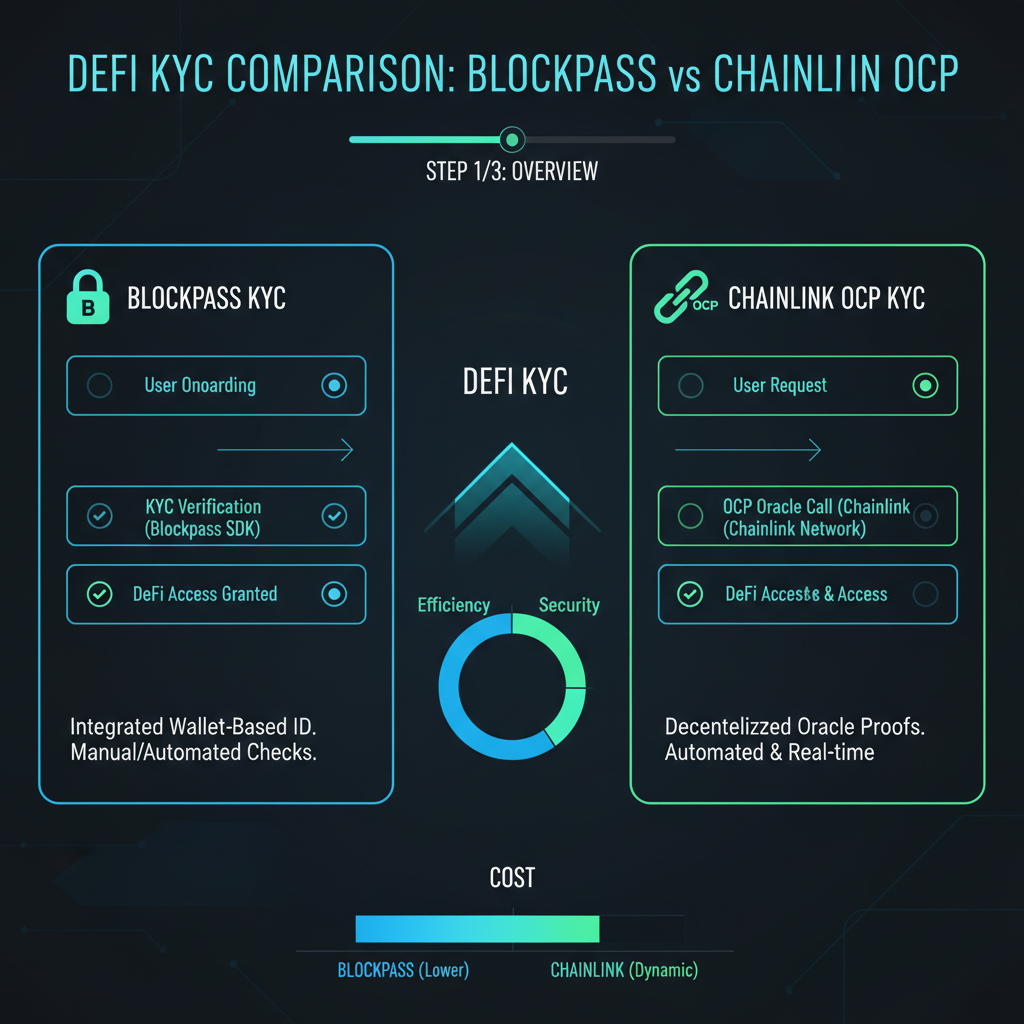

Enhanced privacy via ZKPs: Zero-knowledge proofs let users verify compliance without revealing personal details, as in Chainlink’s OCP and Blockpass On-Chain KYC® 2.0.

-

One-time verification for multi-platform use: Verify once and reuse attestations across DeFi platforms, streamlining onboarding per Blockpass and Attest Protocol.

-

Automated smart contract enforcement: Smart contracts automatically check onchain attestations for real-time compliance, powered by Chainlink’s Automated Compliance Engine.

-

Reduced fraud in token sales: Verifiable KYC proofs minimize fake accounts and fraud in allowlists, boosting trust in token launches.

-

Boosted liquidity through compliant allowlists: Compliant, privacy-first allowlists attract more users and capital to DeFi pools and sales.

From my vantage as an investment strategist, this intersection of ethics and efficiency shines brightest. Projects ignoring it risk delistings or hacks; those embracing it unlock sustainable alpha. Consider token sales: instead of gatekeeping with bespoke checks, platforms query universal attestations, democratizing access while ticking compliance boxes.

Pioneering Protocols Reshaping Web3 Allowlists

At the forefront stand innovators like Blockpass’s On-Chain KYC® 2.0, which issues granular, user-controlled attestations verifiable on or off blockchain. Users regain agency, selectively sharing proofs for Web3 allowlist attestations, from NFT drops to yield farms. Similarly, Attest Protocol’s schema-based system lets developers embed KYC checks with minimal code, turning compliance into a plug-and-play feature.

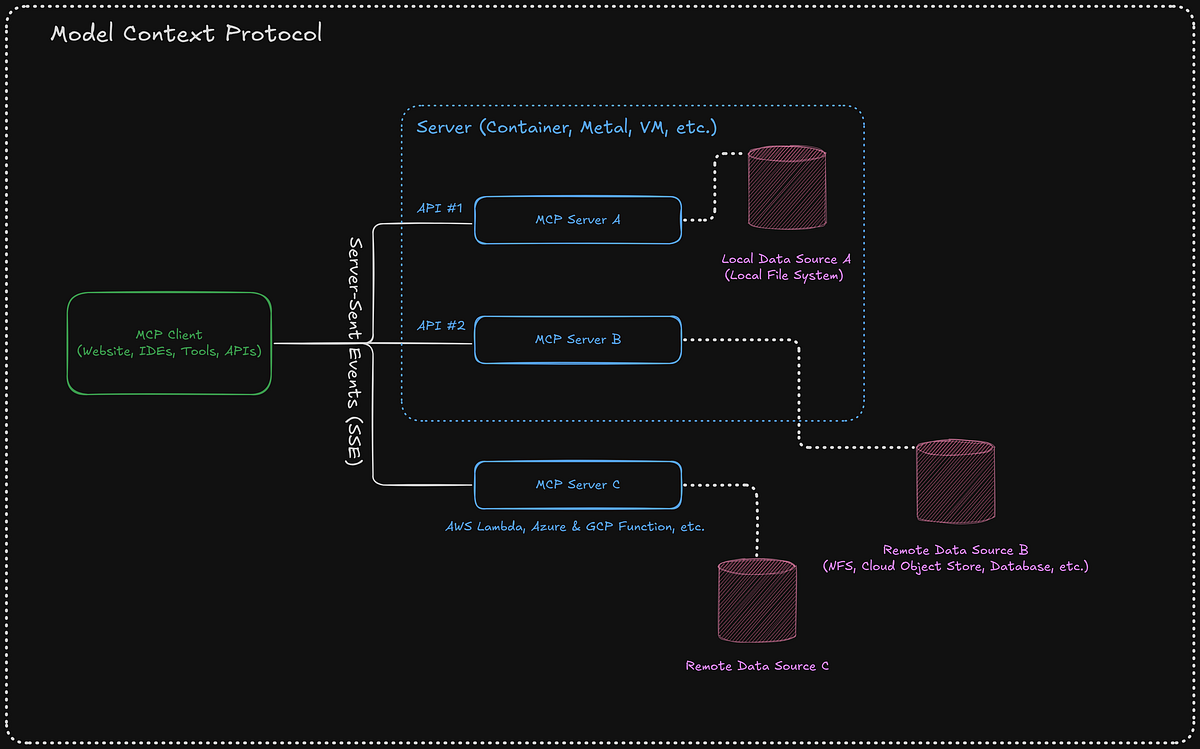

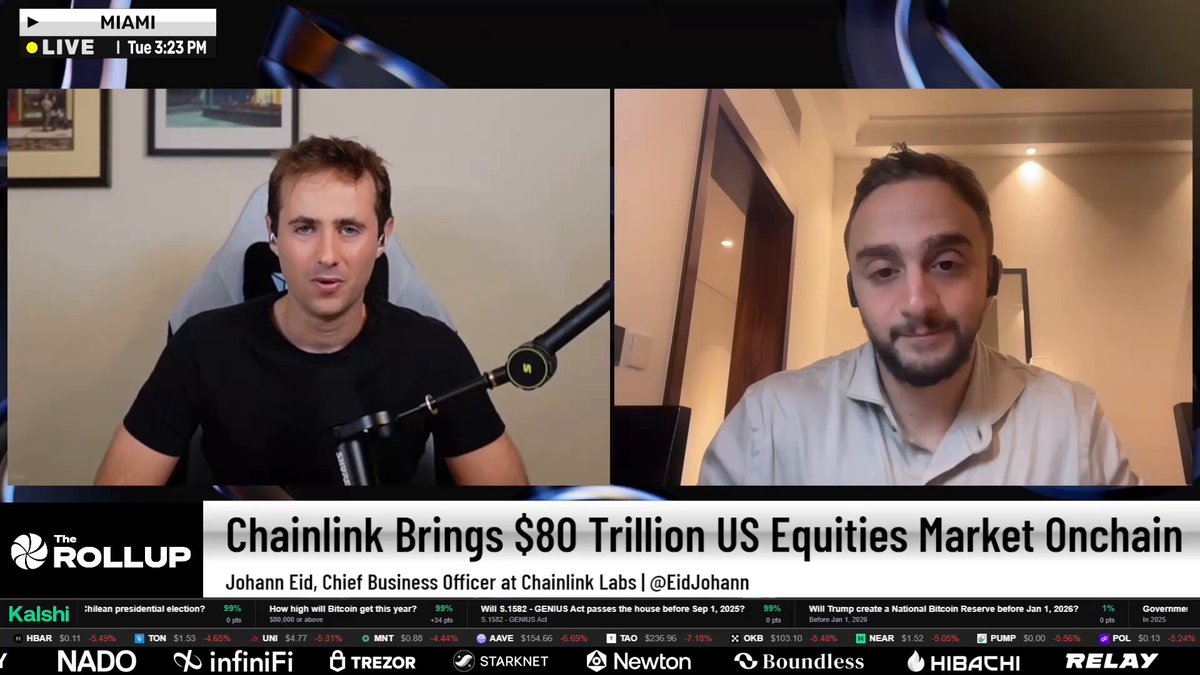

Chainlink’s Onchain Compliance Protocol (OCP) elevates this further, leveraging decentralized oracles to pipe real-time regulatory data into smart contracts. No more oracle exploits undermining trust; instead, seamless enforcement across jurisdictions. These tools address DeFi’s pain points head-on: fragmented identity, sybil attacks, and unbanked exclusion. By 2026, as updated contexts suggest, adoption could mainstream, with platforms like those using onchain attestations leading the charge.

Zero-Knowledge Magic: The Engine of Reusability

Zero-knowledge proofs form the cryptographic backbone, allowing proofs of compliance without data leakage. A user attests ‘I’m over 18 and accredited’ via ZKP; the verifier nods yes, none the wiser. This reusability cascades benefits: lower verifier costs, higher conversion rates, and ecosystems where compliance fuels, rather than fetters, innovation.

Holistically, it’s about ecosystem health. Ethical identity layers prevent wash trading in allowlists, promote financial inclusion for the unbanked, and align DeFi with ESG imperatives. As we witness Chainlink’s Automated Compliance Engine roll out, the path clarifies: reusable attestations aren’t optional; they’re the bridge to mature, resilient markets. Platforms integrating them today position for tomorrow’s standards.

Yet the true measure of this evolution lies in execution. DeFi teams must navigate integration hurdles thoughtfully, ensuring attestations align with diverse chain architectures and regulatory nuances. Providers like OnchainKYCe. me bridge this gap, offering interoperable schemas that plug into existing dApps with minimal refactoring. This pragmatic layer turns abstract ideals into operational reality, where onchain KYC attestations become the default for secure, scalable access control.

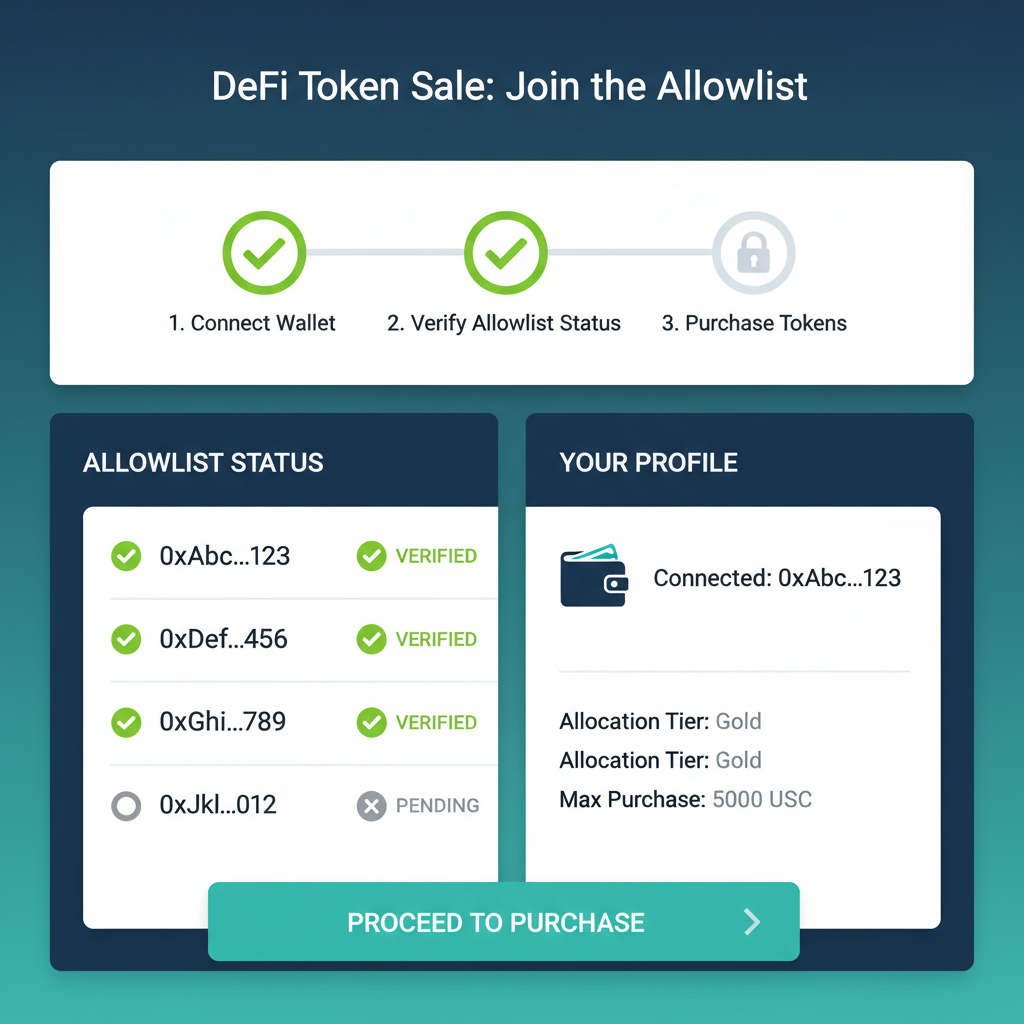

Consider token sales, where timing is everything. A buyer with a pre-minted attestation from a trusted issuer scans into your allowlist instantly, bypassing weeks of manual reviews. Smart contracts enforce rules atomically: no valid proof, no allocation. This not only accelerates launches but fortifies against regulatory backlash, as seen in recent MiCA enforcements across Europe. Platforms wielding reusable KYC blockchain tools report 40% faster onboarding, per Blockpass metrics, unlocking capital that idles elsewhere.

Key Players Driving Adoption

Top Reusable Onchain KYC Protocols

-

Blockpass On-Chain KYC® 2.0: Issues granular, user-controlled attestations for reusable digital identities on-chain. Details

-

Attest Protocol: Schema-based system for easy developer integration of on-chain KYC proofs in DeFi apps. Details

-

Chainlink OCP: Oracle-powered Onchain Compliance Protocol for real-time enforcement via decentralized oracles. Details

-

ComPilot ZKP: Privacy-preserving KYC with zero-knowledge proofs and proof-of-humanity verification. Details

-

OnchainKYC.e.me: Enables verifiable, privacy-first KYC credentials as cryptographic proofs for DeFi allowlists. Details

Each contributes uniquely to a maturing stack. Blockpass emphasizes granularity, letting users parcel out attributes like residency proofs for jurisdiction-specific sales. Attest Protocol democratizes access, its schema library enabling even solo devs to bolt on DeFi KYC verification. Chainlink’s oracle integration stands out for cross-chain resilience, piping compliance signals without single points of failure. Together, they form a resilient web, where no single provider dominates, mirroring DeFi’s decentralized spirit.

Challenges persist, of course. Sybil resistance demands proof-of-humanity layers, often via biometrics or social graphs, layered atop ZKPs. Interoperability lags on L2s, though bridges like Chainlink CCIP are closing gaps. From an ESG lens, these solutions shine: they empower the unbanked with portable credentials, sidestepping predatory data brokers while curbing illicit finance. I see this as foundational for long-term portfolios; protocols without it face asymmetric downside risks in a compliance-tightening world.

Zoom out to token sales specifically. Legacy methods choke velocity, with 70% drop-off from repetitive KYC friction. Reusable proofs invert this: a single Web3 allowlist attestations unlocks multiple opportunities, from IDOs to retroactive airdrops. Imagine a yield optimizer querying your accreditation status before auto-compounding; or an NFT marketplace confirming non-sanctioned status pre-mint. This fluidity boosts TVL, as compliant capital circulates freely.

Regulatory tailwinds accelerate momentum. The EU’s MiCA and US clarity signals demand auditable trails, which onchain primitives deliver immutably. Projects like those detailed in onchain attestations for DeFi exemplify best practices, blending privacy with provability. Investors should prioritize teams already live with these: their moats deepen as competitors scramble.

Beyond Compliance: Holistic Ecosystem Value

Privacy isn’t a byproduct; it’s engineered in. ZKPs ensure verifiers learn nothing extraneous, aligning with Web3’s minimalist ethos. This engenders trust loops: users adopt freely, platforms scale confidently, regulators nod approvingly. For allowlists, it means curated communities sans gatekeeper bias, fostering genuine collaboration over pump-and-dump schemes.

In my practice, weaving these into portfolios yields compounded returns. Ethical infrastructure begets performant networks; those fusing privacy preserving KYC onchain with robust UX capture outsized mindshare. As 2026 unfolds, with Chainlink ACE and Blockpass 2.0 maturing, expect ubiquitous reuse. Platforms ignoring this recalibrate at their peril; pioneers like OnchainKYCe. me chart the course toward inclusive, verifiable prosperity.