In the high-stakes arena of Web3 token sales, verifying participant addresses without compromising speed or privacy has long been a tightrope walk. Enter onchain KYC attestations: cryptographic proofs etched directly onto blockchains that confirm a user’s identity compliance while keeping personal data off-chain. This isn’t just another compliance checkbox; it’s a momentum shifter for DeFi platforms and launchpads racing to balance regulatory demands with decentralized ethos.

Traditional KYC processes bog down token sales with repetitive paperwork, centralized databases vulnerable to breaches, and delays that kill hype. Onchain attestations flip the script. Users undergo a one-time verification, minting a reusable soulbound token or zero-knowledge proof tied to their wallet. Projects then query these attestations via smart contract hooks, greenlighting only KYCed addresses for mints or claims. The result? Frictionless Web3 allowlist verification that scales across chains.

Why Onchain KYC is Momentum Fuel for Token Launches

Picture a token sale where allowlists aren’t static spreadsheets but dynamic, verifiable ledgers. Platforms like Uniswap’s Chainwise Contribution Agreements already embed validation hooks for KYC checks, signaling broader adoption. From my trading days charting commodities, I’ve seen how momentum builds on reliable signals; here, onchain attestations are those signals, slashing verification time from days to seconds.

Privacy preservation stands out. Zero-knowledge proofs let users prove ‘I am KYCed’ without revealing who they are, aligning perfectly with blockchain’s pseudonymity. This privacy-preserving KYC blockchain approach mitigates risks of data leaks that have plagued centralized providers. For token sales, it means higher participation rates: no more abandoned carts from wary users dodging invasive forms.

Trailblazing Platforms Driving Onchain KYC Adoption

The ecosystem is heating up with specialized protocols tackling DeFi compliance attestations. Hypersign’s zero-knowledge suite powers identity verification for real-world assets, while Blockpass’s On-Chain KYC 2.0 issues granular attestations reusable across dApps. SuiVerify mints private Soulbound Tokens post-verification, enabling seamless Web2-Web3 bridges.

Key Onchain KYC Platforms

-

Hypersign: Zero-knowledge proofs for DeFi, identity verification, proof-of-personhood, and transaction monitoring. hypersign.id

-

Blockpass: On-Chain KYC® 2.0 for reusable digital identities via secure attestations. blockpass.org/onchainkyc

-

SuiVerify: SBTs on Sui for one-time identity verification and seamless Web2/Web3 access. suiverify.xyz

-

Attest Protocol: Schema-based proofs as a lightweight trust layer for blockchains. attestprotocol.org

-

Authento: Verifiable Identity Passports via biometrics and document auth as SBTs. authento.io/kyc

-

0xKYC: ZK liveness checks to generate privacy-preserving on-chain attestations. 0xkyc.id

These aren’t theoretical; they’re battle-tested. CoinList’s queued sales with strict KYC set the bar, but onchain versions amplify it by decentralizing trust. Attest Protocol’s lightweight layer lets devs plug in proofs sans heavy coding, ideal for rapid token launches. Authento’s biometric flows yield high pass rates, issuing soulbound passports that projects scan on-chain.

Mechanics of Verification in Web3 Token Sales

Implementation boils down to precise orchestration. Users hit a provider’s portal, submit docs and biometrics, then receive an attestation schema encoded as an ERC-721 or EAS (Ethereum Attestation Service) record. Smart contracts for token sales include a require(isKYCed(msg. sender)) check, querying the attestation registry.

This setup crushes repetitive KYC hurdles. One verification unlocks multiple allowlists, as seen in Cube Exchange’s models blending signed messages with proofs. For high-frequency launches, it’s pure alpha: projects sidestep AML fines while users retain control, revoking attestations if needed.

Regulatory tailwinds accelerate this. As jurisdictions tighten on crypto sales, onchain proofs offer auditable trails without data hoarding. Blockpass and peers extend to KYB for teams, fortifying node sales too. The interplay? Exponential efficiency gains, positioning attested addresses as premium access tiers in crowded markets.

Quantifying these gains reveals the technical edge. Token sales with onchain KYC attestations report 70-90% reductions in verification overhead, per industry benchmarks from providers like Blockpass. Participation spikes as users bypass redundant checks, fueling momentum in oversubscribed launches. From a trader’s lens, this mirrors high-frequency setups where low-latency signals dictate alpha; here, attested addresses become the entry ticket to outsized yields.

Platform Showdown: Core Features at a Glance

Comparison of Top Onchain KYC Platforms

| Platform | Key Tech (ZK/SBT/etc) | Chains Supported | Reuse Across dApps | Token Sale Integration Ease |

|---|---|---|---|---|

| Hypersign | ZK | Multi-chain | Yes | High |

| Blockpass | Attestations | Multi-chain | Yes (reusable identities) | High |

| SuiVerify | SBT | Sui | Yes (no repeated KYC) | Seamless |

| Attest Protocol | Schema-based Attestations | Multi-chain | Yes (cross-ecosystems) | Easy (lightweight) |

| Authento | SBT | Multi-chain | Yes | Seamless |

| 0xKYC | ZK | Multi-chain | Yes | High (anti-bot) |

Scanning this landscape, Blockpass edges out for enterprise-grade KYB extensions, vital for node sales where team verification seals deals. Hypersign dominates DeFi with transaction monitoring hooks, while 0xKYC’s liveness checks neuter sybil attacks in fair launches. My pick for pure token sales? SuiVerify’s SBT model; it’s lean, Sui-native, and scales without gas bloat.

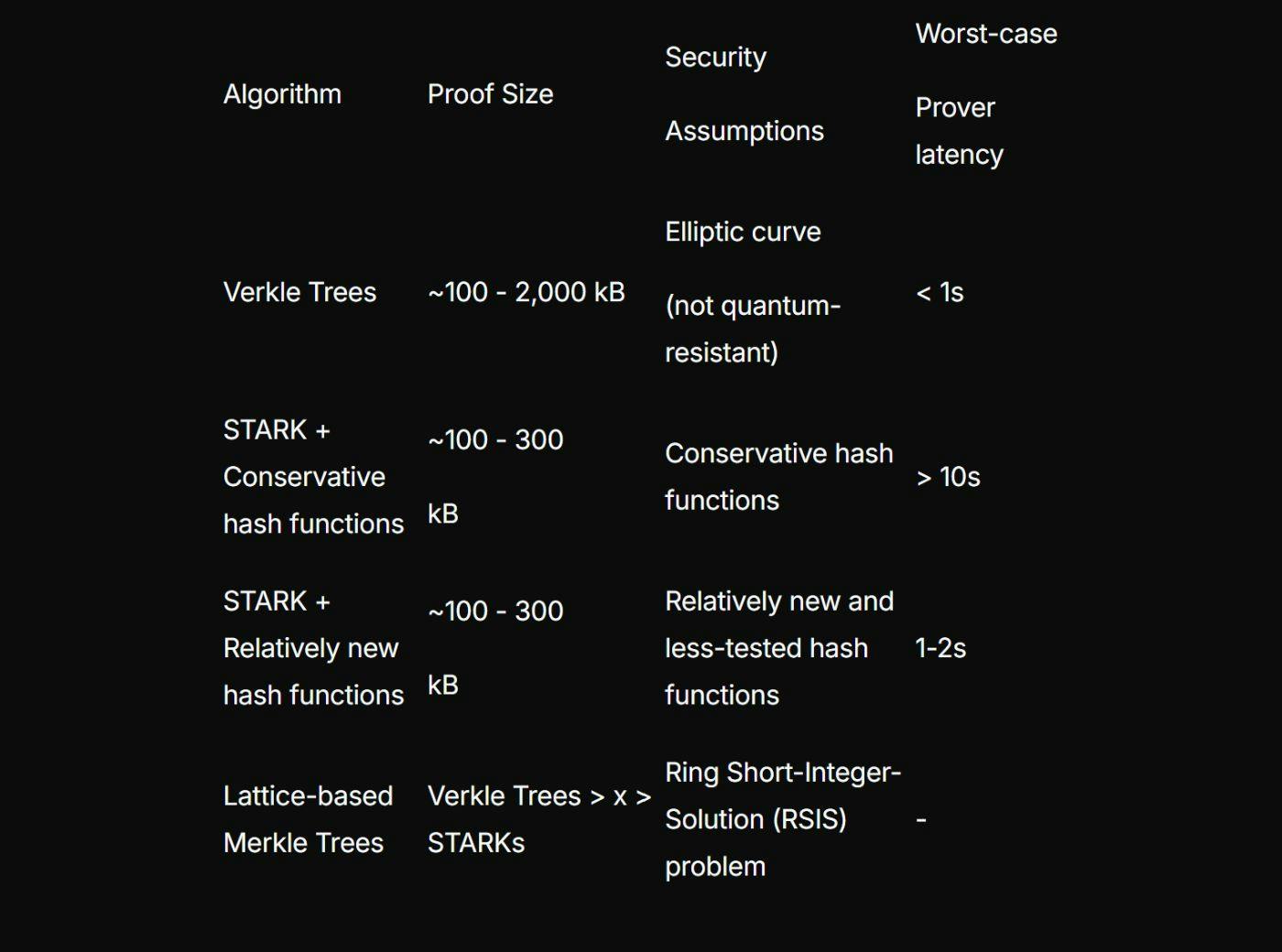

Integration isn’t plug-and-play fantasy, but close. Devs leverage EAS on Ethereum or equivalents like Attest Protocol’s schemas. A typical Merkle proof verifies inclusion without scanning full ledgers, keeping gas under 100k. Smart contracts fire queries pre-mint: if attestation valid and unrevoked, tokens flow. Revocation? Users burn or nullify proofs on-chain, reclaiming sovereignty absent in legacy KYC.

Navigating Risks in the Onchain KYC Surge

No momentum play lacks pitfalls. Oracle risks loom if attestation issuers centralize unduly, yet ZK circuits distribute trust. Interoperability gaps across EVM and non-EVM chains persist, though bridges like LayerZero inch forward. Regulatory flux adds volatility; what flies in Singapore might snag in the US. Still, the upside crushes downsides: DeFi compliance attestations future-proof projects against enforcement waves.

Top Onchain KYC Best Practices

-

Mandate revocation mechanisms: Require providers with revocation, as in Blockpass and Attest Protocol, to invalidate compromised attestations swiftly.

-

Pair with AML screening hooks: Integrate AML via Hypersign transaction monitoring or validation hooks like Uniswap CCA for full compliance.

-

Test Merkle proofs for gas efficiency: Benchmark Merkle proofs for allowlist verification to cut gas costs in high-volume token launches.

-

Audit smart contract queries: Scrutinize contracts querying attestations from SuiVerify or 0xKYC to block exploits.

Users gain most from this shift. One KYC unlocks ecosystems, from allowlists to airdrops. Projects harvest cleaner data signals for analytics, sans PII nightmares. Cube Exchange’s hybrid models preview the norm: proofs plus signed messages for tiered access.

Common Queries on Onchain KYC for Token Sales

Forward momentum builds as Uniswap-like primitives standardize hooks. Expect 2026 to see onchain KYC attestations as table stakes for serious launches. Platforms evolve, fusing AI liveness with quantum-resistant proofs. For traders eyeing allocations, scout projects mandating KYCed addresses; they’re the ones wired for sustained pumps. This tech doesn’t just verify; it ignites scalable, compliant velocity in Web3’s token economy.