In the sprawling ecosystem of Web3, where DeFi protocols, NFT marketplaces, and DAOs proliferate at breakneck speed, allowlists stand as critical gatekeepers. Yet, the traditional KYC process creates friction: users endure repetitive verifications, projects shoulder compliance burdens, and privacy erodes with every data handoff. Enter onchain KYC attestations: a paradigm shift that lets users verify addresses once and reuse those verifiable KYC credentials everywhere. This isn’t just efficiency; it’s a strategic unlock for scalable, privacy-preserving compliance in decentralized networks.

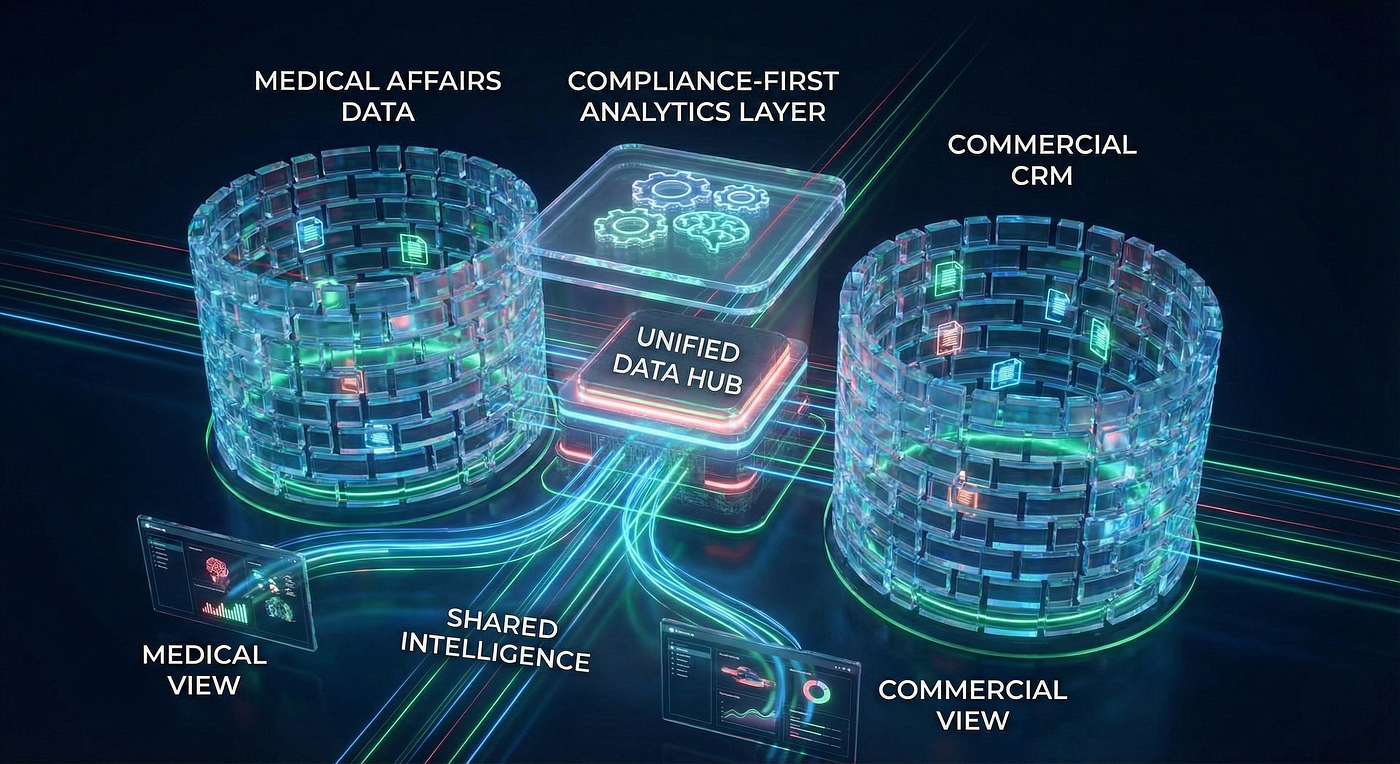

Web3 allowlists verification has evolved from simple Merkle trees to sophisticated compliance layers. Platforms like OnchainKYCe. me pioneer this by issuing blockchain-anchored attestations, ensuring KYCed addresses blockchain status is tamper-proof and interoperable across chains. No more siloed databases or risky offchain storage; instead, cryptographic proofs travel with the user, reducing onboarding time from days to minutes.

The Hidden Costs of Fragmented KYC in Web3

DeFi’s explosive growth amplifies the contradiction of “knowing your customer” in a pseudonymous world. Regulators demand KYC/AML adherence for RWAs and tokenized assets, but repeated checks alienate users and inflate costs. A single DeFi project might spend thousands verifying thousands of wallets, only for those users to repeat the process elsewhere. Sources like Hiro Systems highlight this tension: collecting data once is hard enough, but reusing it without central honeypots? Near impossible until now.

Consider allowlists in action, smart contracts that whitelist addresses for token sales or governance. Without robust DeFi KYC onchain, risks mount: sybil attacks slip through, regulators circle, and user trust frays. Cube Exchange’s explainer underscores the stakes, from NFT mints to exchange safeguards. Projects face not just operational drag but strategic vulnerability in a market where speed wins.

Key Challenges of Traditional KYC

-

Repeated Verifications: Users must redo KYC for each Web3 allowlist or DeFi project, creating redundancy.

-

Privacy Risks: Centralized storage of personal data heightens breach and surveillance vulnerabilities.

-

High Costs: Projects bear significant expenses for per-platform KYC infrastructure and operations.

-

Compliance Silos: Verifications are trapped within ecosystems, blocking cross-platform reuse.

-

User Drop-off: Friction from lengthy processes causes high onboarding abandonment rates.

Engineering Reusability: The Mechanics of Onchain Attestations

Onchain KYC attestations flip the script by anchoring identity proofs directly to blockchain addresses. Users complete KYC via trusted providers, think Blockpass’s On-Chain KYC® 2.0 with zero-knowledge proofs or Attest Protocol’s schema-based system, receiving an attestation that’s verifiable anywhere. This privacy preserving KYC Web3 approach shares only what’s needed: “This address is KYCed” without exposing passports or selfies.

From a big-picture lens, it’s portfolio diversification for compliance. One attestation fuels participation in exclusive NFT drops, DAO votes, or RWA pools. Onchainkyc. me demonstrates this seamlessness: a verified address on Polygon accesses gated communities on Ethereum without re-verification. Providers like 0xKYC add liveness checks, Altme bundles verifiable credentials into wallets, chain-agnostic tools that scale with Web3’s multi-chain reality.

“Onchain attestations allow users to complete KYC once and reuse their verified status across multiple DeFi projects. ” – Guide for Allowlist Managers

Strategic Wins for Allowlist Managers and DeFi Builders

For allowlist managers, the value compounds. Reusable KYC via onchain attestations slashes verification overhead by 90%, per platform benchmarks. Integrate once with APIs from Blockpass or OnchainKYCe. me, then query attestations in smart contracts. Conduit. xyz details onchain rules for permissioned DeFi, where granular checks enforce compliance at the infrastructure layer.

Users gain sovereignty: prove compliance without doxxing, fostering adoption in a trust-minimized ecosystem. Projects like those using Attestations for decentralized social identity (Xin Yan, Medium) extend this to reputation systems. The result? Frictionless onboarding that aligns incentives, users stay engaged, managers scale securely, and ecosystems thrive amid regulatory scrutiny.

Permissioned DeFi isn’t a compromise; it’s evolution. By embedding onchain KYC attestations into allowlists, Web3 projects future-proof against evolving rules while preserving decentralization’s core promise.

Builders embedding these attestations into smart contracts gain granular control, querying proofs onchain without trusting intermediaries. This shifts compliance from a cost center to a competitive edge, much like diversifying a portfolio across uncorrelated assets: one robust verification layer hedges against regulatory volatility across the entire Web3 stack.

Spotlight on Pioneering Onchain KYC Providers

Solutions like Blockpass’s On-Chain KYC® 2.0 lead the charge, blending zero-knowledge verification with reusable digital identities. Businesses set custom rules, users prove compliance via secure APIs, all while maintaining pseudonymity. Attest Protocol layers in lightweight, chain-agnostic schemas that developers integrate with minimal code, turning KYC into a plug-and-play module for dApps.

0xKYC tackles sybil threats head-on with liveness checks live on Polygon and BNB Smart Chain, ensuring real humans back those KYCed addresses blockchain. Altme’s self-sovereign wallet elevates this further, issuing NFT-bound credentials users control and share selectively. OnchainKYCe. me ties it together for allowlist managers, focusing on interoperable attestations that power everything from token sales to gated DAOs.

Top Onchain KYC Providers

-

Blockpass: On-Chain KYC® 2.0 with ZK proofs, reusable IDs, zero-knowledge verification, and customizable rules for Web3 compliance.

-

Attest Protocol: Schema-based, chain-agnostic attestations providing a lightweight trust layer for easy blockchain integration.

-

0xKYC: Zero-knowledge liveness verification live on Polygon and BNB Smart Chain for privacy-preserving identity proofs.

-

Altme: SSI wallets with NFT credentials and verifiable credentials for self-sovereign digital identity management.

-

OnchainKYC.me: Allowlist-focused interoperability enabling verified addresses to reuse KYC across DeFi projects and networks.

These tools aren’t hype; they’re battle-tested for Web3 allowlists verification, addressing the multi-chain sprawl where Ethereum, Solana, and Layer 2s demand seamless proofs.

From Theory to Traction: Case Studies in Action

Picture an NFT project curating an exclusive drop: instead of manual whitelisting, it scans for attested addresses, greenlighting verified wallets instantly. Or a DAO enforcing governance: only KYCed participants vote on sensitive proposals, blending openness with accountability. DeFi platforms gate RWA pools similarly, complying with AML sans data silos.

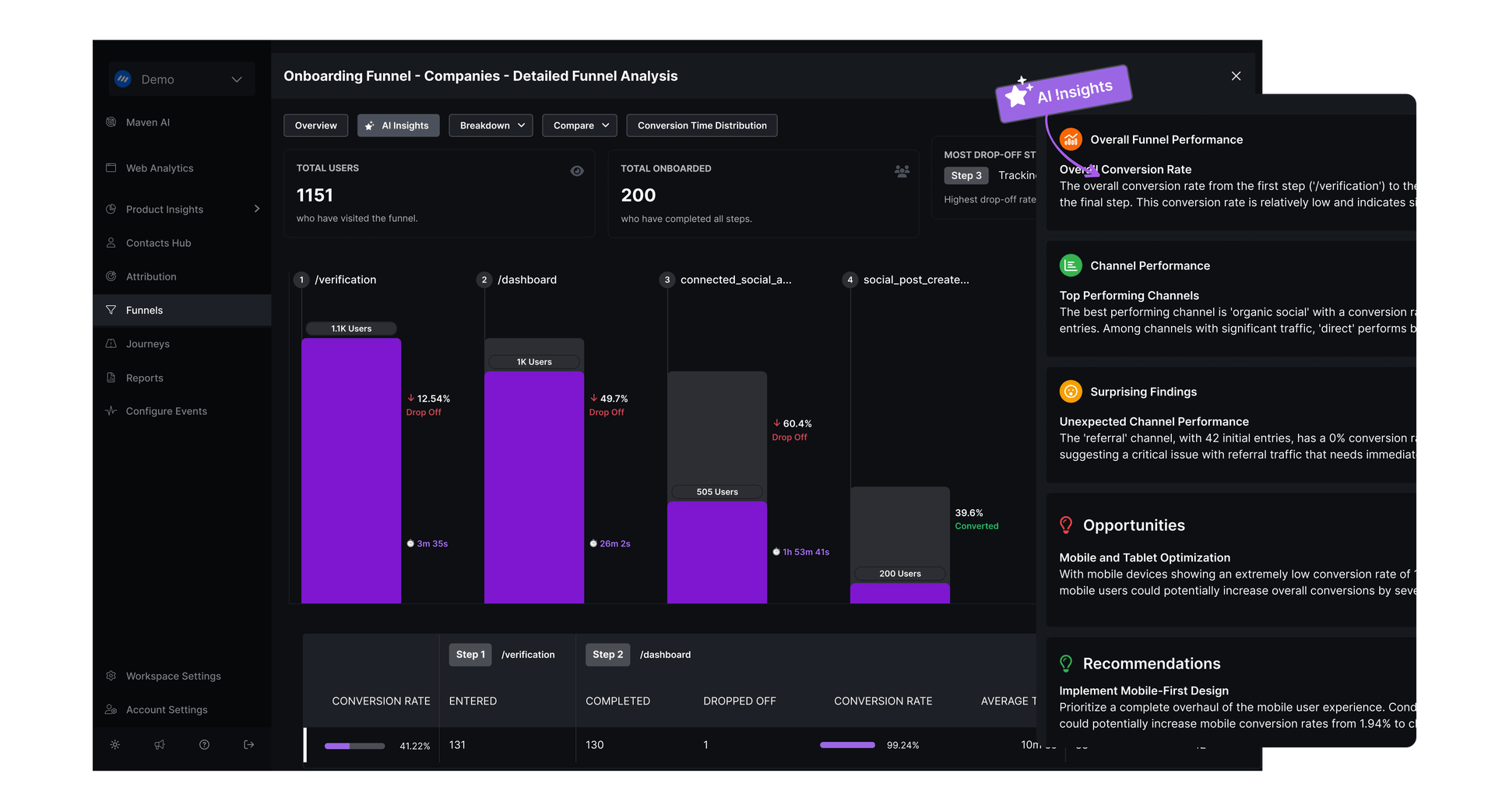

Onchainkyc. me spotlights this portability: one attestation unlocks NFT mints, DAO access, and yield farms across networks. Permissioned DeFi via Conduit. xyz enforces rules at the chain level, where operators define KYC thresholds for liquidity pools. Early adopters report drop-off rates plunging, user retention soaring, proving onchain KYC attestations aren’t optional; they’re the infrastructure upgrade Web3 demands.

This reusability echoes broader trends in decentralized identity, from social graphs (Xin Yan’s attestations vision) to secure wallets topping Token Metrics lists. Projects ignoring it risk obsolescence in a compliance-hardening landscape.

Strategically, it’s a macro play. As regulators tighten on RWAs and tokenized assets, platforms with baked-in verifiable KYC credentials attract institutional flows first. Users flock to frictionless experiences, projects scale without ballooning headcounts, and ecosystems mature toward sustainable growth.

Navigating Implementation: Pitfalls and Best Practices

Start small: audit providers for chain support and proof standards. Integrate via SDKs, test with mock attestations, then deploy. Watch for oracle risks in cross-chain verifies, favoring native protocols. For allowlist managers, prioritize user education; transparency builds trust in this privacy-first model.

Onchain attestations power KYC compliance by design, but success hinges on holistic adoption. Pair with wallet integrations for one-click proofs, monitor evolving regs, and iterate based on onchain analytics.

Web3’s permissionless ethos endures, augmented by verifiable trust. Onchain KYC attestations forge this balance, empowering DeFi KYC onchain without sacrificing sovereignty. Allowlist managers wielding these tools don’t just comply; they command the next cycle of decentralized expansion, where verified addresses unlock value at scale.