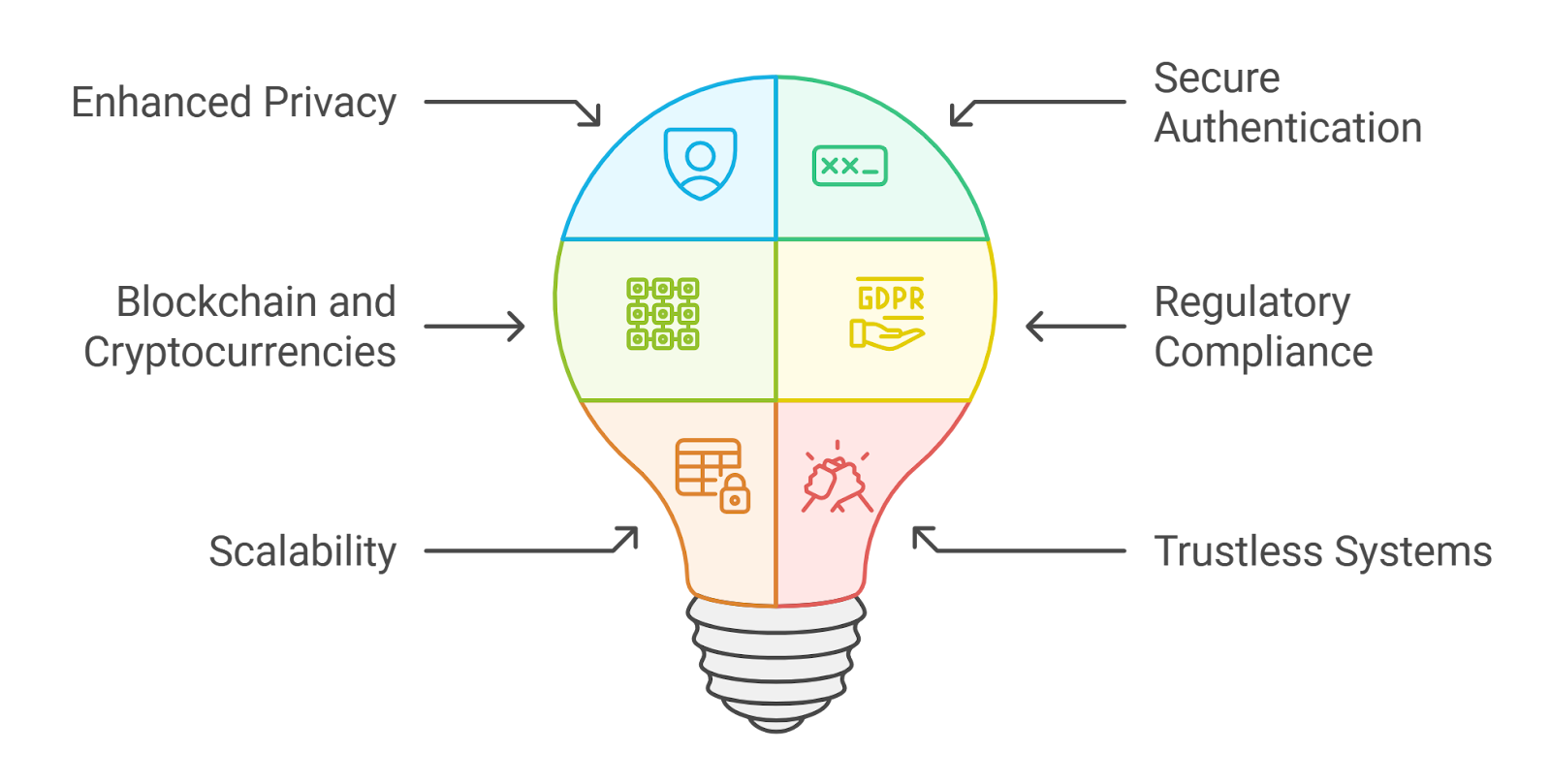

In the evolving landscape of decentralized finance, DeFi allowlist verification has become a critical gatekeeper for token sales, gated communities, and regulated protocols. Yet, traditional Know Your Customer processes clash with Web3’s ethos of pseudonymity, forcing users to surrender privacy for access. Onchain KYC attestations emerge as a sophisticated bridge, enabling privacy-preserving KYC through verifiable credentials stored directly on the blockchain. Users complete a one-time verification, receiving attestations they can reuse across platforms without repeatedly exposing personal data. This approach not only streamlines blockchain KYC compliance but also mitigates risks like data breaches and regulatory overreach.

Balancing Compliance and User Autonomy in DeFi

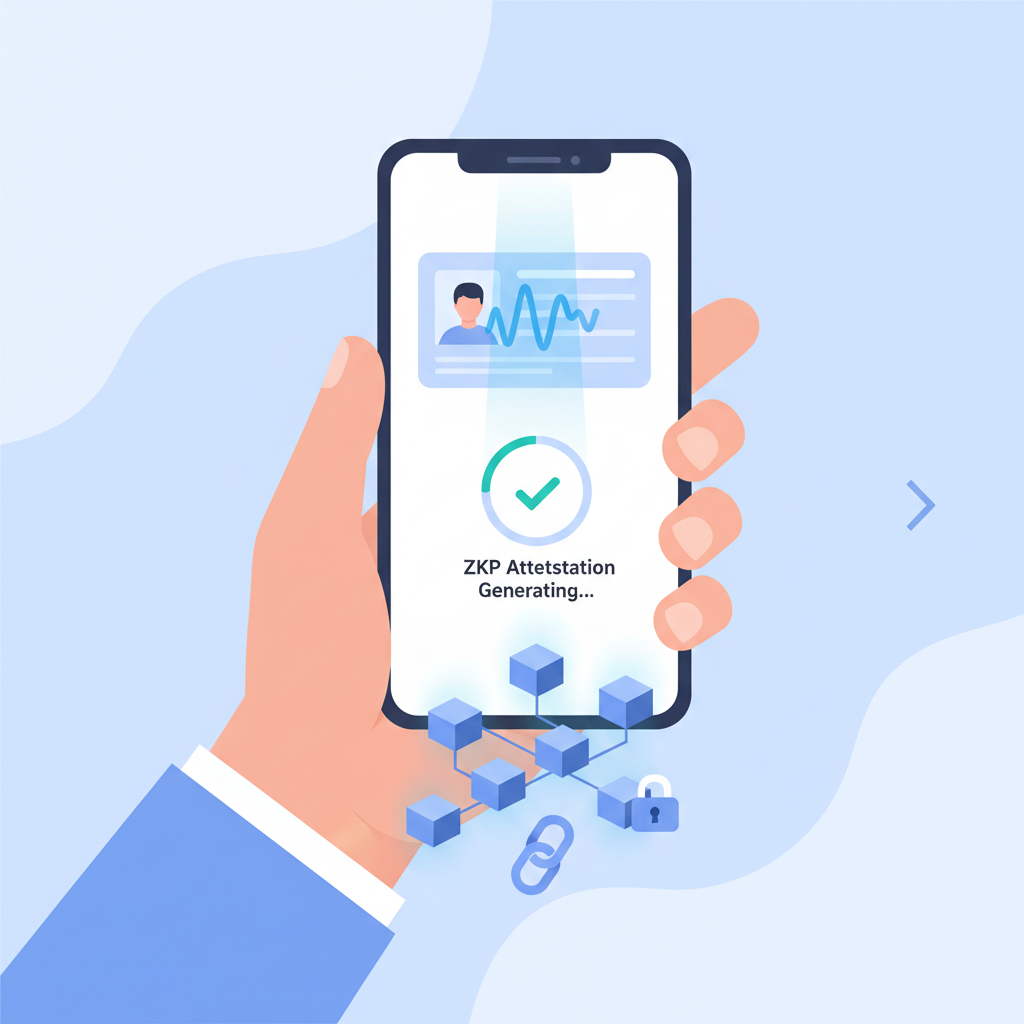

DeFi protocols increasingly face pressure from regulators to implement allowlists that exclude unverified participants, particularly in jurisdictions enforcing anti-money laundering rules. Static snapshots of addresses fall short; they lack dynamism and expose projects to liability if bad actors slip through. Onchain KYC attestations address this by leveraging zero-knowledge proofs (ZKPs) and self-sovereign identity (SSI) frameworks. A user proves attributes like residency or age without revealing underlying details, ensuring protocols verify compliance onchain while users retain control over their Web3 identity credentials.

This shift is timely. As of January 2026, solutions like Blockpass’s On-Chain KYC® 2.0 allow businesses to issue attestations on Ethereum and Solana without handling personally identifiable information. Similarly, 0xKYC’s zero-knowledge liveness checks block bots via onchain proofs, fostering trust without surveillance.

Unpacking the Technology Behind Onchain Attestations

At their core, onchain KYC attestations use standards like Ethereum Attestation Service (EAS) or verifiable credentials (VCs) to create tamper-proof records. Imagine a smart contract querying an attestation: it confirms ‘user is KYC-verified by provider X’ via a cryptographic signature, no PII involved. ZKPs shine here; zkMe’s zkKYC, for instance, generates proofs that satisfy regulatory scrutiny while keeping identities private. Altme’s wallet issues NFT-based credentials post-verification, queryable by dApps for seamless DeFi allowlist verification.

Key Benefits of Onchain KYC Attestations

-

Privacy via ZKPs: Users prove KYC compliance without revealing sensitive PII, using zero-knowledge proofs as in Blockpass On-Chain KYC® 2.0 and zkMe’s zkKYC.

-

Reusability across chains: Single verification reusable on multiple blockchains like Ethereum, Solana, and Tezos via solutions like Altme and Chainlink ACE.

-

Reduced compliance costs: Cost-effective solutions like Blockpass eliminate repeated KYC checks and PII storage for dApps and platforms.

-

Bot resistance: Liveness verification and uniqueness proofs, as in 0xKYC, block bots and duplicates without exposing user data.

-

Regulatory alignment: Meets KYC/AML requirements dynamically, enabling compliant allowlists as with Newton Protocol’s Veriff Oracle and Coinbase Verifications.

Newton Protocol’s Veriff Data Oracle exemplifies programmable enforcement, gating transactions by jurisdiction before execution. These tools transform allowlists from brittle lists into dynamic, policy-driven mechanisms, much like Chainlink’s ACE for cross-chain compliance.

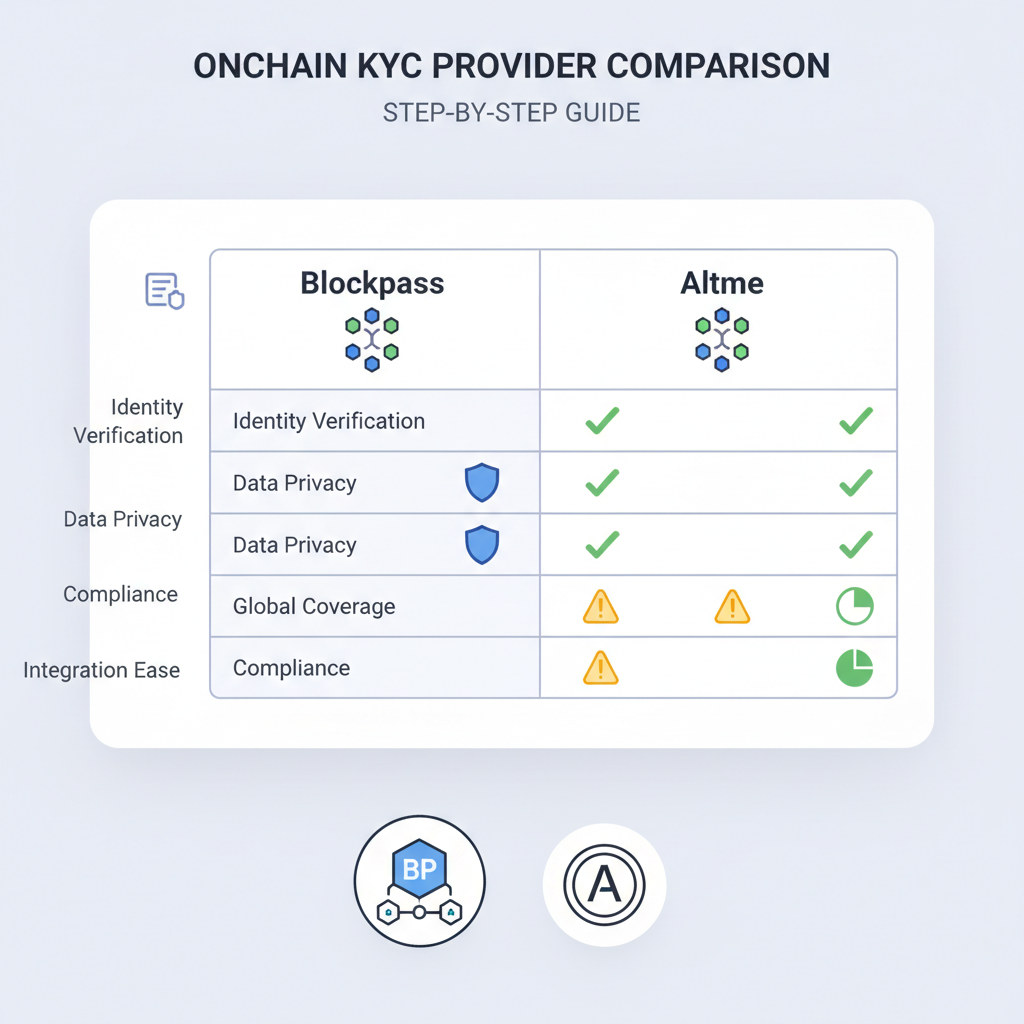

Evaluating Providers for Your DeFi Project

Choosing the right provider hinges on interoperability, cost, and proof mechanisms. Blockpass stands out for its no-PII model and Web3 focus, supporting KYC, KYB, and AML. Zoniqx’s zIdentity offers threshold cryptography for scalability across chains, ideal for multi-protocol ecosystems. IOTA’s tokenized KYC reduces fraud risks, while Coinbase Verifications leverages Base L2 for composable attestations to millions.

Panther Protocol integrates KYT alongside KYC, using ZKPs for transaction-level privacy. For Tezos builders, Altme-TezID partnership delivers tailored onchain compliance. My analysis favors providers with open-source elements, like 0xKYC, as they democratize access and invite audits, aligning with disciplined risk management.

Read more on how onchain attestations enhance KYC compliance for DeFi allowlists.

Integration demands careful selection of standards for broad compatibility. Ethereum Attestation Service powers solutions like Coinbase Verifications, enabling public, composable proofs on Base. For cross-chain needs, protocols supporting multiple networks, such as Zoniqx zIdentity, prevent silos and enhance Web3 identity credentials liquidity.

Step-by-Step Integration for DeFi Allowlists

Once attestations flow, smart contracts query them via oracles or direct reads. A typical flow: user connects wallet, protocol requests proof of KYC from a trusted issuer, ZKP validates without data exposure, access granted. This setup slashes verification times from days to seconds, cutting operational costs by up to 80% in some deployments.

Consider real-world pitfalls. Centralization risks arise if issuers hold keys; decentralized models like Altme’s SSI distribute control. Bot mitigation via 0xKYC’s liveness proofs adds robustness, essential for high-stakes token sales. My portfolio experience underscores auditing integration code; vulnerabilities here amplify systemic risks in DeFi ecosystems.

Comparison of Top Onchain KYC Providers

| Provider | Key Features | Chains | Privacy Tech |

|---|---|---|---|

| Blockpass | On-Chain KYC® 2.0: verifiable reusable digital identities, no PII handled/stored by businesses | Ethereum, Solana | Privacy-preserving blockchain attestations 🔒 |

| 0xKYC | Zero-knowledge liveness verification, open-source, blocks bots & duplicate accounts | Multi-chain (ZK-based) | Zero-knowledge proofs (ZKPs) |

| Altme | SSI wallet, one-time KYC with verifiable credentials & on-chain NFTs | Multi-chain (e.g., Tezos) | Self-sovereign identity (SSI), verifiable credentials |

| zkMe | zkKYC: fully decentralized privacy-first KYC solution | Decentralized | Zero-knowledge proofs (ZKPs) 🔒 |

| Zoniqx | zIdentity: decentralized identity attestations, verifiable claims | Multi-chain | Zero-knowledge proofs (ZKPs), threshold cryptography |

Navigating Risks and Regulatory Horizons

Despite advances, challenges persist. Interoperability gaps between chains demand bridges like Chainlink’s infrastructure. Regulatory flux, from MiCA in Europe to evolving U. S. guidelines, requires adaptable proofs. Providers excelling here, such as Panther Protocol’s KYT fusion, future-proof allowlists against transaction surveillance mandates.

OnchainKYCe. me exemplifies disciplined execution, offering secure attestations tailored for allowlists, token sales, and gated communities. Its focus on privacy, compliance, and seamless integration positions it as a cornerstone for institutional-grade DeFi. Projects leveraging such platforms not only meet blockchain KYC compliance but also cultivate user loyalty through minimized friction.

Dynamic allowlists evolve with user status; revocations propagate onchain, expelling compromised addresses instantly. This granularity outperforms static lists, reducing exposure to hacks or insider threats documented in past exploits.

Forward momentum builds. Partnerships like Altme-TezID signal ecosystem convergence, while IOTA’s tokenized approach hints at broader Web3 adoption. For allowlist managers, the calculus is clear: invest in onchain KYC now to sidestep tomorrow’s compliance cliffs. Sustainable DeFi thrives on verifiable trust without eroded privacy, blending regulatory rigor with blockchain’s promise.

Explore further at building a secure allowlist with onchain attested KYCed addresses or how onchain attestations simplify KYC for DeFi airdrops and allowlists.