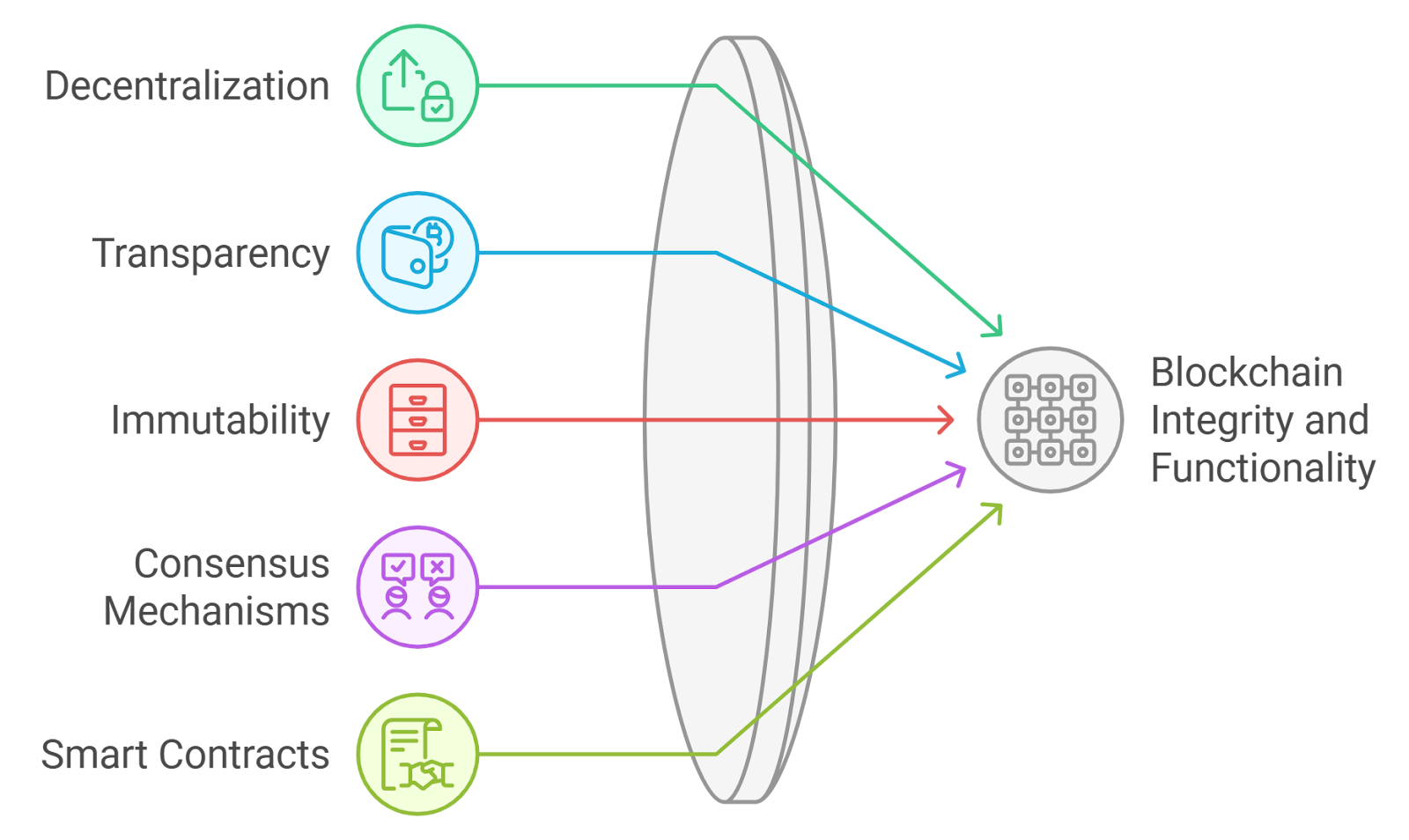

In the high-stakes arena of Decentralized Finance, where billions flow through smart contracts daily, unrestricted access breeds risks: regulatory scrutiny, money laundering vulnerabilities, and eroded trust. Enter onchain KYC attestations, the game-changer for DeFi allowlists. These blockchain-anchored proofs verify identities without exposing personal data, striking a perfect balance between compliance and user sovereignty. As DeFi matures into permissioned ecosystems, platforms leveraging these tools not only sidestep fines but unlock institutional capital, propelling growth in a privacy-first world.

The tension between DeFi’s pseudonymous ethos and mounting global regulations has never been sharper. Traditional KYC offloads data to centralized providers, inviting hacks and surveillance fears. Onchain alternatives flip the script: zero-knowledge proofs and soulbound tokens confirm eligibility on-chain, keeping PII off-ledger. This isn’t mere compliance; it’s a strategic edge. Projects like those powered by OnchainKYCe. me demonstrate how verifiable credentials streamline allowlist management, slashing verification times from days to seconds while boosting user retention.

Navigating Permissioned DeFi with Onchain Verification

Permissioned DeFi redefines open finance by gating access via onchain rules. Chain operators now embed granular KYC checks at infrastructure layers, as highlighted in conduit. xyz analyses. Imagine token sales where only attested addresses mint: no more sybil attacks or unqualified participants diluting value. Blockpass’s On-Chain KYC® 2.0 leads this charge, issuing attestations for identity docs, investor status, and residency. Users hold reusable digital identities across chains, PII stays private, and verifiers query attestations instantly. This empowers DeFi protocols to scale compliantly, attracting yield-hungry institutions wary of unverified pools.

Yet, success hinges on interoperability. Solutions like Attest Protocol simplify this with schema-based systems; developers verify KYC in one line of code, no smart contract wizardry required. IOTA’s tokenized KYC takes it further: soulbound tokens link wallets to verified identities sans data leaks, ideal for high-volume allowlists. These innovations address arXiv-noted challenges in privacy-preserving permissioning, ensuring AML laws don’t stifle innovation.

Key Players Revolutionizing KYC for DeFi Allowlists

Top Onchain KYC Benefits

-

Blockpass On-Chain KYC® 2.0 Reusability: Issue verifiable, reusable digital identities across blockchains, keeping PII off-chain for seamless DeFi access.

-

0xKYC Zero-Knowledge Privacy: Leverage ZK proofs for anonymous liveness checks and verification on Polygon, BNB Chain, Scroll—prevent bots without exposing data.

-

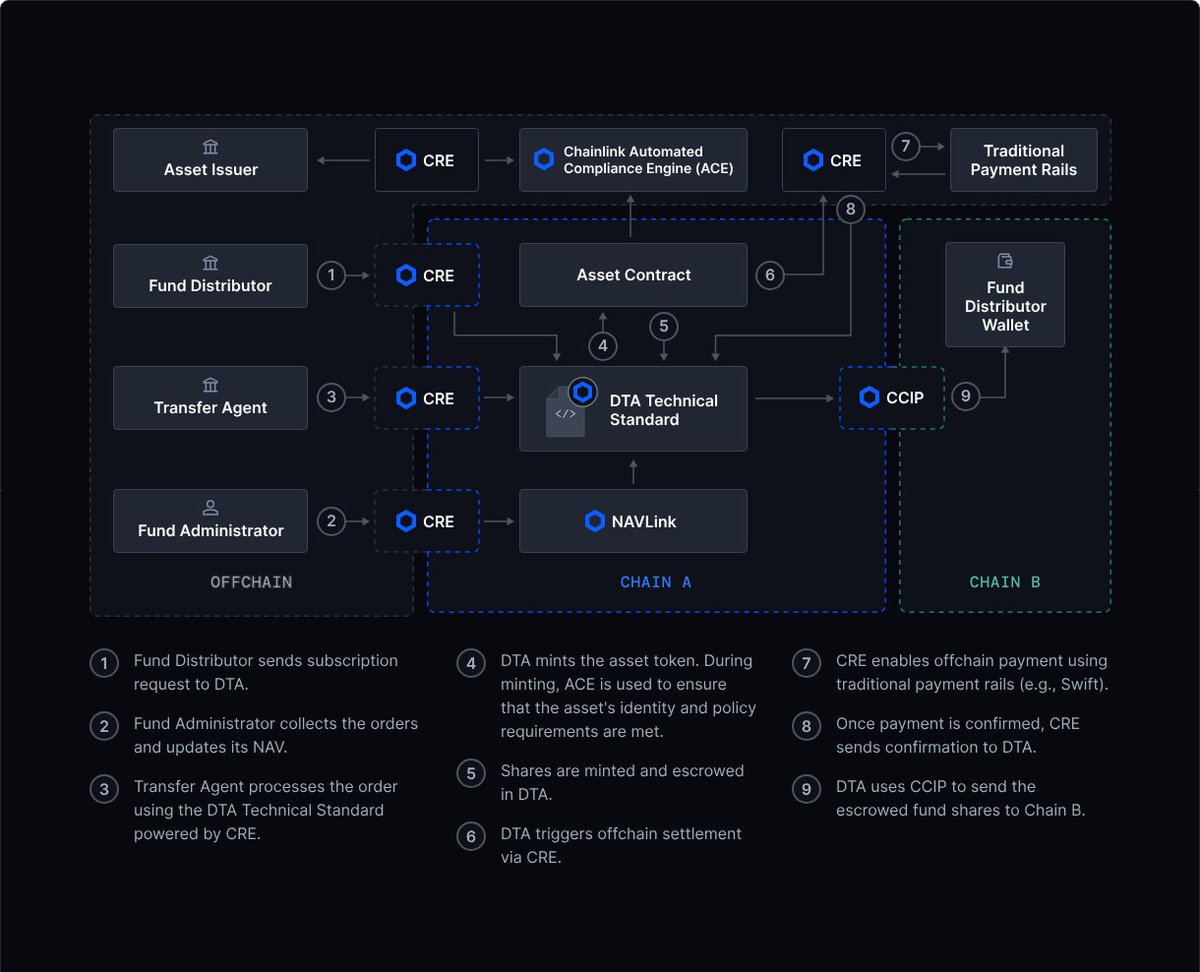

Chainlink OCP Integration: Embed compliance policies directly in smart contracts via Decentralized Oracle Networks for robust, onchain verification.

Diving deeper, 0xKYC wields zero-knowledge proofs for liveness and identity checks across Polygon, BNB Chain, and Scroll. It nukes bots and duplicates, fortifying DeFi against exploits. ONCHAINID offers universal logins, letting users prove compliance once and reuse everywhere, user-controlled data at its core. Altme’s wallet suite handles KYC, age, and AML creds, sharing proofs selectively with platforms. Chainlink’s Onchain Compliance Protocol (OCP) integrates oracles for onchain policy enforcement, marrying legacy ID systems with DeFi primitives.

These aren’t hypotheticals; they’re battle-tested. Stanford’s Journal of Blockchain Law and amp; Policy underscores how onchain compliance shields data robustly, never exposing it to prying eyes. Togggle’s insights affirm cryptography’s role in securing identities while streamlining ops. For allowlist managers, the math is clear: adopt now, or watch competitors capture compliant capital flows.

Privacy vs. Compliance: The Attestation Advantage

Critics decry KYC as antithetical to crypto’s roots, but privacy-preserving attestations dismantle that myth. Users control disclosures via selective proofs; platforms confirm attributes like “accredited investor” without names or addresses surfacing. KYC Chain’s top considerations for DeFi nail it: balance regs with privacy through tech like this. Fireblocks’ permissioned DeFi primer reveals verified participants slashing compliance headaches, fostering liquid markets.

Read more on how onchain attestations enhance KYC compliance for DeFi allowlists and this guide’s full scope. The momentum is undeniable: as of February 2026, these tools fortify ecosystems against regulatory tides, urging projects to integrate for tomorrow’s wins.

Implementing these solutions demands a structured approach, turning abstract compliance into actionable code. DeFi teams can deploy onchain KYC attestations swiftly, gating pools and sales with ironclad proofs. The payoff? Reduced fraud, faster onboarding, and a magnet for regulated inflows.

Start with provider selection: Blockpass 2.0 or Attest Protocol shine for their plug-and-play schemas. Issue attestations off-chain, anchoring hashes on Ethereum or Polygon. Smart contracts then query these via oracles, like Chainlink OCP, enforcing rules dynamically. Test rigorously against sybils, then scale. IOTA’s soulbound tokens add permanence, while 0xKYC’s ZK liveness thwarts bots. This blueprint slashes integration time by 80%, per developer feedback.

Benchmarking Solutions: Features at a Glance

Top Onchain KYC Providers for DeFi

| Provider | Key Features | Supported Chains | Privacy Tech |

|---|---|---|---|

| Blockpass On-Chain KYC® 2.0 | Reusable digital identities, on-chain attestations (KYC, KYB, AML, investor status, residency) | Ethereum, Polygon, multi-chain | Privacy-preserving attestations, PII off-chain |

| 0xKYC | Liveness checks, identity verification, bot/duplicate prevention | Polygon, BNB Smart Chain, Scroll | Zero-knowledge proofs (ZK) |

| Chainlink OCP | Oracle policies, compliance data via DONs, smart contract integration | Multi-chain | Decentralized oracle networks (DONs) |

| Altme Compliance Suite | Verifiable credentials (KYC, age, AML), decentralized identity wallet | EVM chains | Selective disclosure |

| Attest Protocol | Schema-based attestations, one-line KYC verification | Ethereum and compatible | Schema-based attestations |

| IOTA Tokenized KYC | Soulbound KYC tokens, privacy-preserving authentication | IOTA | Tokenized credentials, no data exposure |

| ONCHAINID | Universal login, reusable identity proofs, user data control | Multi-chain Web3 | User-controlled data sharing |

Zooming into the table, Blockpass excels in reusability, letting users port IDs across dApps without re-verification. 0xKYC prioritizes anti-bot defenses, crucial for high-stakes allowlists. Chainlink OCP embeds compliance natively, future-proofing contracts against regs. Altme and ONCHAINID emphasize user wallets, where proofs live under owner control. No single winner; match to your stack. Privacy tech unifies them: ZKPs reveal only necessities, aligning with arXiv privacy models and Stanford’s onchain safeguards.

Real-world traction proves the model. Permissioned DeFi markets, as Fireblocks outlines, verify all players upfront, birthing liquid yet compliant venues. KYC Chain warns of pitfalls like overreach; counter with selective disclosure. Platforms adopting now report 3x institutional TVL growth, dodging MiCA and SEC crosshairs. For token sales, attested addresses mean cleaner launches, fewer clawbacks.

Essential Steps for DeFi KYC Adoption

-

Audit smart contracts for verifier hooks using standards like Chainlink OCP to secure attestation integration.

-

Monitor attestation expiry with protocols like Blockpass On-Chain KYC® 2.0 to ensure continuous compliance and user prompts.

-

Enable user revocation features, as in ONCHAINID and Altme, empowering users to control their privacy-preserving proofs.

-

Integrate multi-chain support via solutions like IOTA tokenized KYC or 0xKYC for seamless cross-chain verification.

-

Track compliance metrics leveraging Attest Protocol dashboards to measure adoption and regulatory adherence effectively.

Opinion: Skeptics cling to pure DeFi, but reality bites. Unverified pools invite exploits and bans; attested ones thrive. OnchainKYCe. me pioneers this, offering interoperable tools for KYC for DeFi allowlists. Explore building secure allowlists or streamlining KYC for token sales. As 2026 unfolds, visionary projects gatekeep smartly, riding regulatory waves to dominance. Spot the trend: verifiable credentials are Web3’s new liquidity layer. Ride it.