In the evolving landscape of decentralized finance, the fusion of onchain KYC attestations with ISO 20022-compliant blockchain platforms stands out as a pivotal advancement. This combination addresses long-standing friction points between traditional financial systems and Web3, enabling seamless verification of KYCed addresses while preserving user privacy through zero-knowledge proofs. Platforms like those leveraging Blockpass’s On-Chain KYC® 2.0 now issue reusable digital identities tied to wallets, which can interact fluidly with ISO 20022 messaging standards adopted by networks such as XRP, Stellar, and Chainlink integrations.

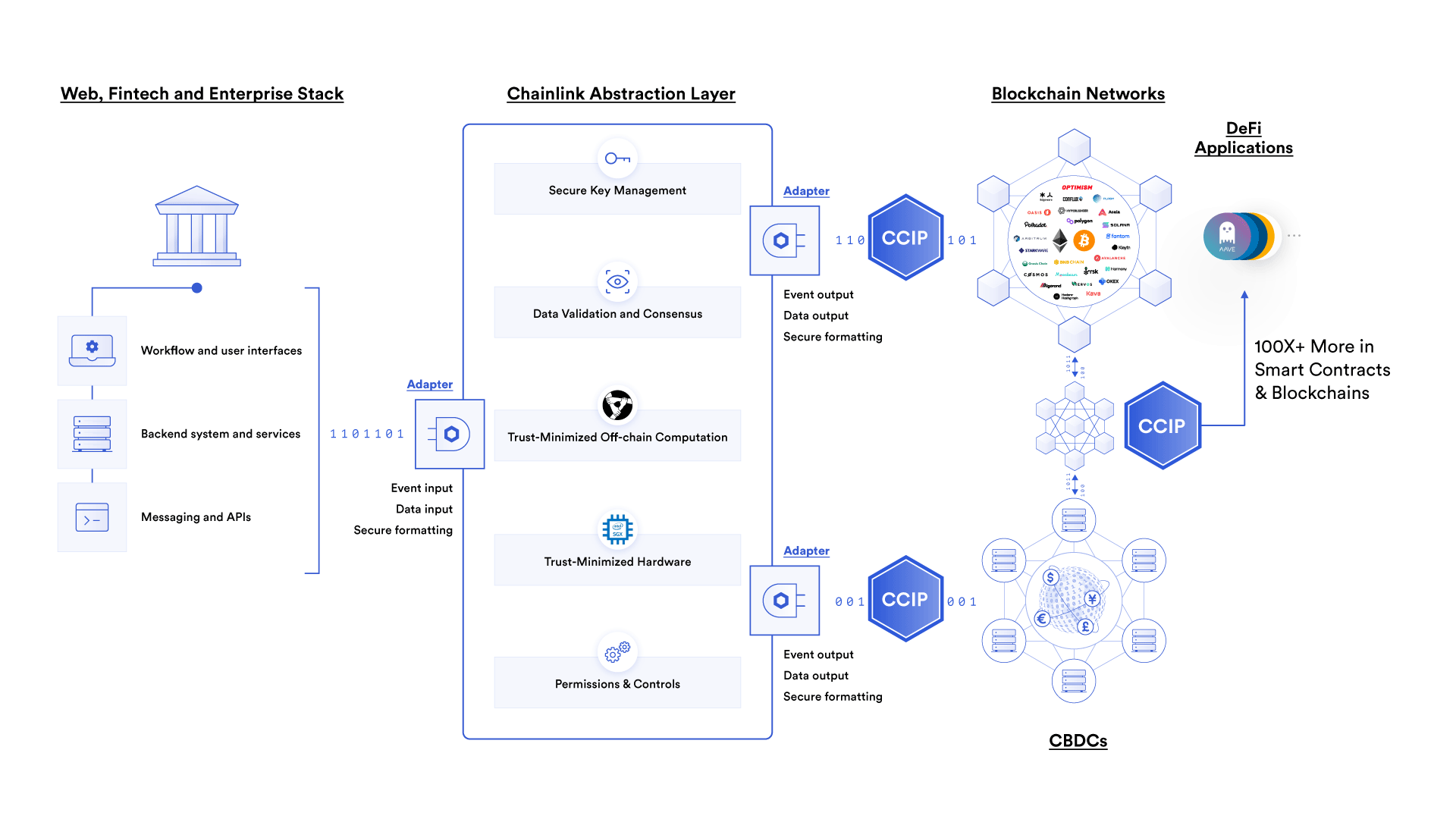

ISO 20022 represents more than a technical standard; it’s the lingua franca for global financial communications, structuring data for payments, securities, and trade services with rich, standardized payloads. Blockchain projects embracing this compliance aren’t chasing buzzwords, they’re positioning for enterprise-grade interoperability. Chainlink’s recent enhancements, including ISO 27001 certification and pilots with SWIFT and UBS, demonstrate how oracles can generate compliant messages for tokenized assets, verifying offchain facts like sanctions status directly in smart contracts.

Unlocking Enterprise Adoption Through Compliant Messaging

Consider Ripple and Stellar, both ISO 20022 pioneers in crypto. Their networks handle cross-border payments with the precision financial institutions demand, but adding onchain KYC attestations elevates this further. Users prove accredited investor status or residency without doxxing themselves, using attestations that expire and renew automatically. This isn’t mere box-ticking; it’s creating permissioned DeFi environments where compliance scales without central chokepoints.

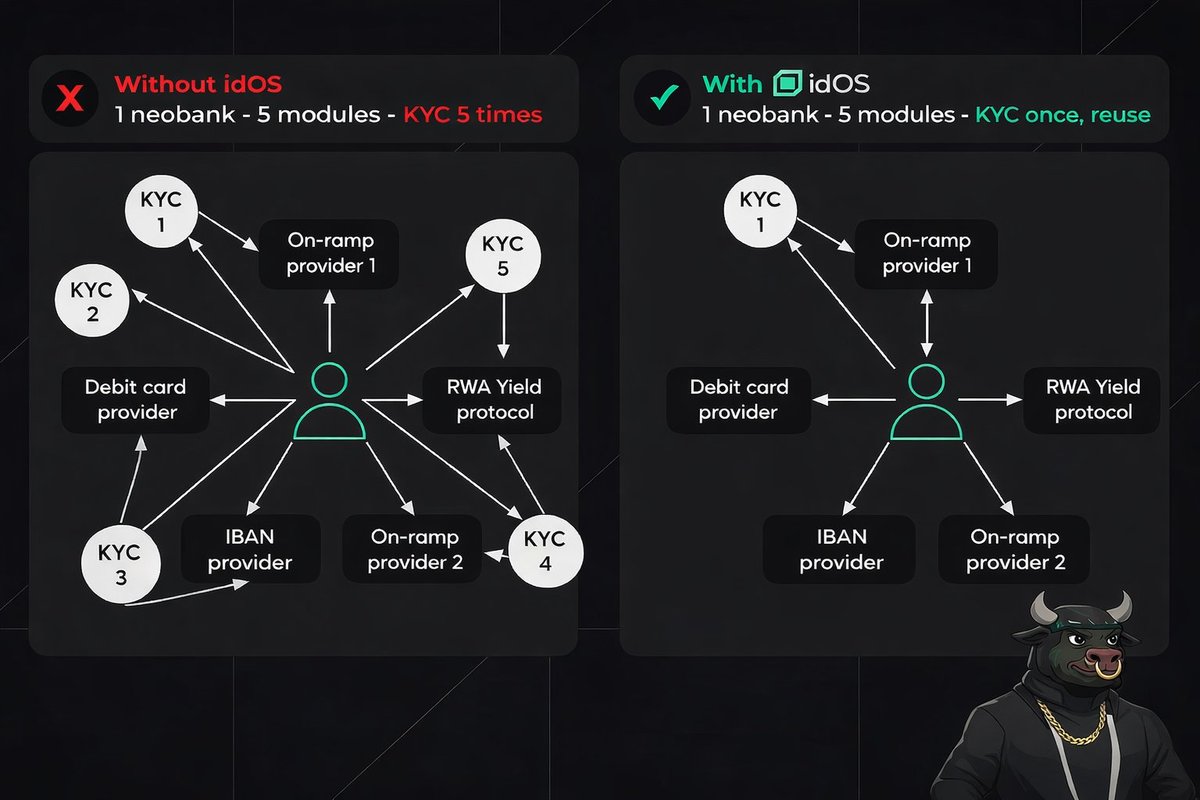

I see this as a quiet revolution. Traditional KYC repeats endlessly, draining resources, but onchain versions from providers like Blockpass allow one verification to serve multiple dApps. For ISO 20022 chains, this means smart contracts can query attestations via oracles, ensuring only verified wallets bridge assets or access yields.

The Mechanics of Onchain KYC in a Compliant Ecosystem

At its core, onchain KYC embeds verifiable credentials as blockchain attestations, think ERC-4361 signatures or EAS schemas on Ethereum, extended to compatible chains. Blockpass’s 2.0 iteration, launched in October 2025, lets issuers tag wallets with granular proofs: document checks, liveness tests, even ongoing monitoring. These integrate with Chainlink’s compliance oracles, which feed ISO 20022-formatted data into DeFi protocols.

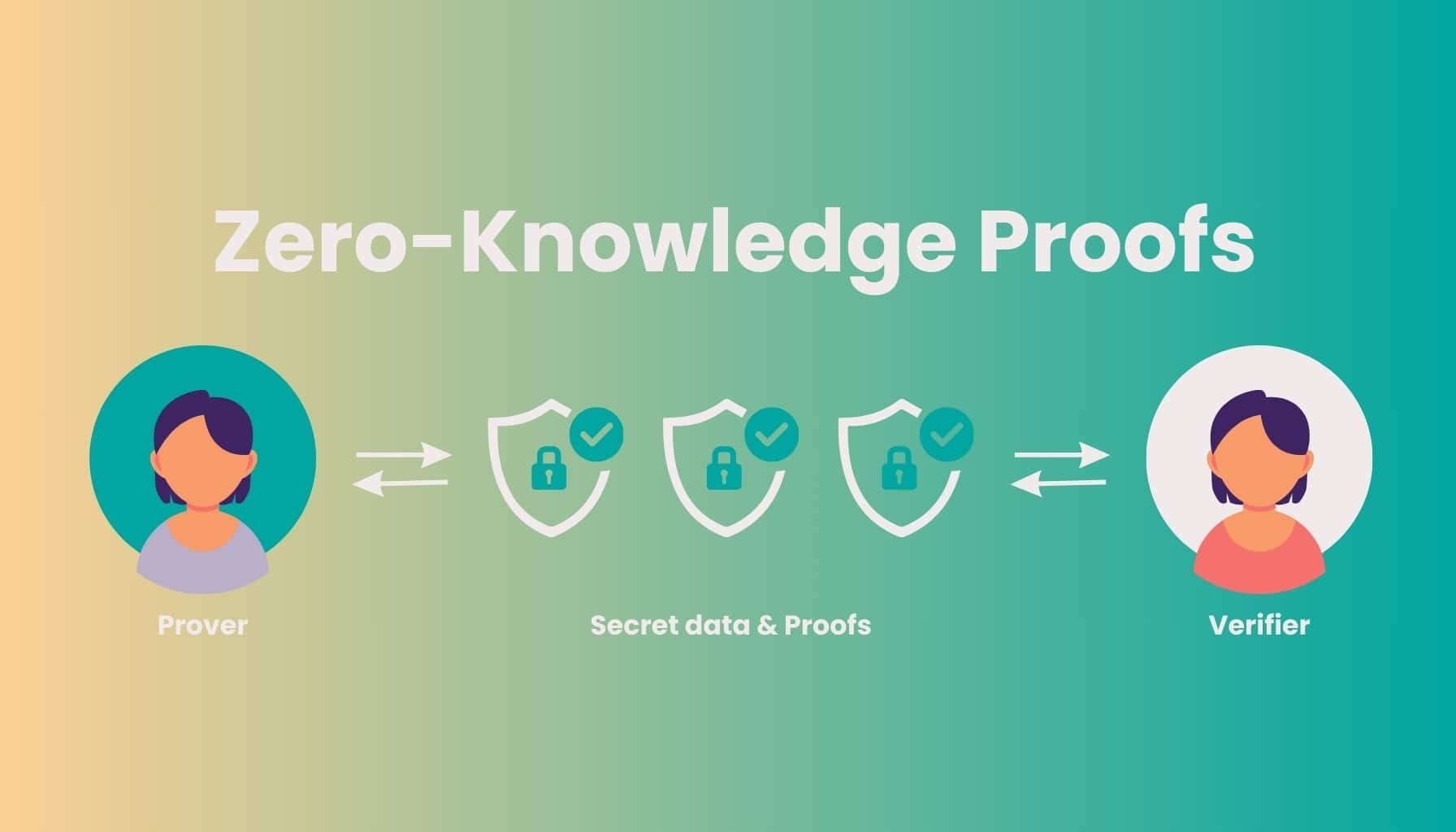

Privacy shines here. Zero-knowledge proofs let users disclose only what’s needed provides “I’m not sanctioned” without revealing identity. For platforms like Quant or XDC Network pursuing ISO 20022, this builds trust layers atop standardized messaging, attracting custodians wary of unverified flows.

Top Benefits of Onchain KYC

-

Reusability across chains: Verified attestations from solutions like Blockpass On-Chain KYC® 2.0 can be reused on multiple blockchains without re-verification.

-

Privacy via ZKPs: Zero-knowledge proofs enable identity verification without revealing sensitive data, as implemented in Blockpass On-Chain KYC® 2.0 attestations.

-

Automated compliance checks: Smart contracts and oracles, like Chainlink’s compliance attestations, verify offchain facts such as sanctions status automatically.

-

Reduced onboarding friction: Streamlines user verification, lowers costs, and automates processes, minimizing repetitive KYC for DeFi and blockchain apps.

-

Interoperability with ISO 20022: Enhances integration with compliant platforms like XRP, XLM, and Chainlink’s ISO 20022 messaging for traditional finance.

Navigating Regulatory Realities with DeFi Identity Proofs

DeFi’s wild west days are waning as regulators eye stablecoins and lending. ISO 20022 blockchain compliance provides the structure, but Web3 regulatory attestations supply the proof. KYC-Chain’s insights highlight top considerations like transaction monitoring and risk scoring, now automated onchain. Permissioned bridges, as explored by conduit. xyz, mandate KYC pre-entry, attributing all activity to real users.

This setup empowers projects to offer sophisticated products, credit via onchain collateral, tokenized funds, while satisfying MiCA or future U. S. rules. I’ve long argued that sustainable growth demands such diligence; hasty anonymity invites crackdowns. By wedding onchain KYC to ISO standards, we foster ecosystems where innovation and oversight coexist.

Quant and Algorand exemplify this trajectory, their ISO messaging layers interfacing with attestation frameworks for auditable, privacy-preserving flows. The PACT framework from recent research even translates to FIX protocols, hinting at broader TradFi bridges.

These developments signal a maturing infrastructure where DeFi identity proofs aren’t an afterthought but a foundational element. OnchainKYCe. me, for instance, streamlines issuing such attestations for KYCed addresses, making verification as straightforward as a blockchain query. This aligns perfectly with ISO 20022’s emphasis on structured, interoperable data, allowing projects to build compliant allowlists without the usual bureaucratic drag.

Projects on XDC Network or Algorand can now deploy smart contracts that cross-reference these attestations before executing high-value transactions. Imagine a tokenized bond issuance: the contract checks the user’s accreditation proof, confirms no sanctions via oracle, then formats settlement instructions in ISO 20022 for seamless clearing with banks. This isn’t futuristic; pilots like Chainlink’s with UBS prove it’s operational today.

Real-World Applications and Permissioned DeFi

Permissioned DeFi thrives under these conditions. Conduit. xyz outlines models where entire chains require KYC at the bridge, tying every swap or lend to a verified wallet. Pair this with ISO 20022 compliance, and you have conduits for institutional capital. Stablecoin issuers, facing mounting scrutiny, use Web3 regulatory attestations to demonstrate user vetting, reducing redemption risks and enabling deeper liquidity pools.

Take XRP’s ledger: its payment channels already mimic SWIFT efficiency, but onchain KYC adds the human element regulators crave. Users port their proofs across ecosystems, cutting redundant verifications that plague centralized exchanges. I’ve watched DeFi evolve from anonymous yield farms to this compliant frontier, and it’s refreshing. No more shadow banking vibes; instead, transparent systems that scale responsibly.

| Blockchain | ISO 20022 Status | Onchain KYC Potential | Use Case Example |

|---|---|---|---|

| XRP (Ripple) | Fully compliant messaging | High – oracle integrations | Cross-border payments with verified senders |

| XLM (Stellar) | Compliant for payments | Medium – attestation schemas | Remittances tied to residency proofs |

| QNT (Quant) | Overledger supports standards | High – multi-chain attestations | Enterprise interoperability gates |

| ALGO (Algorand) | API layers for ISO | Medium – ZKP friendly | Tokenized assets with accreditation |

| XDC Network | Native ISO messaging | High – trade finance focus | Supply chain with KYCed suppliers |

This table underscores why these networks lead. Each offers unique strengths for KYCed addresses verification, from Ripple’s speed to Quant’s connectivity. Blockpass’s On-Chain KYC® 2.0 fits neatly, issuing attestations that decay over time, prompting re-verification to catch changes like address relocations.

Challenges persist, of course. Oracle reliability remains key; a false positive could freeze funds unjustly. Yet Chainlink’s SOC 2 and ISO 27001 badges mitigate this, building oracle trust parallel to attestation validity. Privacy frameworks like PACT further insulate users, exposing only API-compliant snippets to legacy systems.

For allowlist managers and token sale operators, this convergence means gated communities with real teeth. Verify once, access everywhere: DeFi yields, NFT drops, airdrops, all gated by portable proofs. OnchainKYCe. me exemplifies this by focusing on interoperable credentials, empowering projects to onboard institutions without compromising decentralization. Check out how onchain attestations empower KYCed addresses for DeFi allowlists and token sales for deeper dives.

As ISO 20022 adoption accelerates through 2026 mandates, blockchain platforms embedding onchain KYC attestations will capture the lion’s share of hybrid finance flows. This isn’t about regulation stifling innovation; it’s tooling that unlocks trillions in sidelined capital. Patient builders who prioritize ISO 20022 blockchain compliance today position for tomorrow’s dominance, blending Web3’s permissionless ethos with TradFi’s rigor.