In the bustling world of DeFi, where innovation meets regulation, projects are racing to balance open access with essential compliance. With Ethereum trading at $1,970.83 and showing a solid and 0.94% gain over the last 24 hours, the sector’s momentum underscores the need for efficient tools. Enter onchain KYC attestations: a game-changer for verifying addresses without the endless paperwork shuffle. Platforms like OnchainKYCe. me make it possible to issue secure, reusable proofs for KYCed addresses verification, letting users slip seamlessly into DeFi allowlists onchain.

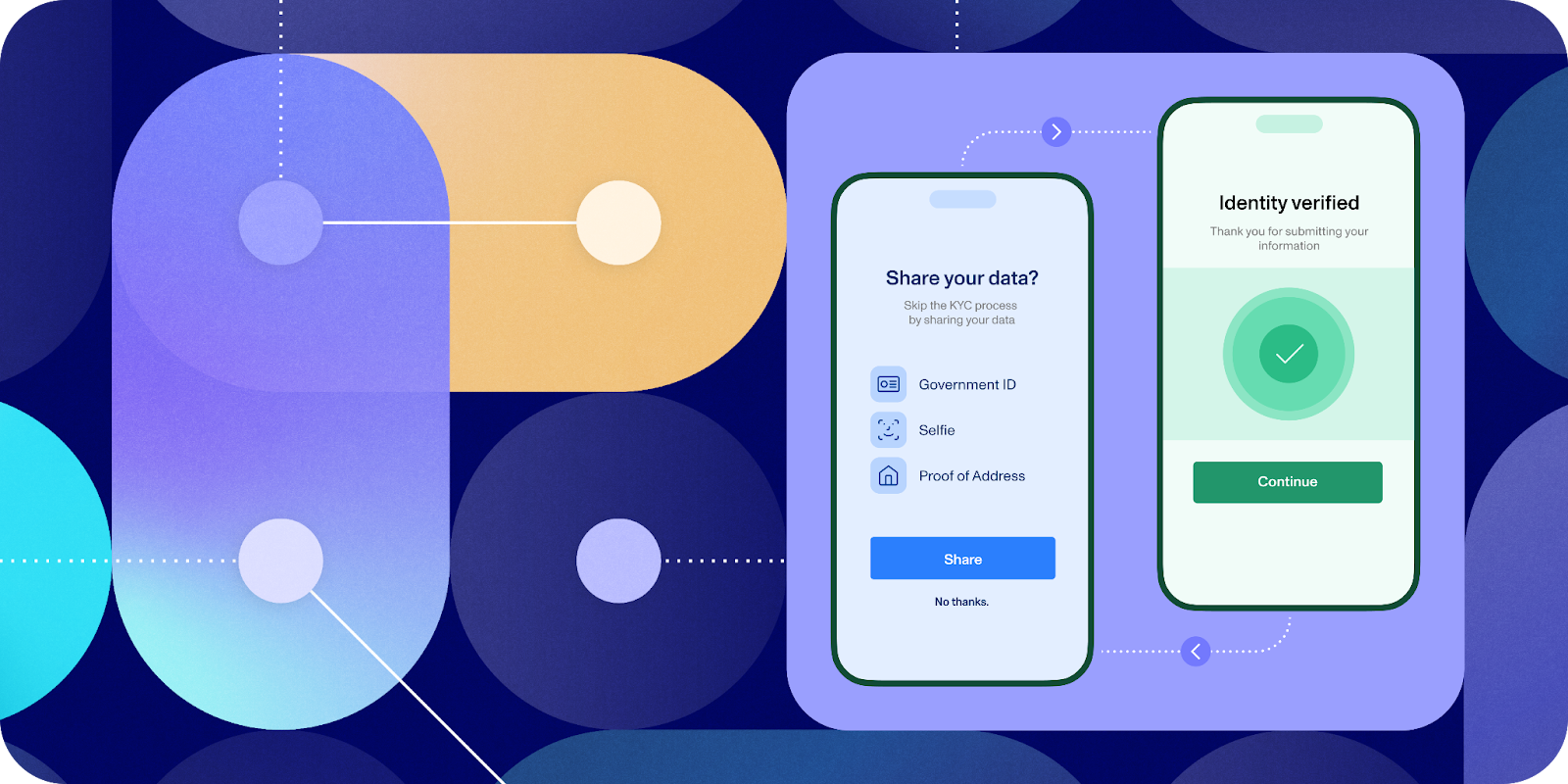

This approach isn’t just hype. As DeFi platforms expand, traditional KYC processes bog down users and teams alike. Imagine completing verification once and reusing it across token sales, gated pools, and communities. That’s the promise of Web3 KYC proofs and blockchain identity attestations, powered by protocols like Ethereum Attestation Service (EAS) and Blockpass’s On-Chain KYC 2.0.

Why Permissioned DeFi Demands Smarter Verification

DeFi started wild and permissionless, but maturity brings scrutiny. Regulators want safeguards against illicit activity, while users crave privacy. Onchain identity solutions, as Chainlink explains, let protocols allowlist addresses vetted by trusted providers. This births “permissioned DeFi” pools, where only verified participants join high-stakes opportunities.

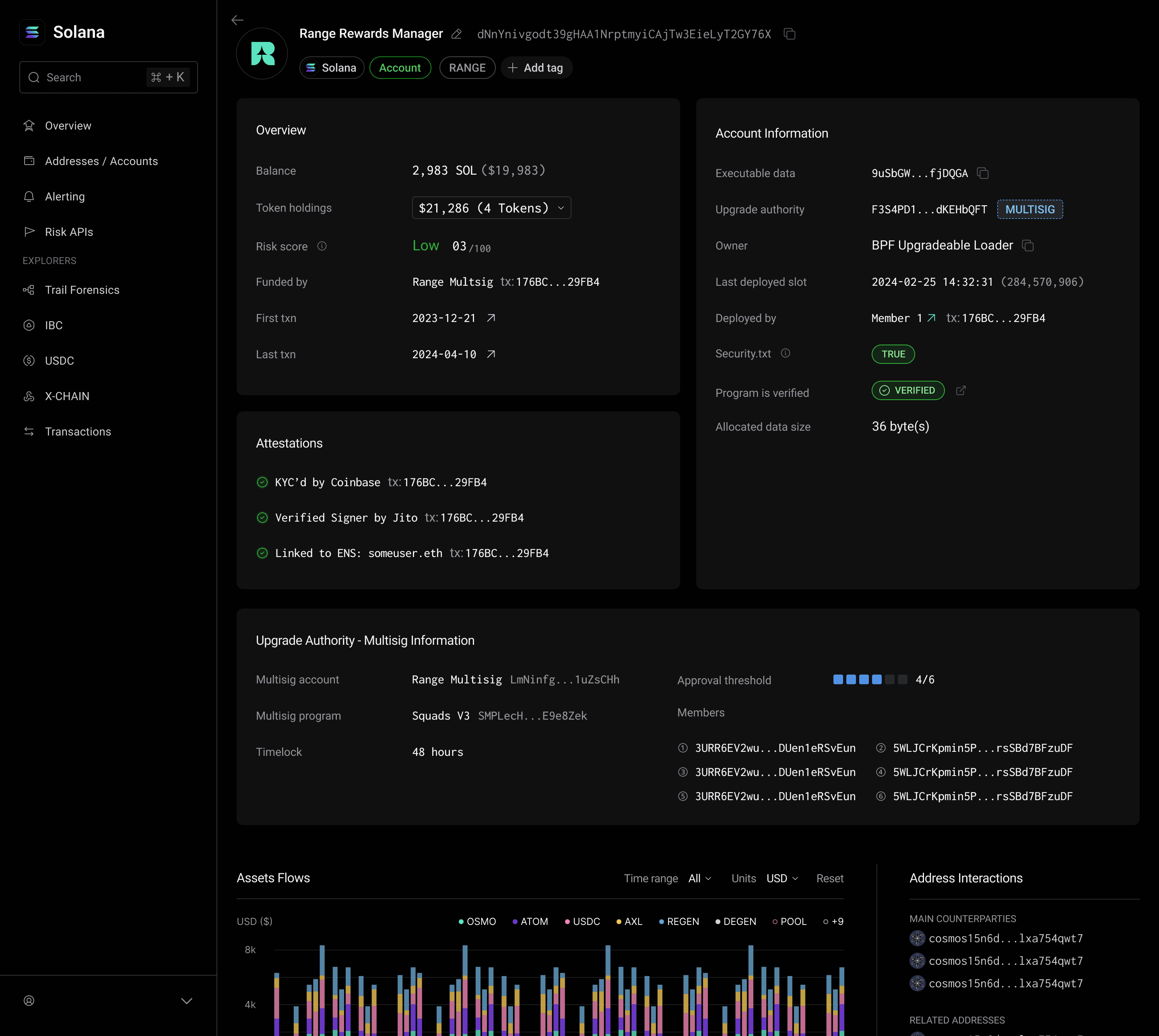

Take Sybil resistance: ERC-5851 highlights how on-chain verifiable credentials prevent one-person-many-wallets tricks, crucial for fair governance or airdrops. Without this, allowlists crumble under fake sign-ups. OnchainKYCe. me steps in with interoperable attestations across Ethereum and Solana, ensuring your project stays compliant without silos.

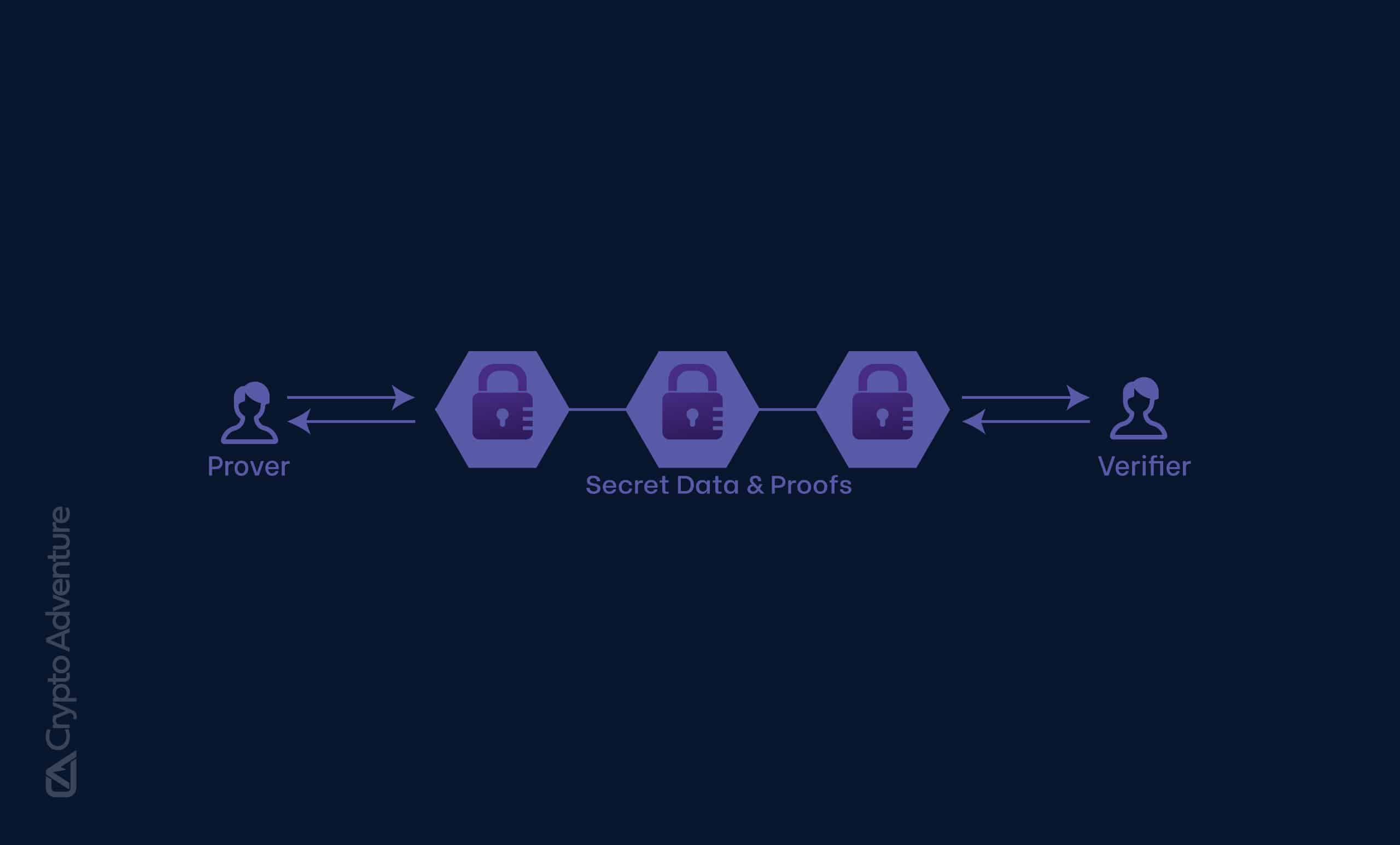

Onchain KYC verifies identities using smart contracts and oracles, bridging off-chain trust to on-chain action.

I’ve seen traders miss launches due to clunky verifications. Now, with reusable attestations, preparation meets opportunity faster. Patience pays when your address is pre-KYCed.

Privacy shines here. Verifiable credentials attest attributes like “KYC complete” sans PII exposure. Ethereum. org notes these live in registry smart contracts, mapping proofs to addresses tamper-proof.

For allowlist managers, this means automated gates. Smart contracts check for valid attestations before mints or stakes. ONCHAINID adds trusted third-party signs from banks or IDs, boosting credibility.

Building Trust in DeFi with Frictionless Onboarding

Friction kills adoption. Repeated KYC? Users bounce. Onchain solutions fix this. A single attestation from OnchainKYCe. me verifies your address for multiple projects. DeFi teams integrate via simple API calls or contract reads, slashing ops costs.

Consider token sales: Verify once, access all. Or gated communities: Attestations ensure real humans, not bots. Chainwire reports On-Chain KYC 2.0 works across chains, so Solana projects tap Ethereum proofs effortlessly.

This isn’t theoretical. With ETH holding strong above $1,970, projects leveraging these tools attract serious capital. I’ve advised teams: Embed onchain attestations early; it future-proofs your allowlist. Users feel supported, not surveilled.

Next, we’ll dive into implementation steps and real-world wins, but first, grasp why this shift feels inevitable in our maturing ecosystem.

As Ethereum maintains its position at $1,970.83 with a 0.94% uptick, DeFi builders who prioritize verified access gain an edge in this compliant era. Tools like OnchainKYCe. me turn complex verifications into straightforward onchain actions, paving the way for scalable growth.

Practical Steps for DeFi Teams to Launch Verified Allowlists

Getting your project onchain-ready starts with choosing a reliable attestation platform. OnchainKYCe. me integrates seamlessly with EAS schemas, letting you define KYC attributes once and deploy across chains. First, register a schema for attributes like residency or accreditation status. Then, vetted users receive signed attestations tied to their addresses, queryable by any smart contract.

This setup shines for token sales, where DeFi allowlists onchain prevent oversubscription by bots. I’ve watched launches falter from unverified crowds; now, contracts auto-filter for KYCed addresses verification, ensuring fair distribution. Pair it with zero-knowledge proofs from providers like 0xKYC, and you verify liveness without data leaks.

Customization fits every need. Gated communities use it for member-only DAOs, while lending protocols restrict high-leverage pools to attested users. Solana compatibility means Ethereum-verified addresses port over, dodging chain-specific hurdles. Check out building secure allowlists for deeper tactics.

Top 5 Onchain KYC Benefits

-

Reduced Onboarding Friction: Reuse KYC proofs across DeFi apps with Blockpass On-Chain KYC® 2.0, verifying once for seamless access.

-

Enhanced Privacy: Selective disclosure via zero-knowledge proofs like 0xKYC, sharing only what’s needed without exposing data.

-

Sybil Resistance: Fair airdrops and governance with one-person-one-vote attestations, powered by ERC-5851.

-

Cross-Chain Interoperability: Seamless use on Ethereum and Solana via Sign Protocol and EAS.

-

Cost Savings: Automate compliance checks with smart contracts and Chainlink oracles, eliminating manual processes.

Real-world adoption proves the model. Blockpass’s On-Chain KYC 2.0 has empowered projects to issue credentials that live on or off chain, reusable indefinitely. Cube Exchange leverages attestations for secure Web3 identity, attesting KYC without full data dumps. Sign Protocol’s omni-chain layer lets anyone verify info tamper-free, from self-attestations to bank-signed proofs.

These aren’t edge cases; they’re the blueprint. A DeFi protocol I consulted integrated EAS attestations, cutting verification time from days to minutes. Users appreciated the one-and-done process, sticking around for yields. With ETH’s resilience signaling market confidence, now’s prime time to upgrade your stacks.

Overcoming Challenges and Maximizing Impact

Skeptics worry about centralization risks, but decentralized issuers like OnchainKYCe. me distribute trust. No single point fails; oracles and contracts handle verification. Regulatory alignment? Attestations map to global standards, easing audits. Chainlink’s onchain KYC bridges offchain checks perfectly, feeding vetted data into permissioned pools.

For allowlist managers, the win is analytics. Track attestation validity on explorers, revoke if needed, all transparently. This builds lasting trust, drawing institutional flows wary of pure permissionless setups. Explore compliance enhancements to see how it fits token sales too.

Privacy advocates love it: ERC-5851 enables one-person-one-vote sans Sybil attacks, ideal for events or votes. Ethereum. org’s decentralized identity specs ensure attestations stay user-controlled, revocable anytime. It’s empowerment, not exposure.

Forward-thinking projects embed this from day one. OnchainKYCe. me handles issuance, management, and verification, so you focus on yields, not paperwork. Traders like me value the speed: verified addresses mean jumping into opportunities without delays. As DeFi matures alongside Ethereum’s steady climb, blockchain identity attestations and Web3 KYC proofs secure the path ahead, blending openness with accountability.