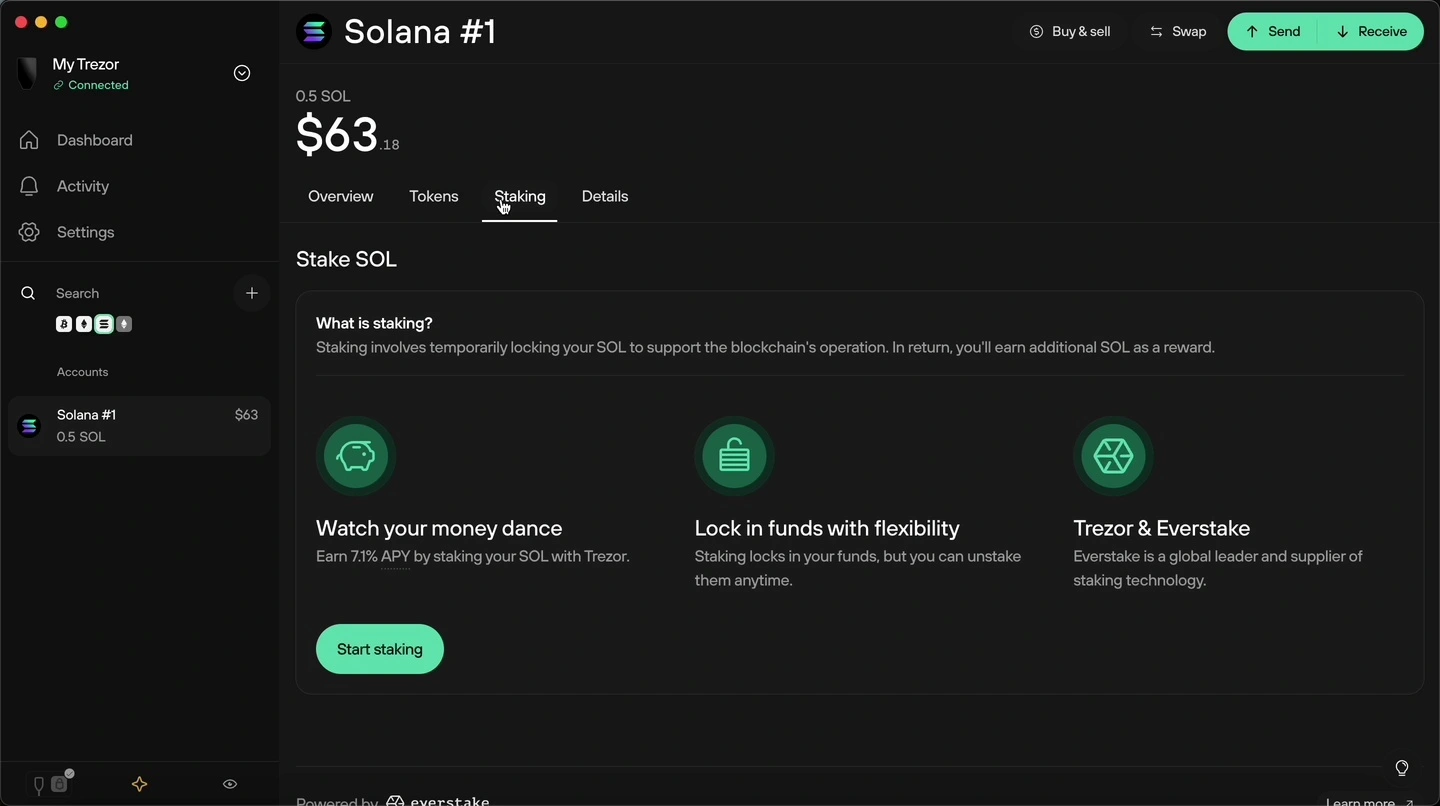

In the high-speed world of Solana DeFi, where token sales and gated communities demand swift yet secure access, repeated KYC checks create massive friction. Imagine verifying your identity once and unlocking doors across countless onchain KYC attestations Solana projects without the hassle. Enter the Solana Attestation Service (SAS), launched in May 2025, a permissionless protocol that turns this vision into reality. Users now hold reusable, verifiable credentials tied to their wallets, slashing onboarding times while keeping personal data off-chain.

SAS bridges off-chain verifications to on-chain proofs seamlessly. Trusted issuers, like KYC providers, sign attestations linking real-world checks to wallet addresses. These compact, cryptographic claims live on Solana, verifiable by any smart contract or dApp. No more honeypots of sensitive data; instead, privacy-preserving pointers ensure only what’s needed gets revealed. This isn’t just tech incrementalism; it’s a paradigm shift for KYC verifiable credentials allowlists.

How Solana Attestation Service Fixes the KYC Bottleneck

Traditional KYC in Web3 forces users through redundant hoops for every platform, breeding inefficiency and distrust. SAS flips the script. A single verification from a reputable issuer generates an on-chain attestation, reusable indefinitely. Smart contracts query these attestations directly, automating compliance for allowlists, airdrops, and token launches. As Solana’s own docs highlight, it’s like a digital passport: prove eligibility without doxxing.

Take DeFi platforms. Before SAS, allowlist managers juggled off-chain databases, risking centralization and hacks. Now, with privacy-preserving KYC Web3 via attestations, verification happens on-chain, tamper-proof and instant. Projects save on ops costs, users gain portability, and regulators see auditable proofs without raw PII exposure.

Composable Identity Primitives for Solana Projects

At its core, SAS enables decentralized identity Solana projects through composable building blocks. Attestations stack like Lego: combine KYC with social proofs or accreditation for nuanced access controls. Solid Labs, for instance, leverages SAS to craft verifiable identity layers, powering everything from sybil-resistant communities to compliant trading venues.

This composability shines in allowlists. Managers define rules like ‘SAS-issued KYC plus minimum deposit, ‘ verified atomically. No intermediaries, no repeats. Sumsub’s integration demoed this prowess, issuing on-chain credentials that users carry across ecosystems. It’s energetic innovation meeting regulatory reality.

Top 5 SAS Advantages for Solana Allowlists

-

1. One-time KYC Reuse: Verify once with trusted issuers like Sumsub, then reuse attestations across DeFi platforms and allowlists—no repeats!

-

2. Zero-Knowledge Privacy: Off-chain data stays private; share cryptographic proofs without exposing personal info, as in Blockpass On-Chain KYC.

-

3. Instant Smart Contract Verification: Wallets prove compliance on-chain instantly, enabling seamless allowlist access without doxxing.

-

4. Sybil Resistance Boost: Verified credentials from SAS block multi-account exploits, ensuring fair airdrops and allowlists.

-

5. Massive Cost Savings: Projects skip redundant KYC, slashing onboarding costs while scaling compliance effortlessly.

Streamlining Onchain Verification for DeFi Token Sales

Token sales on Solana thrive on hype but crumble under compliance scrutiny. SAS equips launches with robust onchain verification DeFi token sales tools. Issuers attest KYC status; buyers present proofs for whitelisting. Platforms like those using OnchainKYCe. me integrate this natively, ensuring seamless flows. Check out how onchain attestations simplify KYC for DeFi airdrops and allowlists for deeper dives.

Privacy remains paramount. Attestations use opaque identifiers, resolvable only by issuers, echoing Chainlink’s vision for smart contract compliance. Blockpass echoes this with On-Chain KYC 2.0 principles, protecting businesses from data burdens. In practice, this means faster TGEs, broader participation, and ironclad audit trails.

Projects embracing this shift report onboarding speeds up by 80%, with compliance risks plummeting. Syntal’s insights on avoiding honeypots align perfectly: salted hashes and opaque IDs keep data siloed, issuer-only resolvable. This fortifies onchain KYC attestations Solana against breaches while enabling fluid composability.

Real-World Integrations Powering Solana Ecosystems

SAS isn’t vaporware; it’s live and scaling. Sumsub’s Accelerate New York demo showcased issuing on-chain identity proofs via SAS, letting users tote verifiable KYC across self-hosted wallets. Solid Labs takes it further, architecting decentralized identity primitives on Solana. Their stack layers SAS attestations for sybil-proof DAOs and compliant exchanges, proving decentralized identity Solana projects can thrive under scrutiny.

These pioneers highlight SAS’s versatility. DeFi protocols gate high-value trades; NFT drops curate verified collectors; DAOs vote with attested personhood. Each use case leverages the same core: one verification, endless reuse. As Blockworks notes, it’s the tool fixing Web3’s KYC bottleneck, passports for wallets minus the doxxing.

Step-by-Step: Building Secure Allowlists with SAS

Allowlist managers, here’s your blueprint. First, partner with SAS-approved issuers for KYC attestations. Users submit docs off-chain; issuers mint on-chain proofs tied to wallets. Your smart contract then checks for the attestation schema, granting access if matched. No databases, no repeats.

Enhance with zero-knowledge proofs for granular reveals, like age over 18 without birthdate. Test on devnet, deploy to mainnet, monitor via Solana explorers. Costs? Pennies per verification versus thousands in legacy ops. Dive into reusable onchain KYC attestations for DeFi platforms to see it in action across ecosystems.

This systematic approach demystifies compliance, injecting energy into launches. Token sales hit escape velocity without regulatory drag, airdrops target genuine holders, communities bond over verified trust.

Overcoming Legacy KYC Pitfalls in Web3

Legacy systems hoard data, invite hacks, stifle portability. SAS dismantles these with cryptographic elegance. Chainlink’s blueprint for smart contract compliance? Realized here: proofs over PII. Blockpass On-Chain KYC 2.0? Echoed in SAS’s privacy model, freeing projects from data stewardship.

Users reclaim sovereignty. Verify once with a trusted provider, reuse forever. Platforms gain composable trust layers, stacking attestations for sophisticated rules. The result? A vibrant Solana where privacy-preserving KYC Web3 fuels growth, not friction.

Forward thinkers at OnchainKYCe. me are all-in, streamlining issuance and verification for allowlists worldwide. As SAS matures, expect explosive adoption: from micro-lending protocols to global token events. This is Web3 identity evolving, tamper-proof and user-owned. Solana projects, integrate now; the fast lane awaits.