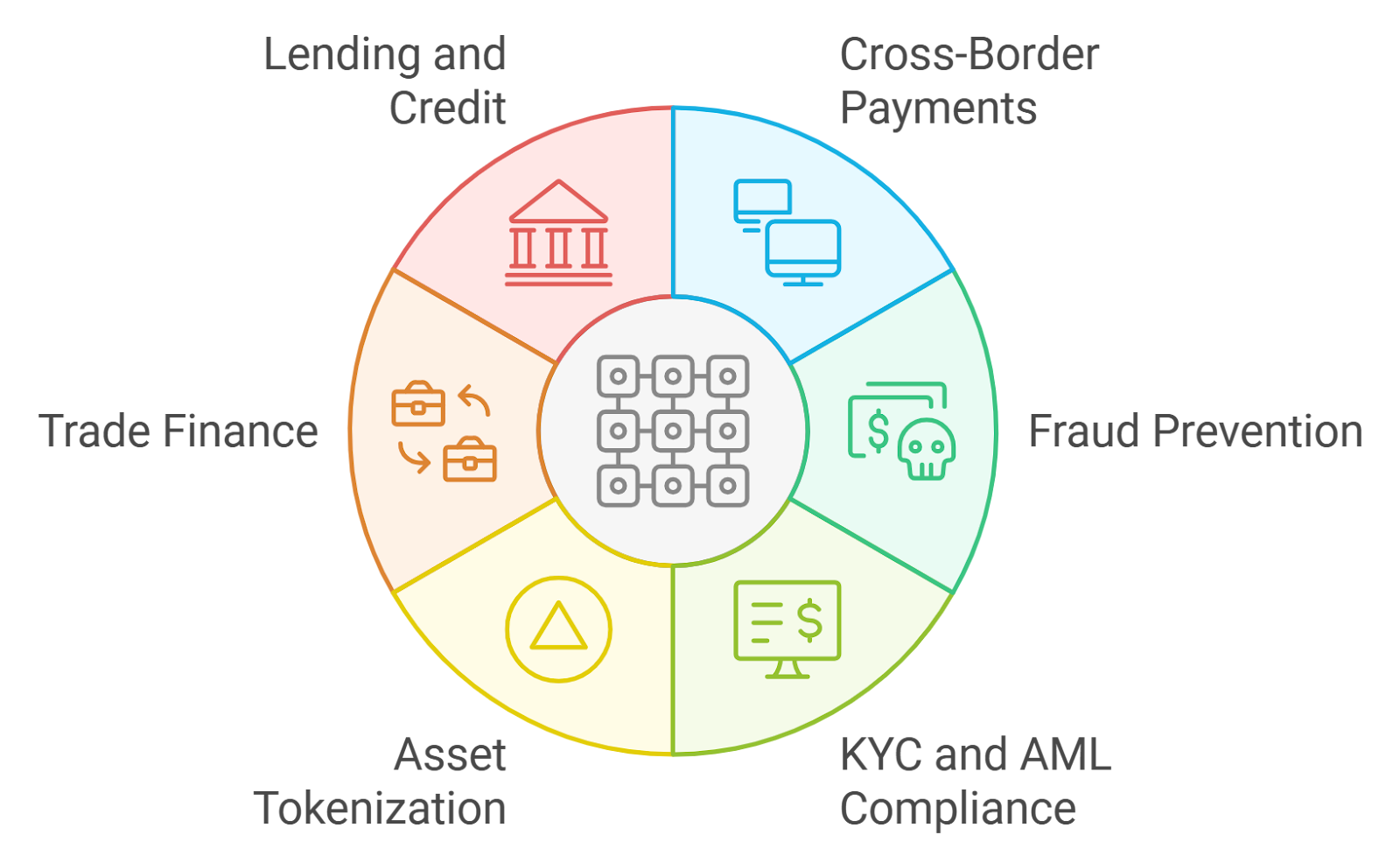

In the high-stakes arena of DeFi by 2026, projects face a relentless tug-of-war: deliver ironclad compliance to appease regulators while shielding users’ sacred privacy. Enter onchain KYC attestations, the game-changing protocol flipping this script. These verifiable credentials, etched immutably on blockchain, let KYCed addresses prove humanity and eligibility without doxxing personal details. Imagine seamless allowlists for token launches, airdrops, and gated protocols, all powered by privacy-first tech like zero-knowledge proofs and soulbound tokens. No more clunky off-chain databases or repeated identity uploads; this is Web3 identity, matured and weaponized for scale.

![]()

DeFi’s explosive growth demands smarter gates. Traditional KYC? A nightmare of centralized honeypots, ripe for hacks and data leaks. Onchain alternatives, drawing from pioneers like Blockpass’s On-Chain KYC 2.0 and 0xKYC’s zero-knowledge liveness checks, flip the model. Users complete verification once, receive a non-transferable attestation, and flash it across chains. Protocols verify instantly via smart contracts, slashing costs and friction. It’s not just efficient; it’s a strategic edge in a compliance-crushed landscape.

Soulbound Tokens Anchor Non-Transferable Proofs of Identity

Soulbound Tokens (SBTs), Vitalik Buterin’s brainchild, form the bedrock here. Unlike fungible ERC-20s or tradeable NFTs, SBTs stick to your wallet like glue, embodying credentials that scream ‘this is me, verified. ‘ Standards like ERC-4973 standardize them across EVM chains, enabling KYCed addresses verification without soul-selling privacy. Cube Exchange nails it: SBTs prove personhood, professional creds, or regulatory nods onchain, risks be damned.

Real talk: SBTs sidestep sybil attacks plaguing pseudonymous blockchains. A DeFi project can require an SBT-backed attestation for allowlist entry, confirming you’re not a bot farm. Benefits stack high – interoperability via protocols like Sign Protocol’s omni-chain attestations, where anything gets signed and verified onchain. Risks? Revocation mishaps or oracle dependencies, but revocable designs from projects like OnchainKYCe. me mitigate that, ensuring credentials expire or update dynamically.

Core SBT Advantages for DeFi

-

Immutable yet revocable proofs: SBTs lock verifications on-chain forever, with revocation via smart contracts or protocols like Sign Protocol, balancing permanence and control.

-

Zero personal data exposure: ZK proofs enable verification without PII leaks, powering privacy tools like 0xKYC attestations for DeFi.

-

Cross-chain portability: Omni-chain standards make SBTs portable across ecosystems, as in Sign Protocol for seamless DeFi allowlists.

-

Sybil resistance: Non-transferable SBTs tie proofs to unique souls, thwarting fake accounts in DeFi networks.

-

Cost savings over repeated KYC: Reusable SBTs from Blockpass On-Chain KYC 2.0 eliminate redundant checks, slashing compliance expenses.

This isn’t theory. Base’s verifications let you attest Coinbase linkage without leaks, while J. P. Morgan’s Project EPIC encrypts AML/KYC onchain for institutional flows. By 2026, expect SBTs as standard for DeFi allowlist attestations, powering everything from yield farms to DAO voting.

Zero-Knowledge Magic Unlocks Compliant Privacy

Privacy without compromise demands zero-knowledge proofs (ZKPs), the cryptographic sorcery making privacy-preserving KYC Web3 viable. Tools like 0xKYC deliver liveness checks and proof-of-personhood attestations, where verifiers confirm traits (over 18? US resident?) sans revealing how. Zyphe’s blockchain ID verification nails FATF compliance via Decentralized Identifiers (DIDs) and verifiable credentials, a blueprint for DeFi.

Systematically, it works like this: User submits ID to a trusted attester (think OnchainKYCe. me). ZKP generates a compact proof. Smart contract queries: ‘Does this address hold a valid KYC SBT?’ Yes/no, no metadata. Riseworks highlights seven apps, from hiring to global pros, but DeFi steals the show – secure allowlists minus data sprawl.

DeFi Allowlists Evolve: From Gates to Smart Filters

Picture 2026 DeFi: Token sales demand KYCed wallets, yet pseudonyms rule. Onchain attestations bridge this via revocable onchain credentials. Joba Network envisions professional profiles backed by achievement proofs; extend that to compliance badges. Blockpass’s reusable digital identities let one verification fuel endless verifications, transforming allowlist management.

Energetically, this scales. No more Excel hell for project teams. Integrate via APIs, query attestations in real-time. For airdrops, filter blockchain identity proofs 2026 style – accredited? Geofenced? All onchain, auditable, private. FF News spotlights On-Chain KYC 2.0’s empowerment; pair it with Sign Protocol, and you’ve got an attestation flywheel.

Projects like OnchainKYCe. me lead the charge, issuing revocable onchain credentials that projects query without storing a shred of PII. This flywheel crushes legacy KYC’s drag, unlocking trillion-dollar DeFi flows compliant yet borderless.

This systematic approach empowers allowlist managers to filter high-value users – accredited investors for token sales, geo-compliant for yields – all while users retain control. Revocation endpoints let attestations self-destruct on demand, dodging stale credential pitfalls. Energetically, it’s a force multiplier: one-time effort, infinite reuse.

Overcoming Hurdles: Revocation, Interop, and Adoption

Skeptics flag risks: What if a hacked wallet flashes a stolen attestation? Counter with multi-sig issuance and liveness proofs, as 0xKYC enforces. Interoperability shines via universal standards – DIDs from Zyphe mesh seamlessly with Base verifications. Adoption accelerates with tools like Blockpass’s reusable IDs, already transforming Web3 pros per Riseworks and Joba Network.

Regulatory tailwinds propel this forward. FATF nods to verifiable credentials mean DeFi sidesteps outright bans, proving compliance onchain. J. P. Morgan’s EPIC prototypes encrypted AML lists; scale that to public DeFi, and you’ve got institutional-grade gates minus the suits. Challenges persist – oracle reliability, chain fragmentation – but layered solutions like optimistic revocation and layer-2 scaling dissolve them.

OnchainKYCe. me exemplifies this resilience, offering secure attestations tailored for token sales and gated communities. Users prove KYCed addresses verification across ecosystems, projects verify in milliseconds. It’s not hype; it’s the infrastructure upgrade DeFi craves in 2026.

2026 Horizon: Allowlists as Economic Engines

Fast-forward: DeFi allowlist attestations evolve into dynamic filters, not static lists. AI-augmented contracts score users onchain – risk profiles, activity history – all privacy-wrapped. Pair with professional onchain identities from Joba, and DAOs vote with verified humanity. Yield protocols tier access: basic for anon, premium for attested. Airdrops target genuine holders, slashing mercenary capital.

This unlocks asymmetric plays. Projects bootstrap trust at warp speed, attracting TVL from timid institutions. Users? Sovereign control over their blockchain identity proofs 2026, monetizing creds across apps without resubmits. Cube Exchange’s SBT guide underscores the shift: Web3 identity matures from gimmick to necessity.

Vision crystallized: Onchain KYC attestations forge privacy-preserving DeFi allowlists that scale with ambition. No more trade-offs between compliance and crypto ethos. Dive in via platforms like OnchainKYCe. me, and position your project – or portfolio – at the vanguard. The chains await verified pioneers.