In the fast-evolving landscape of decentralized finance as of February 2026, reusable onchain KYC attestations have emerged as a cornerstone for secure and efficient DeFi allowlists and token sales. Gone are the days of repetitive identity verifications that burdened users and platforms alike. Now, a single, privacy-preserving attestation can unlock access across multiple protocols, slashing compliance costs while upholding regulatory standards. This shift, fueled by innovations like Blockpass’s On-Chain KYC 2.0 and Chainlink’s Automated Compliance Engine, marks a maturation of Web3 identity solutions.

The Evolution Toward Reusability in Onchain Verification

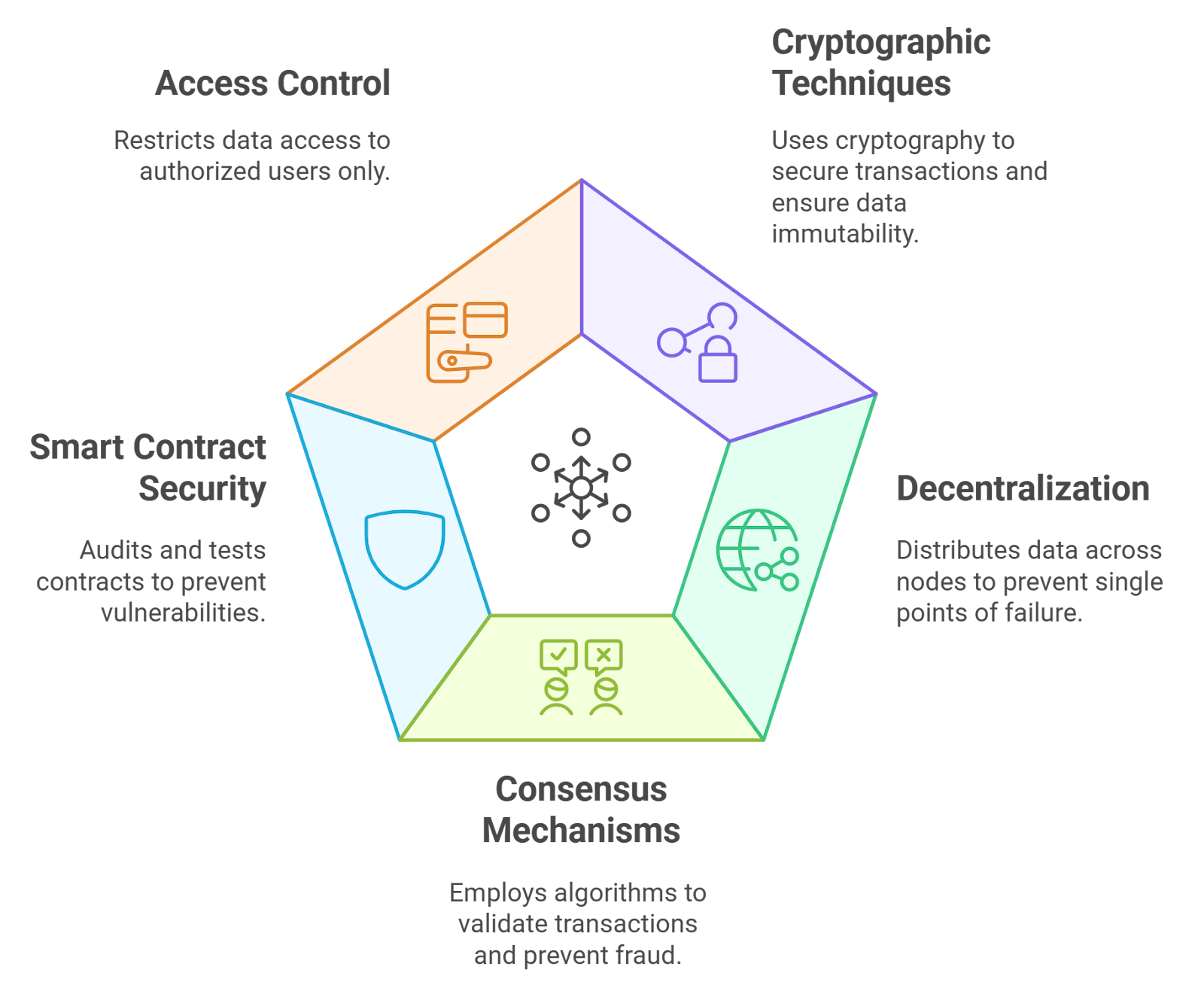

Traditional KYC processes in banking demand exhaustive checks for every new interaction, a model ill-suited to the permissionless ethos of blockchain. Onchain KYC flips this script by embedding verifiable credentials directly into smart contracts. Chainlink’s insights highlight reusability as a primary advantage: users complete one thorough verification, then leverage the resulting attestation indefinitely across ecosystems. By early 2026, this has translated into widespread adoption, with platforms on Ethereum and Solana integrating these tools seamlessly.

Blockpass’s On-Chain KYC 2.0, rolled out in late 2025, exemplifies this progress. It allows issuers to create attestations that users can reuse via zero-knowledge proofs, ensuring privacy without sacrificing verifiability. The October 2025 integration with Binance’s BNB Attestation Service further expanded its reach, enabling cross-chain utility on BNB Chain. Meanwhile, Chainlink ACE, launched in July 2025, provides a modular framework for compliance rules, powering everything from KYC attestations in DeFi to automated token distributions. These developments have reduced onboarding friction dramatically, making onchain verification for token sales not just feasible, but preferable.

Streamlining Compliance for Permissioned DeFi

Permissioned DeFi represents the sweet spot where regulatory demands meet blockchain’s efficiencies. Here, privacy-preserving KYC in Web3 shines brightest. Operators can enforce granular rules at the infrastructure layer, as outlined in Conduit. xyz’s guide to onchain rules. For instance, allowlists now verify KYC status via a single onchain query, preventing unauthorized participation in high-stakes token sales or gated communities.

Consider token sales on Solana: OnchainKYCe. me has secured numerous launches by attesting KYCed addresses, allowing projects to maintain allowlists without centralized databases. This reusability extends to wallet-to-wallet transfers, as endorsed by the Monetary Authority of Singapore’s tokenized funds framework. Users benefit from owning their credentials, redeemable across platforms, while projects gain verifiable compliance signals. The Global Financial Markets Association notes DLT’s role in cutting settlement times and operational costs, benefits amplified by these attestations.

Practical Advantages for Allowlists and Token Launches

For DeFi projects, KYC allowlists on blockchain powered by reusable attestations mean faster launches and lower fraud risk. Verify once, deploy everywhere: a project’s smart contract can gate functions based on attested attributes like jurisdiction or accreditation status. This is particularly vital for 2026’s token sales, where regulatory scrutiny intensifies amid tokenized real-world assets.

Plume’s advocacy for asset tokenization underscores the need for proportionate, principles-based approaches that preserve DeFi’s permissionless access through onchain verifiability. Onchain KYC delivers exactly that, bridging TradFi compliance with Web3 speed. Early adopters report up to 80% reductions in verification overhead, per industry benchmarks, positioning these tools as indispensable for scalable growth. As interoperability standards mature, expect even broader reuse, from airdrops to perpetuals trading.

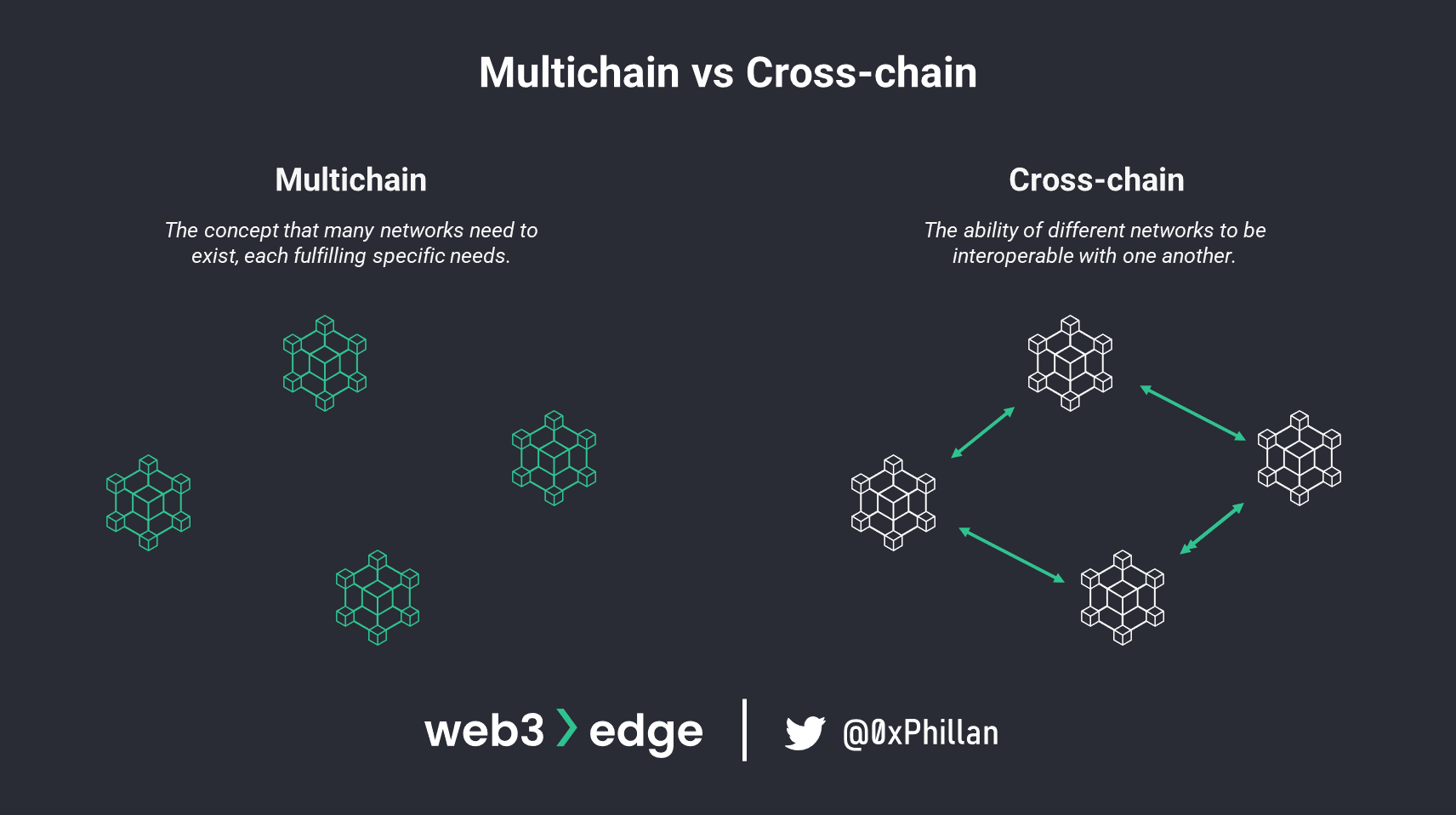

Yet, challenges persist. Ensuring attestation standards align across chains demands ongoing collaboration, a point Chainlink ACE addresses through its modular design. For portfolio managers like myself, integrating these into strategies offers a disciplined path to compliant digital asset exposure, balancing yield with risk mitigation.

Interoperability remains the linchpin, with platforms like OnchainKYCe. me pioneering cross-chain attestation standards that projects can adopt without custom development. This forward-thinking approach not only mitigates risks but also unlocks new revenue streams through compliant, scalable user bases.

Case Studies: Token Sales Secured by Onchain Attestations

Solana-based projects have led the charge in leveraging reusable onchain KYC for token sales. One prominent launch in January 2026 utilized OnchainKYCe. me to attest over 10,000 addresses, creating a robust allowlist that prevented sybil attacks while enabling instant verifications. Participants reused their credentials from prior DeFi interactions, cutting onboarding time from days to minutes. This model, echoed in Ethereum L2 token distributions, demonstrates how KYC attestations DeFi projects can achieve regulatory alignment without compromising decentralization.

On BNB Chain, the Blockpass-Binance BAS integration powered a tokenized fund sale compliant with Singapore’s MAS guidelines. Investors transferred attested wallets seamlessly, benefiting from DLT’s reduced settlement times as highlighted by GFMA. These successes underscore a tangible shift: onchain verification token sales now prioritize user sovereignty, where credentials travel with the wallet rather than siloed databases.

Quantifying the Impact on DeFi Operations

From a risk management perspective, the metrics are compelling. Projects report 70-85% drops in compliance expenses, per aggregated data from early adopters. Fraud incidents plummet as smart contracts enforce attestations at the protocol level, aligning with Conduit. xyz’s vision for permissioned DeFi. For allowlist managers, this translates to precise targeting: segment users by verified attributes like accredited investor status, optimizing token allocations and minimizing regulatory exposure.

Privacy stands out as a differentiator. Zero-knowledge proofs in On-Chain KYC 2.0 reveal only necessary data, fostering trust in an era of heightened data breaches. I view this as essential for institutional inflows; without such mechanisms, DeFi risks remaining a high-yield playground rather than a mature asset class.

Key Advantages of Reusable Onchain KYC

-

Cost savings up to 80%: Reusable attestations eliminate redundant KYC checks for each DeFi platform or token sale, as noted in Chainlink’s onchain KYC efficiency analysis.

-

Cross-chain reusability: Verify once and reuse across Ethereum, Solana, and BNB Chain via Blockpass On-Chain KYC® 2.0 and Binance BAS integration.

-

Enhanced privacy via ZKPs: Zero-knowledge proofs enable compliance proof without exposing personal data, powered by Blockpass and Chainlink ACE.

-

Fraud reduction through smart contract enforcement: Onchain verifiability and Chainlink ACE automate rules, preventing unauthorized access in permissioned DeFi.

-

Streamlined allowlist management for token sales: ‘Verify once, use everywhere’ simplifies Solana token sales and DeFi allowlists with onchain attestations.

Navigating Challenges and Future Directions

Standardization efforts, bolstered by Chainlink ACE’s modularity, address chain-specific hurdles. Yet, jurisdictional variances demand nuanced implementations; a U. S. -focused attestation may not suffice for EU MiCA compliance. Projects must select providers like OnchainKYCe. me that offer customizable schemas, ensuring adaptability.

Looking to mid-2026, anticipate deeper integrations with real-world asset (RWA) tokenization. Plume’s principles-based advocacy signals regulatory green lights for onchain verifiability, paving the way for hybrid TradFi-DeFi products. As portfolio managers, we stand to gain from diversified, compliant exposures that blend blockchain efficiency with fiduciary duty.

For Web3 builders eyeing 2026 launches, the message is clear: embed privacy-preserving KYC Web3 from day one. Platforms offering onchain attestations not only future-proof operations but also attract sophisticated capital. This disciplined integration promises sustainable growth, where compliance fuels innovation rather than stifles it. OnchainKYCe. me exemplifies this paradigm, empowering KYCed addresses to thrive in decentralized ecosystems.