In the fast-evolving world of Web3, allowlists are the gatekeepers for exclusive drops, token sales, and DeFi platforms. But as regulators tighten the screws on compliance, projects face a tough choice: enforce Web3 allowlist KYC or risk shutdowns. Enter onchain KYC attestations, a game-changer that lets users prove they’ve cleared KYC hurdles without doxxing their identities on the blockchain. This privacy-first approach aligns decentralization with real-world rules, making secure verification feel seamless.

Key Benefits of Onchain KYC

-

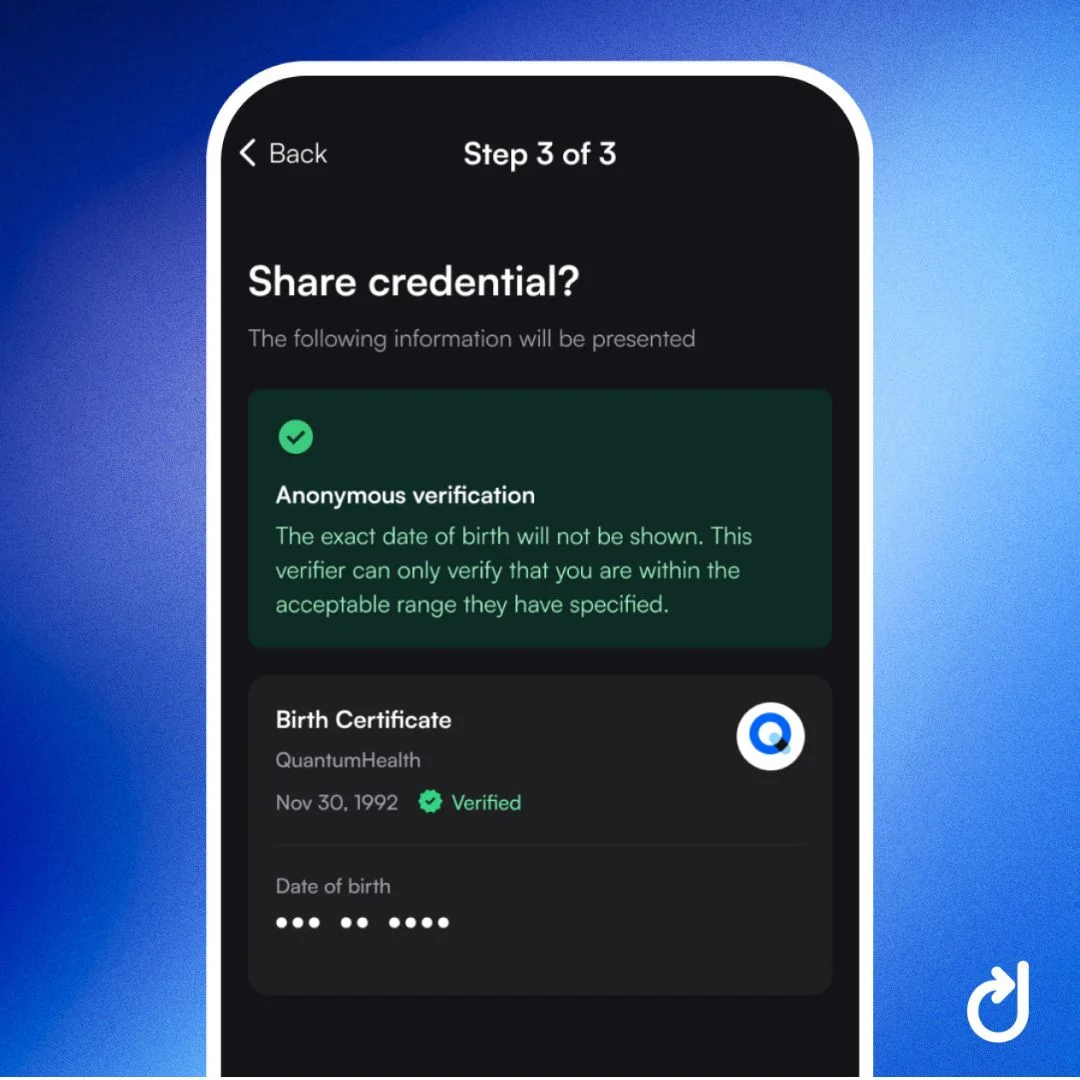

Privacy Preservation: Users prove KYC compliance without revealing sensitive data using zero-knowledge proofs (ZKPs) or self-sovereign identity (SSI).

-

Reusability: One-time verification creates reusable on-chain attestations, like SoulBound NFTs from SuiVerify or credentials from Blockpass On-Chain KYC® 2.0.

-

Regulatory Compliance: Enables secure allowlists for DeFi and RWAs, meeting KYC/AML needs without storing user data in-house.

-

Interoperability: Attestations work across chains and dApps, as supported by Chainlink ACE and multi-chain providers like Altme.

-

Sybil Resistance: Prevents fake accounts via zero-knowledge liveness verification from solutions like 0xKYC.

I’ve seen countless projects scramble with off-chain KYC databases that leak data or demand repeated verifications. As a former fintech product manager who’s navigated these waters, I can tell you: traditional methods are clunky relics in a blockchain era. They store sensitive info centrally, invite hacks, and frustrate users who value pseudonymity. Onchain attestations flip the script by issuing blockchain verifiable credentials that live on-chain but reveal nothing extraneous.

Navigating the Privacy-Compliance Tightrope

Web3 was born from a rebellion against Big Brother surveillance, yet here we are, balancing DeFi privacy KYC with anti-money laundering mandates. Allowlists for regulated token sales or RWA platforms must exclude unverified users, but plastering passports on-chain? That’s a non-starter. Solutions like zero-knowledge proofs (ZKPs) and self-sovereign identity (SSI) let you attest to being over 18 or an accredited investor without sharing your birthdate or net worth.

Take the tension in DeFi: projects want open access, regulators want oversight. Onchain KYC attestations power KYC compliance by offloading verification to trusted issuers while keeping proofs lightweight and reusable. Users verify once, then flash their credential across chains. No more faxed IDs or endless form-filling.

Breaking Down Leading Onchain KYC Providers

Let’s get practical. The landscape is heating up with tools tailored for KYCed addresses verification. Blockpass On-Chain KYC® 2.0 stands out for its granular attestations: prove AML compliance or investor status on multiple networks without on-chain personal data. Altme blends SSI with NFTs, minting soulbound tokens post-KYC that gatekeep allowlists effortlessly.

SuiVerify offers a one-time check yielding a SoulBound NFT, encrypted end-to-end for cross-service use. 0xKYC leverages ZK liveness to squash Sybil attacks, proving humanity via proofs alone. zkMe’s zkKYC verifies attributes like residency privately, while Attest Protocol simplifies integration with one line of code, SOC 2 compliant and audited.

These aren’t pie-in-the-sky; they’re battle-tested for real allowlists. Imagine a DeFi launchpad: users connect wallet, present attestation, join instantly. Projects save on dev time, users retain control.

Ready to build? Start by picking a provider matching your stack. For Ethereum or L2s, Blockpass or Chainlink ACE shine with cross-chain proofs. Audit the issuer’s security, then integrate via SDKs. Users KYC off-chain, receive attestation on-chain. Your smart contract queries the attestation schema: does this address hold a valid KYC credential? If yes, grant access. This enables secure KYC verification without central honeypots. Pro tip: combine with Chainlink for oracle-backed compliance across ecosystems. The beauty? Reusability. One attestation fuels airdrops, vaults, even RWAs. Projects like those using onchain attestations for KYCed addresses report smoother UX and fewer compliance headaches. It’s not just tech; it’s trading psychology applied to identity – trust earned through verifiable scarcity. Users hate re-verifying, and devs hate building from scratch. That’s where standards like ERC-4361 or EAS (Ethereum Attestation Service) come in, standardizing how blockchain verifiable credentials are issued and checked. Pair them with providers, and you’ve got a plug-and-play system for Web3 allowlist KYC. Once integrated, test rigorously. Simulate Sybil attacks or expired creds to ensure your gates hold. I’ve managed products where poor UX killed adoption – don’t let verification be that friction point. Make it as simple as signing a message. Not all tools are equal. Some excel in speed, others in multi-chain support. Attest Protocol wins for no-code ease, ideal for solo devs rushing an NFT drop. Blockpass offers the most attestations – from KYB for DAOs to age gates for gaming. Altme’s wallet-native approach suits mobile-first users, while 0xKYC crushes bot prevention in high-stakes airdrops. SuiVerify shines on its native chain for RWAs, zkMe for pure ZKP purists. Pick based on your audience: retail traders need quick proofs, institutions want audit trails. Chainlink ACE adds oracle reliability for cross-chain drama. This matrix isn’t exhaustive, but it cuts through hype. My take? Start with Blockpass if you’re multi-chain; it’s the workhorse I’ve seen scale in fintech analogs. Implementation sounds straightforward, but landmines lurk. First, issuer trust: vet their compliance history. A hacked provider poisons your whole allowlist. Second, expiration handling – creds aren’t eternal; build auto-revoke logic. Third, UX traps: mobile wallets must support proofs without MetaMask fatigue. Regulatory whiplash is real. MiCA in Europe, SEC in the US – design for modularity. Use composable attestations: layer AML on top of basic KYC. From a trading psychology angle, scarcity drives value. Verified allowlists create FOMO for compliant users, boosting participation without broad doxxing. Case in point: RWA platforms issuing reusable permissions post-accreditation. No repeated wealth proofs, just on-chain nods. DeFi vaults gate high-yield pools to KYCed addresses, slashing risk while keeping yields juicy. It’s permissioned DeFi done right – open where possible, locked where required. We’re early. As ZK tech matures, expect wallet-embedded verifiers and AI-assisted compliance. Projects blending onchain attestations with social graphs could redefine trustless communities. Imagine allowlists that evolve: dynamic scoring based on ongoing behavior proofs. For allowlist managers, this is your edge. Ditch spreadsheets for smart contracts. Empower users with portable identities. The Web3 promise – pseudonymity plus accountability – materializes here. Dive in, iterate fast, and watch compliance become a feature, not a bug. Your next token sale deserves gates that scale with the bull run. Provider Showdown: Which Fits Your Project?

Comparison of Top Onchain KYC Providers

Provider

Key Features

Supported Chains

Privacy Method

Integration Ease

Attest Protocol

Streamlined on-chain verification, SOC 2 compliant, regular audits

Multi-chain

On-chain proofs

Very easy 🚀 (single line of code)

Blockpass (On-Chain KYC® 2.0)

Granular attestations (age, investor, AML), reusable digital identities

Multiple networks

Personal data off-chain

Flexible

SuiVerify

One-time verification, SoulBound NFT

Sui

End-to-end encryption, secure storage

Easy (reusable across services)

0xKYC

Zero-knowledge liveness verification, Sybil resistance

Not specified

Zero-knowledge proofs (ZKPs)

On-chain attestations

Altme

Self-sovereign identity with NFTs, verifiable credentials

Not specified

Privacy-preserving (data off-chain)

Via Altme wallet

zkMe (zkKYC)

Verify attributes like age/residency

Not specified

Zero-knowledge proofs (ZKPs)

Standard ZKP integration

Pitfalls to Dodge and Pro Tips

The Road Ahead for DeFi Privacy KYC