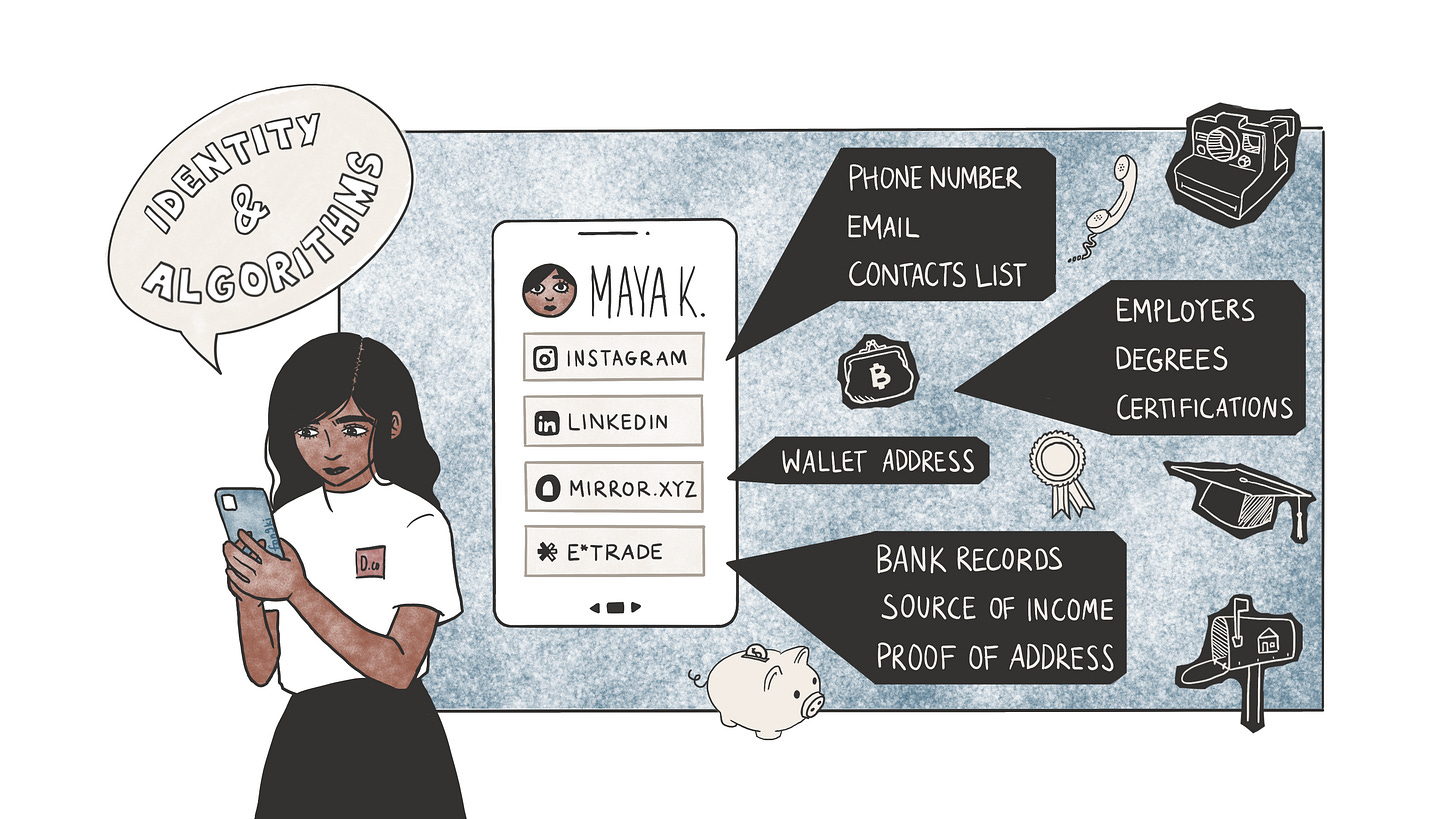

In Solana’s fast-paced DeFi landscape, sybil resistant allowlists have become essential to combat the pervasive threat of Sybil attacks, where malicious actors create multiple fake identities to exploit airdrops, governance votes, or token allocations. Traditional off-chain KYC processes falter under Solana’s high-throughput demands, introducing friction and centralization risks. Enter onchain KYC attestations: decentralized, verifiable proofs of identity that users mint once and reuse indefinitely, transforming how protocols build secure, scalable access controls.

Solana Attestation Service: The Foundation for Verifiable Claims

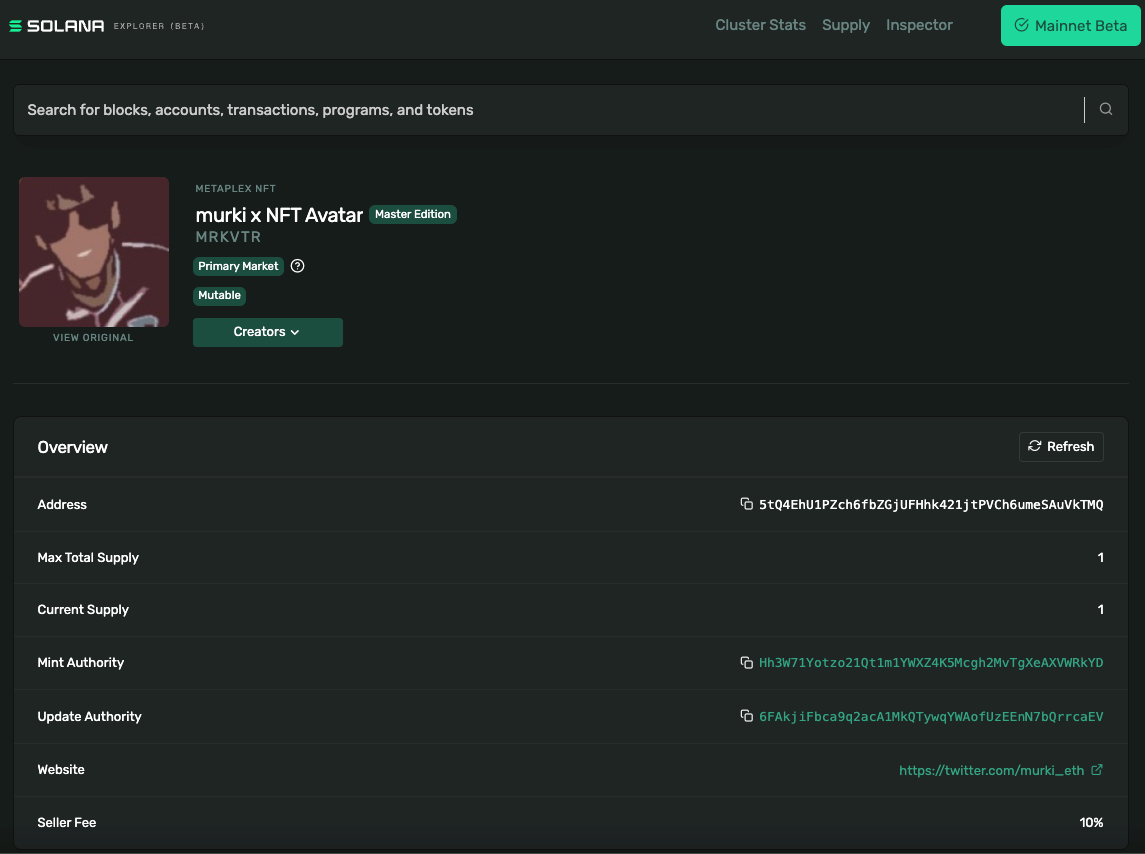

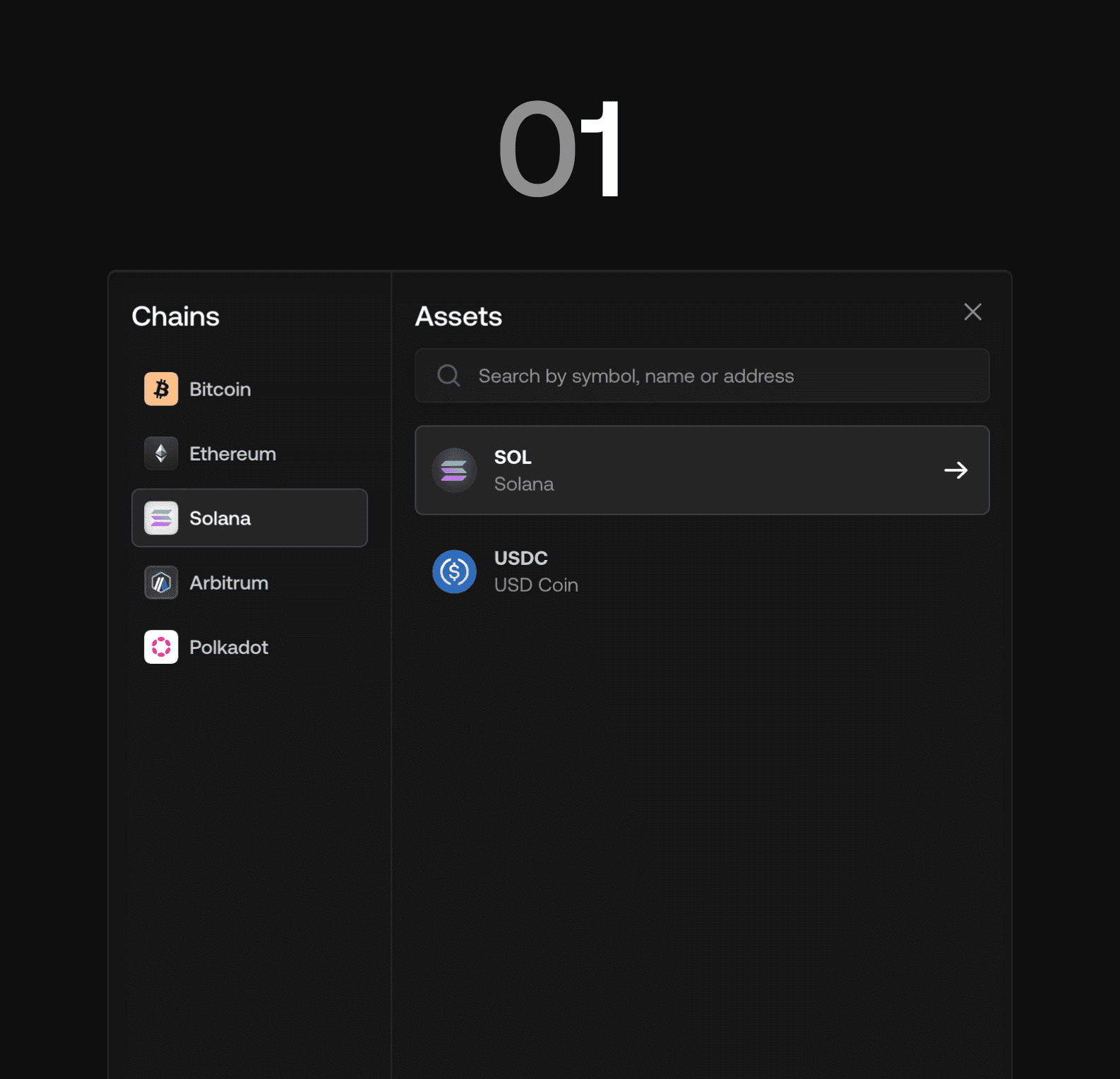

Launched in May 2025, the Solana Attestation Service (SAS) marks a pivotal advancement in Web3 identity verification. This permissionless protocol empowers developers to issue, store, and verify claims directly on-chain without compromising user privacy. Imagine a digital passport for your wallet: SAS attestations bundle credentials like KYC status or proof-of-humanity into compact, schema-defined data structures, queryable by any smart contract.

From my analysis, SAS addresses core pain points in Solana DeFi. Protocols can now enforce allowlist eligibility programmatically, querying attestations in real-time during transactions. This eliminates manual verification bottlenecks, which previously plagued projects like lending platforms or NFT drops. Early adopters report up to 90% reduction in compliance overhead, as verified credentials propagate seamlessly across dApps.

Yet, SAS’s strength lies in its interoperability. Attestations follow standardized schemas, ensuring compatibility with emerging tools like Sumsub’s onchain ID profiles, where users link biometric-verified identities to self-custodial wallets.

Protocols Pioneering Sybil-Resistant Attestations

Beyond SAS, specialized protocols amplify Solana DeFi KYC capabilities. The Anti-Sybil Solana Attestation Protocol (ASSAP) deploys zero-knowledge proofs to certify unique personhood, thwarting multi-account farming in airdrops and reward systems. ASSAP’s decentralized verifiers issue attestations that smart contracts can trust without revealing underlying data.

Sumsub’s integration with SAS, debuted at Accelerate New York in May 2025, bridges traditional KYC with blockchain. Users complete one-time verification off-chain, receiving an onchain attestation tied to their Solana address. This privacy preserving attestations model lets DeFi platforms confirm compliance selectively, exposing only the necessary bits.

DecideID by DecideAI takes a bolder stance, embedding biometric Proof-of-Personhood directly into Solana wallets since November 2024. By sidestepping document-based KYC, it minimizes data exposure while delivering robust sybil resistance. In my view, these layered approaches create a robust ecosystem: SAS as the base layer, augmented by ASSAP’s anti-sybil focus and DecideID’s biometric edge.

Operational Advantages Driving Adoption

Onchain KYC attestations deliver tangible efficiencies for Solana DeFi operators. First, enhanced privacy: zero-knowledge verification proves attributes like “KYCed in jurisdiction X” without doxxing. Smart contracts query these attestations atomically, approving trades or mints in milliseconds.

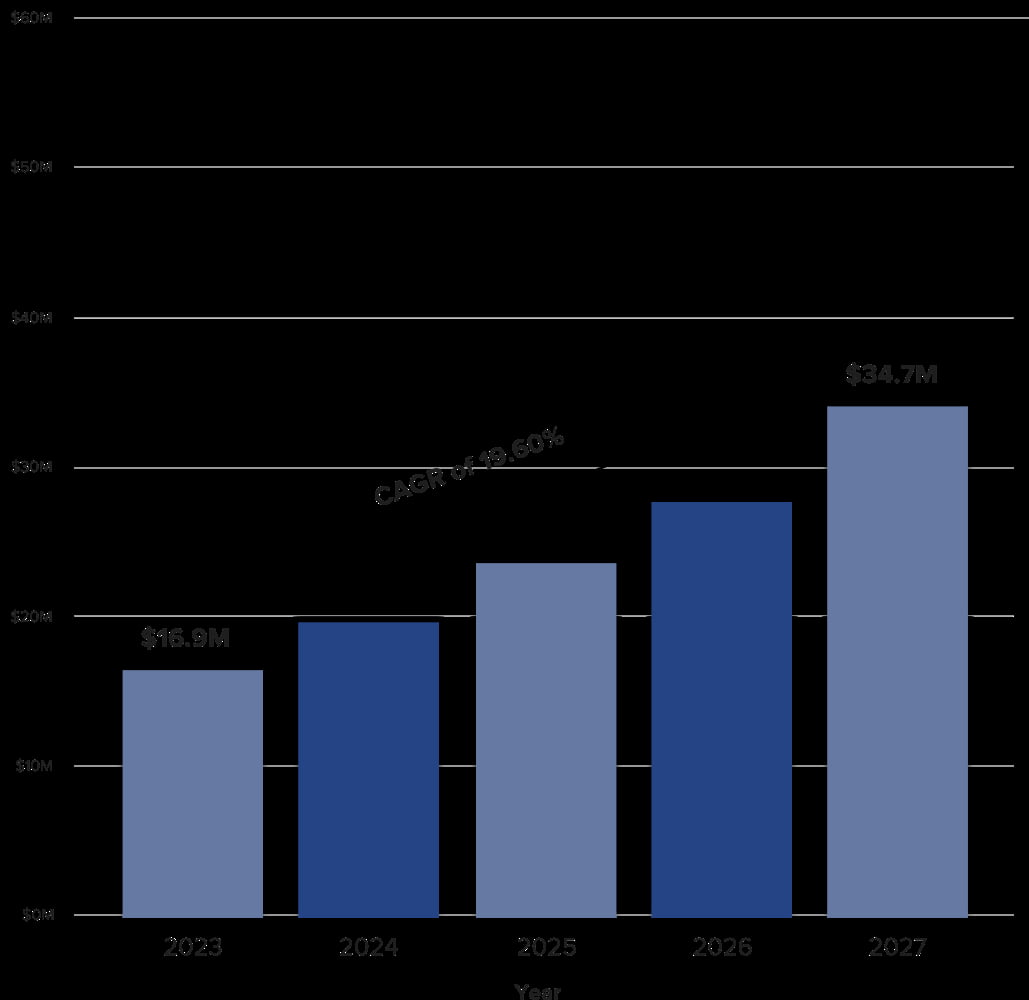

Second, cost savings are profound. Manual KYC for allowlists can consume 20-30% of a project’s budget; attestations shift this to a one-time user expense, reusable via verifiable allowlists. Platforms like DAOs now gate proposals to attested addresses, ensuring genuine stakeholder input.

Interoperability seals the deal. An attestation from Sumsub works in lending protocols, NFT marketplaces, or token sales, fostering network effects. Consider a regulated yield farm: it enforces investor caps and geo-restrictions on-chain, audited transparently. This precision mitigates regulatory scrutiny while scaling user bases exponentially.

Early metrics from SAS-integrated projects show sybil attack rates dropping below 1%, with user retention surging due to frictionless onboarding. As Solana’s TVL climbs, these tools position sybil resistant allowlists as non-negotiable infrastructure.

Implementing these attestations unlocks concrete applications across Solana’s DeFi stack. Picture a DAO treasury proposal: only addresses with valid KYC attestations can submit or vote, filtering out sock-puppet armies that dilute genuine signals. Private NFT drops gain legitimacy too, as creators whitelist attested wallets, starving bots of mint slots and rewarding true collectors.

Real-World Deployments: From Airdrops to Regulated Yields

Lending protocols stand to gain the most. Platforms like those mirroring Aave on Solana can embed jurisdictional checks into their smart contracts, querying SAS attestations for accredited investor status or regional eligibility. This on-chain enforcement turns compliance from a hurdle into a seamless gate, all while users retain full custody. In regulated DeFi products, investor caps become programmable: a contract pauses deposits once attested high-net-worth users hit the limit, audited immutably on Explorer.

Key Onchain KYC Use Cases

-

DAO Governance Gating: Gate participation to KYC-verified addresses using Solana Attestation Service (SAS), ensuring Sybil-resistant voting and proposals.

-

Private NFT Mints: Restrict mints to verified collectors via SAS attestations, blocking bots and Sybil attacks for fair drops.

-

Regulated Lending with Geo-Fencing: Enforce jurisdiction rules and investor caps in lending protocols using onchain KYC attestations for compliance.

-

Airdrop Fairness via Personhood Proofs: Distribute rewards to unique humans with Proof-of-Personhood from DecideID on Solana.

-

Token Sale Allowlists: Create Sybil-resistant allowlists for token sales with verifiable credentials from SAS or ASSAP.

Anti-Sybil measures extend to airdrops, where ASSAP’s zero-knowledge personhood proofs pair with contribution metrics to distribute rewards equitably. No longer do farmers dominate; instead, protocols reward builders and long-term holders. From my portfolio management lens, this maturity signals Solana’s pivot toward institutional-grade infrastructure, blending speed with accountability.

Challenges persist, however. Attestation fragmentation looms if schemas diverge, risking interoperability breakdowns. Low-quality verifiers could flood the network with manipulable claims, undermining trust. Standardization efforts, like those in SAS, counter this by enforcing rigorous issuer registries and revocation mechanisms. Projects must vet providers carefully, prioritizing biometric-backed options like DecideID over basic social proofs.

OnchainKYCe. me emerges as a beacon here, offering a unified platform for issuing and verifying KYC attestations across Solana and beyond. Its privacy-first design integrates seamlessly with SAS, allowing projects to plug in compliant allowlists without custom builds. Users mint once via partnered verifiers like Sumsub, then access gated communities, token sales, or DeFi vaults effortlessly. This streamlines repeated verification, cutting user drop-off by enabling true reuse.

Looking ahead, expect deeper fusion with Solana’s compression tech for cheap, scalable attestations. As TVL surges past recent highs, regulators will scrutinize less those platforms proving on-chain diligence. Sybil resistance evolves from nice-to-have to table stakes, with privacy preserving attestations as the linchpin. Protocols ignoring this risk obsolescence; adopters will capture outsized value in a maturing ecosystem.

For allowlist managers, the playbook is clear: audit SAS schemas today, integrate ASSAP for high-stakes distributions, and leverage platforms like OnchainKYCe. me for plug-and-play compliance. Solana DeFi’s next phase hinges on verifiable humans powering unstoppable finance.