When it comes to building trust in decentralized finance (DeFi), the ability to prove identity without sacrificing privacy is a game changer. That’s where onchain attestations for KYCed addresses step in, transforming how allowlists work across token sales, liquidity pools, and exclusive Web3 communities. Instead of relying on static lists or clunky offchain checks, onchain attestations let users and organizations verify KYC credentials directly on the blockchain – all while keeping sensitive data private.

Why DeFi Needs Onchain Attestations for KYCed Addresses

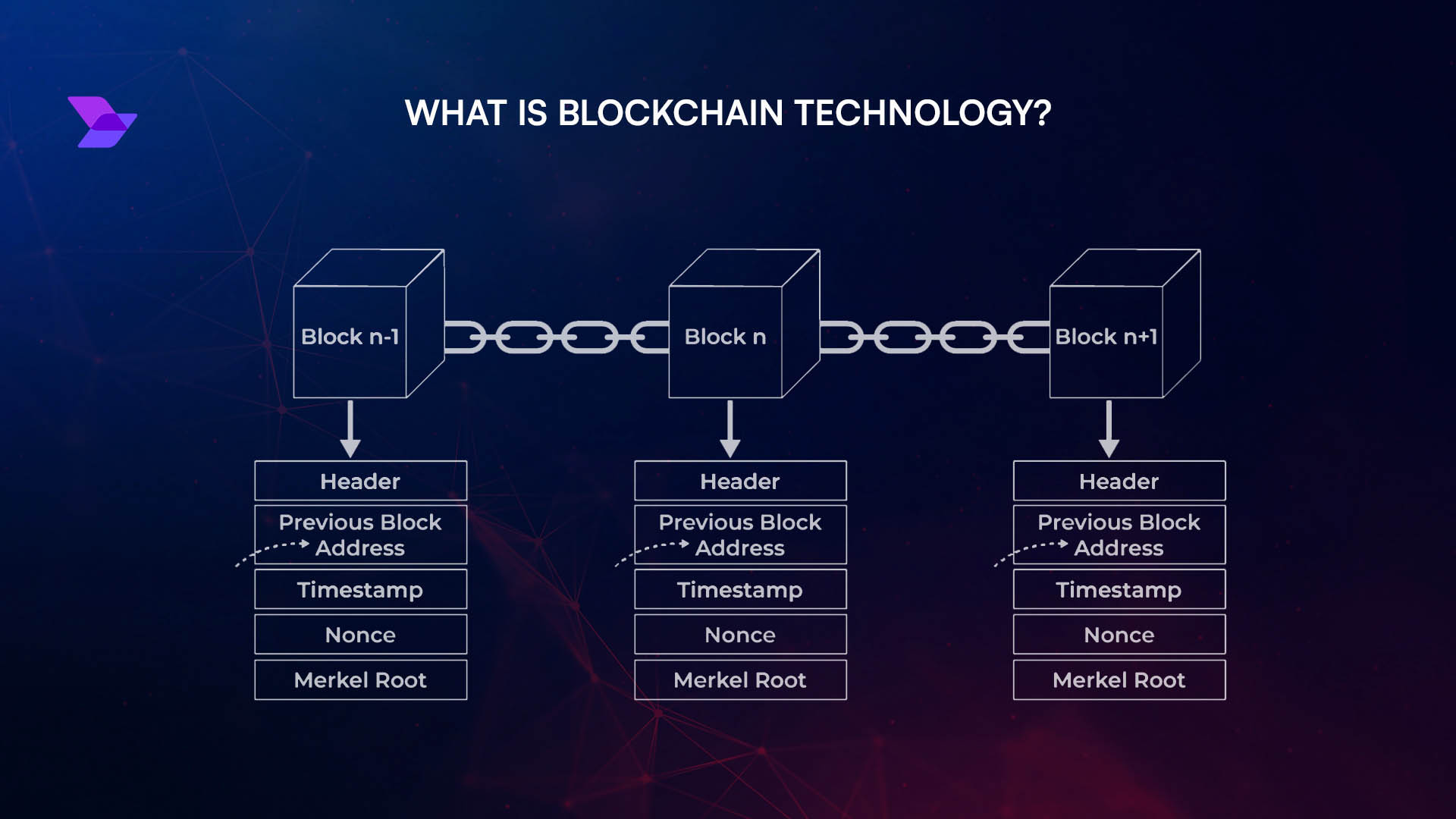

The DeFi ecosystem is exploding with innovation, but regulatory pressure isn’t going anywhere. Projects need to balance openness with compliance – especially as institutional capital flows in. Traditional allowlists are rigid and often managed offchain, leaving gaps in transparency and security. With onchain attestations, every verified address gets a cryptographic proof recorded on-chain, confirming its KYC status without revealing personal details.

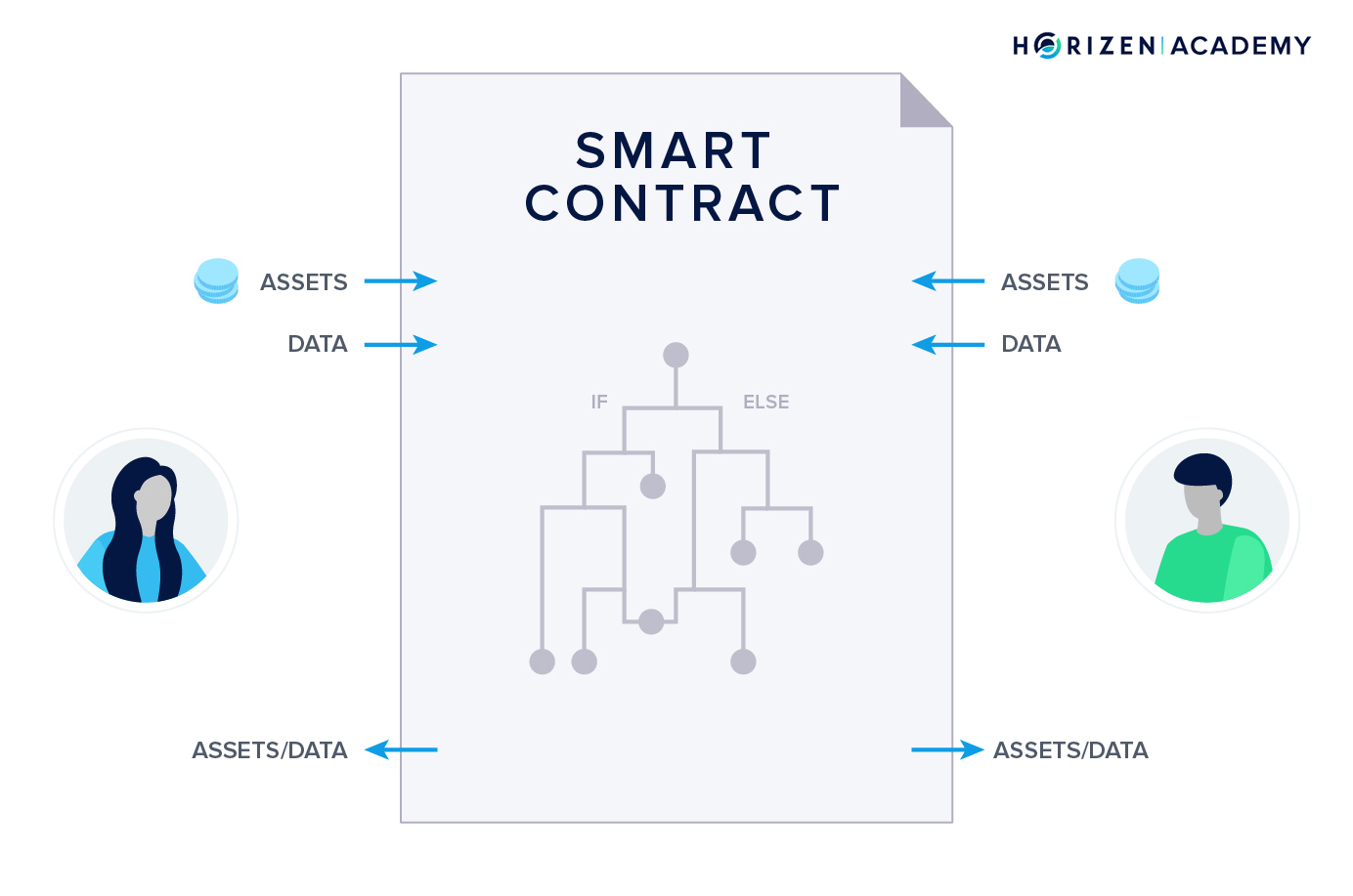

This means smart contracts can automatically check if an address is eligible to participate – whether that’s minting an NFT, joining a token sale, or accessing a gated community. No more endless re-KYC processes or risky data leaks. Plus, these attestations are portable: get verified once and use your credentials across any compatible DeFi platform.

How Onchain Attestations Power Dynamic Allowlists

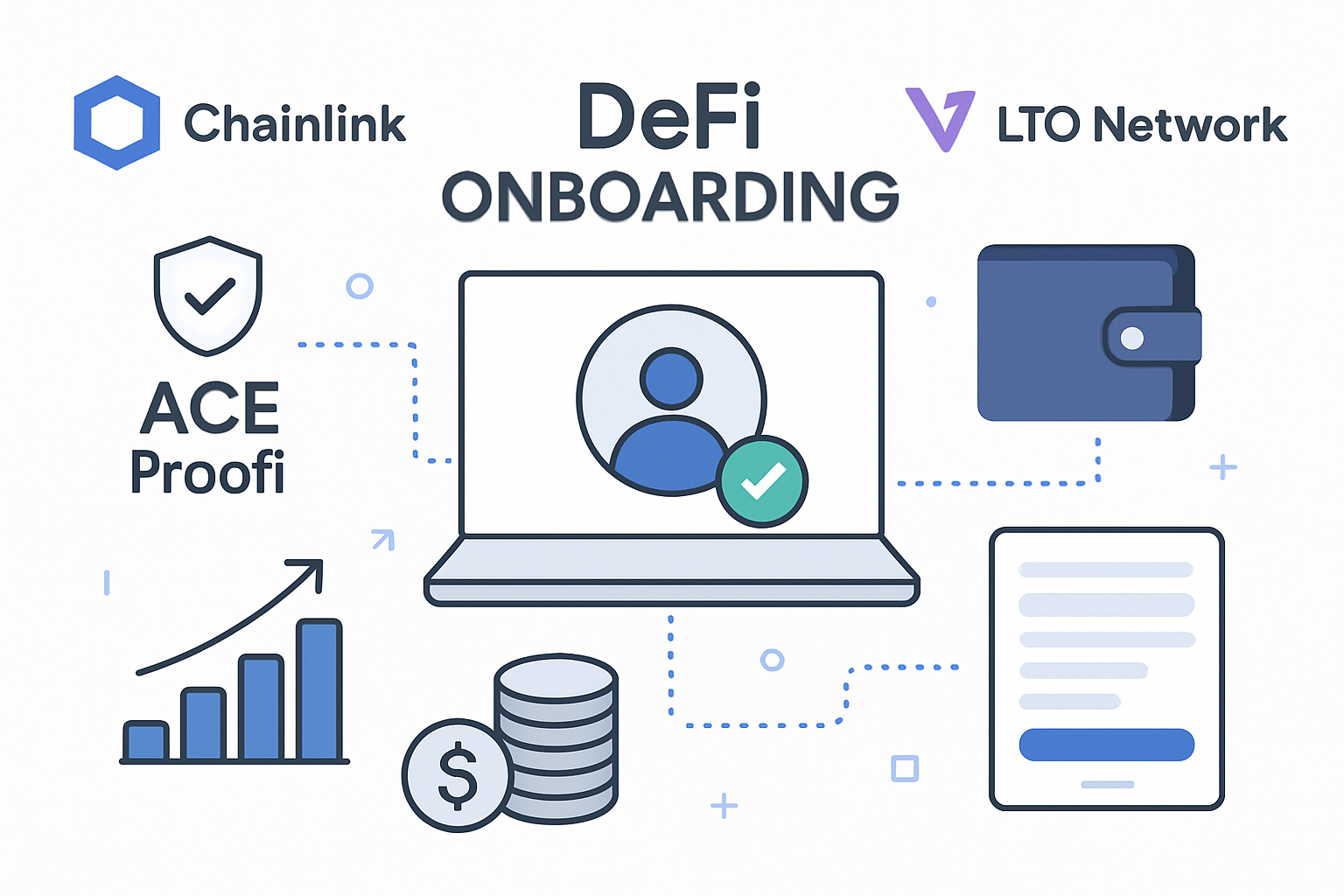

Let’s get practical. Imagine you’re launching a high-profile token sale. You want only compliant users to participate, but you don’t want to scare away privacy-conscious investors or create onboarding friction. By integrating Coinbase’s Verified Pools system, for example, you can leverage KYC-integrated verification that combines identity checks with smart contract transparency. This reduces counterparty risk while keeping everything visible on-chain.

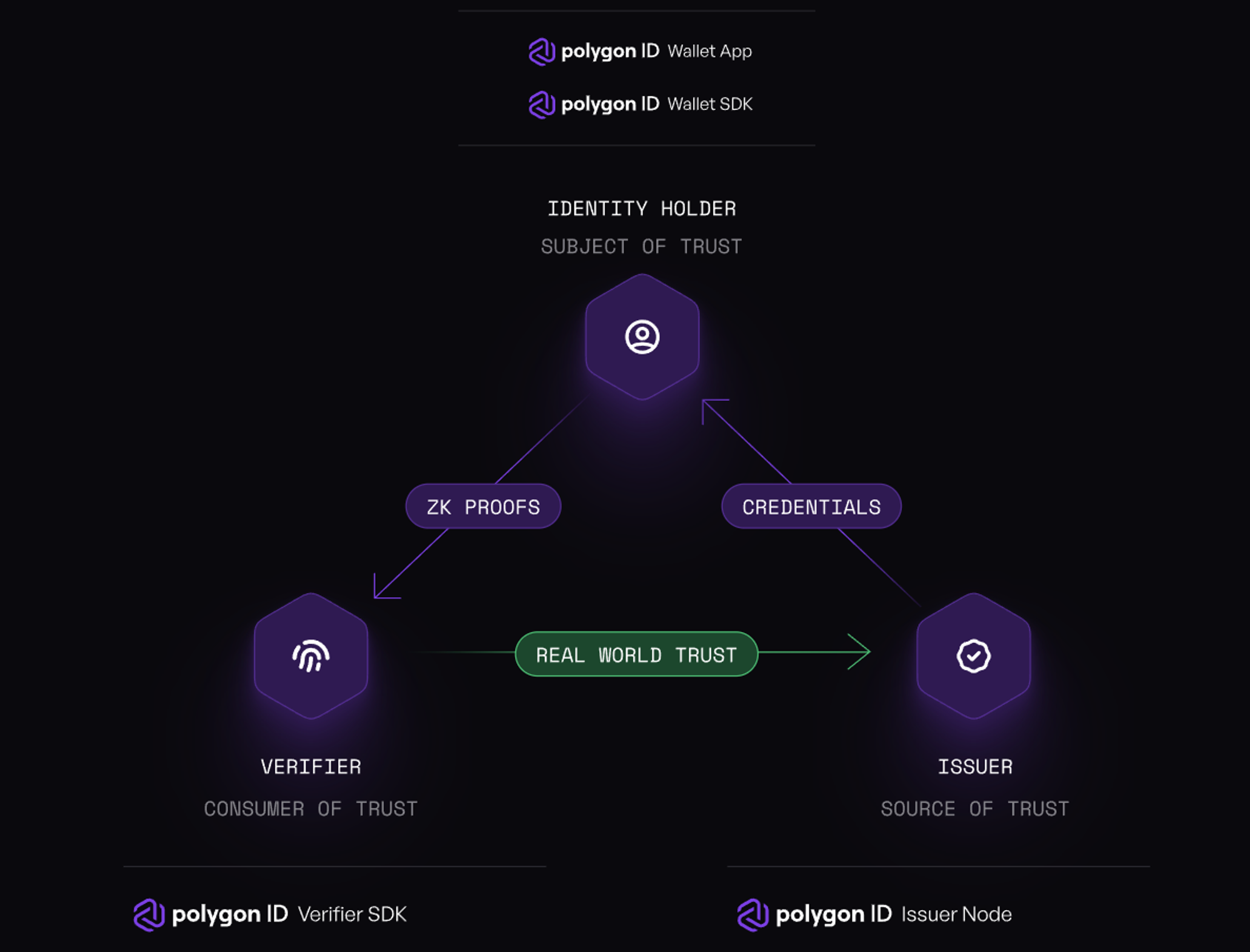

Other protocols go even further: Hinkal uses zero-knowledge proofs alongside KYC attestations so users can prove compliance without exposing their wallet addresses (read more here). The result? Confidential transactions that still meet regulatory standards, no tradeoffs required.

The Real Benefits: Efficiency, Interoperability, Privacy

Top Benefits of Onchain Attestations for KYCed DeFi Addresses

-

Seamless Interoperability Across DeFi Platforms: Onchain attestations, like those supported by Coinbase’s Verified Pools and Chainlink ACE, allow KYC verifications to be recognized universally. Users can verify their identity once and access multiple protocols without repeating the process.

-

Privacy-Preserving Verification: Solutions such as Hinkal and zero-knowledge proof technology enable users to prove compliance without exposing sensitive personal data, striking a balance between privacy and regulatory requirements.

-

Streamlined Onboarding for Token Sales: With attestation protocols like Chainlink ACE and Proofi by LTO Network, users can join token sales and allowlists quickly, as KYC status is instantly verifiable onchain—no more waiting for manual approvals.

-

Dynamic, Policy-Based Compliance: Platforms like Chainlink ACE enable real-time enforcement of compliance rules onchain or offchain, adapting instantly to regulatory changes and reducing risk for projects and users.

-

Reduced Counterparty Risk: By leveraging onchain attestations, DeFi projects can ensure that only authenticated, KYCed participants interact with their smart contracts, as seen in Coinbase’s Verified Pools, making the ecosystem safer for everyone.

Onchain attestations aren’t just about checking boxes for regulators, they’re about making DeFi faster, safer, and more user-friendly:

- Efficiency: Automated verification means no more repetitive manual checks or slow onboarding processes.

- Interoperability: Once your address is attested as KYCed on one platform, you can use it everywhere else that supports the standard, no need to start over each time.

- Privacy Preservation: With techniques like zero-knowledge proofs built in (think Hinkal), users stay compliant while keeping their personal info under wraps.

This approach bridges the gap between decentralized ideals and real-world compliance needs, without making users jump through hoops or give up their privacy.

But the story doesn’t end with efficiency and privacy. The real magic of DeFi allowlist KYC verification comes from its flexibility and security. Protocols like Proofi by LTO Network are integrating with Chainlink to deliver KYC/AML data directly to DeFi dApps, letting projects comply with global regulations without ever storing client data on a vulnerable server. This is a huge leap forward for both security and user autonomy. For more technical details, check out the coverage at Invezz.

Another game changer: dynamic, policy-based compliance. Unlike static allowlists that need constant manual updates, onchain attestation frameworks (like Chainlink ACE) enable rules to be enforced both onchain and offchain, adapting instantly as regulations or project requirements evolve. This means you can automate compliance for everything from token sales to DAO voting – all while keeping things transparent and auditable.

What Does This Mean for Web3 Builders?

If you’re building in Web3, you know onboarding and compliance can be major pain points. Onchain attestations for KYCed addresses let you offer a seamless experience: users verify once, then interact with your protocol (and countless others) without friction. No more lost momentum during launches or migrations due to slow KYC checks.

This opens doors for:

- Token sales that attract global users while staying compliant

- Gated communities where membership is provable but private

- DeFi protocols that want institutional partners but refuse to compromise on decentralization

The result? A Web3 landscape where trust is programmable, privacy is respected, and compliance doesn’t kill the vibe.

Key Takeaways for Projects and Users

If you’re considering integrating blockchain identity credentials into your DeFi app or DAO, here’s what matters most:

Checklist: Integrating Onchain KYC Attestations in DeFi

-

1. Choose a Trusted Onchain Attestation ProtocolSelect a reputable protocol like Sign Protocol, Ethereum Attestation Service (EAS), or Chainlink ACE to issue and verify KYC attestations onchain.

-

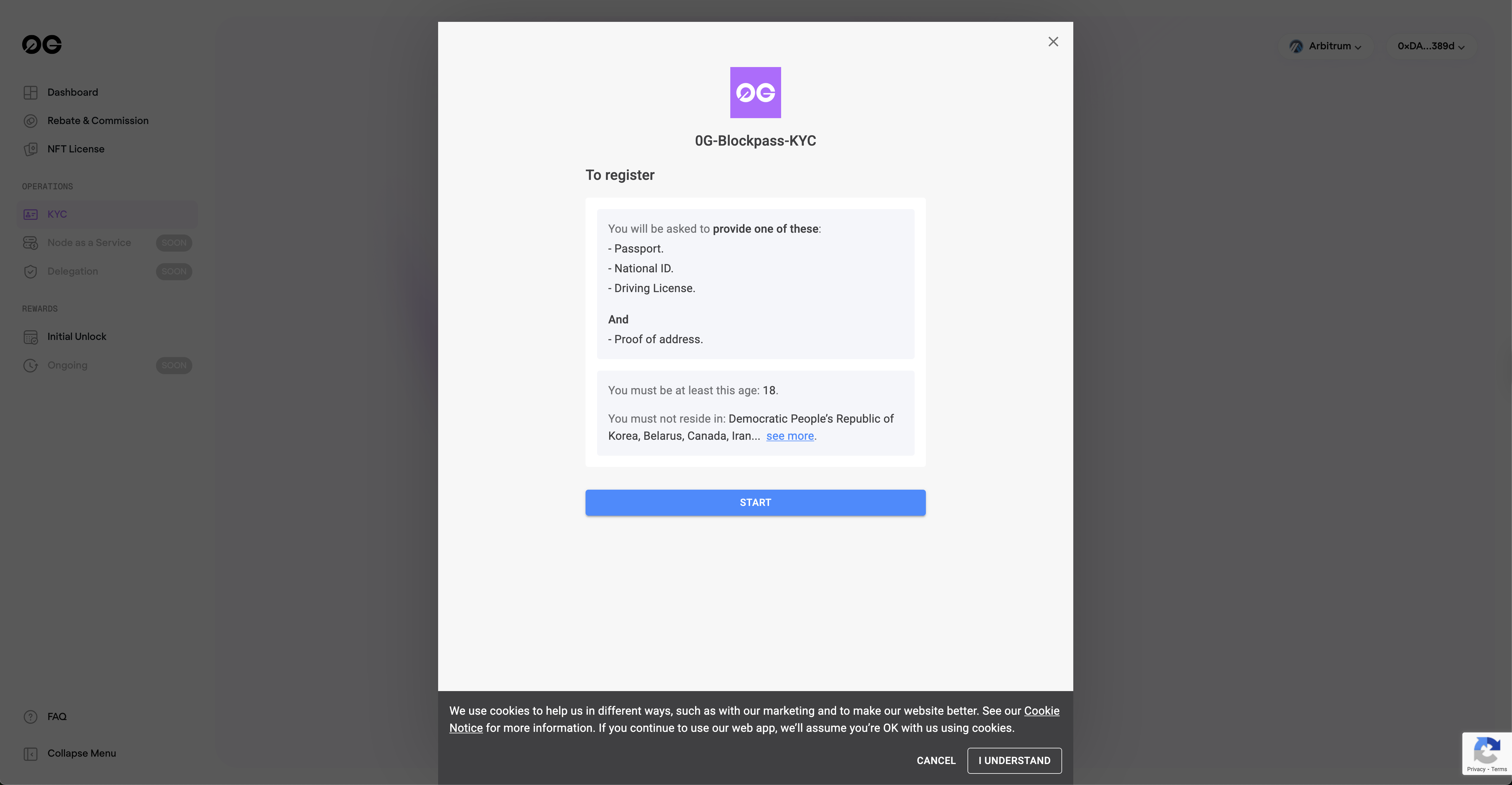

2. Integrate a Reliable KYC ProviderPartner with a KYC provider that supports onchain attestations, such as Coinbase, Blockpass, or Proofi by LTO Network.

-

3. Issue Onchain KYC AttestationsAfter successful KYC checks, have your provider issue cryptographic attestations directly to users’ wallet addresses on the blockchain.

-

4. Update Smart Contracts to Check AttestationsModify your DeFi platform’s allowlist logic to verify that user addresses hold valid onchain KYC attestations before granting access to restricted features.

-

5. Enable Privacy-Preserving VerificationImplement privacy tools like Hinkal or zero-knowledge proofs to allow users to prove KYC status without exposing personal data.

-

6. Test Compliance and User ExperienceThoroughly test your integration to ensure seamless user onboarding, efficient verification, and robust compliance with regulatory standards.

-

7. Monitor and Revoke Attestations as NeededSet up monitoring and governance mechanisms to revoke or update attestations in case of suspicious activity or regulatory changes.

The combination of cryptographic proofs, privacy-preserving tech like zero-knowledge proofs, and interoperability standards makes this approach future-proof. As regulators keep an eye on crypto markets, being able to prove compliance instantly – without leaking sensitive info – sets your project apart.

Pro tip: Choose solutions that support privacy-preserving KYC on Web3 so your users stay safe while you stay compliant.

The bottom line? Onchain attestations are the missing link between open finance and real-world trust requirements. They empower users with reusable credentials, simplify regulatory compliance for projects, and unlock new levels of interoperability across the ecosystem. If you want your community or protocol to thrive in the next wave of decentralized innovation – now’s the time to bring robust onchain verification into your stack.