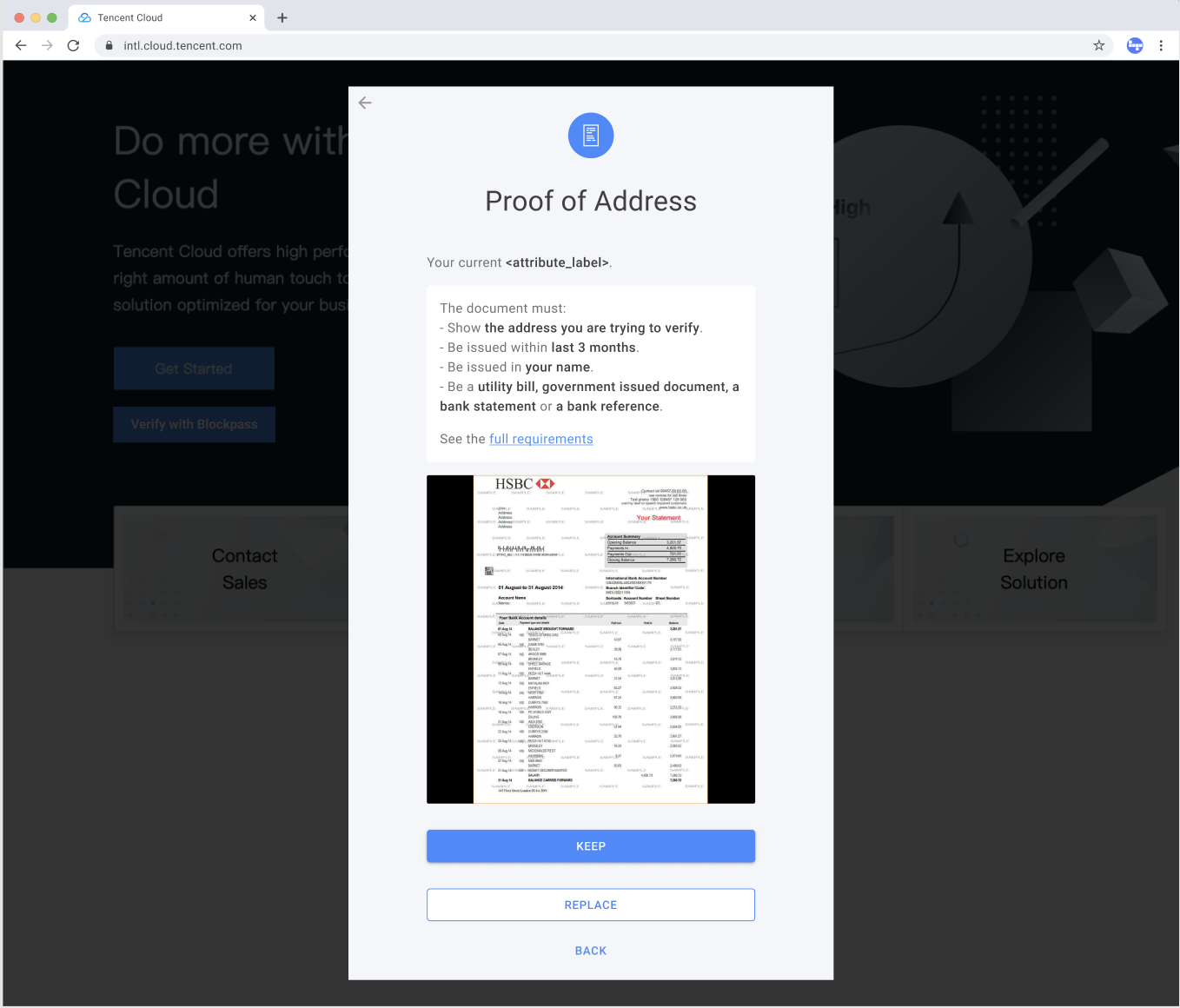

For years, DeFi and token sale projects have wrestled with the challenge of KYC: how to verify user identities to meet compliance requirements without sacrificing privacy or introducing friction. Traditional methods often involve repetitive document uploads, centralized data storage, and clunky onboarding flows that frustrate users and slow down launches. Enter onchain attestations for KYC – a breakthrough approach that is rapidly changing how digital identity works across Web3.

What Are Onchain Attestations for KYC?

An onchain attestation is a cryptographic proof, stored directly on a blockchain, confirming that a user has completed KYC verification. Instead of passing around sensitive documents or relying on siloed databases, projects can now issue (or accept) reusable attestations tied to wallet addresses. These proofs are tamper-resistant, instantly verifiable by smart contracts, and – crucially – don’t expose underlying personal information.

This shift is best illustrated by solutions like Blockpass’s On-Chain KYC® 2.0, which lets businesses issue attestations confirming a user’s verified status while keeping all personal data off-chain. The result? Users get a portable digital identity they can use across multiple dApps and token sales, while platforms gain confidence in compliance without ever handling PII.

Key Benefits: Privacy, Interoperability and Trust

The advantages of this model are clear:

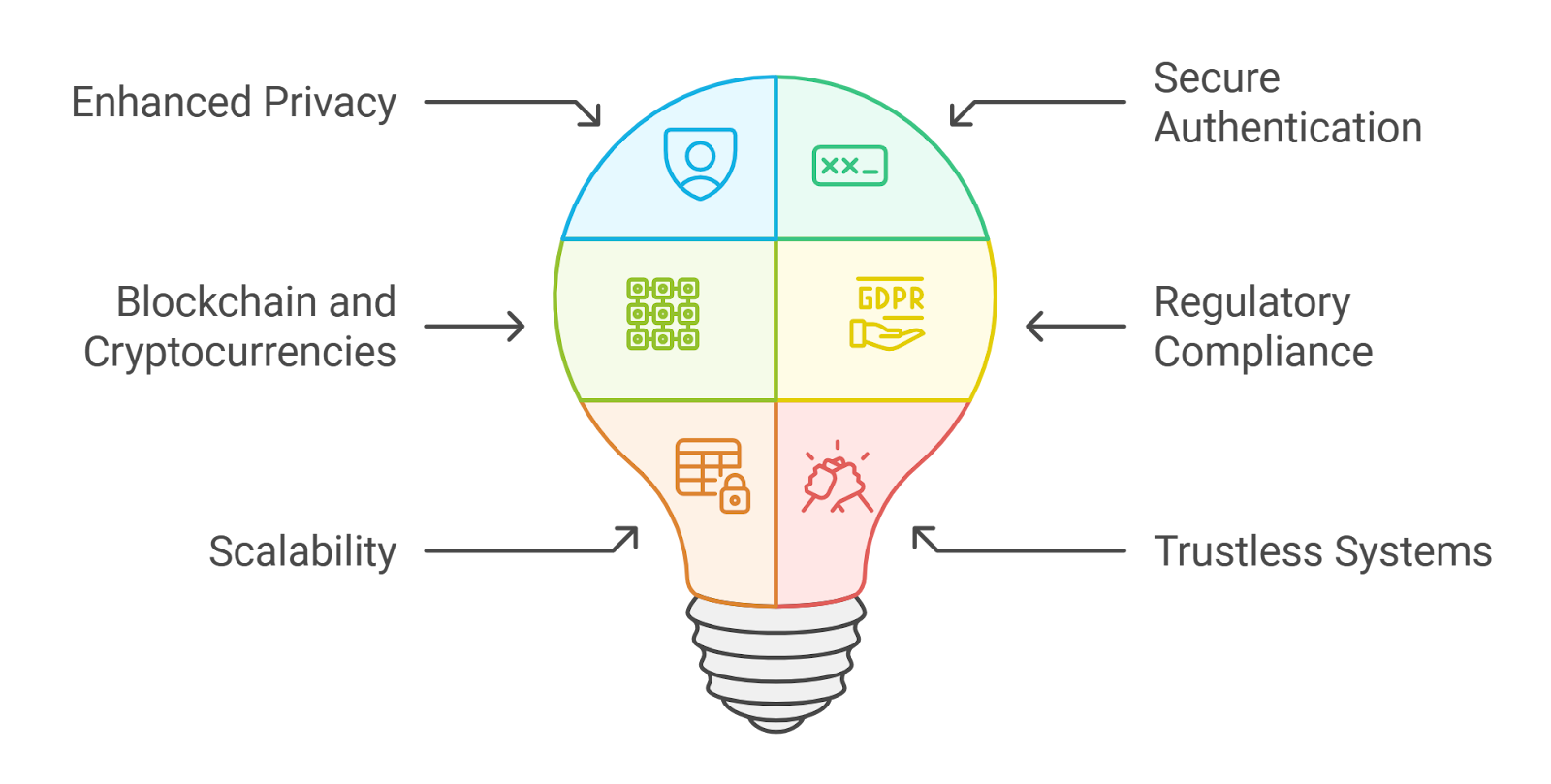

- Privacy Preservation: Attestations confirm verification status without revealing who you are. Zero-knowledge proofs (as used by 0xKYC) let users prove uniqueness or liveness without exposing biometrics or IDs.

- Interoperability: Once issued, an attestation can be reused across any platform that accepts it. This composability streamlines onboarding and reduces repeated KYC checks, a huge win for both users and allowlist managers.

- Enhanced Security and Trust: Because attestations live on-chain, they’re immutable and easy to audit. No more worrying about fake screenshots or forged approvals; anyone can verify their authenticity in real time.

- Regulatory Compliance: Onchain attestations help DeFi platforms align with AML/CTF requirements by providing robust proof of due diligence, all without storing sensitive documents themselves.

If you want a deeper dive into the mechanics behind these benefits, check out our guide on how onchain attestations enable reusable KYC for DeFi and token sales.

The New Standard for Token Sales and DeFi Access

The impact of blockchain KYC verification is already visible in major ecosystems. For example:

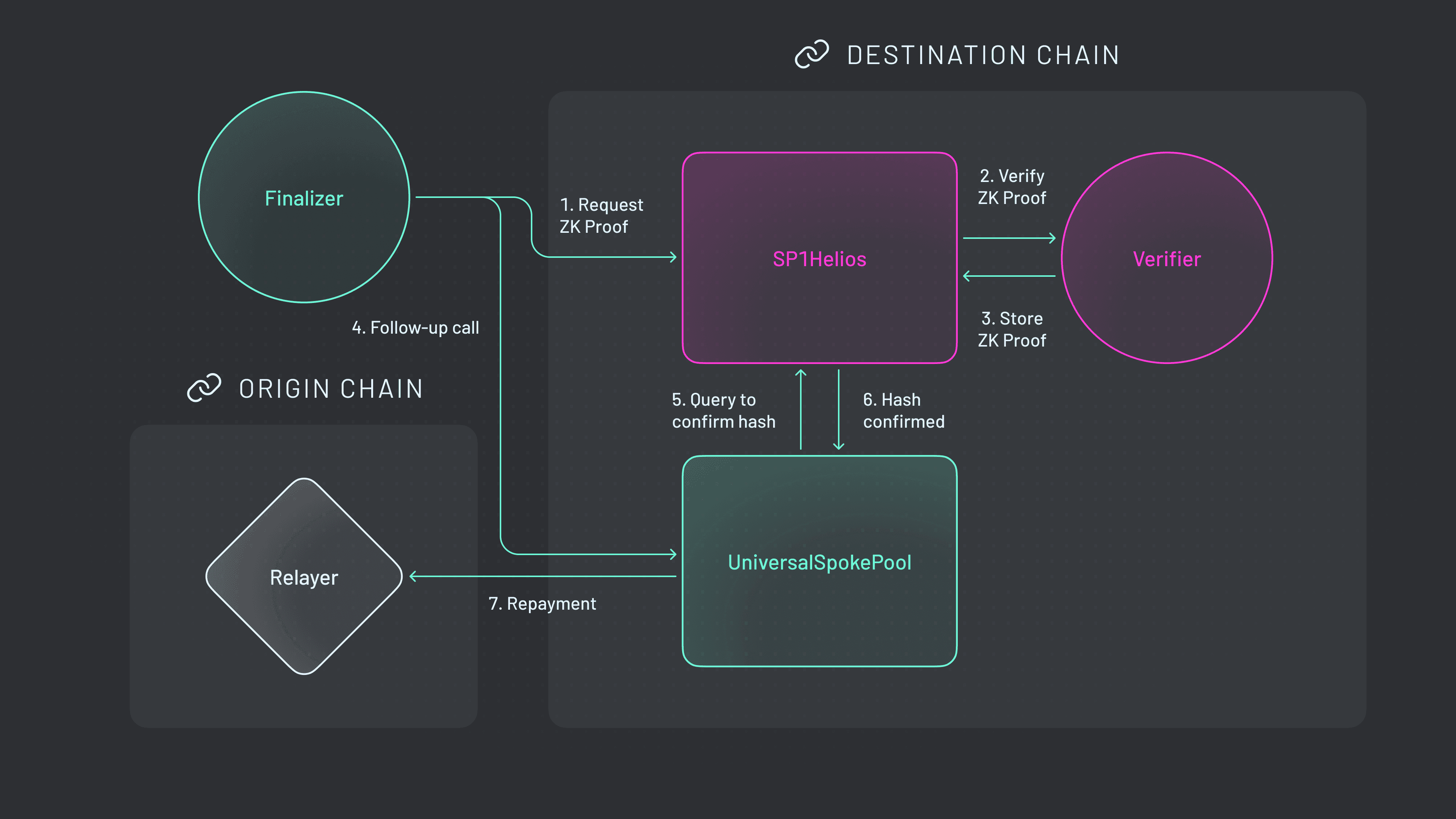

- BAS and Blockpass: Binance’s BNB Chain leverages both on-chain and off-chain attestation modes to let anyone publicly verify compliance status, no more guessing who’s allowed into an IDO or gated community.

- Attest Protocol: Developers can check a wallet’s compliance with just one line of code; no custom backend required. This dramatically lowers the barrier to entry for new projects launching compliant token sales or allowlists.

- Aave and SecureID Protocol: Governance proposals now include native support for secure on-chain identity checks, allowing DAOs to enforce participation rules while protecting member privacy.

This trend is only accelerating as more Web3 projects recognize the value of privacy-preserving KYC solutions that put users first. The days of uploading your passport ten times are numbered, reusable digital identities are here to stay.

For projects managing allowlists, a single onchain attestation can unlock access to multiple rounds of token sales, exclusive airdrops, or gated DeFi features, all without re-verifying the same users. This is particularly powerful for global launches, where compliance checks must adapt to shifting regulatory landscapes and large user bases. With verifiable attestations, platforms can automate eligibility checks in real time, minimizing manual review and speeding up distribution.

How Onchain Attestations Reduce KYC Friction in DeFi

-

Privacy-Preserving Verification: On-chain attestations like Blockpass’s On-Chain KYC® 2.0 confirm users have completed KYC without exposing personal data, keeping identities secure and private.

-

Reusable Digital Identities: Once verified, users can reuse their on-chain attestations across multiple DeFi platforms and token sales, eliminating repetitive KYC checks and speeding up onboarding.

-

Seamless Integration for dApps: Solutions like Attest Protocol let developers verify KYC status with minimal code, making compliance easy and user onboarding frictionless.

-

Enhanced Security & Trust: Storing attestations directly on the blockchain ensures they are immutable and verifiable, reducing fraud. Platforms like 0xKYC use zero-knowledge proofs for additional security and anonymity.

-

Regulatory Compliance Made Simple: On-chain attestations provide clear, verifiable proof of identity checks, helping DeFi projects meet AML and CTF requirements without handling sensitive user data.

Another game-changer: privacy preserving KYC for Web3. Users maintain control over their identity credentials and share only what’s required. Zero-knowledge proof systems (like those used by 0xKYC) enable liveness and uniqueness checks without exposing PII or even wallet addresses. The result is a system that’s both user-friendly and regulator-ready.

Real-World Impact: From Frictionless Onboarding to Regulatory Confidence

The move toward onchain attestations isn’t just technical progress, it’s reshaping user experience and compliance strategy for the entire industry. Here are some practical outcomes:

- Faster Launches: Projects can spin up compliant sales or gated communities in days instead of weeks.

- User Retention: No more KYC fatigue, users onboard once and reuse their verified status across platforms.

- Global Reach: Seamless cross-border participation, since attestations can be validated anywhere the blockchain is accessible.

- Simplified Auditing: Regulators or auditors can confirm compliance at any time by checking onchain proofs, no need to sift through private databases.

The composability of reusable KYC DeFi credentials also means projects can collaborate more easily. Allowlist managers can accept attestations from trusted providers like Blockpass or Attest Protocol, creating interoperable ecosystems where trust flows freely but privacy remains protected. For developers looking to implement these systems, the integration process is often as simple as adding a verification check to a smart contract, no reinventing the wheel.

If you’re curious about how this works under the hood or want step-by-step guidance for your own project, explore our resource on how onchain attestations simplify KYC for DeFi token sales and allowlists.

What’s Next? Toward Universal Digital Identity in Web3

The future of KYC is not just about compliance, it’s about empowering users with portable, privacy-preserving digital identities that work everywhere in Web3. As standards mature and more protocols adopt onchain attestation frameworks, expect onboarding to become nearly invisible for most users. The vision: one identity check, many doors unlocked.

If you’re building in DeFi or managing token sales today, now is the time to embrace blockchain KYC verification as your new standard. Not only will you streamline your operations and reduce risk, you’ll also deliver an onboarding experience users will actually enjoy (and return to).