In 2025, decentralized finance (DeFi) is undergoing a dramatic transformation, fueled by the rise of onchain attestations for KYCed addresses. This technology is quietly but decisively reshaping onboarding flows across the ecosystem, allowing users and organizations to prove identity credentials directly on blockchain networks, without sacrificing privacy or composability. The days of repetitive and siloed KYC checks are numbered. Instead, DeFi projects are embracing reusable digital identities that unlock frictionless access to token sales, allowlists, and gated communities.

Reusable Digital Identities: The End of Repetitive KYC

Historically, every new DeFi platform required users to submit personal documents for Know Your Customer (KYC) verification, an inefficient process that led to onboarding fatigue and data security risks. In 2025, platforms like Blockpass have pioneered On-Chain KYC® 2.0, allowing users to verify their identity once and reuse those credentials across multiple Web3 services. These reusable attestations live onchain or as privacy-preserving zero-knowledge proofs, empowering users with control while reducing administrative overhead for platforms.

This shift doesn’t just make onboarding faster, it fundamentally changes the economics of user acquisition in DeFi. Projects can now tap into pools of pre-verified users, dramatically accelerating growth and compliance at scale. For a deep dive into how this eliminates repeated KYC headaches for allowlist managers and token sales teams, see our guide on solving repeated KYC in Web3.

Self-Sovereign Identity: Privacy Without Compromise

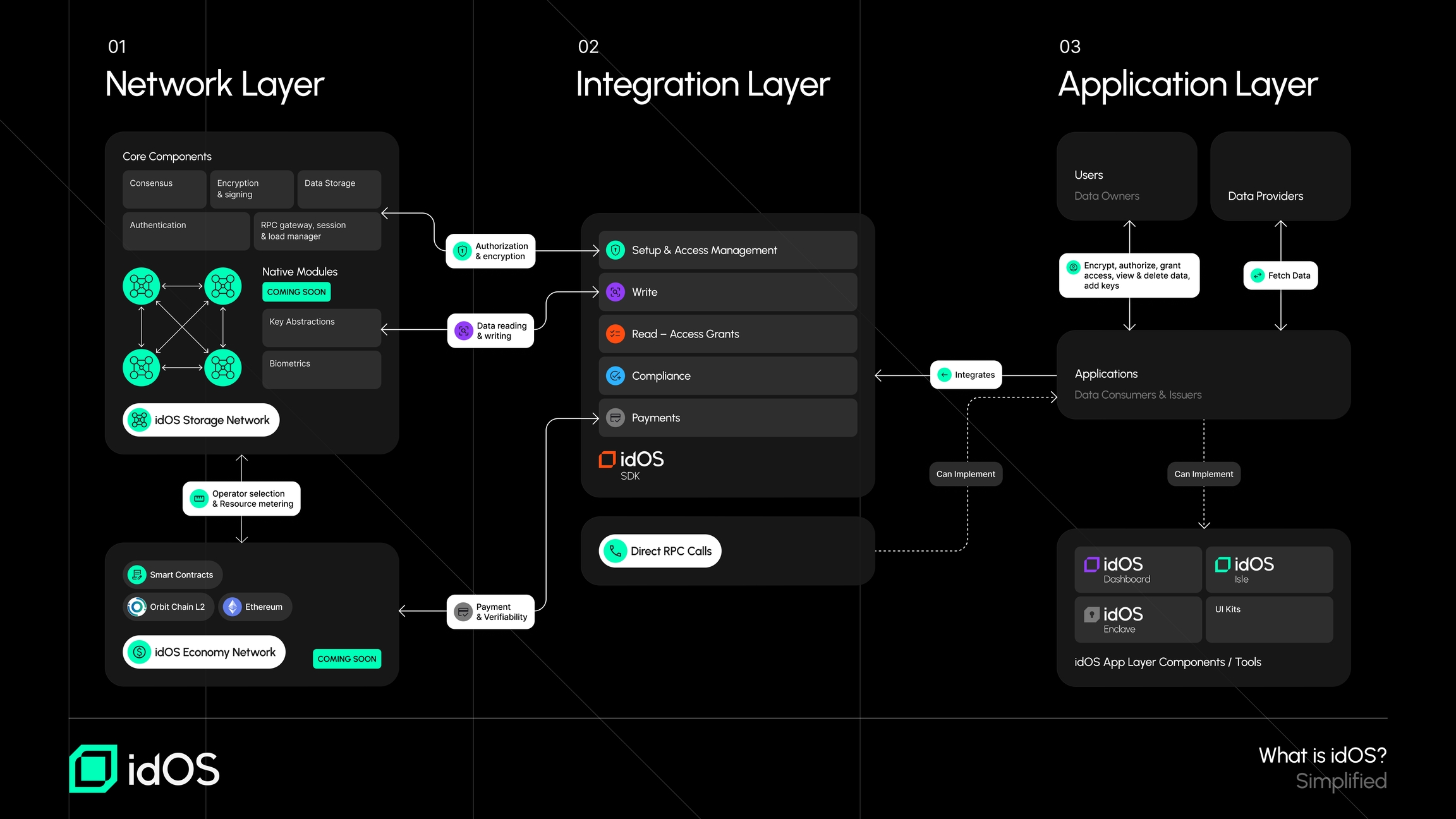

The move toward self-sovereign identity is central to the privacy revolution in DeFi onboarding. Networks like idOS enable users to store encrypted credentials in a decentralized manner, meaning individuals decide when and with whom to share their information. This user-centric approach drastically reduces the risk of data breaches while ensuring regulatory compliance remains robust.

What’s more, these privacy-preserving attestations can be shared selectively across chains or platforms as needed. No more overexposure of sensitive details just to access a new protocol or participate in an exclusive token sale. It’s a win-win for both security-conscious users and compliance-focused projects.

Interoperability Across Chains: The New Standard for Compliance

The true potential of onchain attestations for KYCed addresses lies in their interoperability. In 2025, solutions like Binance’s BNB Attestation Service (BAS) have set new standards by enabling composable identity proofs that travel with the user across different blockchains and dApps. Whether you’re minting real-world asset tokens or joining an exclusive DAO allowlist, your verified status follows you seamlessly.

This cross-chain portability is turbocharging innovation around regulated DeFi products, especially as institutional capital seeks compliant access points into web3 markets. Standards like Chainlink’s Automated Compliance Engine (ACE) unify compliance logic across public and private blockchains, making it easier than ever for developers to build with confidence.

Automated Compliance and Enhanced Security Measures

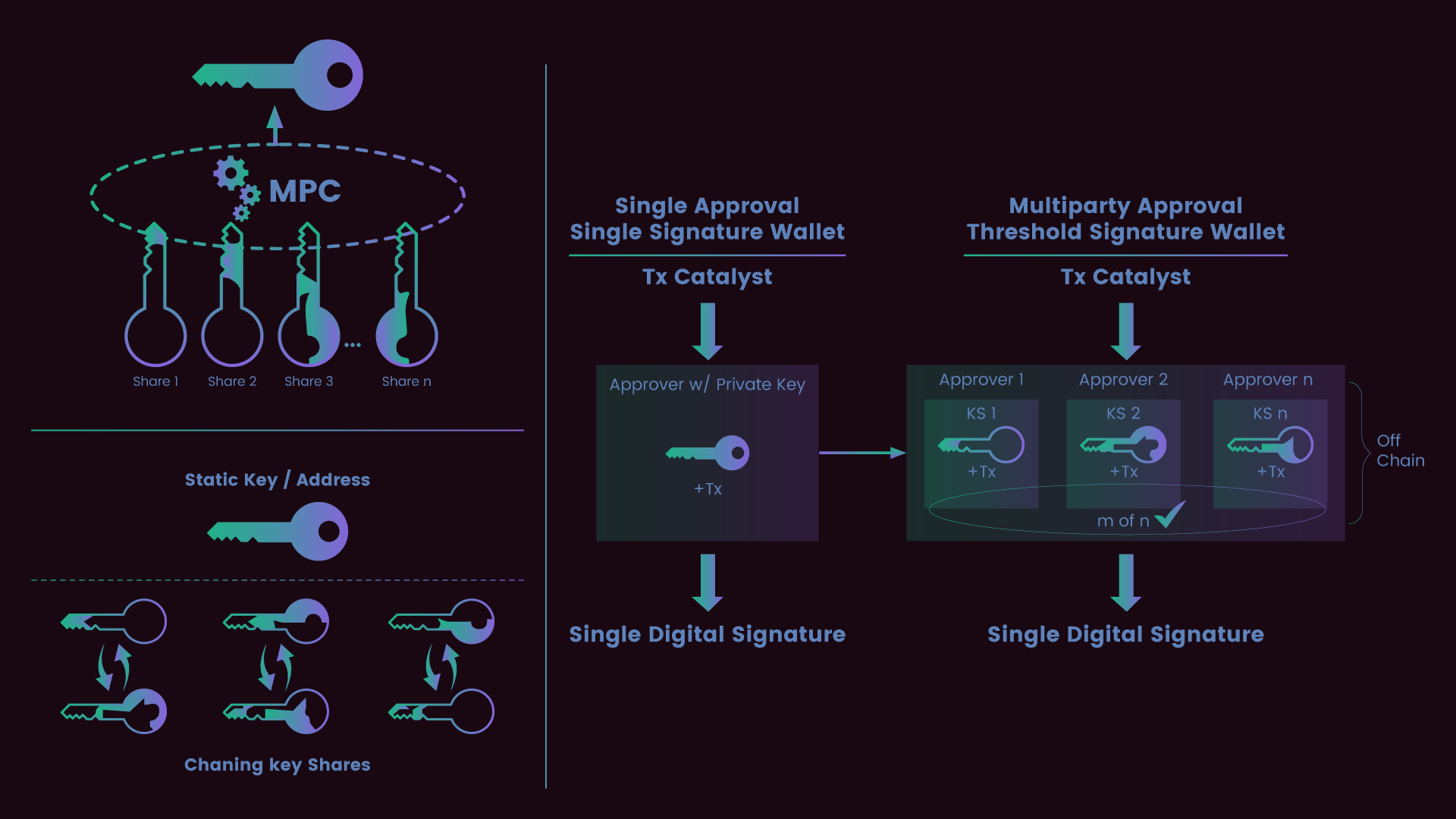

No discussion would be complete without highlighting the security advances underpinning this evolution. By integrating advanced cryptographic techniques such as Multi-Party Computation (MPC), today’s leading attestation providers ensure that private keys and sensitive data remain protected, even if one node or party is compromised.

The result? Onboarding flows that are not only compliant but also resilient against modern attack vectors, a critical consideration as DeFi matures into mainstream finance.

But the impact of onchain KYC attestations doesn’t stop at compliance and security. The real magic is in their ability to unlock composability and ecosystem-wide collaboration. Allowlist managers, token launchpads, and RWA platforms now share a common language, a verifiable, privacy-preserving proof of identity that plugs into any protocol. This synergy is fueling a new era of open innovation where onboarding isn’t a hurdle but a catalyst for network effects.

Top Benefits of Onchain KYC Attestations for DeFi in 2025

-

Reusable Digital Identities: Platforms like Blockpass On-Chain KYC® 2.0 enable users to verify their identity once and seamlessly reuse these credentials across multiple DeFi platforms, eliminating repetitive document submissions.

-

Self-Sovereign Identity & Privacy: Solutions like idOS Network empower users to control their encrypted credentials, ensuring privacy and letting them decide when and with whom to share their KYC data.

-

Interoperability Across Blockchains: Services such as BNB Attestation Service (BAS) on Binance’s BNB Chain allow composable KYC and asset proofs, making verified credentials portable between DeFi ecosystems.

-

Automated Compliance & Allowlist Management: Chainlink Automated Compliance Engine (ACE) automates regulatory checks and allowlist management, reducing manual intervention and ensuring seamless onboarding.

-

Enhanced Security with Advanced Cryptography: Integration of technologies like Multi-Party Computation (MPC) distributes sensitive computations, protecting private keys and user data, and significantly boosting trust in DeFi onboarding.

For users, this means an end to the tedious grind of uploading documents and waiting for manual reviews every time they want to participate in a new DeFi opportunity. Instead, they simply connect their wallet, grant permission to verify their attestation, and get instant access, whether it’s an exclusive token sale or a high-yield lending pool. For projects, it means onboarding pre-verified users at scale, reducing regulatory risk and operational overhead.

The ripple effects are already visible across the industry. Real-world asset (RWA) protocols are bridging trillions in onchain capital into traditional markets with confidence. DAOs are running compliant elections and governance processes without ever seeing user PII. Even AI agents are leveraging composable identity proofs to operate autonomously within regulated boundaries.

What’s Next: The Road Ahead for Seamless DeFi Onboarding

Looking forward, expect standards for onchain attestations for KYCed addresses to become even more robust and interoperable as adoption accelerates. Decentralized KYC onboarding in 2025 is just the beginning, future iterations will likely integrate reputation scores, dynamic compliance logic, and cross-chain portability by default.

If you’re building or managing allowlists for DeFi projects, now is the time to embrace these tools. Not only do they streamline compliance and reduce friction but they also position your platform at the forefront of Web3’s next growth wave. For more tactical insights on integrating onchain attestations into your project’s workflow or allowlist process, check out this practical guide.

The bottom line? Onchain attestations for KYCed addresses have moved from niche innovation to essential infrastructure, powering seamless onboarding experiences that respect privacy while meeting global compliance standards. As we close out 2025, one thing is clear: decentralized finance finally has its passport system, and it’s unlocking access at unprecedented scale.