In the fast-evolving world of decentralized finance (DeFi), regulatory compliance and user privacy often seem at odds. Traditional Know Your Customer (KYC) processes, while essential for anti-money laundering (AML) and global compliance, have long been a pain point for both users and platforms. Enter onchain KYC attestations: cryptographic proofs recorded directly on a blockchain, offering a new paradigm for identity verification that is secure, efficient, and privacy-preserving.

Why DeFi Needs a Smarter KYC Solution

As DeFi platforms attract billions in value and mainstream attention, regulatory scrutiny intensifies. Compliance is non-negotiable for projects seeking legitimacy or planning token sales. However, legacy KYC solutions require users to repeatedly submit personal documents to various centralized entities, creating friction, risking data leaks, and increasing onboarding times.

Onchain attestations solve these problems by letting users prove their identity or eligibility directly on-chain without revealing sensitive details to every platform they interact with. This innovation is especially timely as Ethereum (ETH), the backbone of most DeFi applications, trades at $4,133.88, underscoring the sector’s scale and importance.

How Onchain Attestations Transform KYC

So what makes onchain attestations such a game-changer? Let’s break down the core benefits:

Top Benefits of Onchain KYC Attestations for DeFi

-

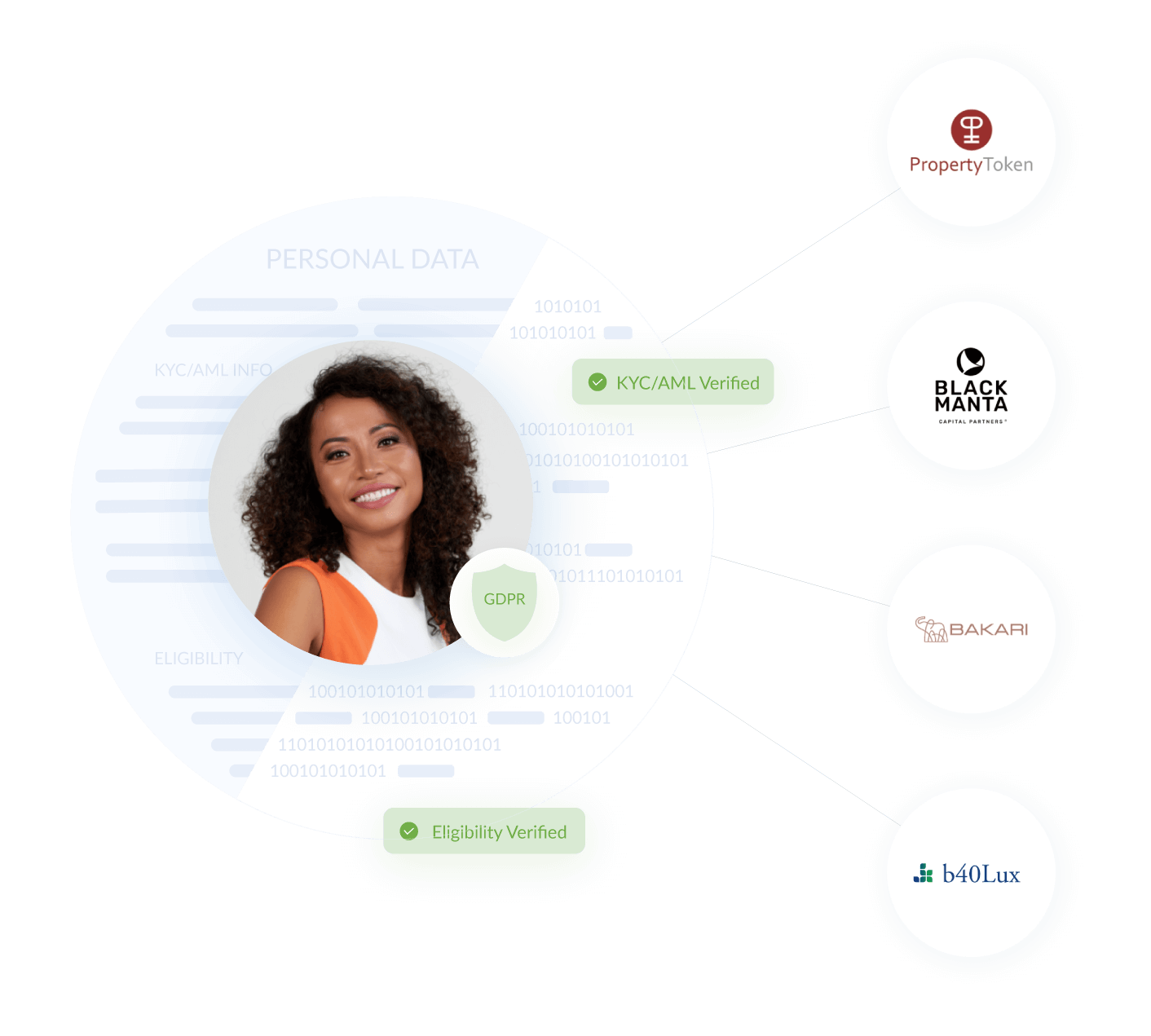

Privacy-Preserving Compliance: Onchain KYC 2.0 solutions, such as Blockpass, leverage zero-knowledge proofs to verify user identities without exposing sensitive personal data, ensuring regulatory compliance while safeguarding user privacy.

-

Reusable Digital Identities: Once verified, users can reuse their onchain attestations across multiple DeFi platforms and token sales, streamlining onboarding and reducing repetitive KYC checks. This boosts efficiency for both users and service providers.

-

Enhanced Security & Tamper-Proof Records: By recording attestations on blockchains like Ethereum, KYC verifications become immutable and auditable, lowering fraud risks and supporting robust compliance. For example, Coinbase Verified Pools utilize onchain attestations for secure DeFi access.

-

Interoperability Across Platforms: Onchain attestations are designed to work seamlessly across different DeFi apps and blockchain networks, fostering a more connected and efficient ecosystem for users and providers alike.

-

Faster, Frictionless User Experience: With onchain attestations, users can quickly access new DeFi services and token sales without repeated document submissions, making the onboarding process smoother and more user-friendly.

1. Privacy Preservation: Instead of handing over passports or utility bills to every new dApp or token sale, users can leverage zero-knowledge proofs to confirm facts like age or residency, without exposing underlying documents. This approach drastically reduces the risk of data breaches while keeping users in control.

2. Reusability Across Platforms: Once an attestation is issued (for example, confirming accredited investor status or passing an AML check), it becomes reusable across any compatible DeFi service or token sale. No more tedious re-verification, users simply present their existing proof.

3. Enhanced Security and Compliance: Attestations are tamper-proof records stored on public blockchains like Ethereum. Platforms can instantly verify compliance without storing sensitive info themselves, a win for both security and auditability.

4. Interoperability: Modern solutions such as On-Chain KYC® 2.0 are designed with cross-chain compatibility in mind. Whether you’re joining a Solana-based launchpad or an Ethereum liquidity pool, your verified credentials travel with you, fostering seamless access across Web3.

The Tech Behind Onchain Attestations: Privacy Meets Usability

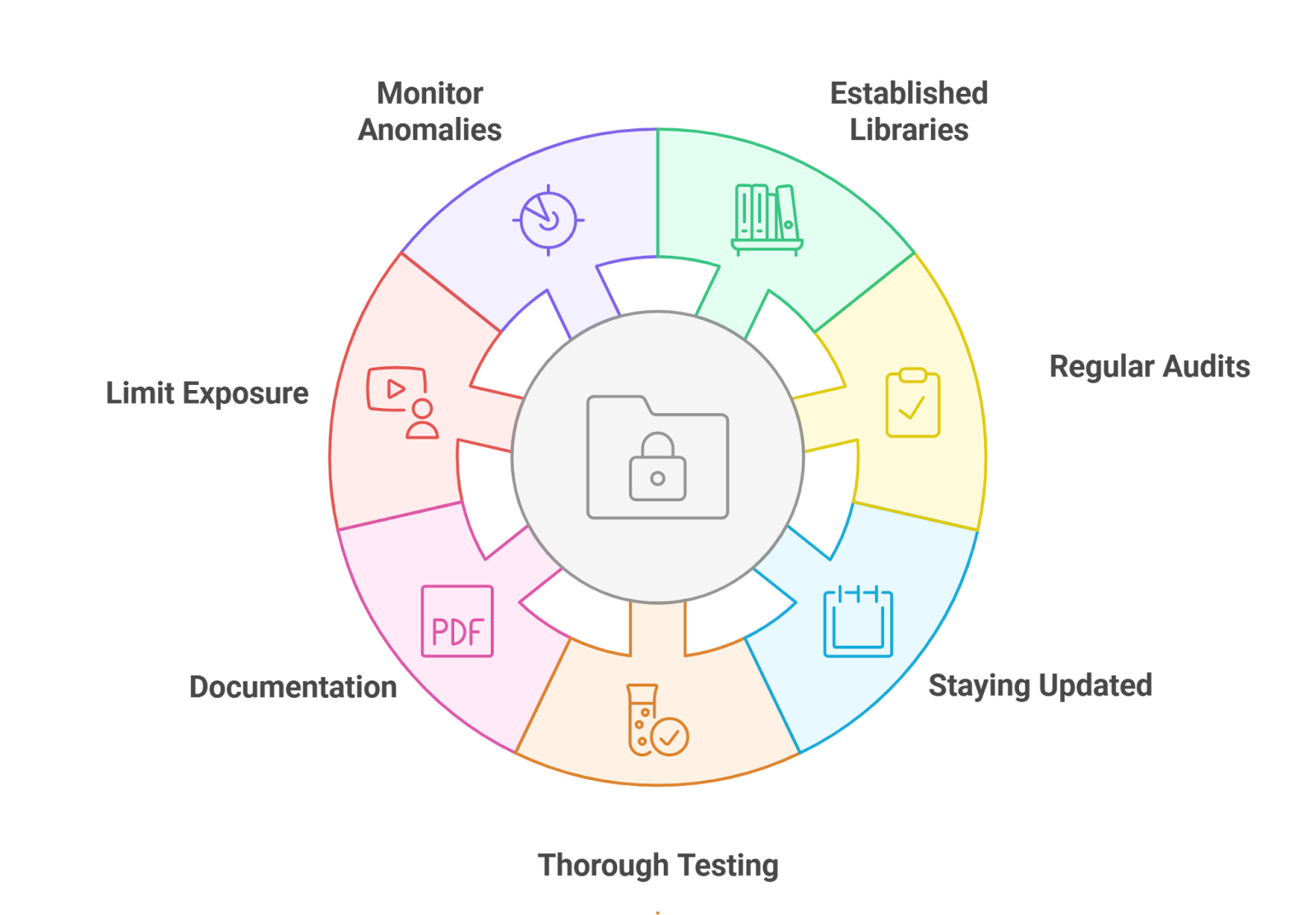

The latest generation of blockchain identity verification, exemplified by On-Chain KYC® 2.0 and similar platforms, leverages customizable modules: document checks, AML/sanctions screening, even proof-of-residency, all bundled into reusable digital IDs secured by zero-knowledge cryptography. This means platforms can automate allowlists for token sales or gated communities while users keep granular control over what they share.

This privacy-first approach is already enabling KYC-first airdrops, compliant DeFi pools, and frictionless onboarding, all without sacrificing regulatory standards.

The Current Market Context: Ethereum Leads the Way

The surge in Ethereum’s price to $4,133.88, up over 10% in just 24 hours, highlights not only market optimism but also growing adoption of compliant DeFi infrastructure powered by onchain verification tools.

This momentum is spurring a new wave of projects to adopt token sale KYC solutions that are both user-friendly and regulator-ready. By embedding onchain attestations into their onboarding flows, platforms can instantly verify if a wallet address belongs to a KYCed user, no more manual checks or endless email trails. For token sales, this means faster access for participants and airtight compliance for issuers, all while minimizing exposure to sensitive personal data.

What’s especially compelling is the automation potential. Allowlist managers can now set up smart contracts that automatically grant access or distribute tokens only to addresses with valid KYC attestations. This not only slashes operational overhead but also ensures that only eligible users participate, reducing legal risk and streamlining the entire process.

Real-World Adoption: From Airdrops to Gated DeFi Pools

Forward-thinking DeFi protocols are already leveraging these advances. For instance, compliant liquidity pools now use onchain attestations to restrict entry to verified users, balancing open participation with regulatory safeguards. Similarly, airdrops can be targeted exclusively at KYCed wallets, enabling projects to reward real users while staying in line with AML requirements.

The impact? A smoother user journey from start to finish. Instead of facing multiple rounds of document uploads for every new platform or token sale, participants simply reuse their existing attestations wherever supported. This interoperability is creating an ecosystem where trust and privacy coexist, and where onboarding friction becomes a relic of the past.

It’s not just about convenience; it’s about future-proofing your project in an evolving regulatory landscape. As regulations tighten worldwide, solutions like On-Chain KYC® 2.0 provide the flexibility and auditability needed to adapt without sacrificing growth or user experience.

Checklist: Is Your Platform Ready for Onchain Attestations?

If you’re building or managing a DeFi platform, ask yourself:

- Are you still relying on manual KYC checks?

- Could your onboarding be faster and more secure?

- Do you want reusable credentials that travel across Web3?

If the answer is yes, it’s time to explore onchain KYC attestations. They’re not just a compliance tool, they’re a competitive edge in today’s interconnected financial landscape.

To dive deeper into practical strategies and integration tips, check out our guide on how onchain attestations streamline KYC for Web3 allowlists and token sales.