In 2025, the convergence of onchain attestations and decentralized finance (DeFi) has fundamentally transformed Know Your Customer (KYC) processes, particularly for allowlist management. No longer are users required to endure repetitive KYC checks or trust opaque intermediaries with their sensitive data. Instead, reusable, privacy-preserving attestations now empower both users and DeFi platforms to meet compliance requirements with unprecedented efficiency.

Why Onchain Attestations Are Reshaping DeFi Allowlist Management

Traditional KYC workflows have long been a friction point in DeFi onboarding. Each new platform or token sale often demanded a fresh round of document uploads and identity checks, introducing user fatigue and unnecessary risk exposure. In contrast, onchain attestations for KYCed addresses provide a cryptographically verifiable proof that a wallet has passed compliance checks, without revealing the underlying personal data.

This paradigm shift is not just theoretical. The emergence of self-sovereign identity systems such as ONCHAINID and attestation protocols like Solana Attestation Service (SAS) means users can now verify once with a trusted provider and reuse that credential across an array of DeFi allowlists. This reduces onboarding time from days to seconds while maintaining robust regulatory alignment.

The Technical Stack: From Self-Sovereign Identities to Automated Compliance Engines

The backbone of this new KYC architecture is a blend of off-chain validation and on-chain attestation:

- Self-Sovereign Identity (SSI): Platforms like ONCHAINID enable users to maintain control over their identity data. Sensitive information remains off-chain with trusted parties; only encrypted proofs are published onchain.

- On-Chain KYC® Solutions: Blockpass’s On-Chain KYC® 2.0 issues reusable digital identities as granular attestations, each tied to specific compliance requirements but universally verifiable by smart contracts.

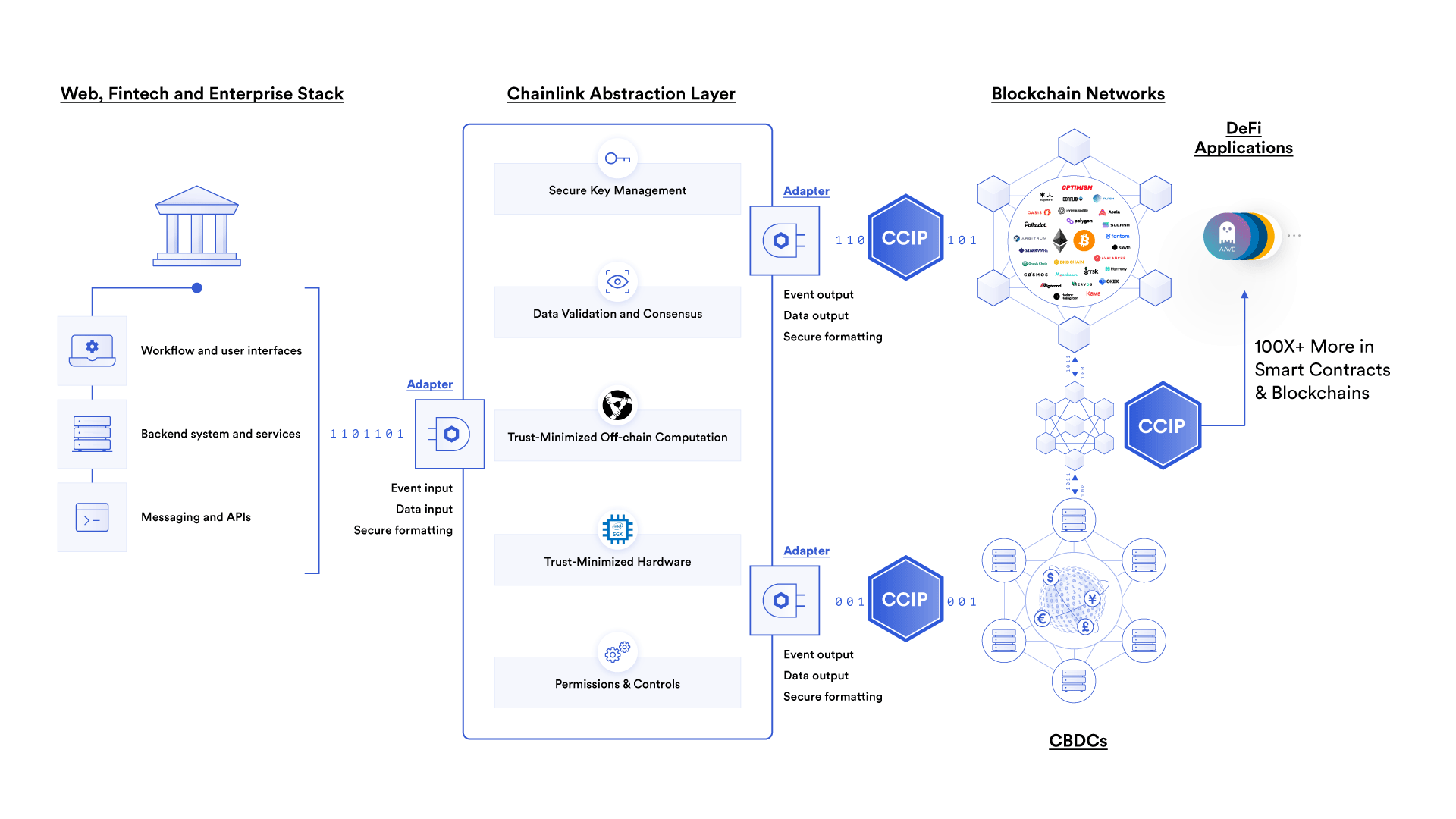

- Automated Compliance Engines: Chainlink ACE acts as the connective tissue between blockchains and compliance infrastructure, allowing dynamic allowlist management based on real-time regulatory signals.

This modular stack enables seamless interoperability between projects while giving users fine-grained control over what they share, and when. For deeper technical coverage on these architectures, see our detailed breakdown here.

User Privacy Meets Regulatory Rigor: The Core Benefits

The core innovation lies in the balance between privacy preservation and regulatory assurance. With onchain attestations:

- User privacy is maximized: Only zero-knowledge proofs or hash commitments are public; personal data never leaves the user’s chosen verifier unless explicitly authorized.

- KYC onboarding is streamlined: One-time verification unlocks access across dozens of token sales or gated communities, no more redundant paperwork.

- Regulatory compliance is auditable: All attestations are timestamped, immutable records that regulators can audit without compromising decentralization principles.

This approach directly addresses concerns raised in recent industry research about implicit trust assumptions in permissioned DeFi solutions (see SSRN eLibrary; arXiv preprints). By anchoring trust in cryptographic proofs rather than third-party custodians, platforms can confidently open their doors to institutional capital without sacrificing user autonomy or security.

The result? A new era where verifiable credentials for DeFi allowlists are not only possible but rapidly becoming the industry standard. If you’re interested in practical implementation details for your project or community, explore our guide on streamlining KYC with onchain attestations here.

Adoption of onchain attestations is accelerating as major DeFi protocols, launchpads, and token issuers recognize the operational and reputational upside. Allowlist managers can now automate access control with smart contracts that check for valid attestations, eliminating manual review bottlenecks and mitigating the risk of human error or data leaks. This shift not only reduces administrative overhead but also significantly cuts onboarding costs for both users and platforms.

KYCed Address Attestation Workflow for DeFi Allowlists

-

1. User Identity Verification via Self-Sovereign SystemsUsers initiate KYC by verifying their identity through platforms like ONCHAINID, which store sensitive data off-chain with trusted parties and publish encrypted validation proofs on-chain.

-

2. Issuance of On-Chain KYC AttestationVerified users receive a reusable, on-chain KYC attestation from solutions such as Blockpass On-Chain KYC® 2.0, enabling decentralized and privacy-preserving identity proofs.

-

3. Storage and Management of AttestationsAttestations are securely linked to users’ wallet addresses using services like the Solana Attestation Service (SAS), allowing seamless association of KYC status with on-chain accounts.

-

4. Automated Allowlist Inclusion via Compliance EnginesChainlink Automated Compliance Engine (ACE) dynamically reads on-chain attestations to automate allowlist management, ensuring only KYCed addresses gain access to DeFi token sales or services.

-

5. Cross-Platform Access with Portable KYC CredentialsUsing networks like idOS, users can leverage their single KYC attestation for instant access to multiple DeFi platforms, eliminating redundant onboarding and enhancing user experience.

Another key advantage is interoperability. Onchain attestation standards are being adopted across multiple chains (Ethereum, Solana, L2s), enabling a truly cross-platform identity layer. For example, Chainlink ACE’s modular compliance logic can be deployed on any EVM-compatible chain, while solutions like idOS Network allow users to port their verifiable credentials wherever they participate in DeFi. This composability is crucial for institutional adoption and for emerging use cases such as cross-chain token sales or global DAOs.

Emerging Applications: Token Sales, Gated Communities and Beyond

The implications extend far beyond simple whitelist management. Onchain attestations are powering:

- Token sales with embedded compliance: Only wallets with valid KYC attestations can participate, reducing legal exposure for issuers.

- Gated DeFi communities: DAOs and private forums use attestations to restrict access to verified contributors or investors.

- Airdrops and rewards: Projects can target real users while excluding bots or sanctioned addresses based on attested credentials.

This programmable permissioning unlocks new business models and regulatory clarity without sacrificing the open ethos of Web3. For a deeper dive into these use cases, see our resource on streamlined KYC for DeFi token sales.

Challenges and Forward Momentum

No system is without trade-offs. The main challenges now revolve around standardization of attestation formats, verifier trust frameworks, and ensuring robust privacy guarantees even as regulatory demands evolve. However, the technical trajectory is clear: privacy-preserving KYC on blockchain is rapidly maturing from pilot to production at scale.

Industry initiatives are coalescing around open standards (e. g. , W3C Verifiable Credentials) and decentralized registries of trusted verifiers. As more DeFi projects integrate these tools natively into their onboarding flows, friction will continue to drop while compliance confidence rises, a win-win for innovators and regulators alike.

The bottom line: by leveraging onchain attestations for KYCed addresses, DeFi allowlist management in 2025 has become faster, safer, and more user-centric than ever before. The next wave of adoption will be driven by projects that embrace these standards early, delivering seamless onboarding without compromise. To keep pace with best practices or deploy your own attestation-based workflow, explore our comprehensive guides on DeFi allowlists and reusable KYC credentials in Web3.