For years, Know Your Customer (KYC) verification has been a thorn in the side of DeFi users and token sale participants. The requirement to repeatedly submit sensitive documents across multiple platforms not only creates friction, but also exposes users to unnecessary privacy risks. The emergence of onchain attestations KYC is rapidly changing this paradigm, ushering in a new era of reusable digital identity for the decentralized economy.

The Power of Reusable KYC Credentials in DeFi

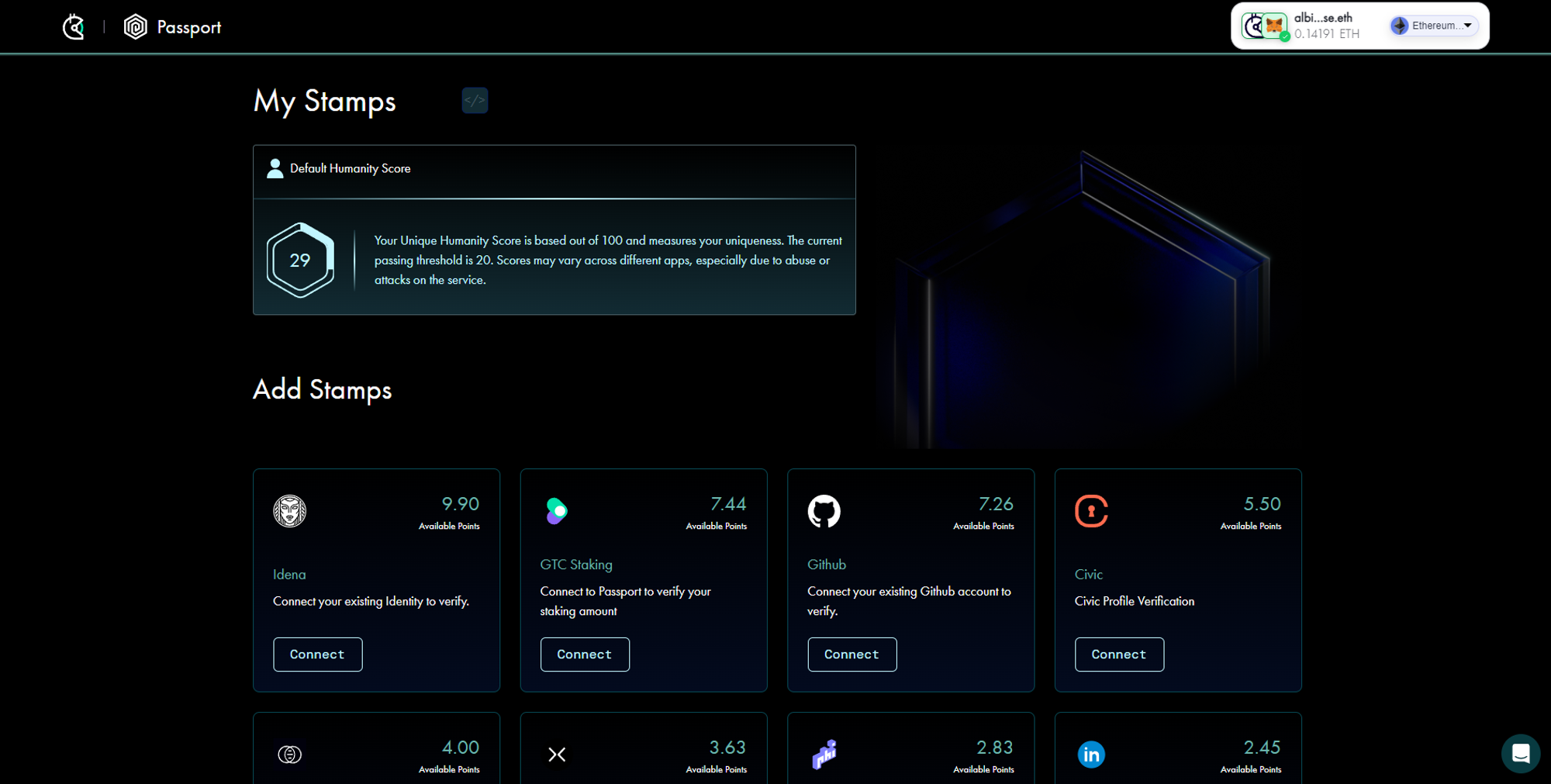

Onchain attestations are cryptographic proofs recorded directly on blockchain networks, confirming facts such as whether a wallet address has passed KYC checks. This innovation enables reusable KYC for DeFi and token sales by allowing users to complete identity verification once and then leverage that attestation across any compatible platform.

This shift is far from theoretical, solutions like Blockpass’s On-Chain KYC® 2.0 and Sumsub’s integration with Solana demonstrate real-world adoption. These platforms empower users to establish decentralized KYC credentials, dramatically reducing onboarding friction while maintaining regulatory compliance.

How Onchain Attestations Work

The process typically unfolds in three streamlined steps:

- Single Verification: A user completes a one-time KYC check with a trusted provider such as Blockpass or Altme.

- Attestation Issuance: Upon passing verification, the provider issues an onchain attestation, a cryptographic proof linked to the user’s wallet address, recorded immutably on the blockchain.

- Seamless Reuse: Any DeFi protocol or token issuer can instantly verify this attestation without ever accessing or storing sensitive personal data.

This model isn’t just efficient, it’s fundamentally more secure. Platforms never need direct access to documents like passports or utility bills; they only check the validity of an attestation, which is tamper-proof and transparent thanks to blockchain technology.

User Privacy and Regulatory Compliance: No Longer at Odds

The genius of privacy-focused KYC attestations is that they decouple identity verification from data exposure. Users retain control over their information, only sharing proof of compliance, not underlying documents, with every transaction or platform interaction. This approach aligns with global privacy regulations such as GDPR while satisfying anti-money laundering (AML) requirements.

Key Benefits of Onchain Attestations for Reusable KYC

-

Streamlined User Onboarding: Onchain attestations enable users to complete KYC verification once and reuse their credentials across multiple DeFi platforms and token sales, eliminating repetitive checks and accelerating access to services.

-

Enhanced Privacy and Data Control: Only the verification proof is shared on-chain—never the underlying personal data—empowering users to retain control over their sensitive information and reducing the risk of data breaches.

-

Regulatory Compliance Without Data Exposure: Platforms can verify KYC and AML compliance status via blockchain attestations, ensuring regulatory adherence without directly handling or storing personal user data.

-

Tamper-Proof and Secure Records: Attestations recorded on the blockchain are immutable and verifiable, providing robust protection against identity fraud and unauthorized modifications.

-

Cross-Platform Interoperability: Solutions like Blockpass’s On-Chain KYC® 2.0 and Sumsub’s Solana Attestation Service allow verified identities to be recognized across multiple blockchains and DeFi applications, fostering a more connected and efficient ecosystem.

The result? Faster onboarding, reduced risk of data breaches, and increased trust among both users and project teams. For deeper insights into how these systems streamline compliance without sacrificing UX, see our guide on how onchain attestations streamline KYC for Web3 allowlists and token sales.

As DeFi and token sale projects scale globally, the demand for interoperable, privacy-first identity solutions has never been higher. Onchain attestations are quickly becoming the backbone of trust in Web3, enabling projects to build compliant communities without inheriting the liabilities of legacy KYC handling.

Real-World Impact: From Token Sales to Gated Communities

The transformative power of onchain KYC goes beyond DeFi protocols. Token launches, NFT allowlists, gated DAOs, and even regulated real-world asset platforms are adopting these attestations for frictionless onboarding. Instead of siloed identity checks that slow down participation and introduce security gaps, users can now move seamlessly between platforms with a single verifiable credential.

Consider a user who completes KYC once with Blockpass or Altme. When a new token sale or NFT drop requires compliance checks, all that’s needed is the presence of a valid onchain attestation linked to their wallet. No more uploading documents or waiting days for approval, just instant access and provable compliance. This model not only accelerates growth for Web3 projects but also appeals to regulators by providing an auditable trail without exposing sensitive data.

The Future: Cross-Chain Interoperability and Automation

What’s next? The rise of cross-chain identity frameworks like Chainlink’s CCID is paving the way for attestations that travel across blockchains. Imagine completing KYC once and using that credential on Ethereum, Solana, Polygon, or any EVM-compatible chain, no silos, no repeated checks.

This vision is already coming to life with solutions such as Sumsub’s integration with Solana Attestation Service and Blockpass’s multi-chain support. As protocols standardize around interoperable attestations, expect automated compliance engines to become the norm, reducing manual review costs and letting developers focus on innovation rather than paperwork.

Why Adoption Is Accelerating Now

The convergence of stricter global regulations and user demand for privacy has made reusable KYC more than just a technical upgrade, it’s an operational necessity. Projects that embrace decentralized KYC credentials are already seeing faster user acquisition and fewer compliance headaches.

- User-centric privacy: Only proofs are shared, not personal data.

- Tamper-proof records: Blockchain ensures attestations cannot be falsified.

- Seamless scaling: One credential works everywhere it’s accepted.

- No vendor lock-in: Open standards let users choose their verification provider.

If you’re building in DeFi or managing token sales, integrating onchain attestations isn’t just about compliance, it’s about unlocking frictionless growth while respecting user sovereignty. For practical steps to get started or deepen your understanding of this paradigm shift in digital identity management, explore our resource on how onchain attestations simplify KYC for DeFi platforms and token sales.