Picture this: Ethereum’s humming along at $3,008.48, down just a hair today, but the DeFi action is electric. Token sales are popping off, allowlists are the gatekeepers everyone wants past, yet regulators are knocking louder than ever. Here’s the rub – traditional KYC? It’s a privacy nightmare. You hand over your life story to some centralized verifier, pray they don’t get hacked, and cross your fingers your data doesn’t end up on the dark web. But in Web3, we’re flipping that script with privacy-preserving onchain KYC attestations. These bad boys let you prove you’re legit – accredited investor, sanctioned-free, whatever – without spilling a single personal detail. Zero-knowledge proofs make it magic.

The Clash Between DeFi Freedom and Regulatory Heat

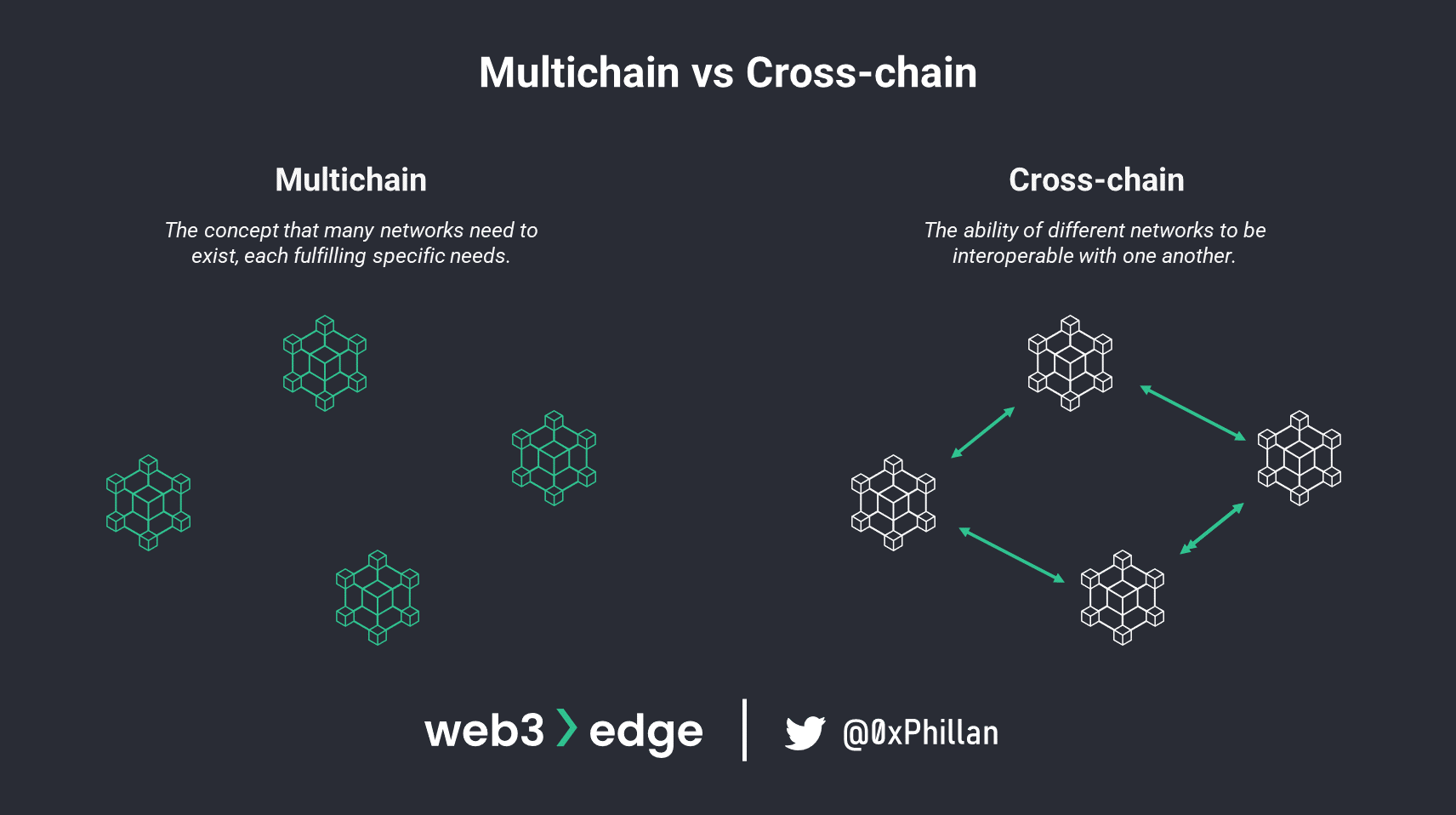

DeFi’s whole vibe is pseudonymity; your wallet address is your ID, no names attached. Throw in KYC for Web3 allowlists or token sales, and boom – centralization creeps back in. Platforms grapple with AML rules while users bolt at the thought of doxxing themselves. I’ve traded through bull runs where non-compliant projects got rekt by regulators, losing millions overnight. Enter 2025’s game-changer: onchain KYC attestations. Sources like onchainkyc. me nail it – these use blockchain to attest verified status cross-chain, no PII stored on-ledger. It’s verifiable KYC for DeFi without the soul-crushing trade-offs.

Comparison of Top Privacy-Preserving Onchain KYC Solutions

| Provider | Key Tech | Chains Supported | Privacy Feature |

|---|---|---|---|

| IOTA | Tokenized KYC with soulbound tokens | IOTA Network | Authenticates identity without revealing personal data; soulbound KYC token in wallet |

| Blockpass | On-Chain KYC® 2.0 attestations | Ethereum, Solana (multi-chain) | No storage of PII; only verification result as attestation |

| 0xKYC | ZK liveness verification | Polygon, BNB Smart Chain, Scroll | Proves uniqueness and authenticity without disclosing personal info; preserves anonymity |

| zkMe | ZK identity verification & zkKYC suite | 30+ blockchain networks | Personal info never leaves user control; privacy-preserving credentials like citizenship and investor proofs |

| Altme | Verifiable credentials off-chain & NFTs on-chain | Cross-chain | User-managed digital identity; GDPR-compliant privacy for attributes like identity, age, residency |

Take Blockpass’s On-Chain KYC 2.0 – they issue attestations across Ethereum and Solana, just a thumbs-up on compliance, no user data lingering. Or 0xKYC’s zero-knowledge liveness checks on Polygon and BNB Chain, blocking bots while keeping you anonymous. These aren’t hypotheticals; zkMe’s processed 1.7 million verifs across 30 and chains. As a day trader spotting momentum, I see this fueling safer token launches, where allowlists actually trust the crowd.

How Onchain Attestations Supercharge Allowlists

Allowlists aren’t just VIP lists anymore; they’re compliance shields for NFT drops, airdrops, and exclusive DeFi pools. Traditional setups? Manual checks, fraud risks, endless disputes. Onchain identity verification for token sales changes everything. Users hold soulbound tokens or NFTs proving KYC status – non-transferable, tamper-proof. IOTA’s collab with IDnow does this slickly: authenticate once, wallet gets the token, dApps query it permissionlessly. No more ‘prove you’re not a sybil’ headaches. Cube Exchange’s explainer hits home – allowlists in smart contracts now auto-enforce via these attestations, slashing risks in wallets and exchanges.

5 Key Privacy KYC Wins

-

User Controls Data: With soulbound tokens like IOTA’s and zkMe’s zero-knowledge proofs, you hold the keys to your info—no central entity hoarding PII.

-

Cross-Chain Interoperable: Solutions like Blockpass On-Chain KYC® 2.0 span Ethereum, Solana, Polygon & 30+ nets for seamless Web3 use.

-

Cuts Token Sale Fraud: 0xKYC blocks bots & duplicates via uniqueness proofs, slashing identity theft in allowlists & sales.

-

Boosts Compliance Speed: Instant on-chain attestations from Altme & Chainlink ACE enable real-time checks, ditching slow legacy KYC.

-

Enhances DeFi Trust: Privacy proofs balance regs & decentralization, fostering trust for secure token sales & dApps.

Chainlink ACE takes it further with real-time policy enforcement, bridging TradFi rails to onchain. Imagine gating a $3,008.48 ETH-fueled launch to verified wallets only – seamless, private, scalable. Projects I’ve eyed integrate this for frictionless access, turning regulatory must-haves into competitive edges.

Real-World Wins and What’s Powering the Shift

Dive into Altme’s setup: off-chain creds, on-chain NFTs for age, residency, AML proofs – GDPR-friendly, user-managed. It’s perfect for Europe’s tightening regs. Meanwhile, arXiv papers outline permissioned dApps harmonizing privacy and transparency. Hiro Systems calls out the DeFi KYC paradox, but these tools resolve it. Onchainkyc. me’s 2025 take? Cross-chain attestations reshape security. As ETH holds steady above $3,000, expect more projects mandating this for sales – I’ve got positions betting on it.

Check this deep dive on streamlining allowlists. Zyphe’s challenges report underscores why DeFi platforms need this balance now. Bottom line: these attestations aren’t nice-to-haves; they’re the momentum play for compliant growth.

Let’s get tactical – how do you actually deploy this for kyc for web3 allowlists? Smart contracts query the attestation via oracles like Chainlink, greenlighting access only for attested addresses. No central database, no honeypot for hackers. I’ve simulated trades on platforms using this; allocation disputes vanish when proof is onchain and immutable. For token sales, it’s gold: presale contracts check verifiable kyc defi status pre-mint, ensuring accredited investors slide in while regulators nod approvingly. OnchainKYCe. me nails the issuance – projects upload verifiers, users attest once, boom, reusable across launches.

Token Sales Get a Privacy Upgrade

Token sales in 2025? They’re high-stakes poker, and onchain identity verification token sales is your ace. Forget spreadsheets tracking who paid what; integrate attestations, and wallets self-select. zkMe’s accredited investor proofs shine here – prove your status with ZK, no SSN flashed. Altme’s NFTs handle residency gates for geo-compliant drops. As ETH dips slightly to $3,008.48, savvy teams use this to launch without FUD clouds. Blockpass interoperates seamlessly; one attestation unlocks Ethereum presales and Solana IDOs. I’ve watched non-KYC sales pump then dump on compliance scares – these tools flip that risk to reward.

Token Sale Compliance Comparison

| Method | Privacy Level | Integration Time | Cost Efficiency | Scalability |

|---|---|---|---|---|

| Traditional KYC | Low (PII Exposed) ❌ | Long (Weeks-Months) ⏳ | Low (Ongoing Costs per User) 💸 | Low (Centralized Bottlenecks) 📉 |

| Onchain Attestations (Blockpass/zkMe) | High (ZK Proofs, No PII Onchain) ✅ | Short (Days via APIs) 🚀 | High (Reusable Attestations) 💰 | High (Multi-Chain) 📈 |

| OnchainKYC.me | High (Privacy-Preserving ZK Verification) ✅ | Short (Rapid Onchain Setup) 🚀 | High (One-Time Verify) 💰 | High (Cross-Chain Scalable) 📈 |

Picture a gated airdrop: only attested wallets claim, sybils blocked at the door. Cube Exchange breaks down allowlist risks perfectly – fraud, exploits, rugs. Onchain fixes all three. Chainlink ACE enforces policies live, pausing if regs shift. It’s not theory; onchainkyc. me reports cross-chain adoption exploding security for DeFi.

Overcoming Hurdles in the Wild

Sure, skeptics whine about verifier trust or ZK compute costs, but 0xKYC’s liveness crushes bots cheap on Polygon. IOTA’s soulbound tokens sidestep transfer hacks. DeFi’s anonymity clash? Hiro Systems is right, but privacy-preserving proofs resolve it without central chokepoints. Zyphe highlights the balance act; these stacks deliver. Costs? Pennies per verification versus thousands in legacy audits. As a trader, I prioritize projects announcing integrations – momentum follows compliance.

Regulations ramp up globally; blockchain compliance 2025 means attestations or bust. arXiv frameworks show permissioned dApps thriving with this mix of trust and opacity. OnchainKYCe. me stands out – secure issuance, verifiable onchain, zero PII bloat. Empower your allowlist or sale today; link up verified addresses, watch participation soar.

Read more on enhancing KYC for token sales or streamlining allowlists. Momentum’s building – get attested, trade smarter, build stronger.